IoT Medical Devices Market Size, Share, Trends, Industry Analysis and Demand, for Forecasts (2024-2029)

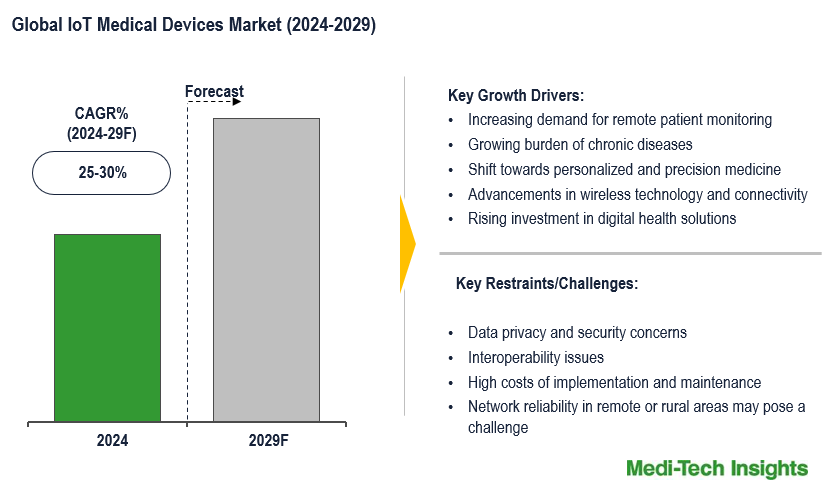

The Global IoT Medical Devices Market is expected to witness a growth rate of 25-30% in the next five years. The IoT medical devices market is experiencing a significant growth driven by the increasing demand for real-time patient monitoring, advancements in wireless technologies, and the shift towards personalized medicine. These devices, ranging from wearable health trackers to smart implants, offer continuous health data collection and transmission, enhancing patient care and treatment outcomes. The rise in chronic diseases, growing health awareness, and the need for efficient and remote patient management are further accelerating market expansion. Additionally, innovations in sensor technology, increasing investments in digital health, and supportive healthcare policies are contributing to the market’s growth. However, challenges such as data privacy and security concerns, interoperability issues among different devices, high costs of implementation, and the need for robust regulatory frameworks may hinder market progress. To learn more about the research report, download a sample report.

IoT medical devices are advanced tools designed to enhance patient care through continuous monitoring and real-time data collection. These devices integrate with healthcare systems to provide valuable insights into patient health. Their primary goals are to improve patient outcomes, streamline chronic disease management, and facilitate personalized treatment plans. By leveraging IoT technology, these devices enable seamless data transmission, enhance clinical decision-making, and support proactive health interventions. Additionally, they foster improved patient engagement and communication between healthcare providers and patients. As the market expands, IoT medical devices play a crucial role in advancing healthcare delivery and optimizing treatment efficiency.

Increasing Demand for Real-Time Patient Monitoring

The increasing demand for real-time patient monitoring is a key driver in the IoT medical devices market. As healthcare systems strive to provide more personalized and proactive care, the need for continuous health monitoring has become paramount. Real-time monitoring allows the instant collection and analysis of patient data, facilitating early detection of health issues and enabling timely interventions. IoT medical devices, including wearable sensors and connected implants, provide healthcare providers with up-to-the-minute information on patients' vital signs, activity levels, and overall health status. This data-driven approach not only enhances patient care by enabling prompt adjustments to treatment plans but also improves patient outcomes through more precise and responsive care.

To learn more about this report, download the PDF brochure

Rise in chronic diseases likely to propel demand for IoT Medical Devices

The increasing prevalence of chronic diseases, such as diabetes, hypertension, and chronic obstructive pulmonary disease (COPD), would drive the growth in IoT medical devices market. According to the World Health Organization, by 2030, the proportion of total global deaths due to chronic diseases is expected to increase to 70% and the global burden of disease to 56% due to aging populations and lifestyle factors. IoT medical devices address this growing challenge by enabling continuous health monitoring and personalized care. These devices facilitate early detection of disease exacerbations, real-time data sharing with healthcare providers, and more effective management of chronic conditions, ultimately leading to improved patient outcomes and reduced healthcare costs.

