Life Sciences Software Market – Global Industry Size, Share, Growth Analysis, Trends and Forecast 2024 to 2029

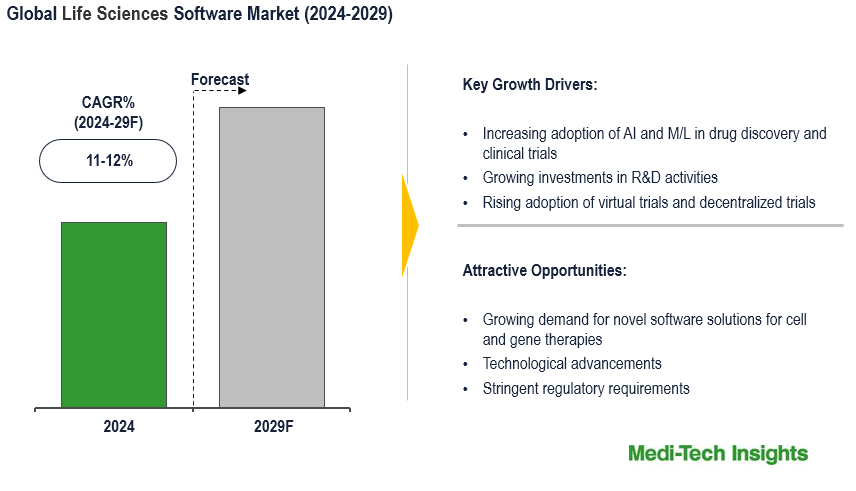

The global Life Sciences Software market is expected to grow at a CAGR of 11-12% by 2029, driven by increasing R&D activities across the world, stringent regulatory compliance/reporting, rising use of AI & ML in drug discovery and clinical trial phases, and growing demand for novel software solutions specifically designed for biologics/cell & gene therapy. To learn more about the research report, download a sample report.

The life science industry is rapidly evolving and is increasingly looking for automation and digital data management technologies to research and innovate most efficiently and accurately possible. The market for life sciences software (such as eTMF, LIMS, computer-aided drug discovery, RWE, ERP, CRM, QMS, virtual trials, patient recruitment software, patient & outcomes data management, etc.) is driven by the increasing R&D spending and pipeline, growing number and size of biotechs, Covid-accelerated decentralized trials, increasing cost efficiencies and shorter time to market.

Mounting Interest in Novel Software Solutions Specifically Designed for Biologics

Advanced therapies, such as cell and gene therapies and personalized vaccines require advanced software infrastructure across the entire development and manufacturing process. With rapidly expanding research on cell and gene therapies and a healthy CGT pipeline, there is robust demand for software solutions to maximize process and workflow efficiencies across services. Some of the key technology providers for CGT include Vineti, TrakCel, Be The Match, SAP, WellSky, Synthace and Cytiva. The FDA predicts that by 2025, 10 to 20 cell and gene therapy products will be approved a year. Companies are entering/expanding into the Biologics software space to leverage growth opportunities. For instance,

- In Oct 2021, Körber, the leading supplier of manufacturing IT solutions for pharma and biotech, and Vineti, the leading digital enterprise platform provider for cell and gene therapy supply chains and data management, entered into a partnership to provide improved manufacturing performance and global visibility for CGT

To learn more about this report, download the PDF brochure

COVID-19 Impact on Life Sciences Software Market

Covid-19 has impacted all phases of drug development however, the clinical trials phase was hit the most. This paved the way for technological solutions to overcome such hurdles. Virtual trials have become more important than ever post-pandemic. There were hardly any M&As related to virtual trials taking place before the pandemic, but the market observed ~10 M&A deals in 2020. The companies are increasingly consolidating through M&As to enhance their technology/service offerings for decentralized trials and leverage growth opportunities in the life sciences software market.

Regional Trends: Medical image analysis software market

The life sciences software market, encompassing biotechnology, pharmaceuticals, biomedical technologies, and healthcare, supports R&D, clinical trials, regulatory compliance, and data management. North America leads this market due to its advanced healthcare infrastructure, significant R&D investments, and the presence of key players like Oracle and IBM, with trends showing increased adoption of AI and big data analytics. Europe, the second-largest market, benefits from a robust healthcare system, substantial government R&D funding and a focus on personalized medicine and GDPR compliance. The Asia-Pacific region, experiencing the fastest growth, is driven by rising healthcare investments, clinical trial activities, and expanding pharmaceutical markets in China, India, and Japan, with local and international companies like Infosys and Wipro contributing to this growth amid rapid digital transformation and government initiatives.

