Cardiology Information System Market Size is Growing at a CAGR of 8-10% by 2029

The Cardiology Information System (CIS) Market is expected to witness a CAGR of 8-10% in the forecast period. The rising incidence of cardiovascular diseases like CAD and strokes stands as the primary catalyst propelling market expansion. Additionally, there’s an increasing requirement for efficient data management tools, rising adoption of cloud-based solutions, a necessity for real-time data analysis, surging demand for electronic health records, and a growing inclination towards personalized medicine. To learn more about the cardiology information system market research report, download a sample report.

A Cardiology Information System (CIS) is a specialized solution tailored for managing cardiac care within healthcare facilities. It efficiently handles patient data, including medical history, diagnostic tests, and procedures such as echocardiograms and electrocardiograms. Integration with diagnostic devices streamlines data transfer, minimizing transcription errors and improving workflow efficiency. CIS provides clinical decision support tools and robust reporting capabilities to aid in diagnosis, treatment decisions, performance analysis, and regulatory compliance. Overall, CIS optimizes cardiac care delivery by streamlining workflows, supporting evidence-based practices, and facilitating accurate decision-making.

Enhancing Efficiency and Compliance: Cardiology Information Systems in Healthcare

With the increasing complexity of cardiovascular care, there's a growing demand for efficient patient data management. Cardiology Information Systems (CIS) offer integrated solutions for storing, accessing, and analysing patient information, reducing paperwork, and streamlining administrative processes. Advances in information technology, particularly in areas such as cloud computing, artificial intelligence, and interoperability standards, have significantly enhanced the capabilities of CIS, making them more powerful, user-friendly, and adaptable to evolving needs. These systems also ensure compliance with healthcare regulations, such as HIPAA (Health Insurance Portability and Accountability Act), through features like robust encryption, access controls, and audit trails, fostering trust among healthcare providers and patients alike. Additionally, integration with Electronic Health Record (EHR) systems facilitates comprehensive patient care by allowing cardiologists to access relevant clinical data and diagnostic results from a centralized interface. Automation of routine tasks, such as order entry, result reporting, and documentation, saves time for healthcare providers and enhances the overall quality of care delivered. As cardiovascular diseases continue to rise globally, the specialized functionalities offered by CIS tailored to the needs of cardiologists play a crucial role in managing these conditions effectively and improving patient outcomes. For instance,

- In February 2019, Philips launched IntelliSpace Cardiovascular 4.1, an upgraded cardiovascular image and information management system featuring enhanced pediatric reporting capabilities, streamlined workflow via web browsers, interoperability with Philips Forcare for data sharing, improved security measures, and access to QLAB and TOMTEC software tools.

To learn more about this report, download the PDF brochure

Advancements in Cardiology Information Systems: Reshaping Healthcare Delivery

Cardiology Information Systems (CIS) are witnessing a transformative shift with the integration of emerging trends and technologies, revolutionizing healthcare delivery in cardiology departments. One such trend is the integration of CIS with wearable devices, enabling remote monitoring of patient's cardiac health and proactive interventions. Artificial Intelligence (AI) and machine learning algorithms are being harnessed within CIS to analyze extensive cardiac data, aiding clinicians in diagnosis, outcome prediction, and treatment optimization. Telemedicine and remote monitoring solutions facilitated by CIS have surged in importance amid the COVID-19 pandemic, allowing for virtual consultations and ongoing patient care. Interoperability standards play a crucial role in CIS, facilitating seamless data exchange with other healthcare systems for comprehensive patient management. Enhanced imaging and visualization tools incorporated into CIS improve the accuracy of cardiac imaging studies, enhancing diagnosis and treatment planning. CIS systems offer clinical decision support tools that assist healthcare providers in making evidence-based decisions regarding diagnosis, treatment, and management of cardiovascular diseases. These tools may include clinical guidelines, risk assessment calculators, and alerts for abnormal test results or medication interactions. Mobile applications and patient portals integrated with CIS empower patients to manage their cardiac health actively. Additionally, blockchain technology is explored to bolster data security and privacy within CIS, ensuring the integrity and confidentiality of cardiac data. These advancements underscore the pivotal role of CIS in reshaping cardiac care delivery, driving efficiency, accuracy, and patient outcomes in the healthcare landscape.