"Amid the growing prevalence of chronic diseases, IoT medical devices are crucial for delivering continuous monitoring and timely interventions, thus enhancing patient care and optimizing disease management."- Chief Technology Officer, Leading IoT Medical Device Company

Data privacy and security challenges

The Internet of Things (IoT) in healthcare, while transformative, presents data privacy and security challenges. IoT medical devices—such as wearables, smart implants, and connected monitors—continuously collect and transmit sensitive health data, making them prime targets for cyberattacks. These devices are vulnerable to hacking, which can lead to unauthorized access, data breaches, and misuse of patient information. Moreover, compromised device data can be exploited to create fake identities or commit fraud, such as purchasing prescription drugs under false pretenses. Therefore, ensuring robust encryption, secure storage, and regular security updates are critical to safeguarding patient privacy and maintaining the integrity of health data.

US Market Leadership in IoT Medical Devices: Growth Drivers and Opportunities

The US leads the global IoT medical devices market due to its advanced healthcare infrastructure, robust investment in digital health, and rising prevalence of chronic diseases like diabetes and heart conditions. The demand for IoT devices is being propelled by the shift towards value-based care, which emphasizes continuous patient monitoring and data-driven decision-making. Additionally, the widespread adoption of telemedicine and remote patient management, accelerated by the COVID-19 pandemic, has further fueled market growth. The US healthcare sector’s focus on personalized medicine and preventive care is creating opportunities for innovative IoT solutions, particularly in managing chronic diseases and improving patient engagement.

To learn more about this report, download the PDF brochure

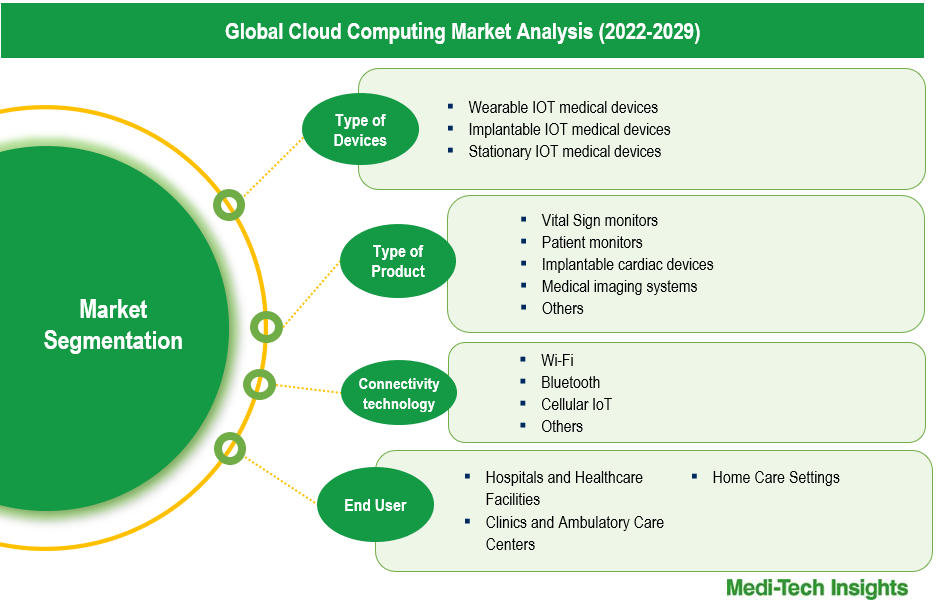

Global IoT Medical Devices Market, by Type of Device

In the IoT medical devices market, wearable medical devices represent the largest segment due to their increasing adoption for remote monitoring and chronic disease management. Devices such as smartwatches, fitness trackers, and wearable ECG monitors enable real-time tracking of vital signs, improving patient outcomes while reducing hospital visits. Their ease of use, portability, and ability to provide continuous data are key drivers for their widespread adoption. Implantable and stationary IoT devices are also significant, catering to long-term health management and hospital-based diagnostics, but wearables dominate due to their versatility and patient accessibility.

Global IoT Medical Devices Market, by Type of Product

Among various IoT medical device products, vital sign monitors is one of the largest segments. These devices, which measure critical health indicators like heart rate, blood pressure, and oxygen levels, are increasingly used in both clinical settings and home care. The demand for continuous health monitoring, especially for high-risk patients and those with chronic conditions, has fueled the growth of these products. Patient monitors, implantable cardiac devices, and medical imaging systems also play essential roles in providing comprehensive IoT-enabled health solutions, though vital sign monitors' broad application across various health conditions makes them one of the dominant product segments.

