Spine Surgery Devices Market Size, Share, Growth, Trends & Demands 2027

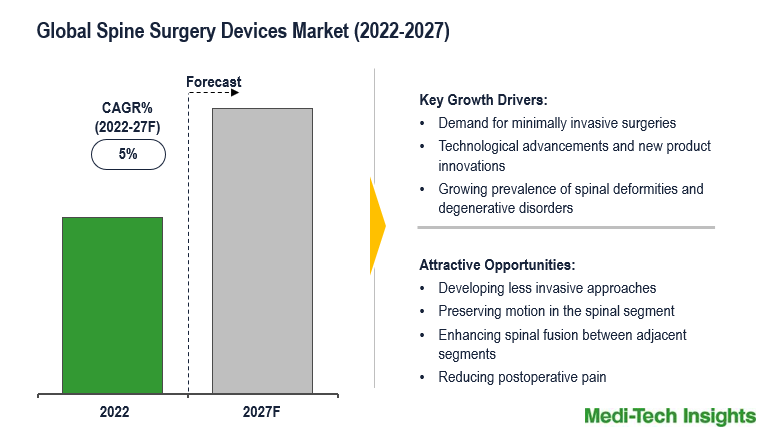

The Global Spine Surgery Devices Market is expected to grow at a rate of ~5 % by 2027. The growing demand for minimally invasive spinal surgery, an increased volume of spinal surgery procedures, technological advancements in spine surgery devices, and rising age-related spinal deformities and degenerative disorders are some of the key factors driving the global market growth.

Spinal surgery devices are used to restore or enhance the mechanical stability of the spine, correct and maintain spinal alignment, and enhance spinal fusion caused by trauma or slipped discs originating from degenerative intervertebral disks.

A Slowdown in the Demand for Spine Surgery Devices Points to A Looming Recession

Due to the looming recession, patients are expected to delay elective surgical procedures including spinal fusion surgeries until the future of the broader economy looks more promising. Considering the current economic and financial conditions, patients are expected to be less willing to incur the costs of these private pays or discretionary procedures and may choose to forgo such procedures. Another factor that will be limiting the placements of these devices is tighter spending by hospitals amid an economic slowdown and a looming recession risk.

Innovation in Spine Surgery Procedures Fuels the Spine Surgery Devices Market Demand

For many patients experiencing pain or discomfort from a spinal condition, spine surgery can be an excellent option to relieve pain and return to day-to-day activities. Currently, four common types of procedures represent about 90% of all spine surgeries including discectomy, laminectomy/ laminotomy, spinal decompression & fusion, and anterior cervical discectomy & fusion. The ongoing investment in minimally invasive surgery and robotic-assisted surgery technology is transforming spine surgery. For instance,

- In November 2022, NuVasive, Inc, announced the commercial launch of its NuVasive Tube System (NTS) and Excavation Micro, a new minimally invasive surgery (MIS) system that provides comprehensive solutions for both transforaminal lumbar interbody fusion (TLIF) and decompression.

- In October 2022, DePuy Synthes, the Orthopaedics Company of Johnson & Johnson announced that they have secured 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its TELIGEN™ System, an integrated technology platform that enables minimally invasive surgical transforaminal lumbar interbody fusion (MIS-TLIF) procedures through digital tools for visualization and access.

Growing Prevalence of Spine Disorders Drives the Global Spine Surgery Devices Market

Spinal problems like scoliosis, kypho scoliosis (spinal deformity), cervical stenosis and craniovertebral junctional anomalies, and spinal cord tumor are the most common disorders that affect the cervical spine. Although, low back pain and neck pain are considered the most common spinal disorders. The recent advancements in spine surgery devices for treating spinal disorders increases accuracy, reduces the incidence of complications, and delivers consistently good results. Further, advancements in biomaterial development, computer-assisted image-guided technology, stimulation products, ventional spine products, and genetic engineering of disc tissue, bone fusion, & vertebral bone are expected to drive the spinal surgery devices market. For instance,

- In October 2022, Centinel Spine, LLC announced the continued expansion of the availability of the prodisc Cervical Total Disc Replacement (TDR) portfolio that allows the disc to be matched to patient anatomy.

- In August 2022, Nexus Spine announced the launch of its PressONposterior lumbar fixation system. PressON features rods that press onto pedicle screws rather than attach using set screws.

Key Market Constraints/Challenges: Spine Surgery Devices Market

The high costs of spinal treatment procedures and the risk & complications associated with spinal surgery such as paralysis or a spinal infection during the surgery is likely to hamper the growth of the spine surgery devices market in the coming years.

North America is Expected to Continue to Hold a Major Share in the Spine Surgery Devices Market

From a geographical perspective, North America holds a major share of the spine surgery devices market. This can be mainly attributed to the growing prevalence of spinal disorders, the rising number of spinal injuries in athletes, advancements in spine surgery technology, and increased demand for minimally invasive procedures in the region. However, the Asia-Pacific region is expected to witness strong growth in the coming years due to growing health concerns, growing innovation in spine surgery, and improved awareness regarding stimulation devices in the region.

Competitive Landscape Analysis: Spine Surgery Devices Market

Some of the established market players operating in the global spine surgery devices market are as follows:-

- Medtronic

- DePuy Synthes

- NuVasive

- Globus Medical

- Stryker Corporation

- Zimmer Biomet Holdings Inc

- Spinal Elements

- Aesculap

- Ulrich Medical

- RTI Surgical

- Orthofix International N.V

- Alphatec Spine

- SeaSpine

- Centinel Spine

- Nexus Spine

- Richard Wolf among others.

