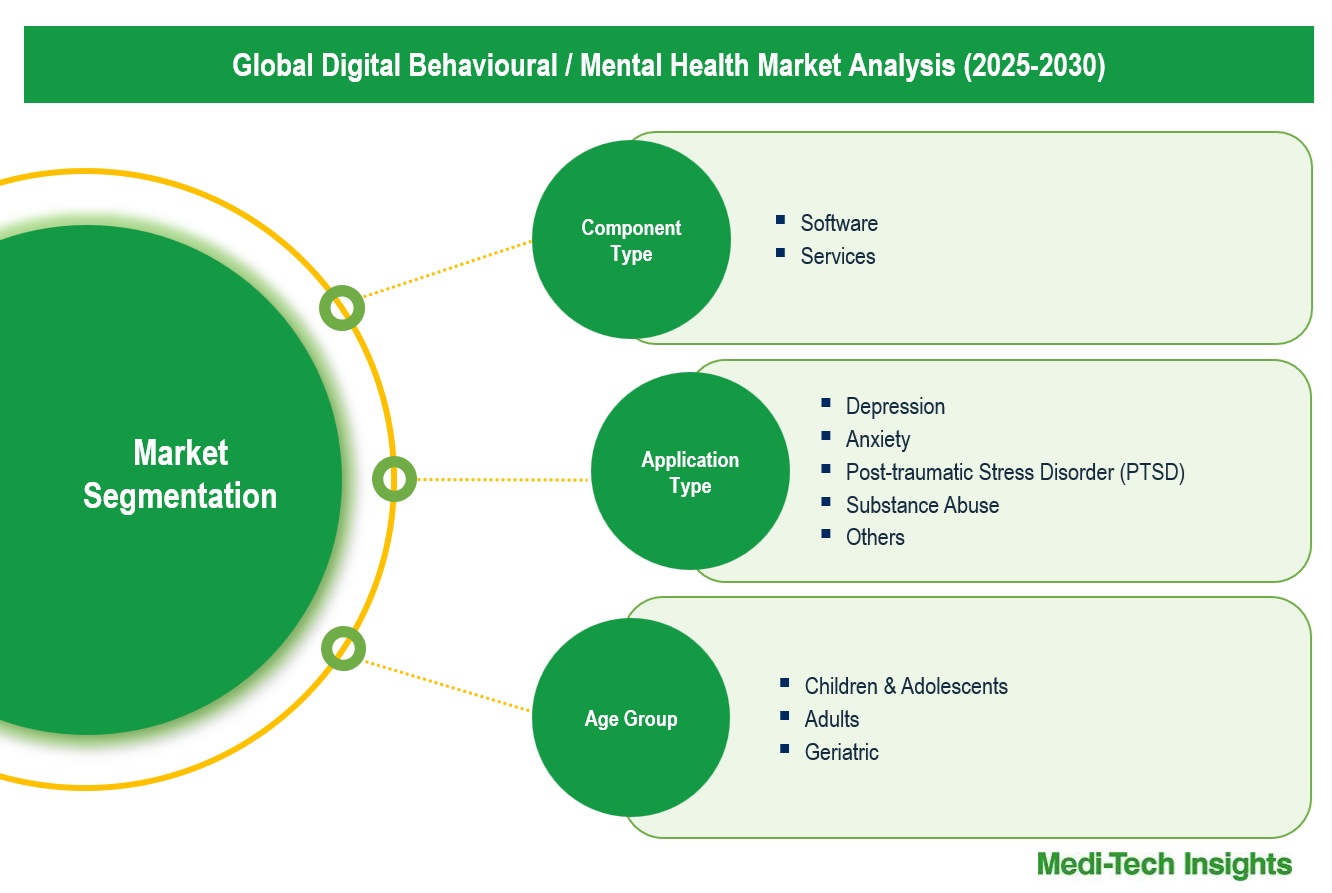

Global Digital Behavioral/Mental Health Market Size & Trends Report Segmented by Component Type (Software, Services), Application Type (Depression, Anxiety, PTSD), Age Group (Children & Adolescents, Adults, Geriatric), End-user & Regional Forecast to 2030

The digital behavioral/mental health market is expected to grow at a CAGR of 18-20% during the forecast period. The increasing demand for affordable mental health services like e-therapies, rising smartphone penetration, and rising prevalence and awareness of mental health conditions are the major drivers fuelling the market’s growth. The market growth may be hindered due to data privacy concerns and varying regulatory landscapes across regions. To learn more about the research report, download a sample report.