To learn more about this report, download the PDF brochure

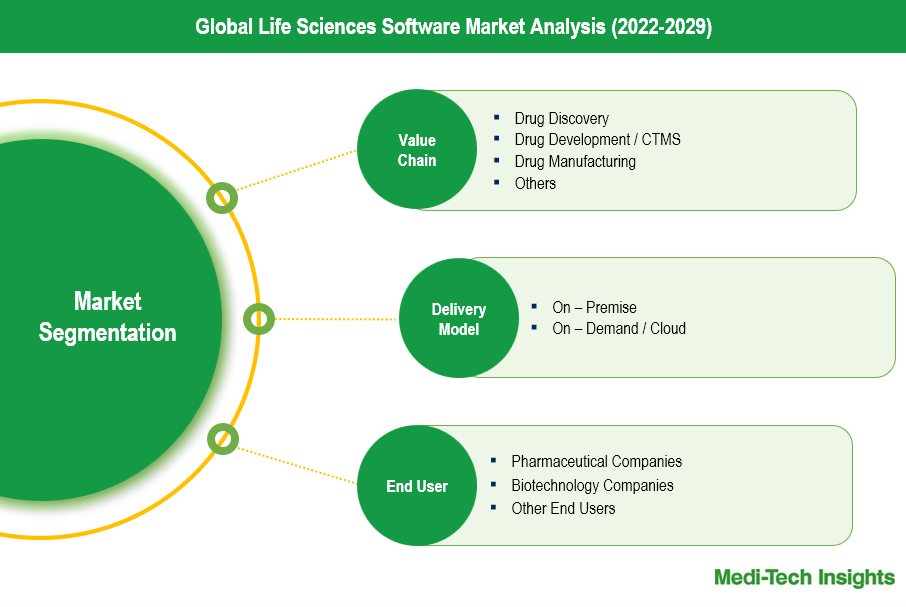

Drug Discovery Software Likely to Witness Fastest Growth

The life sciences software market value chain segment, includes Drug Discovery, Drug Development/Clinical Trial Management Systems (CTMS), Drug Manufacturing, and Commercialization, each with distinct market shares and growth dynamics. The drug discovery software market, though niche, is rapidly expanding due to the increasing pressure on pharmaceutical and biotech companies to reduce costs and timelines in the research and preclinical stages. Advanced deep-learning software tools are instrumental in enhancing transparency and efficiency in this segment. Drug development and CTMS software are crucial for managing and optimizing clinical trials, representing a significant portion of the market as companies seek to streamline trial processes and ensure regulatory compliance. Drug manufacturing software supports the production process by ensuring quality control and compliance with stringent regulations. Lastly, commercialization software aids in market analysis, customer relationship management, and strategic product launches.

“Large players present in this segment are trying to consolidate the market by becoming a one-stop shop. Moreover, companies are also considering to combine their solutions with bioinformatics and LIMS tools to have a competitive edge.” - Executive, Leading Drug Discovery Software Provider, US

Rising Demand for Cloud-based Software

The life science software market is segmented into On-Premise and On-Demand/Cloud delivery models, each with distinct market dynamics. On-premise systems, despite their historical prevalence, are increasingly challenged by the need for efficient data sharing and integration across organizations. These systems are often characterized by high implementation and management costs, and they lack the scalability and flexibility required in today’s data-driven environment. As a result, their market share is declining. In contrast, the On-Demand/Cloud segment is experiencing a surge in demand, capturing a significant portion of the market due to its advantages such as quick deployment, minimal upfront costs, and superior scalability. This model is particularly appealing to small and medium-sized pharmaceutical companies, biotech’s, contract research organizations (CROs), and contract development and manufacturing organizations (CDMOs), which benefit from its affordability and operational efficiency.

