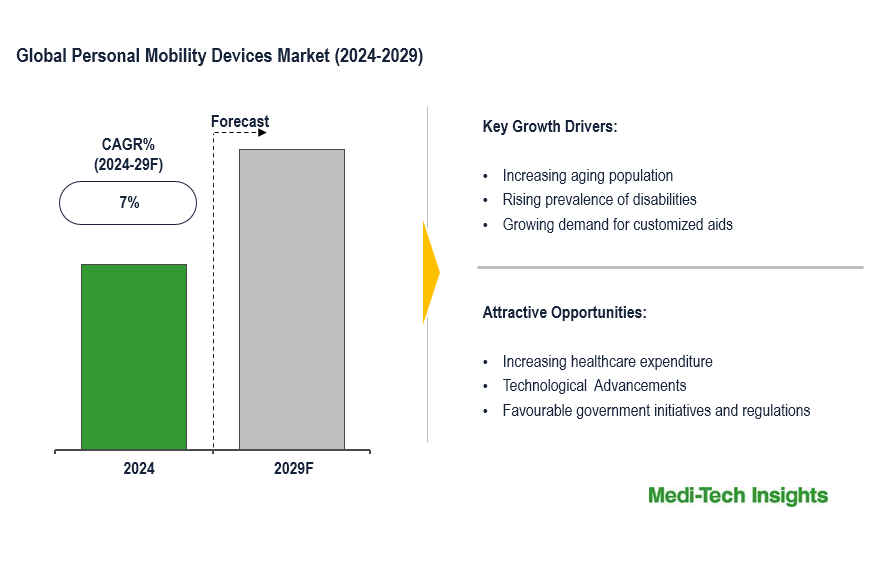

Personal Mobility Devices Market: 7% CAGR, Key Trends, Growth Drivers, and Forecast Analysis (2024-2029)

The Personal Mobility Devices Market is poised for steady growth, with an anticipated expansion rate of around 7% during the forecast period. This growth is driven by several factors, including the aging global population, a rise in disability rates, technological advancements in mobility solutions, and increasing healthcare spending worldwide. These trends are collectively boosting the demand for personal mobility devices, particularly among older adults and individuals with mobility challenges, thereby propelling the market forward. To learn more about the research report, download a sample report.

Personal mobility devices are specifically designed to help individuals with mobility impairments move more easily and safely. These mobility devices come in different forms to cater to particular needs, and choosing the right one can significantly enhance mobility and quality of life. Some of the personal mobility devices include:

Wheelchairs: Ideal for those who struggle with walking or standing for long periods, wheelchairs offer essential mobility. Available in both manual and electric models, they come in various sizes and designs to suit different user preferences and needs

Walkers: Also known as Zimmer frames, walkers provide stability and support with four legs and handgrips. Some models feature wheels on the front legs, making them easier to manoeuvre, particularly on flat surfaces

Crutches: Crutches are used by individuals with temporary or permanent mobility limitations to support body weight and provide balance while walking. They are available in different styles, including underarm and forearm crutches, each designed for specific situations

Meeting Mobility Needs: The Growing Demand for Personal Mobility Devices

With the global population aging, there's a significant increase in the number of elderly individuals experiencing mobility challenges due to conditions like arthritis, osteoporosis, and general age-related mobility decline. This has led to a growing demand for personal mobility devices, including wheelchairs, walkers, and scooters. Additionally, disabilities caused by accidents, injuries, or medical conditions are further fueling the need for these essential devices. Personal mobility aids are vital in promoting independence and enhancing the quality of life for those with disabilities, thereby driving market demand.

To learn more about this report, download the PDF brochure

Innovations and Policies Driving the Personal Mobility Device Market

The personal mobility device market is experiencing significant growth, fueled by both technological advancements and supportive government initiatives. Modern mobility devices are now equipped with cutting-edge features that enhance functionality, comfort, and accessibility, making them increasingly attractive to consumers who seek solutions that fit their lifestyles. This trend is further amplified by the expansion of healthcare infrastructure, improved insurance coverage, and rising healthcare expenditures, which together drive market expansion. For instance,

- In May 2023, Drive Medical, a division of Drive DeVilbiss Healthcare, launched the Nitro Sprint, the newest addition to its Nitro mobility line, offering advanced features for precision control and improved safety, providing an enhanced mobility experience for those requiring walking support

Sustainability has also become a key focus, with manufacturers prioritizing eco-friendly materials and recycling programs to reduce environmental impact. At the same time, governments around the world are implementing policies and initiatives to promote inclusivity and accessibility for individuals with disabilities. These efforts include regulatory measures, funding programs, and public awareness campaigns that support the adoption of mobility devices, ultimately enhancing the quality of life and independence for those with mobility impairments. As a result, the personal mobility device market is evolving with innovative solutions and a stronger emphasis on personalized care.