Report Overview

Digital behavioral/mental health is the application of digital platforms, apps, and telehealth services to provide mental health intervention, therapy, and intervention programs. These services traditionally include virtual sessions, self-directed tools, e-therapies, and integration with mobile phones or smart devices for patient monitoring for their emotional and psychological well-being. Its main function is to fill the accessibility gap for patients who are unable to access traditional/offline therapy. Additionally, it lowers the cost of mental health treatment, makes it scalable and stigma-free in nature, satisfying the surging demand of various population groups across the globe.

To learn more about this report, download the PDF brochure

Rising demand for accessible mental health care

The increased demand for easily accessible mental health services is one of the significant factors driving the development of the digital behavioral/mental health market. Traditional offline consultations have long waiting times, high costs, and far geographical locations that are a hindrance to many people who need them. With growing issues of anxiety, depression, and stress, especially following the COVID-19 pandemic, there has been an abrupt surge in individuals seeking timely and convenient mental health services. Online platforms have proven to be an easy solution to these challenges, offering convenient consultations with licensed therapists from the comfort of home. There is a surge in digital behavioral health solution adoption by healthcare providers, payers and employers to address the increasing demand for mental wellness support among demographic populations.

Increasing funding fuels digital behavioral/mental health market solutions demand

As per the article published by WHO, one in eight people suffered from a psychiatric disorder such as anxiety, depression, or insomnia, which significantly affected their thinking skills and emotional behavior. The mental health crisis fueled by COVID-19 led to increased demand for behavioral/mental health solutions, which in turn attracted the attention of investors. The market witnessed several investments from private equity companies and venture capitalists. For instance,

- In June 2024, Talkiatry, a provider of high-quality, in-network psychiatric care, raised $130 million in equity and debt financing. This Series C investment intends to expand its value-based care model aimed at reducing the total cost and improving health outcomes

- In April 2024, Grow Therapy, a mental health tech startup, raised $88 million in a Series C funding round led by Sequoia Capital, with support from Growth Equity at Goldman Sachs Alternatives and PLUS Capital. The company launched its upgraded measurement-informed care system, which improves client’s and providers experience and aims to make value-based behavioral care more accessible to all patient populations, including Medicaid and Medicare members

- In January 2022, Lyra Health, the leading provider of innovative Workforce Mental Health solutions for employers, secured financing of $235 million to fuel international expansion. The firm’s platform delivers customized behavioral and mental health care virtually and/or in-person, alongside self-care lessons and exercises

To learn more about this report, download the PDF brochure

Competitive Landscape Analysis

The global digital behavioral/mental health market is marked by the presence of established and emerging market players such as Teladoc Health, Inc., Headspace, Talkspace, BetterHelp, Calm, Akili, Lyra Health, Spring Health, Brightline, and Little Otter, among others. Some of the key strategies adopted by market players include new product development, strategic partnerships and collaborations, and geographic expansion.

Report Scope

| Report Metric | Details |

| Base Year Considered | 2024 |

| Historical Data | 2023 - 2024 |

| Forecast Period | 2025 – 2030 |

| Growth Rate | 18-20% |

| Market Drivers |

|

| Attractive Opportunities |

|

| Segment Scope | Component Type, Application Type, Age Group, and End-user |

| Regional Scope |

|

| Key Companies Mapped | Teladoc Health, Inc., Headspace, Talkspace, BetterHelp, Calm, Akili, Lyra Health, Spring Health, Brightline, and Little Otter, among others |

| Report Highlights | Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

Global Digital Behavioral/Mental Health Market Segmentation

This report by Medi-Tech Insights provides the size of the global digital behavioral/mental health market at the regional- and country-level from 2023 to 2030. The report further segments the market based on component type, application type, age group and end-user.

Market Size & Forecast (2023-2030), By Component Type, USD Million

- Software

- Services

Market Size & Forecast (2023-2030), By Application Type, USD Million

- Depression

- Anxiety

- Post-traumatic Stress Disorder (PTSD)

- Substance Abuse

- Others

Market Size & Forecast (2023-2030), By Age Group, USD Million

- Children & Adolescents

- Adults

- Geriatric

Market Size & Forecast (2023-2030), By End-user, USD Million

- Patients

- Providers

- Payers

- Employers

Market Size & Forecast (2023-2030), By Region, USD Million

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Key Strategic Questions Addressed

- What is the market size & forecast of the digital behavioral/mental health market?