Key Constraints/Challenges

The growth trajectory of the cardiology information systems market may encounter constraints due to the significant expenses associated with advanced technologies and their intricate nature. Moreover, the sector will grapple with hurdles arising from stringent regulatory frameworks governing healthcare data, as well as challenges related to interoperability and seamless integration with existing systems. However, the absence of standardized protocols presents a notable impediment to the market's full potential, necessitating collaborative efforts to establish industry-wide guidelines.

Regional Dynamics in the Cardiology Information System Market: Analyzing Geographic Trends

The regional dynamics of the cardiology information systems market vary significantly across different geographical regions. In North America, the market is driven by factors such as the presence of advanced healthcare infrastructure, high adoption rates of healthcare IT solutions, and significant investments in research and development. The region also benefits from favourable government initiatives aimed at promoting the adoption of electronic health records and other digital healthcare technologies. In Europe, the market is characterized by a growing emphasis on healthcare digitization, increasing demand for efficient patient data management solutions, and stringent regulations governing data privacy and security. Asia-Pacific is poised to witness substantial growth due to factors such as rising healthcare expenditure, increasing prevalence of cardiovascular diseases, and rapid advancements in healthcare IT infrastructure. Additionally, the region's large population base and growing awareness of healthcare technology are driving the adoption of cardiology information systems. However, market growth in Asia-Pacific may be hampered by challenges such as limited access to healthcare services in rural areas and disparities in healthcare infrastructure across different countries. Overall, each region presents unique opportunities and challenges for the cardiology information systems market, with varying levels of market penetration and growth potential.

Competitive Landscape

Major players in the Cardiology Information System market include Philips Healthcare, GE Healthcare, Siemens Healthineers, McKesson Corporation, Merge Healthcare (an IBM company), Agfa-Gevaert Group, Cerner Corporation, Intelerad, and Fujifilm Medical System, among others.

Get a sample report for competitive landscape analysis

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the Market

Players operating in this market are adopting both organic and inorganic growth strategies such as collaborations, and acquisitions to garner market share. For instance,

- In February 2023, the Cardiovascular Institute of the South (CIS), in collaboration with Lee Equity Partners, launched Cardiovascular Logistics, a national platform aimed at establishing a network of cardiovascular practices across the United States, unified in their commitment to delivering top-tier cardiovascular care

- In March 2022, GE Healthcare and AliveCor collaborated to provide medical-grade six-lead electrocardiograms (ECGs) captured by patients using an AliveCor KardiaMobile 6L ECG device outside of hospital premises, directly into GE Healthcare’s MUSE Cardiac Management System for physicians to review and assess, aiming to enhance diagnostic accuracy and proactive patient management, ultimately reducing hospitalizations associated with cardiac conditions such as atrial fibrillation

- In February 2021, Intelerad announced its acquisition of LUMEDX Corporation, a leading provider of cardiovascular information systems (CVIS). This acquisition was a strategic move by Intelerad to bolster its cardiovascular expertise and offerings in enterprise imaging solutions.

The Cardiology Information System Market is expected to gain momentum in the coming years due to the growing prevalence of cardiovascular diseases, rising research and development activities, technological advancements, strategic collaborations and aggressive organic and inorganic growth strategies followed by the players.

Key Strategic Questions Addressed

-

What is the market size & forecast for the Global Cardiology Information SystemMarket?

-

What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the Global Cardiology Information SystemMarket?

-

How has COVID-19 impacted the Global Cardiology Information SystemMarket?

