Gastrointestinal Endoscopic Devices Market Size, Share, Trends & Growth Analysis 2026

The Global Gastrointestinal MedTech Devices Market was valued at $13.7 billion in 2021 and is set to witness a growth rate of 5% in the next 5 years. Rising number of GI procedures, increasing preference for minimally invasive surgeries, growing adoption of single-use devices to prevent patient cross-contamination and ensure patient safety, growing cases of colorectal cancer and screening mandates in most healthcare systems, growing hospital investments in endoscopy facilities, and benefits of endoscopic procedures are some of the key factors driving the market’s growth.

Gastrointestinal (GI) diseases are disorders of the digestive system that involve a range of vital digestive organs such as mouth, esophagus, stomach, small and large bowels, rectum, anus, and GI connected organs (liver, gallbladder, and pancreas).

The burden of GI diseases such as colorectal cancer, gastroesophageal reflux disease, ulcerative colitis (UC), inflammatory bowel disease (IBD), and Crohn’s disease (CD) is growing globally and can be attributed to varying environmental factors brought on by changes in diet, industrialization, enhanced sanitation, and the increased use of antibiotics. Medical devices such as endoscopes, laparoscopes/surgical endoscopes, endotherapy devices, and laparoscopic devices play a vital role in the early & accurate diagnosis and treatment of potentially life-threatening GI diseases, which in turn opens up growth avenues for GI MedTech device manufacturers.

The Resurgence of Gastrointestinal Endoscopic Devices Market Post Covid-19 Pandemic

Throughout 2020 and 2021, the Covid-19 virus spread rapidly and relentlessly across the globe and adversely impacted a multitude of industries worldwide. With lockdowns implemented, social distancing mandated, and widespread apprehension – Covid-19 adversely impacted health services internationally and the GI MedTech industry was no different.

Specialties such as gastroenterology were directly affected by Covid-19. The pandemic adversely impacted the workflow and safety of endoscopists, ancillary staff, and patients. Shortages of personal protective equipment (PPE), curtailed patient volume, dearth of testing kits, workforce furloughs, and lockdowns forced units to drastically reduce the volume of the procedures, postpone and even cancel GI procedures in medium- to low-risk cases. The dip in the number of GI procedures resulted in the decline of Gastrointestinal Endoscopic Devices revenue

However, since 2021, the Gastrointestinal Endoscopic Devices is on the recovery path. The market has been driven by the strong performance of GI MedTech companies in Japan, Europe, and North America, increased sales of gastroscopes and colonoscopes, the launch of innovative products, strong performance of the GI MedTech device manufacturers in North America, improving Covid-19 coverage globally and rising number of GI procedures.

“A price erosion in Gastrointestinal Endoscopic Devices is expected due to consolidation of group purchasing organizations (GPOs) in different markets and demand of discounts by cash-strapped hospitals in high volume purchases especially due to Covid-19 pandemic.” - Senior Director, Leading Endoscope Manufacturer, United States

Technological Advancements is driving the Gastrointestinal Endoscopic Devices Market

The Gastrointestinal Endoscopic Devices market is a technology-driven market and is marked by constant product enhancements/innovations. For instance,

- In May, 2022, Fujifilm showcased its new endoscopy innovations for the detection, diagnosis, and treatment of diseases at Digestive Disease Week (May 21-24), 2022. The firm showcased its entire portfolio of endoscopic imaging solutions for core gastrointestinal (GI), therapeutic, interventional, and third space endoscopy including ELUXEO® VISION, G-EYE® 700 Series Colonoscopes, El-740D/S Dual-Channel Endoscope, TRACMOTION [Fujifilm’s new device for endoscopic submucosal dissection (ESD)]

- In Feb 2022, Ambu received the 510(k) regulatory clearance of the Ambu® aScope™ Gastro and Ambu® aBox™ 2 in the United States. aScope Gastro is Ambu’s first sterile single-use gastroscope and includes new advanced imaging and design features in a combined solution with next-generation display and processor technology. With HD capabilities, the aBox 2 sets a new benchmark in terms of image quality and is at the centre of Ambu’s endoscopy ecosystem.