Organic and Inorganic Growth Strategies Adopted by Key Players to Establish Their Foothold in the Spine Surgery Devices Market

All leading players operating in the spine surgery devices market are adopting both organic and inorganic growth strategies such as collaborations, acquisitions, and new product launches to garner a higher market share. For instance,

- In October 2022, DePuy Synthes, the Orthopaedics Company of Johnson & Johnson, announced they have received 510(k) clearance from the Food and Drug Administration (FDA) for its ALTALYNE™ Ultra Alignment System for adolescent spinal deformities, such as scoliosis.

- In September 2022, NuVasive, Inc. announced the commercial launch of its Reline Cervical, a new fixation system for posterior cervical fusion (PCF), in targeted regions.

- In July 2022, Medtronic plc announced that they have received U.S. Food and Drug Administration (FDA) 510(k) clearance for its UNiD Spine Analyzer v4.0 planning platform, which includes a new Degen Algorithm for degenerative spine procedures.

The global spine surgery devices market is a growing and an emerging market that is expected to gain further momentum in the upcoming years due to a strong emphasis on developing new minimally invasive procedures, investment in R&D to introduce several advanced products, and aggressive organic and inorganic growth strategies followed by the leading market players.

Key Strategic Questions Addressed in this Report

- What is the market size & forecast for the spine surgery devices market?

- What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the spine surgery devices market?

- How has Covid-19 impacted the spine surgery devices market?

- What are the major growth drivers, restraints/challenges impacting the global spine surgery devices market?

- What are the opportunities prevailing in the spine surgery devices market?

- What is the investment landscape of spine surgery devices market?

- Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

- Who are the major players operating in the global market? What is the competitive positioning of key players?

- Who are the new players entering the global spine surgery devices market?

- What are the key strategies adopted by leading market players?

1. Research Methodology

1.1. Secondary Research

1.2. Primary Research

1.3. Market Estimation

1.4. Market Forecasting

2. Executive Summary

3. Market Overview

3.1. Market Dynamics

3.1.1. Drivers

3.1.2. Restraints

3.1.3. Opportunities

3.1.4. Market Trend

3.2. Industry Speaks

3.3. Technology Trends

4. COVID-19 Impact on Spine Surgery Devices Market

5. Looming Recession (2023) – Key Challenges & Impact

6. Global Spine Surgery Devices Market- Size & Forecast (2019-2027), By Product

6.1. Spinal Fusion Devices

6.2. Spinal Biologics

6.3. Vertebral Compression Fracture Treatment Devices

6.4. Non-Fusion Devices

6.5. Spinal Decompression Devices

6.6. Spinal Bone Stimulator

7. Global Spine Surgery Devices Market- Size & Forecast (2019-2027), By Surgery

7.1. Open Surgeries

7.2. Minimally Invasive Surgeries

8. Global Spine Surgery Devices Market- Size & Forecast (2019-2027), By Region

8.1. North America (U.S. & Canada)

8.2. Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

8.3. Asia Pacific (China, India, Japan, Rest of Asia Pacific)

8.4. Rest of the World (Latin America, Middle East & Africa)

9. Competitive Landscape

9.1. Key Players and their Competitive Positioning

9.1.1. Market Share Analysis (2022)

9.1.2. Segment-wise Player Mapping

9.2. Key Strategies Assessment, By Player (2020-2022)

9.2.1. New Product & Service Launches

9.2.2. Partnerships, Agreements, & Collaborations

9.2.3. Mergers & Acquisitions

9.2.4. Geographic Expansion

10. Key Companies Scanned (Indicative List)

10.1. Medtronic

10.2. NuVasive

10.3. DePuy Synthes

10.4. Stryker Corporation

10.5. Globus Medical

10.6. Zimmer Biomet Holdings Inc.

10.7. Spinal Elements

10.8. Centinel Spine

10.9. Nexus Spine

10.10. Orthofix International N. V

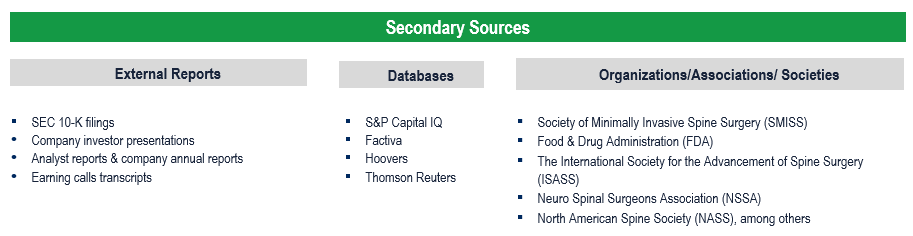

The study has been compiled based on the extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

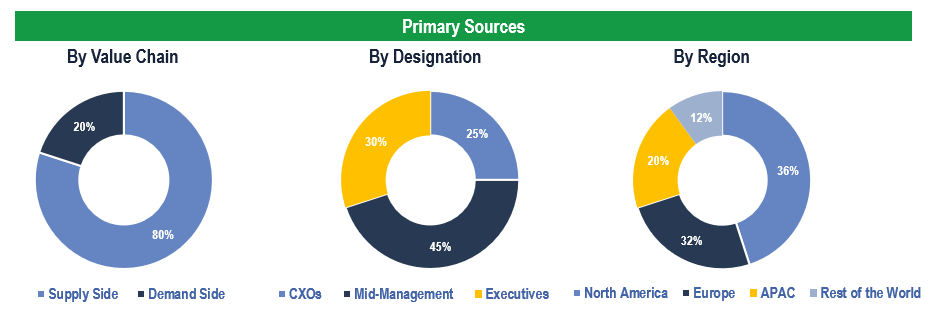

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, R&D Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders in Hospitals, Speciality Clinics, Ambulatory Surgical Centers, Orthopedic Centers, and Other End Users.

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis were validated with Primary Interviews, Internal Knowledge Repository, and Company Sales Data.