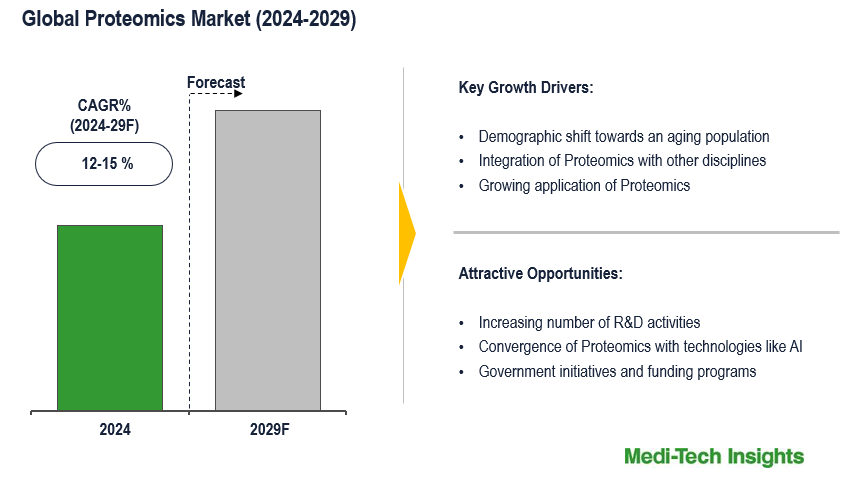

Proteomics Market is Projected to Grow at a Strong CAGR of 12–15% from 2024 to 2029 with Market Size Share and Analysis

The Proteomics Market is expected to witness a CAGR of 12-15% from 2024 to 2029. The market is propelled by several key factors, including ongoing technological advancements, the demographic shift towards an aging population, growing awareness of the diverse applications of proteomics, expanding research and development activities, and rising investments in healthcare infrastructure that contribute to the market’s growth trajectory. To learn more about the research report, download a sample report.

Proteomics refers to the comprehensive study of all proteins produced by an organism, system, or biological sample. It involves identifying, characterizing, and quantifying proteins within specific biological contexts, enabling researchers to grasp the intricate dynamics of cellular processes. Proteomics encompasses diverse techniques and methodologies aimed at thoroughly analyzing protein structure, function, and interactions within biological systems. Proteomics can be categorized into various types:

- Expression Proteomics: Analyzes the quantitative expression levels of proteins to understand fluctuations in protein abundance across different conditions or tissues

- Structural Proteomics: Investigates the three-dimensional structures of proteins, offering insights into their functions and interactions at a molecular level

- Functional Proteomics: Explores protein functions, including their roles in biochemical pathways, cellular processes, and interactions with other biomolecules

- Protein-Protein Interaction Studies: Focuses on understanding how proteins interact within biological systems, providing insights into cellular processes and signalling pathways

- Protein Modification Studies: Examines post-translational modifications of proteins, such as phosphorylation or glycosylation, which are crucial for regulating protein function

- Protein Localization Studies: Investigates the subcellular location of proteins, aiding in understanding their spatial distribution within cells and tissues

Driving Forces of Proteomics: Technological Breakthroughs, Collaborations, and Market Expansion

The proteomics market experiences growth driven by a multitude of factors and trends. Technological advancements in mass spectrometry, chromatography techniques, and bioinformatics tools have revolutionized proteomics research, facilitating faster and more precise protein analysis. Proteomics is increasingly employed in drug discovery and development endeavours, aiding in target identification, mechanism understanding, and safety assessment. Clinical diagnostics also witness a surge in proteomics adoption, leveraging protein analysis for disease diagnosis, prognosis, and monitoring across various ailments. Collaborations among academia, research entities, and biotech firms drive innovation, propelling the evolution of proteomics technologies and applications. Furthermore, proteomics finds utility in agriculture and food science realms, enhancing crop yield, ensuring food safety, and identifying allergens. With substantial investments from government agencies, private investors, and venture capitalists, proteomics research receives a significant boost, fueling innovation and market expansion. In essence, the proteomics market is poised for sustained growth, underpinned by technological advancements, increasing demand for personalized medicine, and diversified applications across sectors. For instance,

- In January 2024, Agilent Technologies Inc. unveiled the Agilent ProteoAnalyzer system at the 23rd Annual PepTalk Conference in San Diego, an automated parallel capillary electrophoresis system for protein analysis, simplifying and enhancing the efficiency of analyzing complex protein mixtures, vital to analytical workflows in various sectors such as pharma, biotech, food analysis, and academia

