High-Throughput Screening Market Size, Share, Growth, and Forecast 2024 to 2029 with Revolutionizing Drug Discovery

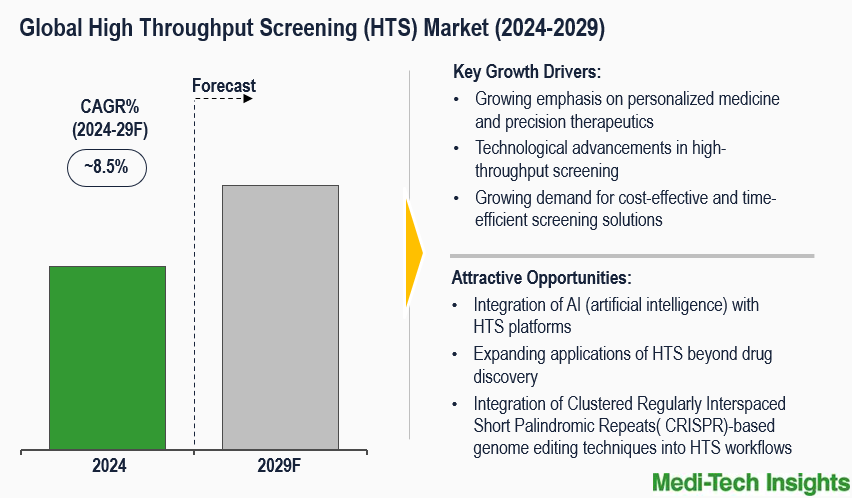

The High Throughput Screening Market is expected to witness a growth rate of ~8.5% by 2029. The key factors driving the market are the increasing demand for novel drug discovery and development, advancements in screening technologies, rising investments in drug discovery research and development by pharmaceutical and biotechnology industries, growing emphasis on personalized medicine and precision therapeutics, and the need for cost-effective screening solutions. To learn more about the research report, download a sample report.

High Throughput Screening (HTS) is the process of screening a large quantity of chemical/or biological modulators against specific targets. These systems employ robotics, artificial intelligence, and other advanced technologies to rapidly assess the biological or biochemical activity of numerous molecules, typically drugs. HTS serves as a valuable tool for evaluating pharmacological targets and profiling agonists and antagonists for receptors (such as GPCRs) and enzymes.

Growing Demand for High Throughput Screening in Drug Discovery Drives Market Growth

High Throughput Screening (HTS) finds multiple applications within drug discovery processes, serving as a common method for identifying lead compounds essential for drug development. Typically, HTS employs liquid handling devices, robotics, plate readers as detectors, and specialized software for instrument control and data processing. While HTS processes generally don't directly identify drugs, their primary function lies in swiftly pinpointing hit compounds demonstrating promising biological activity. This expedites the lead discovery phase, allowing researchers to efficiently identify potential drug candidates for further optimization and characterization. HTS enables iterative cycles of compound screening, lead optimization, and analysis of structure-activity relationships (SAR), culminating in the development of optimized lead compounds with enhanced potency, selectivity, and drug-like properties. Consequently, the results from HTS assays serve as the starting point for subsequent stages in the drug discovery pipeline, including drug design and understanding the interaction or function of specific biochemical processes.

The deployment of newly developed HTS platforms significantly supports drug discovery endeavors. Automated liquid handling systems, robotic plate handlers, and high-speed imaging instruments enable swift assay execution, sample handling, and data acquisition. This automation not only enhances assay consistency and reproducibility but also reduces assay costs and resource requirements, thereby enhancing accessibility to HTS across academic, industrial, and governmental sectors. Furthermore, HTS is increasingly pivotal in precision medicine initiatives, aiding in the selection of appropriate drugs based on patients' tumor characteristics.

To learn more about this report, download the PDF brochure

Advancement in High Throughput Screening Technologies Fuels Its Demand

Advances in automation, robotics, and miniaturization have significantly enhanced the throughput and efficiency of HTS systems. Some of the emerging technological innovations currently being used for HTS to lead discovery include:

Assay Miniaturization: Miniaturization in high throughput screening (HTS) refers to the process of scaling down assay volumes and dimensions to increase screening throughput, efficiency, and cost-effectiveness. This approach allows researchers to perform a higher number of assays in a given time frame while conserving precious reagents and samples.

