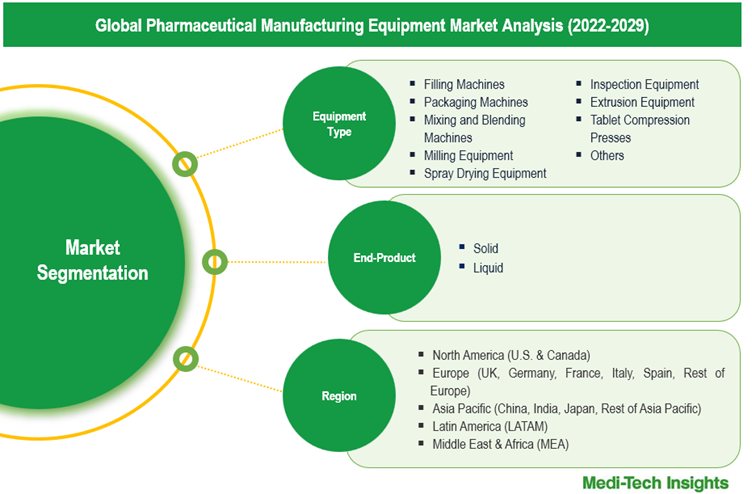

Pharmaceutical Manufacturing Equipment Market Size & Trends Report by Equipment Type (Filling Machines, Packaging Machines, Mixing and Blending Machines, Milling Equipment and Others), End-Product (Solid, Liquid) & Regional Forecasts to 2029

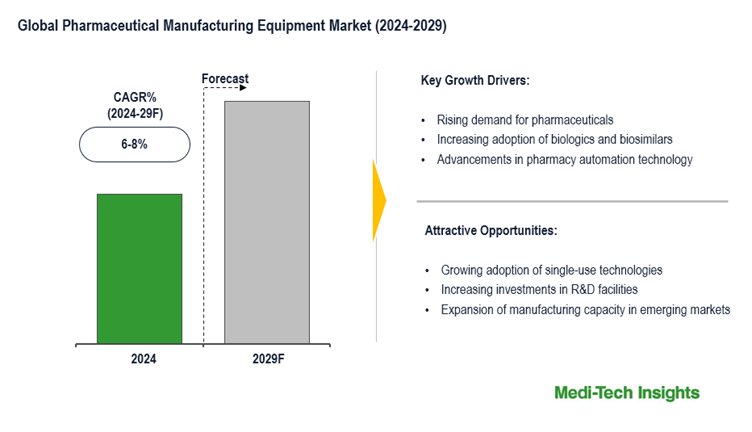

The pharmaceutical manufacturing equipment market is projected to grow at a CAGR of 6-8% during the forecast period. Growth is driven by rising pharmaceutical demand, advancements in automation, increased adoption of biologics, and regulatory emphasis on GMP compliance. The need for cost-efficient manufacturing and eco-friendly practices also propels the market. However, high capital investment and operational complexity may restrain its growth in certain regions. To learn more about the research report, download a sample report.

Report Overview

The pharmaceutical manufacturing equipment market includes machinery and systems designed to support the production of pharmaceutical products such as tablets, capsules, injectables, and biologics. This equipment facilitates critical processes like formulation, filling, sterilization, quality control, and packaging while adhering to stringent regulatory standards. The market caters to small-molecule drugs and biologics, enabling the large-scale production of safe and effective medicines. Its scope also includes automated, continuous, and single-use systems that align with modern manufacturing trends.

To learn more about this report, download the PDF brochure

Biologics and Biosimilars Driving Pharmaceutical Equipment Innovations

The increasing focus on biologics and biosimilars is fundamentally transforming the pharmaceutical manufacturing equipment industry. Biologics, which address complex and previously untreatable conditions, require advanced technologies like single-use bioreactors and aseptic filling systems to handle sensitive biological molecules. These innovations ensure contamination-free production, crucial for maintaining the integrity of biologics. Biosimilars, gaining approval from regulatory bodies like the FDA and EMA, necessitate equipment capable of high precision to meet stringent quality standards. The shift toward personalized medicine adds another layer of complexity, pushing for modular and flexible systems designed for small-batch production, catering to specific patient populations with customized therapeutic needs. This evolution underscores the critical role of tailored equipment in modern drug manufacturing.

Continuous Manufacturing Revolutionizing the Industry

Continuous manufacturing technology is fundamentally changing pharmaceutical production processes. Unlike traditional batch systems, continuous manufacturing offers uninterrupted workflows that improve efficiency and minimize resource wastage. Regulatory endorsements, including those from the FDA, highlight its ability to enhance drug quality and meet supply demands swiftly. These systems incorporate real-time monitoring tools, ensuring consistent quality standards while reducing the time required for production cycles. By minimizing downtime between batches, continuous manufacturing enables agile responses to fluctuating market requirements. Manufacturers adopting this approach not only enhance productivity but also align with sustainability goals, offering a competitive edge in addressing global healthcare challenges effectively and responsibly.