- In July 2023, Olink introduced Olink Explore HT, a revolutionary high-throughput proteomics solution offering exceptional specificity, scalability, and workflow simplicity, enabling precise measurement of over 5,300 proteins from just 2µl of sample with an entirely redesigned and automated data analysis platform

To learn more about this report, download the PDF brochure

Charting the Course of Proteomics: Emerging Trends and Future Directions

Several trends are shaping the proteomics market. Emerging technologies such as parallel reaction monitoring (PRM) and data-independent acquisition (DIA) are gaining traction. The integration of proteomics with multi-omics approaches, including genomics, transcriptomics, and metabolomics, offers a more comprehensive understanding of biological systems, facilitating systems biology and personalized medicine approaches. Single-cell proteomics techniques are also becoming more refined, enabling the analysis of individual cell proteomes, which is crucial in fields like cancer research and immunology to study cellular heterogeneity and rare cell populations. Furthermore, proteomics is increasingly applied in clinical settings for biomarker discovery, disease diagnosis, prognosis, and therapeutic monitoring across various medical fields such as oncology, infectious diseases, neurology, and cardiovascular diseases. Automation of sample preparation, data acquisition, and analysis workflows is becoming more prevalent, enhancing the efficiency and reproducibility of proteomics experiments. Additionally, there is a growing emphasis on developing user-friendly software tools for data analysis and interpretation. For instance,

- In June 2022, Thermo Fisher Scientific Inc. launched the Thermo Scientific AccelerOme Automated Sample Preparation Platform, enabling proteomics researchers to streamline sample preparation for LC-MS analysis, eliminating manual labour, associated method development, and reagent sourcing, thereby enhancing productivity and minimizing errors

Proteomics is also expanding into drug discovery and development, aiding in target identification, validation, and understanding of drug mechanisms of action, including pharmacokinetic and pharmacodynamic studies. The convergence of proteomics with technologies like microfluidics, nanotechnology, and artificial intelligence is driving innovation, leading to the development of novel experimental platforms and analytical methods. Lastly, efforts towards standardization and quality control in proteomics research, such as the Human Proteome Project (HPP), aim to establish comprehensive maps of the human proteome and ensure the reproducibility and reliability of results.

Key Constraints/Challenges

The proteomics field faces several challenges hindering its progress. These include the complexity of data analysis, which requires sophisticated tools and expertise, as well as the need for standardization and quality control to ensure reproducible results across different laboratories. The high cost of equipment and consumables poses a financial barrier, particularly for smaller research institutions. Sample preparation variability, limited sensitivity and specificity of techniques, and the challenge of biomarker validation for clinical translation further complicate proteomics research. Additionally, ethical and legal considerations surrounding human sample research add complexity to study workflows and collaboration efforts.

Regional Segmentation

North America is a significant contributor to the global proteomics market, owing to its well-established biotechnology and pharmaceutical sectors, presence of advanced healthcare infrastructure, substantial investments in research and development, and the presence of key market players. Europe holds a prominent position in the global proteomics market, characterized by a robust healthcare system, supportive regulatory environment, and significant research funding. The European proteomics market benefits from initiatives such as Horizon Europe, which aims to advance research and innovation in the life sciences sector, including proteomics.

The Asia Pacific region is experiencing rapid growth in the proteomics market, fueled by increasing investments in healthcare infrastructure, rising research and development activities, and growing awareness of personalized medicine. Countries like China, Japan, and India are key players in the Asia Pacific proteomics market, with a burgeoning biotechnology sector and a growing focus on precision medicine.

Competitive Landscape

Some of the key players operating in the market include Agilent Technologies, Bio-Rad Laboratories, ThermoFisher Scientific, Bruker Corporation, F. Hoffmann-La Roche Ltd., Promega Corp, Merck KGaA, and Danaher Corporation, among others.

Get a Sample Report for Competitive Landscape Analysis

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the Market

Players operating in this market are adopting both organic and inorganic growth strategies such as collaborations, and acquisitions to garner market share. For instance,

- In October 2023, Thermo Fisher Scientific's acquisition of Olink, a leader in next-generation proteomics, will enhance its portfolio by incorporating Olink's proprietary Proximity Extension Assay (PEA) technology, offering high-throughput protein analysis compatible with the extensive installed base of qPCR and next-generation sequencing readout systems

- In May 2023, Waters Corporation revealed its acquisition of Wyatt Technology, a move aimed at bolstering Waters' capability to grow its bioanalytical characterization business in emerging fields like cell and gene therapies

- In September 2022, the FDA and NIH signed a memorandum of understanding (MOU) to enhance collaboration, particularly in advancing proteogenomics research aimed at improving cancer treatment outcomes and patients' quality of life

The proteomics market is expected to gain momentum in the coming years due to growing and diverse applications of proteomics, rising research and development activities, technological advancements, strategic collaborations and aggressive organic and inorganic growth strategies followed by the players.