IoT Medical Devices Market, by End User

In terms of end users, hospitals and healthcare facilities is a significantly larger market segment. These institutions require sophisticated IoT solutions to manage large volumes of patient data, monitor equipment, and streamline operations. The need for real-time patient monitoring, integration of IoT systems with electronic health records (EHR), and the ability to provide personalized care at scale make hospitals the one of the leading adopters of IoT medical devices. While clinics, ambulatory care centers, and home care settings are also key users of IoT devices, hospitals dominate due to the complexity and volume of their operational needs.

Key players are focusing on organic as well as inorganic growth strategies to establish their foothold in the market

Players operating in this market are adopting both organic and inorganic growth strategies. Organic growth strategies such as approvals/new product launches and inorganic growth strategies such as partnerships/acquisitions are some of the key strategies adopted by market players to enhance their presence. For instance,

- Medtronic's recent (August 2024) FDA approval of the Simplera continuous glucose monitor (CGM) marks a significant advancement in the IoT medical device market. This disposable, all-in-one CGM integrates with Medtronic’s IoT-enabled insulin delivery systems, enhancing remote glucose monitoring and data-driven diabetes management. In addition, Medtronic formed a global partnership with Abbott to create an integrated CGM system based on Abbott's advanced platform. This CGM will work exclusively with Medtronic's insulin delivery and Smart MDI systems, enhancing diabetes care. The agreement is expected to positively impact Medtronic's diabetes revenue. The Abbott-based CGM will be sold solely by Medtronic

- In May 2023, Medtronic acquired EOFlow, a maker of the EOPatch wearable insulin device, boosts its position in the IoT MedTech market by adding a tubeless insulin patch to its connected diabetes management solutions. Integrating EOFlow's patch with Medtronic’s continuous glucose monitoring (CGM) and Meal Detection Technology™ enhances its real-time, IoT-enabled diabetes care ecosystem, offering more personalized and connected healthcare

- In January 2023, Philips and Masimo enhanced their partnership by integrating Masimo's W1 health tracking watch into Philips' patient monitoring ecosystem. This collaboration allows vital sign data from the W1 watch to be transmitted to Philips' system, enabling remote monitoring of patients post-discharge

Competitive Landscape Analysis: IoT Medical Devices Market

The global IoT medical devices market features players such as Medtronic, Philips, GE Healthcare, Abbott Laboratories, Boston Scientific, Honeywell, Siemens Healthineers, Johnson & Johnson, Omron Healthcare, and Masimo, among others.

Get a sample report for competitive landscape analysis

Future Outlook of the IoT medical devices Market

The IoT medical devices market is expected to experience continued growth due to increasing adoption of connected health solutions and strategic investments by key players. As demand for remote monitoring and personalized care continues to rise, IoT medical devices will play a crucial role in transforming healthcare delivery.

Global IoT Medical Devices Market Scope

|

Report Scope |

Details |

|

Base Year Considered |

2023 |

|

Historical Data |

2022 - 2023 |

|

Forecast Period |

2024 - 2029 |

|

Growth Rate |

25-30% |

|

Segment Scope |

Device Type, Product Type, Connectivity Technology, End User |

|

Regional Scope |

|

|

Key Companies Mapped |

Medtronic, Philips, GE Healthcare, Abbott Laboratories, Boston Scientific, Honeywell, Siemens Healthineers, Johnson & Johnson, Omron Healthcare, and Masimo |

|

Report Highlights |

Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

Key Strategic Questions Addressed

-

What is the market size & forecast for the Global IoT Medical Devices Market?

-

What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the Global IoT Medical Devices Market?

-

How has COVID-19 impacted the Global IoT Medical Devices Market?

-

What are the major growth drivers, restraints/challenges impacting the market?

-

What are the opportunities prevailing in the market?

-

What is the investment landscape?

-

Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market? What is the competitive positioning of key players?

-

Who are the new players entering the market?

-

What are the key strategies adopted by players?