New Trends Shaping the Personal Mobility Device Market

The market is witnessing trends such as:

Customization: Companies offer customizable and personalized mobility solutions to meet individual needs, including adjustable settings, ergonomic designs, and tailored accessories.

Lightweight and Portable Designs: In demand by active users seeking devices for travel and various activities.

Smart Mobility Solutions: Equipped with sensors and connectivity features, providing monitoring capabilities and navigation assistance. For example:

- In November 2021, Drive DeVilbiss Healthcare collaborated with the BILT Video Assembly App to streamline product assembly, offering features such as 3D walkthroughs, clear visuals, audio guidance, and essential information access

- In February 2021, Invacare Corporation introduced the Invacare AVIVA STORM RX, representing a major leap forward in rear-wheel drive power wheelchairs and setting a new benchmark in power mobility

Key Constraints / Challenges

The personal mobility device market encounters several obstacles. High costs for devices like wheelchairs, walkers, and scooters often pose financial challenges for those with limited resources or insufficient insurance. Additionally, navigating insurance coverage and reimbursement can be complex and time-consuming for users and healthcare providers. Social stigma and barriers surrounding mobility aids further hinder adoption, discouraging individuals from seeking the necessary assistance.

To learn more about this report, download the PDF brochure

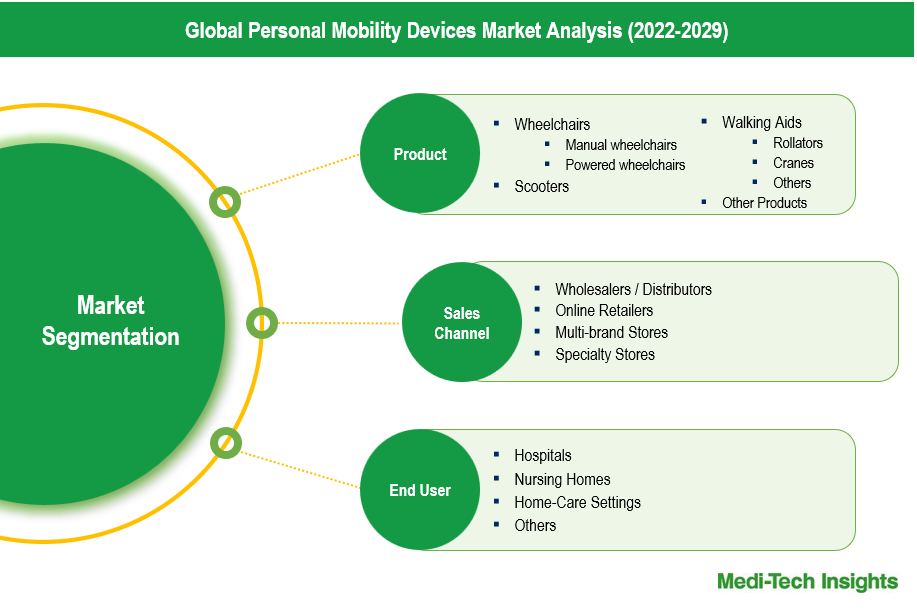

Product Segment Outlook

The personal mobility devices market comprises various product types, each catering to specific mobility needs and contributing differently to the overall market share. Wheelchairs form a significant segment, providing essential mobility for individuals with severe movement restrictions. Walking aids are another substantial segment, offering support to individuals who can walk but need assistance with balance and stability. Scooters represent a growing market share due to their popularity among elderly individuals and those with mild to moderate mobility impairments. Mobility scooters provide a convenient and comfortable mode of transportation, especially for outdoor use, and are appreciated for their ease of use and longer battery life.

Each subsegment holds a distinct place within the market, with wheelchairs and scooters typically leading in terms of innovation and adoption. Walking aids like rollators, crutches, and cranes follow, each contributing to the growth and diversification of the personal mobility devices market. These devices collectively drive the market forward by addressing the varied needs of individuals with mobility impairments and enhancing their independence and quality of life.

