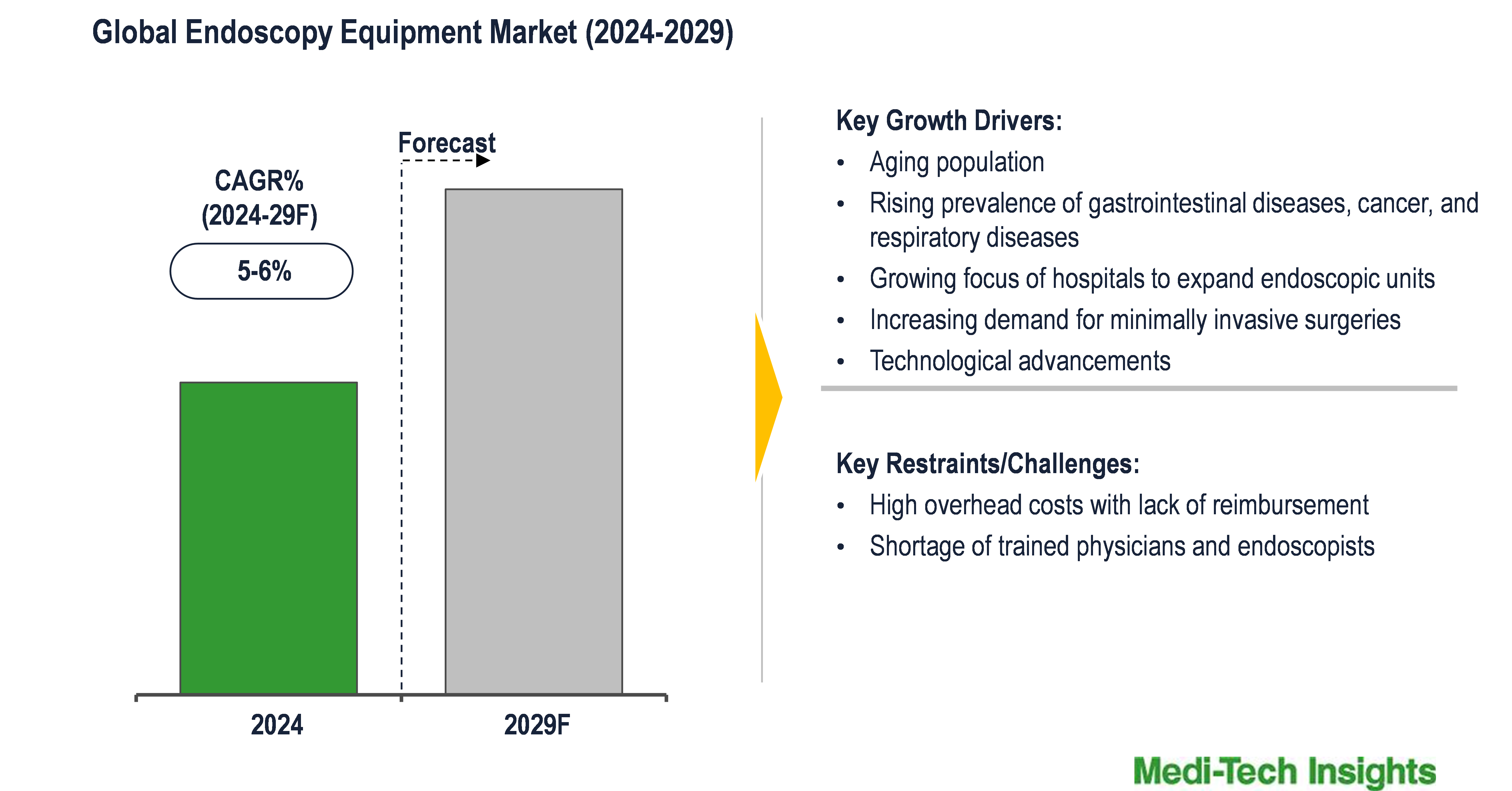

Endoscopy Equipment Market Valued at an Estimated $33 bn in 2024 is Expected to Witness a CAGR of 5-6% by 2029

The global endoscopy equipment market is expected to witness a growth rate of 5-6% in the next 5 years. Aging population, rising cancer rates, rising prevalence of gastrointestinal diseases, growing demand for minimally invasive surgeries, rising demand for single-use endoscopy instruments, and technological advancements are some of the key factors driving the endoscopy equipment market. To learn more about the research report, download a sample report.