Label-free Technologies: These technologies enable the real-time, direct measurement of molecular interactions and cellular responses without the need for fluorescent or radioactive labels. Label-free detection technologies range from mass-spectrometry systems to reflectometric interference spectroscopy, measurement of dynamic mass redistribution (DMR) using waveguide resonance, or surface plasmon resonance.

High Content Screening (HCS): High-content screening (HCS, also known as high-content analysis, or HCA) is an approach to cell biology that combines automated imaging and quantitative data analysis in a high-throughput format suitable for large-scale applications such as drug discovery and systems biology.

Growing Adoption of High Throughput Screening in Various Applications Propels Market Growth

The use of High Throughput Screening (HTS) is rapidly expanding across various fields, extending beyond traditional drug discovery. Here are some examples of its applications:

LAMP-seq test (High-throughput COVID-19 screening): This novel test can simultaneously analyze a large number of swabs using sequencing technology, offering sensitivity similar to the qPCR test. LAMP-seq employs a modified, highly scalable reverse transcription isothermal amplification (RT-LAMP) method. It utilizes unpurified biosamples, which are barcoded and amplified in a single heat-induced step. Subsequently, the pooled products undergo mass sequencing before analysis. The HTS design of this approach enables rapid screening of large samples, a capability not present in the PCR test.

Proximity Extension Assay: This proteomics test is utilized in Alzheimer’s diagnosis for the high-throughput detection of protein biomarkers in liquid samples. The assay employs a matched pair of antibodies linked to unique oligonucleotides for each biomarker, which bind to the respective protein target. This high-throughput protein technology allows for the examination of over 1,000 proteins in the plasma of patient samples.

High-throughput Functional Screening: In the realm of cancer immunotherapy, a highly efficient droplet-based microfluidic platform has been developed. This platform combines a lentivirus transduction system and has demonstrated the ability to screen millions of antibodies to identify potential hits with desired therapeutic functionalities. Simple binding assays can screen millions of plasma cells for antibodies bound to vaccines/cancer targets. These antibodies represent first-generation cancer immunotherapy agents, consisting of antagonist antibodies that act as checkpoint inhibitors.

Key Constraints/ Challenges

The high throughput screening market faces numerous challenges and constraints. High assay costs, instrumentation expenses, and reagent expenditures are a constant challenge for drug discovery researchers. Miniaturizing assays for high throughput screening is technically demanding, requiring the preservation of assay robustness, sensitivity, and reproducibility at smaller scales. Additionally, HTS generates large volumes of data, posing challenges in terms of storage, management, and analysis. Other constraints include the complexity of cell-based assays, ensuring the diversity and quality of compound libraries, and maintaining the reproducibility and reliability of results across different laboratories and platforms.

North America Expected to Continue to Hold a Major Share in the High Throughput Screening Market

From a geographical perspective, North America holds a major market share of the high throughput screening market. This can be mainly attributed to the increasing demand for drug discovery, increasing investments in research and development (R&D) by pharmaceutical companies, and biotechnology firms, technological advancements in high-throughput screening, and open access to high-throughput screening laboratories in the region. However, the Asia-Pacific region is expected to witness strong growth in the coming years due to growing emphasis on personalized medicine and precision therapeutics, growing application of HTS in other areas such as chemical biology, genomics, and functional genomics, and growing demand for cost-effective and time-efficient screening solutions in the region.

Competitive Landscape

Some of the key players operating in the market include Agilent Technologies Inc., Bio-Rad Laboratories Inc., Merck KGaA, PerkinElmer Inc., Thermo Fisher Scientific Inc., Beckman Coulter Inc., BMG LABTECH, Tecan Trading AG, Hamilton Company, BioTek Instruments, Inc., Charles River, Sygnature Discovery, Molecular Devices LLC, Eurofins Scientific, and Evotec SE, among others.