-

What are the major growth drivers, restraints/challenges impacting the market?

-

What are the opportunities prevailing in the market?

-

What is the investment landscape?

-

Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market? What is the competitive positioning of key players?

-

Who are the new players entering the market?

-

What are the key strategies adopted by players?

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Market Forecasting

- Executive Summary

- Market Overview

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Market Dynamics

- Global Cardiology Information System Market - Size & Forecast (2021-2028), By Component Type

- Hardware

- Software

- Services

- Global Cardiology Information System Market - Size & Forecast (2021-2028), By Application Type

- Cardiovascular Information System (CVIS)

- Electrocardiography (ECG) Data Management System

- Others

- Global Cardiology Information System Market - Size & Forecast (2021-2028), By End User

- Hospital

- Diagnostics Centers

- Other End Users

- Global Cardiology Information System Market - Size & Forecast (2021-2028), By Region

- North America (U.S. & Canada)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, Rest of Asia Pacific)

- Rest of the World (Latin America, Middle East & Africa)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Competitive Positioning of Key Players (2022)

- Offerings Assessment, By Players

- Key Strategies Assessment, By Player (2021-2023)

- New Product Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Other Developments

- Key Players and their Competitive Positioning

- Key Companies Scanned (Indicative List)

- Philips Healthcare

- GE Healthcare

- Siemens Healthineers

- McKesson Corporation

- Merge Healthcare (IBM company)

- Agfa-Gevaert Group

- Cerner Corporation

- Intelerad

- Fujifilm Medical System

- Other Players

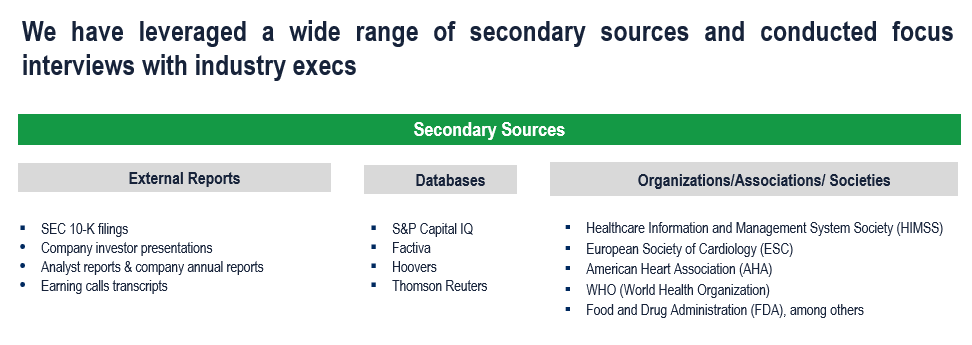

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

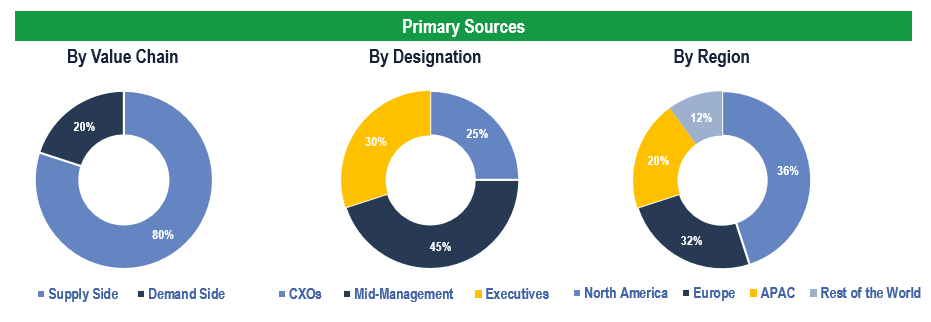

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders in Hospitals, and Diagnostics Centers among others

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis were validated with Primary Interviews, Internal Knowledge Repository, and Company Sales Data.