Endoscopy equipment includes tools and devices used to perform endoscopic procedures that involve examining the inside of the body using an endoscope - a flexible tube equipped with a light and a camera at its tip. An endoscope is inserted into the body through a natural opening or a small incision to capture images or video of internal organs. The key components involved in this procedure include an endoscope, light source, camera, monitor, insufflator, suction/irrigation system, and operating instruments. Endoscopy equipment is crucial for diagnosing, monitoring, and treating various medical conditions with minimal invasiveness, reducing the need for extensive surgery.

To learn more about this report, download the PDF brochure

Rising burden of GI, cancer, respiratory diseases, and shift towards minimally invasive surgeries to propel market growth

The rapidly growing global cancer burden is likely to fuel the adoption of endoscopy devices for the early diagnosis and treatment of the disease. As per WHO, over 35 million new cancer cases are predicted in 2050, a 77% increase from the estimated 20 million cases in 2022. Further, global burden of CRC is expected to increase by 60%, to over 2.2 million new cases and 1.1 million annual deaths, by 2030. Moreover, gastrointestinal (GI) diseases affect over 300 million people across Europe and the Mediterranean area and the health, economic and social burden of digestive diseases is increasing at an alarming rate worldwide.

Rising burden of such diseases coupled with the growing demand for minimally invasive surgical procedures over traditional surgeries to reduce hospital stay and minimize post-procedure complications is anticipated to accelerate the demand for endoscopy equipment.

Technological advancements in endoscopy equipment driving the market growth

Technological advancements are a significant driver for the endoscopy equipment market growth. Companies are continuously focusing on innovation to come up with advanced endoscopic devices for better diagnosis and treatment of several chronic disorders. For instance, in Oct 2023, Olympus launched its next-generation EVIS X1 endoscopy system for GI practitioners that features Texture and Color Enhancement Imaging technology to enhance image colour and texture during endoscopic screening to increase the visibility of lesions and polyps. Advancements in endoscopic imaging (e.g., high-definition cameras, AI-enhanced detection), better visualization systems, and the development of minimally invasive tools are propelling the demand. Moreover, increasing adoption of single-use endoscopes across GI, respiratory, and urology fields to prevent cross-contamination and ensure patient safety, presents high growth opportunities.

To learn more about this report, download the PDF brochure

Competitive Landscape Analysis

The global endoscopy equipment market is marked by the presence of established and emerging market players such as Olympus Corporation, Boston Scientific Corporation, Fujifilm Holdings Corporation, Pentax Medical/Hoya Corporation, Karl Storz GmbH, Stryker, Medtronic, Johnson & Johnson, Cook Medical, Smith+Nephew, and Steris; among others. Some of the key strategies adopted by market players include product innovation and development, strategic partnerships and collaborations, and geographic expansion.

Endoscopy Equipment Market Scope

|

Report Scope |

Details |

|

Base Year Considered |

2023 |

|

Historical Data |

2022 - 2023 |

|

Forecast Period |

2024 - 2029 |

|

Growth Rate |

CAGR 5-6% |

|

Segment Scope |

Product Type, Specialty, End User |

|

Regional Scope |

|

|

Key Companies Mapped |

Olympus Corporation, Boston Scientific Corporation, Fujifilm Holdings Corporation, Pentax Medical/Hoya Corporation, Karl Storz GmbH, Stryker, Medtronic, Johnson & Johnson, Cook Medical, Smith+Nephew, and Steris; among others |

|

Report Highlights |

Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

Key Strategic Questions Addressed

-

What is the market size & forecast of the endoscopy equipment market?

-

What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the endoscopy equipment market?

-

What are the key trends defining the market?

-

What are the major factors impacting the market?

-

What are the opportunities prevailing in the market?

-

Which region has the highest share in the global market?

-

Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market?

-

What are the key strategies adopted by players?

- Introduction

- Introduction

- Market Scope

- Market Definition

- Segments Covered

- Regional Segmentation

- Research Timeframe

- Currency Considered

- Study Limitations

- Stakeholders

- List of Abbreviations

- Key Conferences and Events (2024-2025)

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Bottom-Up Approach

- Top-Down Approach

- Market Forecasting

- Executive Summary

- Endoscopy Equipment Market Snapshot (2024-2029)

- Segment Overview

- Regional Snapshot

- Competitive Insights

- Market Overview

- Market Dynamics

- Drivers

- Aging population

- Rising prevalence of gastrointestinal diseases, cancer, and respiratory diseases