Key Strategic Questions Addressed

-

What is the market size & forecast for the Global Proteomics Market?

-

What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the Global Proteomics Market?

-

How has COVID-19 impacted the Global Proteomics Market?

-

What are the major growth drivers, restraints/challenges impacting the market?

-

What are the opportunities prevailing in the market?

-

What is the investment landscape?

-

Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market? What is the competitive positioning of key players?

-

Who are the new players entering the market?

-

What are the key strategies adopted by players?

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Market Forecasting

- Executive Summary

- Market Overview

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Market Dynamics

- Global Proteomics Market - Size & Forecast (2021-2028), By Technology Type

- Chromatography

- Mass Spectroscopy

- Protein Microarrays

- Other Technologies

- Global Proteomics Market - Size & Forecast (2021-2028), By Service Type

- Core Proteomics Services

- Bioinformatics Software & Services

- Global Proteomics Market - Size & Forecast (2021-2028), By Application Type

- Clinical Diagnostics

- Drug Discovery

- Other Applications

- Global Proteomics Market - Size & Forecast (2021-2028), By End User

- Hospitals

- Clinical Laboratories

- Academic & Research Institutes

- Other End Users

- Global Proteomics Market - Size & Forecast (2021-2028), By Region

- North America (U.S. & Canada)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, Rest of Asia Pacific)

- Rest of the World (Latin America, Middle East & Africa)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Competitive Positioning of Key Players (2022)

- Offerings Assessment, By Players

- Key Strategies Assessment, By Player (2021-2023)

- New Product Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Other Developments

- Key Players and their Competitive Positioning

- Key Companies Scanned (Indicative List)

- Agilent Technologies

- Bio-Rad Laboratories

- ThermoFisher Scientific

- Hoffmann-La Roche Ltd.

- Merck KGaA

- Danaher Corporation

- Bruker Corporation

- Promega Corp

- Other Players

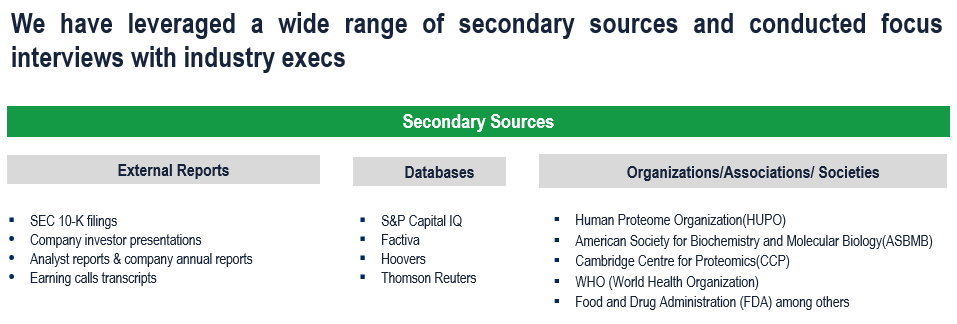

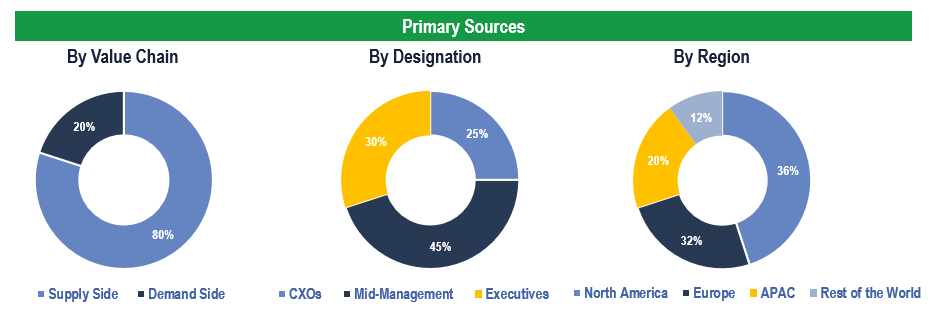

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders in Hospitals, Clinical Laboratories, Bio-Pharma Companies and Academic & Research Institutes among others

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis were validated with Primary Interviews, Internal Knowledge Repository, and Company Sales Data.