End User Segment Outlook

The personal mobility devices market is segmented by end-users, each contributing differently to the overall market share. Hospitals represent a significant portion of the market, as they require a wide range of mobility aids for patient care, rehabilitation, and post-surgery recovery. Nursing Homes also hold a substantial market share due to the high prevalence of elderly residents who need mobility assistance for daily activities and overall well-being. Home-care settings are becoming increasingly important, driven by the growing preference for home-based care among patients with chronic conditions or mobility impairments. This segment is expanding rapidly as families and caregivers seek reliable and user-friendly mobility devices to enhance the quality of life for individuals in their own homes.

Regional Analysis of the Personal Mobility Device Market

North America: A prominent player, driven by a large aging population and a high incidence of mobility issues linked to age-related conditions, supported by strong healthcare infrastructure and favourable reimbursement policies

Europe: Offers substantial growth prospects, driven by an expanding elderly demographic and increasing recognition of the need for mobility solutions

Asia Pacific: Shows significant potential for market growth, spurred by rapid urbanization, increasing healthcare spending, and enhanced healthcare infrastructure. Countries like China, India, and Japan are experiencing rising demand for mobility devices due to demographic changes and efforts to improve the quality of life for the elderly. The region's market growth is further accelerated by the adoption of advanced technologies and the development of innovative mobility solutions

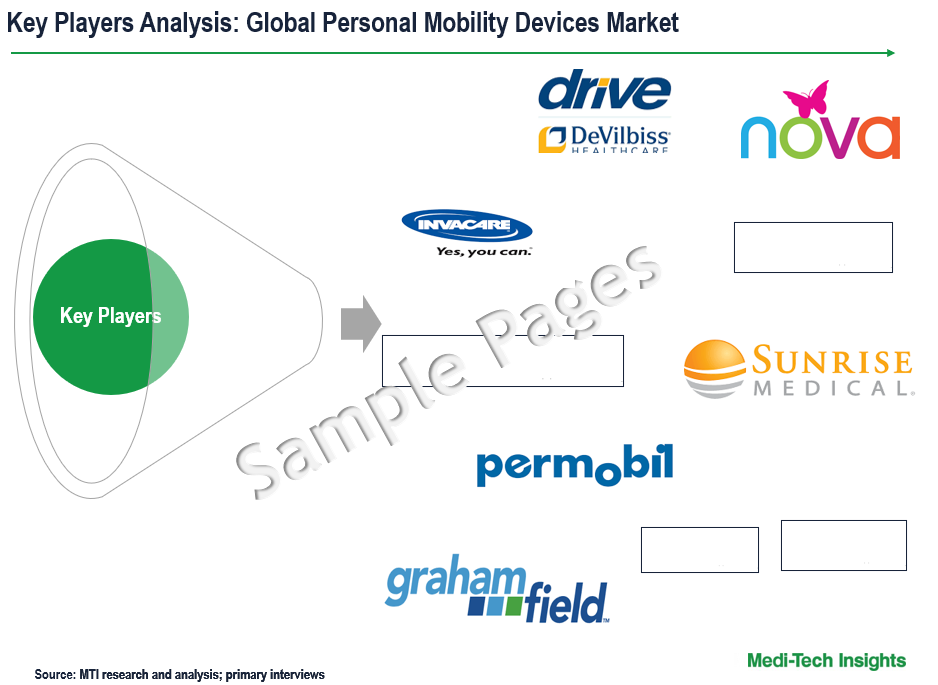

Competitive Landscape Analysis

Some of the key players in the market include Drive DeVilbiss Healthcare, GF Health Products, Inc., Invacare Corporation, Sunrise Medical, Ottobock Healthcare GmbH, Permobil Group, Carex Health Brands, Inc., Kaye Products, Inc., Medline Industries, Inc., NOVA Medical Products, Performance Health, Stryker, National Seating & Mobility and Rollz International among others.