- Growing focus of hospitals to expand endoscopic units

- Increasing demand for minimally invasive surgeries

- Technological advancements

- Restraints

- High overhead costs with lack of reimbursement

- Shortage of trained physicians and endoscopists

- Opportunities

- Emerging markets

- Key Market Trends

- Drivers

- Unmet Market Needs

- Industry Speaks

- Market Dynamics

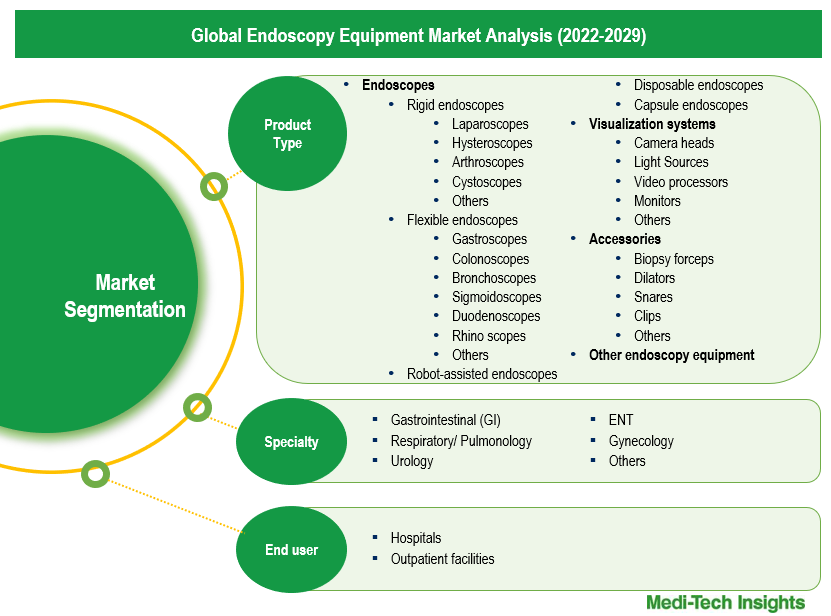

- Global Endoscopy Equipment Market Size & Forecast (2022-2029), By Product Type, USD Million

- Introduction

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Hysteroscopes

- Arthroscopes

- Cystoscopes

- Others

- Flexible Endoscopes

- Gastroscopes

- Colonoscopes

- Bronchoscopes

- Sigmoidoscopes

- Duodenoscopes

- Rhino scopes

- Others

- Robot-assisted Endoscopes

- Disposable Endoscopes

- Capsule Endoscopes

- Rigid Endoscopes

- Visualization Systems

- Camera Heads

- Light Sources

- Video Processors

- Monitors

- Others

- Accessories

- Biopsy forceps

- Dilators

- Snares

- Clips

- Others

- Other endoscopy equipment

- Global Endoscopy Equipment Market Size & Forecast (2022-2029), By Specialty, USD Million

- Introduction

- Gastrointestinal (GI)

- Respiratory/ Pulmonology

- Urology

- ENT

- Gynecology

- Others

- Global Endoscopy Equipment Market Size & Forecast (2022-2029), By End User, USD Million

- Introduction

- Hospitals

- Outpatient Facilities

- Global Endoscopy Equipment Market Size & Forecast (2022-2029), By Region, USD Million

- Introduction

- North America Endoscopy Equipment Market Size & Forecast (2022-2029), By Country, USD Million

- US

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Specialty (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Canada

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Specialty (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Europe Endoscopy Equipment Market Size & Forecast (2022-2029), By Country, USD Million

- UK

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Specialty (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Germany

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Specialty (USD Million)

- Market Size & Forecast, By End User (USD Million)

- France

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Specialty (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Italy

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Specialty (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Spain

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Specialty (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Rest of Europe

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Specialty (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Asia Pacific (APAC) Endoscopy Equipment Market Size & Forecast (2022-2029), By Country, USD Million

- China

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Specialty (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Japan

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Specialty (USD Million)

- Market Size & Forecast, By End User (USD Million)

- India

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Specialty (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Rest of Asia Pacific

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Specialty (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Latin America (LATAM) Endoscopy Equipment Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Specialty (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Middle East & Africa (MEA) Endoscopy Equipment Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Specialty (USD Million)

- Market Size & Forecast, By End User (USD Million)

- China

- US

- North America Endoscopy Equipment Market Size & Forecast (2022-2029), By Country, USD Million

- Introduction

- Competitive Landscape

- Key Players and their Competitive Positioning

- Key Player Comparison

- Segment-wise Player Mapping

- Market Share Analysis (2023)

- Company Categorization Matrix

- Dominants/Leaders

- New Entrants

- Emerging Players

- Innovative Players

- Key Strategies Assessment, By Player (2022-2024)

- New Product & Service Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Company Profiles*

(Business Overview, Financial Performance**, Products/Services Offered, Recent Developments)