Get a sample report for competitive landscape analysis

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the Market

Players operating in this market are adopting organic and inorganic growth strategies such as launching new products, acquiring related firms, and entering into collaborations to garner higher market share. For instance,

- In July 2023, Beckman Coulter, announced it will debut its hematology analyzer and slidemaker stainer connected to Scopio Labs’ High-throughput digital morphology platform capable of continuous loading, scanning, and analysis for end-to-end digitization with artificial intelligence-assisted peripheral blood smear analysis at the 2023 American Association for Clinical Chemistry (AACC) Annual Scientific Meeting and Clinical Lab Expo

- In May 2023, Evotec SE announced the expansion of new high-throughput screening (“HTS”) facilities at the Company’s headquarters in Hamburg, as well as additional equipment for investigating the safety and efficacy of new therapeutic candidates have been put into operation

- In February 2023, Agilent Technologies Inc. announced that their xCELLigence RTCA HT (real-time cell analysis high-throughput) platform now integrates with the BioTek BioSpa 8 Automated Incubator. Developed in response to market needs, this combination enables a higher level of workflow automation that provides novel functionality for the development of label-free high-throughput potency assays for the immuno-oncology space and high-throughput viral cytopathic effects (CPE) assays for the vaccine market

- In February 2023, Tecan Group Ltd. entered into a collaboration with Oxford Nanopore Technologies plc (Oxford Nanopore) to drive easier high-throughput nanopore library preparation in an automated, hands-free fashion

The high throughput screening (HTS) market is a growing market that is expected to gain further momentum in the coming years due to a strong emphasis on developing new products, innovations in high throughput screening technology, and aggressive organic and inorganic growth strategies followed by the players.

Key Strategic Questions Addressed

-

What is the market size and forecast for the High Throughput Screening (HTS) Market?

-

What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the High Throughput Screening (HTS) Market?

-

What are the major growth drivers, restraints/challenges impacting the market?

-

What are the opportunities prevailing in the market?

-

What is the investment landscape?

-

Which region has the highest share in the market? Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market? What is the competitive positioning of key players?

-

Who are the new players entering the market?

-

What are the key strategies adopted by players?

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Market Forecasting

- Executive Summary

- Market Overview

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Industry Speaks

- Market Dynamics

- High Throughput Screening (HTS) Market- Size & Forecast (2022-2029), By Product & Service

- Consumables & Reagents

- Instruments

- Software

- Services

- High Throughput Screening (HTS) Market- Size & Forecast (2022-2029), By Technology

- Ultra-High Throughput Screening

- Cell-based Assay

- Label-Free Technology

- Lab On a Chip

- High Throughput Screening (HTS) Market- Size & Forecast (2022-2029), By Application

- Drug Discovery

- Biochemical Screening

- Life Science Research

- Other Application

- High Throughput Screening (HTS) Market- Size & Forecast (2022-2029), By End-Users

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations (CROs)

- Other End Users

- High Throughput Screening (HTS) Market- Size & Forecast (2022-2029), By Region

- North America (U.S. & Canada)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, Rest of Asia Pacific)

- Rest of the World (Latin America, Middle East & Africa)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Competitive Positioning of Key Players (2023)

- Offerings Assessment, By Players

- Key Strategies Assessment, By Player (2021-2023)

- New Service Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Other Developments

- Key Players and their Competitive Positioning

- Key Companies Scanned (Indicative List)

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Merck KGaA

- PerkinElmer Inc.

- Thermo Fisher Scientific Inc.

- Beckman Coulter Inc.

- BMG LABTECH

- Tecan Trading AG

- Charles River

- Evotec SE

- Sygnature Discovery

- Other Prominent Players

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

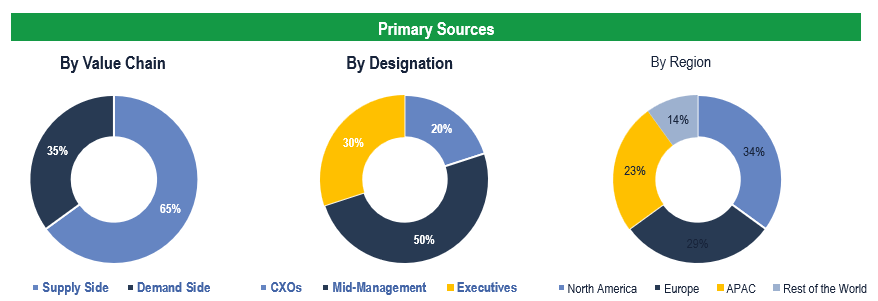

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, Business Development Managers, Consultants

- Demand Side Stakeholders: Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, and Clinical Research Organizations (CROs), Among Others

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & and internal analysis were validated with Primary Interviews, an Internal Knowledge Repository, and Company Sales Data.