Get a sample report for competitive landscape analysis

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the Market

Players operating in this market are adopting both organic and inorganic growth strategies such as collaborations, acquisitions, and new product launches to garner market share. For instance,

- In June 2024, Drive DeVilbiss Healthcare (DDH) announced the strategic acquisition of Mobility Designed, Inc.'s entire product portfolio, strengthening DDH's range of innovative medical equipment and incorporating advanced industrial design expertise into its operations

- In September 2023, Permobil finalized its acquisition of PDG Mobility, enhancing Permobil's manual wheelchair portfolio and adding expertise in tilt-in-space products, known for their exceptional durability, functionality, design, and customer support

- In October 2023, Sunrise Medical revealed its strategic acquisition of Ride Designs, representing a notable expansion of its custom seating offerings, clinical expertise, and service capabilities, which seamlessly complement the wide array of manual and powered mobility products already provided by Sunrise Medical

- In August 2022, Graham-Field introduced the Everest & Jennings patented PureTilt Tilt-in-Space Wheelchair, designed by an Occupational Therapist, offers a user-adjustable tilt control and an ergonomic, height-adjustable contoured back, ensuring safe, independent transitions for optimal patient comfort and pressure relief

The personal mobility device market is poised for continued growth, driven by technological innovations, government initiatives, and a focus on improving the quality of life and independence of individuals with mobility impairments, new product launches, and aggressive organic and inorganic growth strategies followed by the players.

Global Personal Mobility Devices Market Score

|

Report Scope |

Details |

|

Base Year Considered |

2023 |

|

Historical Data |

2022 – 2023 |

|

Forecast Period |

2024 – 2029 |

|

Growth Rate (2024 – 2029) |

CAGR of 7% |

|

Segment Scope |

Product, Sales Channel, End User |

|

Regional Scope |

|

|

Key Companies Mapped |

Invacare Corporation, Drive DeVilbiss Healthcare, GF Health Products, Inc., Sunrise Medical, Ottobock Healthcare GmbH, Permobil Group, Carex Health Brands, Inc., Kaye Products, Inc., Medline Industries, Inc., NOVA Medical Products, Performance Health, Stryker, National Seating & Mobility and Rollz International among others |

|

Report Highlights |

Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

Key Strategic Questions Addressed

-

What is the market size & forecast for the Global Personal Mobility Devices Market?

-

What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the Global Personal Mobility Devices Market?

-

How has COVID-19 impacted the Global Personal Mobility Devices Market?

-

What are the major growth drivers, restraints/challenges impacting the market?

-

What are the opportunities prevailing in the market?

-

What is the investment landscape?

-

Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market? What is the competitive positioning of key players?

-

Who are the new players entering the market?

-

What are the key strategies adopted by players?

- Introduction

- Introduction

- Market Scope

- Market Definition

- Segments Covered

- Regional Segmentation

- Research Timeframe

- Currency Considered

- Study Limitations

- Stakeholders

- List of Abbreviations

- Key Conferences and Events (2023-2024)

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Bottom-Up Approach

- Top-Down Approach

- Market Forecasting

- Executive Summary

- Personal Mobility Devices Market Snapshot (2023-2029)

- Segment Overview

- Regional Snapshot

- Competitive Insights

- Market Overview

- Market Dynamics

- Drivers

- Global increase in the aging population

- Higher prevalence of disabilities due to accidents, injuries and chronic health conditions

- Technological advancements in mobility solutions

- Increasing healthcare spending worldwide

- Supportive government initiatives and policies promoting inclusivity and accessibility

- Restraints

- High costs of personal mobility devices

- Complex and time-consuming insurance coverage and reimbursement process

- Social stigma and barriers surrounding the use of mobility aids

- Opportunities

- Growing demand in emerging markets like APAC

- Development of eco-friendly and sustainable mobility devices

- Key Market Trends

- Growing demand for smart mobility solutions with monitoring and navigation features

- Expansion of product offerings with customizable and lightweight designs

- Unmet Market Needs

- Industry Speaks

- Porter’s Five Forces Analysis

- Regulatory Analysis

- Drivers

- Market Dynamics

- Global Personal Mobility Devices Market Size & Forecast (2022-2029), By Product Type, USD Million

- Introduction

- Wheelchairs

- Manual Wheelchairs

- Powered Wheelchairs

- Scooters

- Walking aids

- Rollators

- Cranes

- Others

- Other Products

- Global Personal Mobility Devices Market Size & Forecast (2022-2029), By Sales Channel, USD Million

- Introduction

- Wholesalers / Distributors

- Online Retailers

- Multi-brand Stores

- Speciality Stores

- Global Personal Mobility Devices Market Size & Forecast (2022-2029), By End User, USD Million