- Olympus Corporation

- Boston Scientific Corporation

- Fujifilm Holdings Corporation

- Pentax Medical/Hoya Corporation

- Karl Storz GmbH

- Stryker

- Medtronic

- Johnson & Johnson

- Cook Medical

- Smith+Nephew

- Steris

- Other Prominent Players

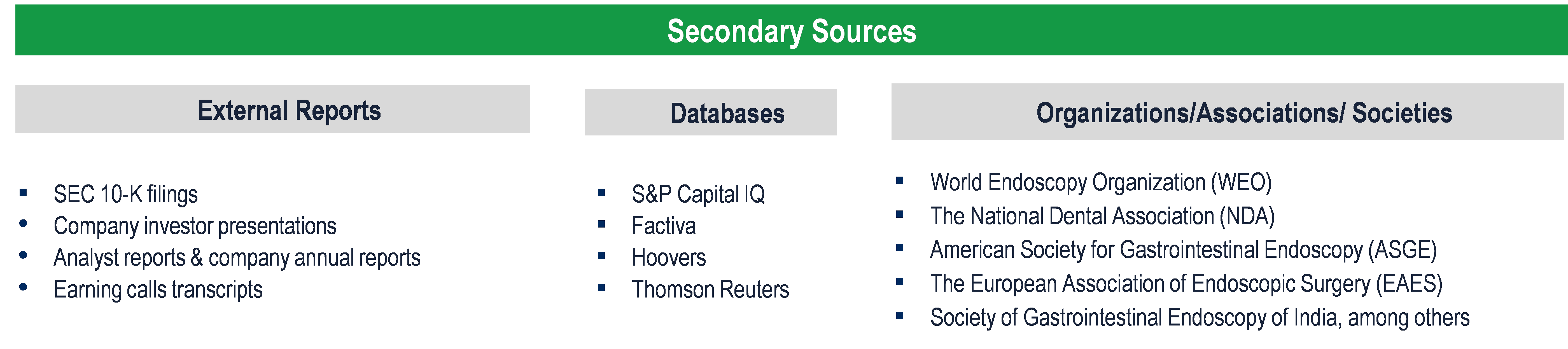

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

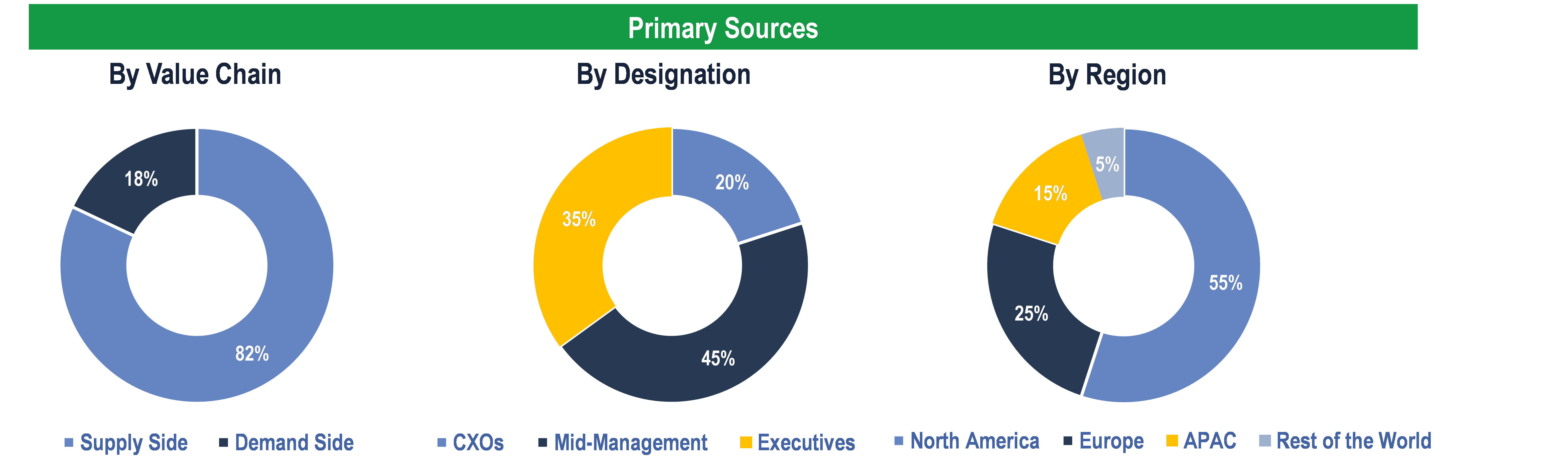

Primary Research

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, R&D Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Hospitals, Outpatient facilities

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down & Bottom-Up Approaches’ were used to derive market size estimates and forecasts

Data Triangulation

Research findings derived through secondary sources & internal analysis was validated with Primary Interviews, Internal Knowledge Repository and Company’s Sales Data