To learn more about this report, download the PDF brochure

Competitive Landscape Analysis

The global pharmaceutical manufacturing equipment market features both established and emerging players, including GEA Group; I.M.A. Industria Macchine Automatiche S.P.A.; Syntegon Technology GmbH; Thermo Fisher Scientific Inc.; Merck KGaA; Sartorius Stedim Biotech; Korber AG; Romaco Group; Rockwell Automation; Siemens AG; and Danaher Corporation among others. Some of the key strategies adopted by market players include product innovation and development, strategic partnerships and collaborations, and geographic expansion.

Report Scope

| Report Metric | Details |

| Base Year Considered | 2023 |

| Historical Data | 2022 - 2023 |

| Forecast Period | 2024 - 2029 |

| Growth Rate | CAGR of 6-8% |

| Market Drivers |

|

| Attractive Opportunities |

|

| Segment Scope | Equipment Type and End-Product |

| Regional Scope |

|

| Key Companies Mapped | GEA Group; I.M.A. Industria Macchine Automatiche S.P.A.; Syntegon Technology GmbH; Thermo Fisher Scientific Inc.; Merck KGaA; Sartorius Stedim Biotech; Korber AG; Romaco Group; Rockwell Automation; Siemens AG; and Danaher Corporation among others |

| Report Highlights | Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

Market Segmentation

This report by Medi-Tech Insights provides size of the pharmaceutical manufacturing equipment market at the regional- and country-level from 2022 to 2029. The report further segments the market on the basis of equipment type and end-product.

- Market Size & Forecast (2022-2029), By Equipment Type, USD Million

- Filling Machines

- Packaging Machines

- Mixing and Blending Machines

- Milling Equipment

- Spray Drying Equipment

- Inspection Equipment

- Extrusion Equipment

- Tablet Compression Presses

- Others

- Market Size & Forecast (2022-2029), By End-Product, USD Million

- Solid

- Liquid

- Market Size & Forecast (2022-2029), By Region, USD Million

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

- North America

Key Strategic Questions Addressed

- What is the market size & forecast of the pharmaceutical manufacturing equipment market?

- What are historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the pharmaceutical manufacturing equipment market?

- What are the key trends defining the market?

- What are the major factors impacting the market?

- What are the opportunities prevailing in the market?

- Which region has the highest share in the global market?

- Which region is expected to witness the highest growth rate in the next 5 years?

- Who are the major players operating in the market?

- What are the key strategies adopted by players?

- Introduction

- Introduction

- Market Scope

- Market Definition

- Segments Covered

- Regional Segmentation

- Research Timeframe

- Currency Considered

- Study Limitations

- Stakeholders

- List of Abbreviations

- Key Conferences and Events (2023-2024)

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Bottom-Up Approach

- Top-Down Approach

- Market Forecasting

- Executive Summary

- Pharmaceutical Manufacturing Equipment Market Snapshot (2023-2029)

- Segment Overview

- Regional Snapshot

- Competitive Insights

- Market Overview

- Market Dynamics

- Drivers

- Rising demand for pharmaceuticals

- Increasing adoption of biologics and biosimilars

- Advancements in pharmacy automation technology

- Growing focus on personalized medicine and small-batch production

- Regulatory emphasis on GMP compliance

- Restraints

- High capital investment for advanced equipment

- Limited skilled workforce

- Stringent regulatory requirements for equipment

- Opportunities

- Growing adoption of single-use technologies

- Increasing investments in R&D facilities

- Key Market Trends

- Shift towards continuous manufacturing solutions

- Development of sustainable equipment with reduced environmental footprint

- Drivers

- Unmet Market Needs

- Industry Speaks

- Market Dynamics

- Global Pharmaceutical Manufacturing Equipment Market Size & Forecast (2022-2029), By Equipment Type, USD Million

- Introduction

- Filling Machines

- Packaging Machines

- Mixing and Blending Machines

- Milling Equipment

- Spray Drying Equipment

- Inspection Equipment

- Extrusion Equipment

- Tablet Compression Presses

- Others

- Global Pharmaceutical Manufacturing Equipment Market Size & Forecast (2022-2029), By End-Product, USD Million

- Introduction

- Solid

- Liquid

- Global Pharmaceutical Manufacturing Equipment Market Size & Forecast (2022-2029), By Region, USD Million

- Introduction

- North America Pharmaceutical Manufacturing Equipment Market Size & Forecast (2022-2029), By Country, USD Million

- US

- Market Size & Forecast, By Equipment Type (USD Million)

- Market Size & Forecast, By End-Product (USD Million)

- Canada

- Market Size & Forecast, By Equipment Type (USD Million)

- Market Size & Forecast, By End-Product (USD Million)

- US

- Europe Pharmaceutical Manufacturing Equipment Market Size & Forecast (2022-2029), By Country, USD Million

- UK

- Market Size & Forecast, By Equipment Type (USD Million)

- Market Size & Forecast, By End-Product (USD Million)

- Germany

- Market Size & Forecast, By Equipment Type (USD Million)

- Market Size & Forecast, By End-Product (USD Million)

- France

- Market Size & Forecast, By Equipment Type (USD Million)

