Rapid Diagnostic Tests (RDTs) Market Size is Set to Witness a 4.5% CAGR by 2026

The Global Rapid Diagnostic Tests (RDTs) Market is set to witness a CAGR of 4.5% from 2021 to 2026. High adoption of point-of-care (POC) diagnostics, availability of advanced rapid testing devices, growing number of infectious & other chronic diseases, and rising geriatric population are some of the key factors driving the rapid diagnostic tests market growth.

Rapid diagnostic tests or RDTs are simple-to-use procedures that provide results in less than 20 minutes. Unlike most standard diagnostic tests, which are required to be sent to a lab for analysis, RDTs are done and results are provided at the point-of-care. Rapid tests are most frequently used to diagnose infectious diseases, such as flu, malaria, HIV, and COVID 19, among others. There are several advantages associated with RDTs which drive its adoption; these include fast results, easy-to-use, and little or no special equipment requirement.

High impact of COVID 19 fueled the demand for Rapid Diagnostic Tests Market

The Rapid Diagnostic Tests market has experienced a positive impact due to the COVID 19 pandemic. Although the demand for RDTs specifically for the detection of SARS-CoV-2 during 2020 and 2021 increased exponentially, the pandemic showed a negative impact on the sales of RDTs for cancer screening, blood glucose, cardiac markers, and other infectious diseases, among others. However, there has been a significant development in the RDTs market during the last two years; some of these are listed below:

- In October 2021, the NIH Rapid Acceleration of Diagnostics (RADx) initiative has awarded contracts totalling $77.7 million for the development and manufacturing of 12 new rapid diagnostic tests for SARS-CoV-2; offering high performance and low-cost home and POC tests.

- In September 2021, LumiraDx, a next-generation POC diagnostics company, launched its LumiraDx SARS-CoV-2 Ag Surveillance Test in the US market, specifically for use at schools and workplaces; which allows simultaneous testing of up to five samples on a small and portable instrument, costing $4 per sample and delivering digital results within 12 minutes.

- In July 2021, the Department of Defense (DOD), in coordination with the Department of Health and Human Services (HHS) has awarded a contract of $35.1 million to LightDeck Diagnostics, to scale-up the production capacity of LightDeck’s SARS-CoV-2 Ultra-Rapid Antigen and COVID-19 Total Antibody Tests.

- In March 2021, FUJIFILM Corporation announced the launch of its antigen testing kit – ‘FUJIFILM COVID-19 Ag Test’, for detecting SARS-CoV-2, which is developed by using highly-sensitive detection technology based on silver halide amplification.

- In March 2020, Becton, Dickinson and Company and BioMedomics announced the release of a new point-of-care test which can detect antibodies in blood to confirm exposure to COVID-19 within 15 minutes.

Collaborations and acquisitions to boost adoption and co-develop advanced solutions

The Rapid Diagnostic Tests market has witnessed a number of acquisitions by market players to either enhance the adoption of these tests or to co-develop advanced diagnostic tests. Some of the strategic initiatives that boost the adoption of RDTs are listed below:

- In April 2022, bioMérieux entered into an agreement to acquire Specific Diagnostics, a developer of rapid antimicrobial susceptibility test (AST) system. Rapid AST provides fast and accurate AST results while reducing the global antimicrobial resistance (AMR) burden caused by antibiotic resistant pathogens.

- In February 2022, Sorrento Therapeutics, Inc. acquired a majority ownership of Zhengzhou Fortune Bioscience Co., Ltd. (FortuneBio), a diagnostic product manufacturer and Sorrento’s exclusive OEM manufacturer for COVISTIX. With enhanced sensitivity in detecting the Omicron variant, COVISTIX is a rapid antigen detection test for SARS-CoV-2 and its major variants of concern (VOCs).

- In February 2021, Becton, Dickinson and Company collaborated with Scanwell Health, a provider of smartphone-enabled at-home medical tests, to develop an at-home rapid test for SARS-CoV-2 using Becton, Dickinson and Company’s antigen test and Scanwell Health’s mobile app.