- Introduction

- Hospitals

- Nursing Homes

- Home-Care Settings

- Others

- Global Personal Mobility Devices Market Size & Forecast (2022-2029), By Region, USD Million

- Introduction

- Personal Mobility Devices Market Size & Forecast (2022-2029), By Country, USD Million

- US

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Sales Channel (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Canada

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Sales Channel (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Personal Mobility Devices Market Size & Forecast (2022-2029), By Country, USD Million

- UK

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Sales Channel (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Germany

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Sales Channel (USD Million)

- Market Size & Forecast, By End User (USD Million)

- France

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Sales Channel (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Italy

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Sales Channel (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Spain

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Sales Channel (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Rest of Europe

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Sales Channel (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Asia Pacific (APAC) Personal Mobility Devices Market Size & Forecast (2022-2029), By Country, USD Million

- China

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Sales Channel (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Japan

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Sales Channel (USD Million)

- Market Size & Forecast, By End User (USD Million)

- India

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Sales Channel (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Rest of Asia Pacific

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Sales Channel (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Latin America (LATAM) Personal Mobility Devices Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Sales Channel (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Middle East & Africa (MEA) Personal Mobility Devices Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Sales Channel (USD Million)

- Market Size & Forecast, By End User (USD Million)

- China

- UK

- US

- Competitive Landscape

- Key Players and their Competitive Positioning

- Competitive Positioning of Key Players (2022)

- Offerings Assessment, By Player

- Key Strategies Assessment, By Player (2021-2023)

- New Product & Service Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Company Profiles*

(Business Overview, Financial Performance**, Products Offered, Recent Developments)

- Invacare Corporation

- Drive DeVilbiss Healthcare

- GF Health Products, Inc.

- Sunrise Medical

- Carex Health Brands, Inc.

- Kaye Products, Inc.

- Medline Industries, Inc.,

- NOVA Medical Products

- Performance Health

- Rollz International

- Ottobock Healthcare GmbH

- Permobil Group

- National Seating Mobility

- Other Prominent Players

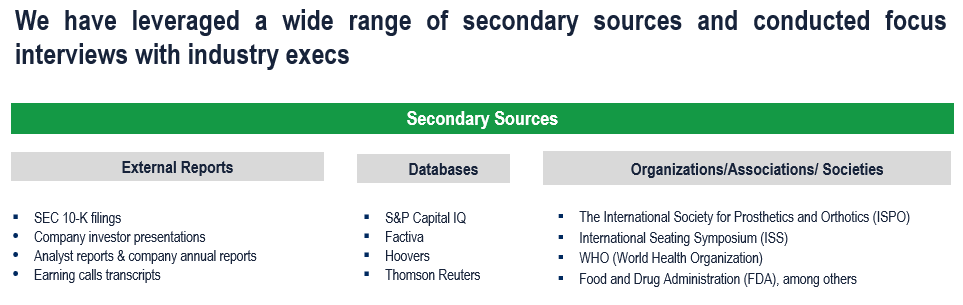

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

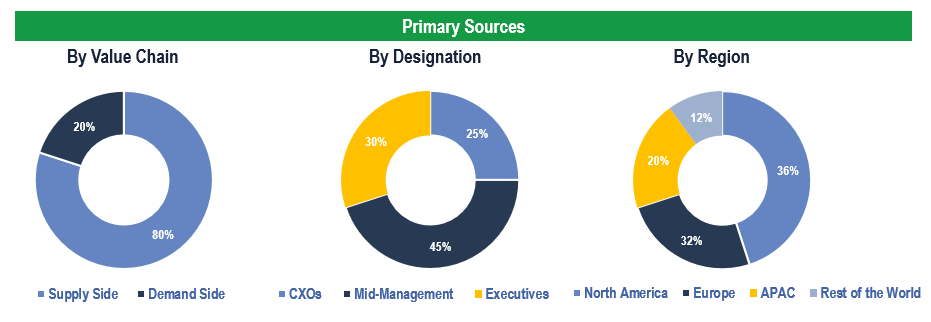

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, Business Development Managers, Consultants

- Demand Side Stakeholders: Stakeholders in Hospitals, Nursing Homes, and Home-Care Settings among others

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis were validated with Primary Interviews, Internal Knowledge Repository, and Company Sales Data.