- Market Size & Forecast, By End-Product (USD Million)

- Italy

- Market Size & Forecast, By Equipment Type (USD Million)

- Market Size & Forecast, By End-Product (USD Million)

- Spain

- Market Size & Forecast, By Equipment Type (USD Million)

- Market Size & Forecast, By End-Product (USD Million)

- Rest of Europe

- Market Size & Forecast, By Equipment Type (USD Million)

- Market Size & Forecast, By End-Product (USD Million)

- UK

- Asia Pacific (APAC) Pharmaceutical Manufacturing Equipment Market Size & Forecast (2022-2029), By Country, USD Million

- China

- Market Size & Forecast, By Equipment Type (USD Million)

- Market Size & Forecast, By End-Product (USD Million)

- Japan

- Market Size & Forecast, By Equipment Type (USD Million)

- Market Size & Forecast, By End-Product (USD Million)

- India

- Market Size & Forecast, By Equipment Type (USD Million)

- Market Size & Forecast, By End-Product (USD Million)

- Rest of Asia Pacific

- Market Size & Forecast, By Equipment Type (USD Million)

- Market Size & Forecast, By End-Product (USD Million)

- China

- Latin America (LATAM) Pharmaceutical Manufacturing Equipment Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Equipment Type (USD Million)

- Market Size & Forecast, By End-Product (USD Million)

- Middle East & Africa (MEA) Pharmaceutical Manufacturing Equipment Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Equipment Type (USD Million)

- Market Size & Forecast, By End-Product (USD Million)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Key Player Comparison

- Segment-wise Player Mapping

- Market Share Analysis (2023)

- Company Categorization Matrix

- Dominants/Leaders

- New Entrants

- Emerging Players

- Innovative Players

- Key Strategies Assessment, By Player (2022-2024)

- New Product Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Company Profiles* (Business Overview, Financial Performance**, Products Offered, Recent Developments)

- GEA Group

- M.A. Industria Macchine Automatiche S.P.A.

- Syntegon Technology GmbH

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Sartorius Stedim Biotech

- Korber AG

- Romaco Group

- Rockwell Automation

- Siemens AG

- Danaher Corporation

- Other Prominent Players

Note: *Indicative list

**For listed companies

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

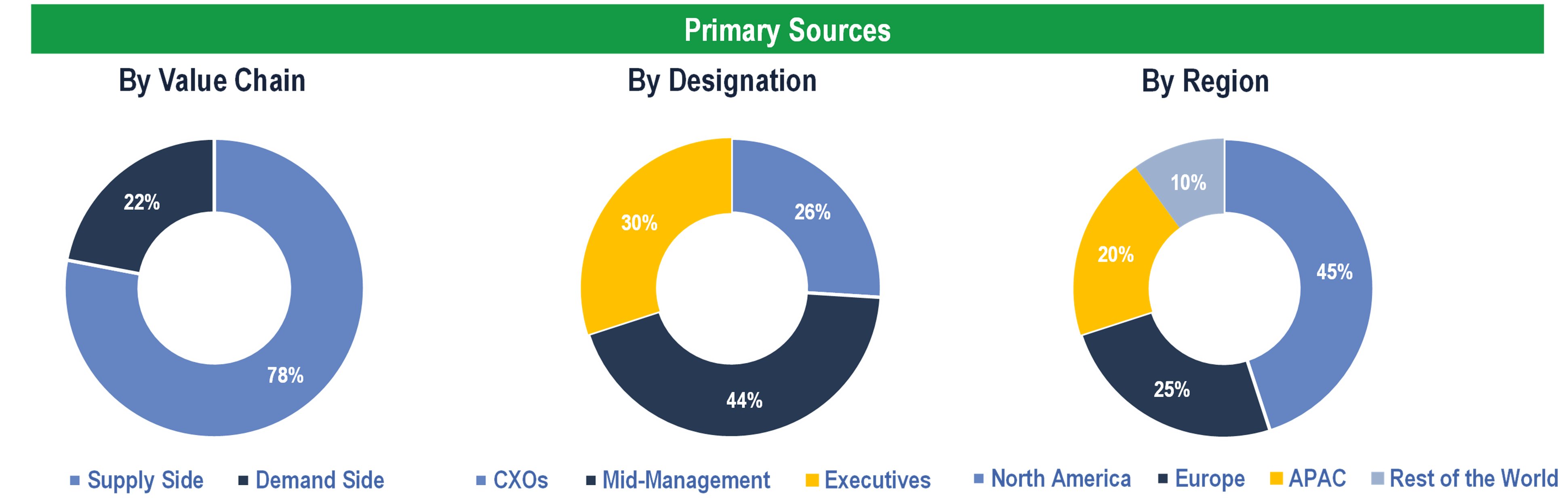

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, R&D Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Hospitals and Clinics, Online Pharmacies, Retail Pharmacies and Others

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down & Bottom-Up Approaches’ were used to derive market size estimates and forecasts

Data Triangulation

Research findings derived through secondary sources & internal analysis was validated with Primary Interviews, Internal Knowledge Repository and Company’s Sales Data