- In February 2021, Thermo Fisher Scientific Inc. completed the acquisition of Mesa Biotech, Inc., a point-of-care molecular diagnostic company. This acquisition is aimed at rapidly scaling manufacturing volume for RDTs by combining Thermo Fisher's operational excellence such as access to raw materials and existing distribution and sales channels with Mesa Biotech's innovative platform.

Low Sensitivity and other technical barriers – A Deterrent for Rapid Diagnostic Tests Market Growth

Although RDTs offers multiple advantages such as fast results, ease-of-use, limited need for instrumentation/infrastructure, and minimum training requirements; it is plagued with certain limitations and challenges. These include lower sensitivity as compared to other tests, false negatives, and lack of evaluative process for efficacy.

- Lower sensitivity: Clinical sensitivity of a molecular test depends on multiple factors such as quality of sampling and the timing of testing relative to the onset of infection. As RDTs have lower sensitivity of RDTs as compared to other diagnostic tests such as ELISA and PCR; results from RDTs need to be re-confirmed by performing lab tests.

- False negatives: Sometimes, there is a high probability of a RDT showing false negative result at early stage of infection. Such incidences generally affect the treatment cycle by delaying the inception of therapy and may in turn lead to disease progression.

- Lack of evaluative process: In low-resource settings, production and implementation of RDTs have several problems; lack of an evaluative process to determine their real efficacy is a major concerning factor possessed by RDTs. Further, the accuracy of several RDTs in real-life clinical settings is unclear due to lack of adequately designed diagnostic accuracy studies.

To address the persistent difficulty of rapid tests’ quality assurance, the WHO is independently evaluating RDTs for a variety of diseases, including HIV and malaria, in order to pre-qualify them. Irrespective of the technical limitations and challenges, rapid diagnostic tests market is expected to grow at a significant rate due to advancements in this technology and ever-increasing infectious disease cases.

Competiitve Landscape Analysis: Rapid Diagnostic Tests Market

The global rapid diagnostic tests market is marked by the presence of key players such as Abbott Laboratories (US), Bio-Rad Laboratories, Inc. (US), F. Hoffmann-La Roche Ltd. (Switzerland), Becton, Dickinson and Company (US), and ACON Laboratories, Inc. (US), and others.

Key Strategic Questions Addressed

- What is the market size & forecast of the Rapid Diagnostic Tests Market?

- What are historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the Rapid Diagnostic Tests Market?

- What are the key trends defining the rapid diagnostic tests market?

- What are the major factors impacting the market?

- What are the opportunities prevailing in the rapid diagnostic tests market?

- Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

- Who are the major players operating in the rapid diagnostic tests market?

- What are the key strategies adopted by players?

The study has been compiled based on the extensive primary and secondary research.

Secondary Research (Indicative List)

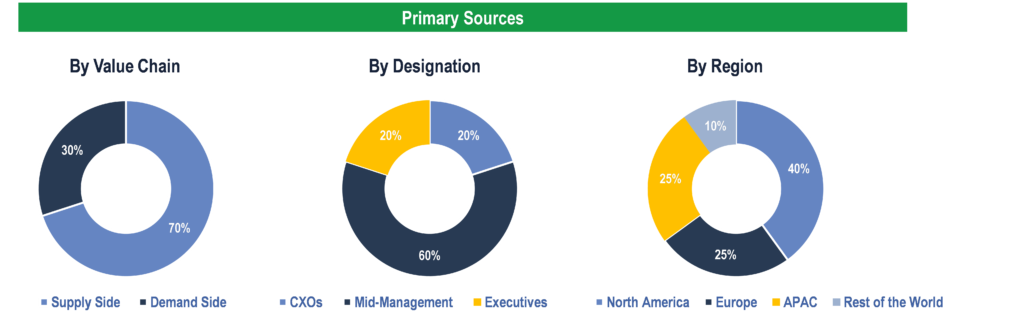

Primary Research

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, R&D Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders in Hospitals, Diagnostic Centers, Government Organizations, and Academic & Research Institutes.

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis was validated with Primary Interviews, Internal Knowledge Repository and Company’s Sales Data.