- What are historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the digital behavioral/mental health market?

- What are the key trends defining the market?

- What are the major factors impacting the market?

- What are the opportunities prevailing in the market?

- Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

- Who are the major players operating in the market?

- What are the key strategies adopted by players?

- Introduction

- Introduction

- Market Scope

- Market Definition

- Segments Covered

- Regional Segmentation

- Research Timeframe

- Currency Considered

- Study Limitations

- Stakeholders

- List of Abbreviations

- Key Conferences and Events (2025-2026)

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Bottom-Up Approach

- Top-Down Approach

- Market Forecasting

- Executive Summary

- Digital Behavioral/Mental Health Market Snapshot (2025-2030)

- Segment Overview

- Regional Snapshot

- Competitive Insights

- Market Overview

- Market Dynamics

- Drivers

- Rising prevalence of mental health disorders globally

- Surge in smartphone and wearable device adoption

- Post-COVID-19 shift to remote care

- Growing awareness and destigmatization

- Integration of digital tools into healthcare systems

- Restraints

- Limited access to digital infrastructure in low-resource regions

- Concerns over data privacy and patient confidentiality

- Shortage of trained mental health professionals in digital care

- Opportunities

- Tailored pediatric digital mental health solutions

- Increasing adoption of self-guided therapy platforms

- Integration of measurement-informed care systems

- Collaboration with public health initiatives and school systems

- Key Market Trends

- Growing adoption of virtual therapy and telepsychiatry

- Increased venture capital and PE funding

- Unmet Market Needs

- Industry Speaks

- Drivers

- Market Dynamics

- Global Digital Behavioral/Mental Health Market Size & Forecast (2023-2030), By Component Type, USD Million

- Introduction

- Software

- Services

- Global Digital Behavioral/Mental Health Market Size & Forecast (2023-2030), By Application Type, USD Million

- Introduction

- Depression

- Anxiety

- Post-traumatic Stress Disorder (PTSD)

- Substance Abuse

- Others

- Global Digital Behavioral/Mental Health Market Size & Forecast (2023-2030), By Age Group, USD Million

- Introduction

- Children & Adolescents

- Adults

- Geriatric

- Global Digital Behavioral/Mental Health Market Size & Forecast (2023-2030), By End-user, USD Million

- Introduction

- Patients

- Providers

- Payers

- Employers

- Global Digital Behavioral/Mental Health Market Size & Forecast (2023-2030), By Region, USD Million

- Introduction

- North America Digital Behavioral/Mental Health Market Size & Forecast (2023-2030), By Country, USD Million

- US

- Market Size & Forecast, By Component Type (USD Million)

- Market Size & Forecast, By Application Type (USD Million)

- Market Size & Forecast, By Age Group (USD Million)

- Market Size & Forecast, By End-user (USD Million)

- Canada

- Market Size & Forecast, By Component Type (USD Million)

- Market Size & Forecast, By Application Type (USD Million)

- Market Size & Forecast, By Age Group (USD Million)

- Market Size & Forecast, By End-user (USD Million)

- US

- Europe Digital Behavioral/Mental Health Market Size & Forecast (2023-2030), By Country, USD Million

- UK

- Market Size & Forecast, By Component Type (USD Million)

- Market Size & Forecast, By Application Type (USD Million)

- Market Size & Forecast, By Age Group (USD Million)

- Market Size & Forecast, By End-user (USD Million)

- Germany

- Market Size & Forecast, By Component Type (USD Million)

- Market Size & Forecast, By Application Type (USD Million)

- Market Size & Forecast, By Age Group (USD Million)

- Market Size & Forecast, By End-user (USD Million)

- France

- Market Size & Forecast, By Component Type (USD Million)

- Market Size & Forecast, By Application Type (USD Million)

- Market Size & Forecast, By Age Group (USD Million)

- Market Size & Forecast, By End-user (USD Million)

- Italy

- Market Size & Forecast, By Component Type (USD Million)

- Market Size & Forecast, By Application Type (USD Million)

- Market Size & Forecast, By Age Group (USD Million)