“Single-use gastroscopes counter concerns related to the long waiting lists and staff shortages. Ease of setup and elimination of reprocessing are other advantages offered by the system which is expected to drive its adoption.” - Professor, Leading Hospital, United States

United States Expected to Continue to Hold a Major Share in the Gastrointestinal Endoscopic Devices Market

The United States currently holds a major share in the Global Gastrointestinal Endoscopic Devices Market. It is expected to continue to hold a major share in the coming years due to the increasing number of endoscopic examinations, rising aging population, favourable reimbursement climate for endoscopy procedures, growth in minimally invasive endoscopic therapy procedures, rising concerns over cleaning, disinfection & sterilization, and higher quality expectations.

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold

The Gastrointestinal Endoscopic Devices Market is marked by the presence of both established and new players. Players operating in the market adopt both organic and inorganic growth strategies such as new product launches, and partnerships to garner market share. For instance,

- In February 2022 Motus GI, received FDA Clearance to market the Pure-Vu® EVS System. The new Pure-Vu EVS System improves the speed of set-up, enhances navigation capabilities in tortuous anatomy, builds upon the excellent cleansing capabilities of the Pure-Vu system and enables physicians to rapidly overcome the challenges of poorly prepared colons during a colonoscopy.

- In November 2021, Micro-Tech Endoscopy launched the Lesion Hunter Cold Snare, a novel cold snare with an ultra-thin Nitinol wire. The cold snare offers two great features - the ability to trap the tissue regardless of how flat the lesion is, and the 'cheese cutter' capability to resect even larger lesions.

The Gastrointestinal Endoscopic Devices Market is expected to continue to grow in the coming years due to growing cases of GI disorders & requirements for endoscopes, laparoscopes/surgical endoscopes, endotherapy devices, and laparoscopic devices to diagnose and treat GI disorders.

Competitive Landscape Analysis : Gastrointestinal Endoscopic Devices Market

The gastrointestinal endoscopic devices market is marked by the presence of players such as Olympus, Boston Scientific, Pentax (Hoya), Fujifilm, Cook Medical, Karl Storz, Ethicon, Medtronic, Stryker, Medi-Globe, Ambu, Arthrex, Richard Wolf, ERBE, Micro-Tech, among others.

Key Strategic Questions Addressed

- What is the market size & forecast of the Gastrointestinal Endoscopic Devices Market?

- What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the Gastrointestinal Endoscopic Devices Market?

- What are the key trends defining the market?

- What are the major factors impacting the Gastrointestinal Endoscopic Devices market?

- What are the opportunities prevailing in the GI MedTech Devices Market?

- Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

- Who are the major players operating in the Gastrointestinal Endoscopic Devices market?

- What are the key strategies adopted by leading market players?

The study has been compiled based on the extensive primary and secondary research.

Secondary Research (Indicative List)

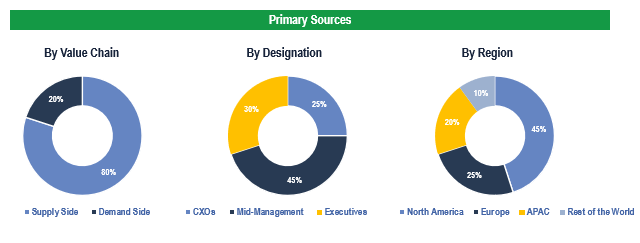

Primary Research

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, R&D Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders in Hospitals, Ambulatory Surgery Centers/Clinics, and Endoscopy Centers.

Breakdown of Primary Interviews

Market Size Estimation

The market size was derived based on extensive secondary research further validated through expert interviews.

Data Triangulation

Research findings derived through secondary sources & internal analysis was validated with Primary Interviews, Internal Knowledge Repository and Company’s Sales Data.