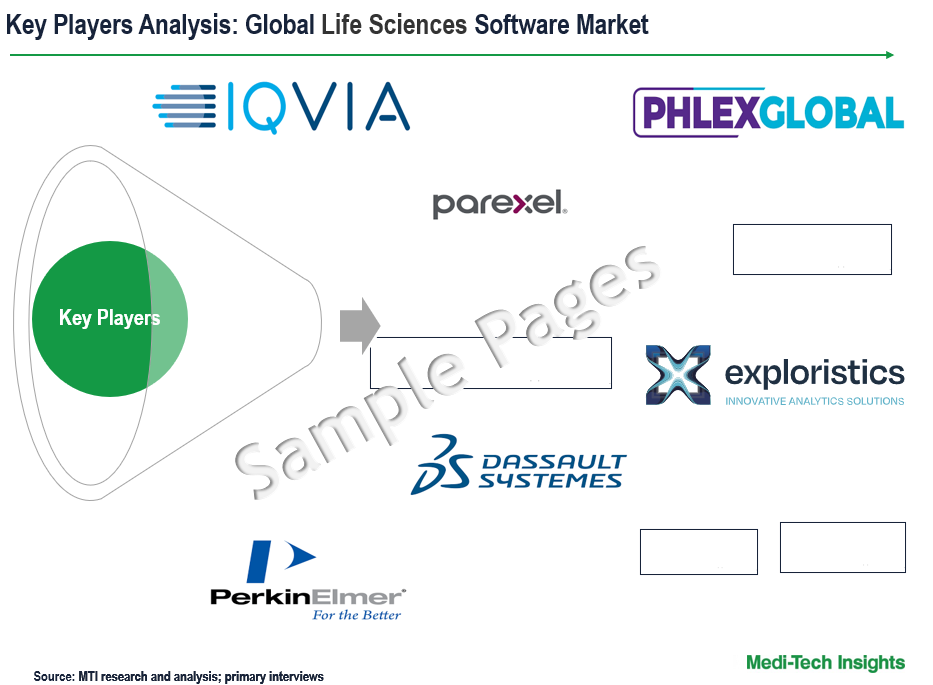

Competitive Landscape: Life Sciences Software Market

The global life sciences software market is highly competitive and fragmented. Some of the key players having a strong foothold in the global life science software market include Dassault Systèmes, LabVantage, PerkinElmer, Schrodinger, ICON, Veeva, PhlexGlobal, Saama Technologies, IQVIA, Parexel, Signant Health, Calyx, Salesforce, ConcertAI, Abbott, Science37, Healx, Medidata, IBM Watson Health, Koneksa, SAP, Oracle, Optibrium, Verily and Exploristics among others.

Get a sample report for competitive landscape analysis

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the Market

Players operating in this market are adopting both organic and inorganic growth strategies such as collaborations, acquisitions, and new product launches to garner market share. For instance,

- In January 2023, IQVIA entered into its first life sciences industry collaboration with Alibaba Cloud in China. IQVIA and Alibaba Cloud will be providing solutions hosted in Mainland China leveraging Salesforce on Alibaba Cloud. This will enable customers with a path to begin using or extending their investments on the best-in-class platform for engaging with their customers

- In January 2023, ArisGlobal launched LifeSphere Clarity, a strong addition to the robust and comprehensive LifeSphere platform and a key offering within the data & analytics product line

- In November 2022, Veeva Systems entered into a ten-year strategic partnership agreement with Merck. Under the terms of the agreement, Merck will take a Veeva-first approach to new industry-specific software and data, selecting Veeva products when they are fit for purpose to maximize the value of Veeva’s integrated, cloud-based platform and products

- In April 2022, Veeva Systems announced Veeva Data Cloud, a group of cloud data applications that includes Veeva OpenData customer reference data, Veeva Link for real-time intelligence, and Veeva Compass patient, prescriber, and sales data for the U.S. market

The market is expected to gain further momentum in the coming years due to technological advancements, rising R&D investments, new product launches, and aggressive organic and inorganic growth strategies followed by the players.

Life Sciences Software Market Futures and Scope

| Report Scope | Details |

| Base Year Considered | 2023 |

| Historical Data | 2022 - 2023 |

| Forecast Period | 2024 - 2029 |

| CAGR (2024-2029) | 11-12% |

| Segment Scope | Product, Application, End User |

| Regional Scope |

|

| Key Companies Mapped | Dassault Systèmes, LabVantage, PerkinElmer, Schrodinger, ICON, Veeva, PhlexGlobal, Saama Technologies, IQVIA, Parexel, Signant Health, Calyx, Salesforce, ConcertAI, Abbott, Science37, Healx, Medidata, IBM Watson Health, Koneksa, SAP, Oracle, Optibrium, Verily and Exploristics among others |

| Report Highlights | Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

Key Strategic Questions Addressed

-

What is the market size & forecast for the Global Life Sciences Software Market?