- Market Size & Forecast, By End-user (USD Million)

- Spain

- Market Size & Forecast, By Component Type (USD Million)

- Market Size & Forecast, By Application Type (USD Million)

- Market Size & Forecast, By Age Group (USD Million)

- Market Size & Forecast, By End-user (USD Million)

- Rest of Europe

- Market Size & Forecast, By Component Type (USD Million)

- Market Size & Forecast, By Application Type (USD Million)

- Market Size & Forecast, By Age Group (USD Million)

- Market Size & Forecast, By End-user (USD Million)

- UK

- Asia Pacific (APAC) Digital Behavioral/Mental Health Market Size & Forecast (2023-2030), By Country, USD Million

- China

- Market Size & Forecast, By Component Type (USD Million)

- Market Size & Forecast, By Application Type (USD Million)

- Market Size & Forecast, By Age Group (USD Million)

- Market Size & Forecast, By End-user (USD Million)

- Japan

- Market Size & Forecast, By Component Type (USD Million)

- Market Size & Forecast, By Application Type (USD Million)

- Market Size & Forecast, By Age Group (USD Million)

- Market Size & Forecast, By End-user (USD Million)

- India

- Market Size & Forecast, By Component Type (USD Million)

- Market Size & Forecast, By Application Type (USD Million)

- Market Size & Forecast, By Age Group (USD Million)

- Market Size & Forecast, By End-user (USD Million)

- Rest of Asia Pacific

- Market Size & Forecast, By Component Type (USD Million)

- Market Size & Forecast, By Application Type (USD Million)

- Market Size & Forecast, By Age Group (USD Million)

- Market Size & Forecast, By End-user (USD Million)

- China

- Latin America (LATAM) Digital Behavioral/Mental Health Market Size & Forecast (2023-2030), USD Million

- Market Size & Forecast, By Component Type (USD Million)

- Market Size & Forecast, By Application Type (USD Million)

- Market Size & Forecast, By Age Group (USD Million)

- Market Size & Forecast, By End-user (USD Million)

- Middle East & Africa (MEA) Digital Behavioral/Mental Health Market Size & Forecast (2023-2030), USD Million

- Market Size & Forecast, By Component Type (USD Million)

- Market Size & Forecast, By Application Type (USD Million)

- Market Size & Forecast, By Age Group (USD Million)

- Market Size & Forecast, By End-user (USD Million)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Key Player Comparison

- Segment-wise Player Mapping

- Market Share Analysis (2024)

- Company Categorization Matrix

- Dominants/Leaders

- New Entrants

- Emerging Players

- Innovative Players

- Key Strategies Assessment, By Player (2022-2025)

- New Product Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Company Profiles*

(Business Overview, Financial Performance**, Products Offered, Recent Developments)

- Teladoc Health, Inc

- Headspace

- Talkspace

- BetterHelp

- Calm

- Akili

- Lyra Health

- Spring Health

- Brightline

- Little Otter

- Other Prominent Players

Note: *Indicative list

**For listed companies

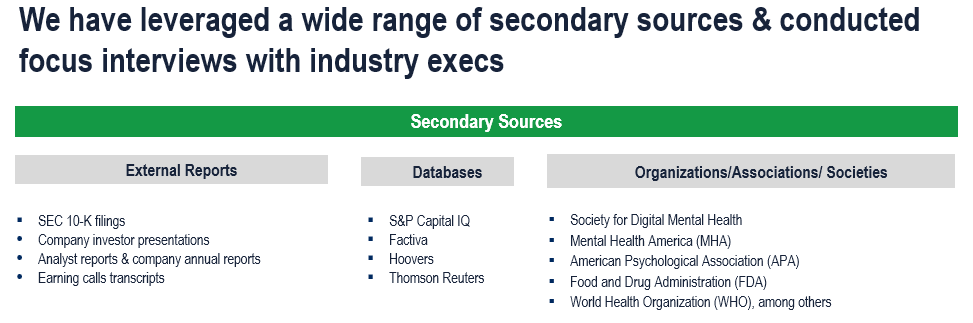

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, R&D Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders from Community Clinics, Hospitals, and Private Practices

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down & Bottom-Up Approaches’ were used to derive market size estimates and forecasts

Data Triangulation

Research findings derived through secondary sources & internal analysis was validated with Primary Interviews, Internal Knowledge Repository and Company’s Sales Data