-

What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the Global Life Sciences Software Market?

-

How has COVID-19 impacted the Global Life Sciences Software Market?

-

What are the major growth drivers, restraints/challenges impacting the market?

-

What are the opportunities prevailing in the market?

-

What is the investment landscape?

-

Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market? What is the competitive positioning of key players?

-

Who are the new players entering the market?

-

What are the key strategies adopted by players?

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Market Forecasting

- Executive Summary

- Market Overview

-

- Market Dynamics

- Drivers

- Restraints

- Key Market Trends

- Industry Speaks

- Market Dynamics

- Key Revenue Pockets

- Global Life Sciences Software Market - Size & Forecast (2021-2028), By Value Chain

- Drug Discovery

- Drug Development/ CTMS

- Drug Manufacturing

- Commercialization, RWE & Pharmacovigilance

- Global Life Sciences Software Market - Size & Forecast (2021-2028), By Delivery Model

- On-Premise

- On-demand/Cloud

- Global Life Sciences Software Market - Size & Forecast (2021-2028), By End User Type

- Pharmaceutical Companies

- Biotechnology Companies

- Other End Users

- Global Life Sciences Software Market - Size & Forecast (2021-2028), By Region

- North America (U.S. & Canada)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, Rest of Asia Pacific)

- Rest of the World (Latin America, Middle East & Africa)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Competitive Positioning of Key Players (2022)

- Offerings Assessment, By Player

- Key Strategies Assessment, By Player (2021-2023)

- New Product & Service Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Key Companies Scanned (Indicative List)

- Dassault Systèmes

- LabVantage

- PerkinElmer

- Schrodinger

- ICON

- Veeva

- PhlexGlobal

- Saama Technologies

- IQVIA

- Parexel

- Calyx

- Salesforce

- ConcertAI

- Abbott

- Science37

- Healx

- Medidata

- IBM Watson Health

- Koneksa

- SAP

- Oracle

- Optibrium

- Verily

- Exploristics

- Other Prominent Players

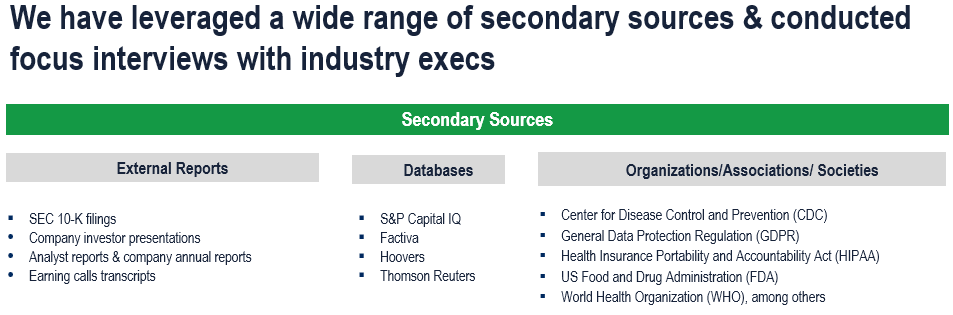

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

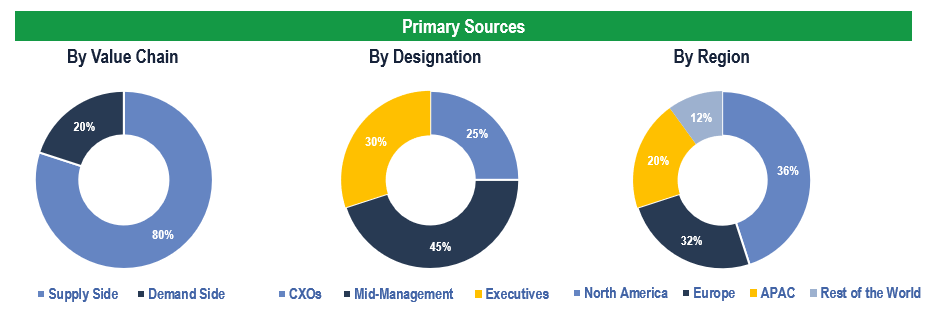

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders in Pharma, Biotech, CROs, CDMOsand Other End Users

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis were validated with Primary Interviews, Internal Knowledge Repository, and Company Sales Data.