- Introduction

- Introduction

- Market Scope

- Market Definition

- Segments Covered

- Regional Segmentation

- Research Timeframe

- Currency Considered

- Study Limitations

- Stakeholders

- List of Abbreviations

- Key Conferences and Events (2023-2024)

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Bottom-Up Approach

- Top-Down Approach

- Market Forecasting

- Executive Summary

- IoT Medical Devices Market Snapshot (2023-2029)

- Segment Overview

- Regional Snapshot

- Competitive Insights

- Market Overview

- Market Dynamics

- Drivers

- Increasing demand for remote patient monitoring

- Growing burden of chronic diseases

- Shift towards personalized and precision medicine

- Advancements in wireless technology and connectivity

- Rising investment in digital health solutions

- Restraints/Challenges

- Data privacy and security concerns

- Interoperability issues

- High costs of implementation and maintenance

- Network reliability in remote or rural areas may pose a challenge

- Opportunities

- Emerging markets

- Expanding telemedicine and remote patient monitoring services

- Key Market Trends

- Drivers

- Unmet Market Needs

- Industry Speaks

- Market Dynamics

- Global IoT Medical Devices Market Size & Forecast (2022-2029), By Type of Device, USD Million

- Introduction

- Wearable IOT medical devices

- Implantable IOT medical devices

- Stationary IOT medical devices

- Global IoT Medical Devices Market Size & Forecast (2022-2029), By Type of Product, USD Million

- Introduction

- Vital Sign monitors

- Patient monitors

- Implantable cardiac devices

- Medical imaging systems

- Others

- IoT Medical Devices Market Size & Forecast (2022-2029), By Connectivity Technology, USD Million

- Introduction

- Wi-Fi

- Bluetooth

- Cellular IoT

- Others

- IoT Medical Devices Market Size & Forecast (2022-2029), By End User, USD Million

- Introduction

- Hospitals and Healthcare Facilities

- Clinics and Ambulatory Care Centers

- Home Care Settings

- Others

- Global IoT Medical Devices Market Size & Forecast (2022-2029), By Region, USD Million

- Introduction

- North America IoT Medical Devices Market Size & Forecast (2022-2029), By Country, USD Million

- US

- Market Size & Forecast, By Device Type (USD Million)

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Connectivity Technology (USD Million)

- Market Size & Forecast, By End User (USD Million)

- US

- Canada

- Market Size & Forecast, By Device Type (USD Million)

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Connectivity Technology (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Europe IoT Medical Devices Market Size & Forecast (2022-2029), By Country, USD Million

- UK

- Market Size & Forecast, By Device Type (USD Million)

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Connectivity Technology (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Germany

- Market Size & Forecast, By Device Type (USD Million)

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Connectivity Technology (USD Million)

- Market Size & Forecast, By End User (USD Million)

- France

- Market Size & Forecast, By Device Type (USD Million)

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Connectivity Technology (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Italy

- Market Size & Forecast, By Device Type (USD Million)

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Connectivity Technology (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Spain

- Market Size & Forecast, By Device Type (USD Million)

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Connectivity Technology (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Rest of Europe

- Market Size & Forecast, By Device Type (USD Million)

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Connectivity Technology (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Asia Pacific (APAC) IoT Medical Devices Market Size & Forecast (2022-2029), By Country, USD Million

- China

- Market Size & Forecast, By Device Type (USD Million)

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Connectivity Technology (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Japan

- Market Size & Forecast, By Device Type (USD Million)

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Connectivity Technology (USD Million)

- Market Size & Forecast, By End User (USD Million)

- India

- Market Size & Forecast, By Device Type (USD Million)

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Connectivity Technology (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Rest of Asia Pacific

- Market Size & Forecast, By Device Type (USD Million)

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Connectivity Technology (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Latin America (LATAM) IoT Medical Devices Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Device Type (USD Million)

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Connectivity Technology (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Middle East & Africa (MEA) IoT Medical Devices Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Device Type (USD Million)

- Market Size & Forecast, By Product Type (USD Million)

- Market Size & Forecast, By Connectivity Technology (USD Million)

- Market Size & Forecast, By End User (USD Million)

- China

- UK

- Competitive Landscape

- Key Players and their Competitive Positioning

- Market share analysis/Key players rankings (2024)

- Key players comparison

- Key Strategies Assessment, By Player (2022-2024)

- New Product Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Company Profiles*

(Business Overview, Financial Performance**, Products Offered, Recent Developments)

- Medtronic

- Philips

- GE Healthcare

- Athenahealth

- Abbott

- Boston Scientific

- Honeywell

- Siemens Healthineers

- Johnson & Johnson

- Omron Healthcare

- Masimo

- Other Prominent Players

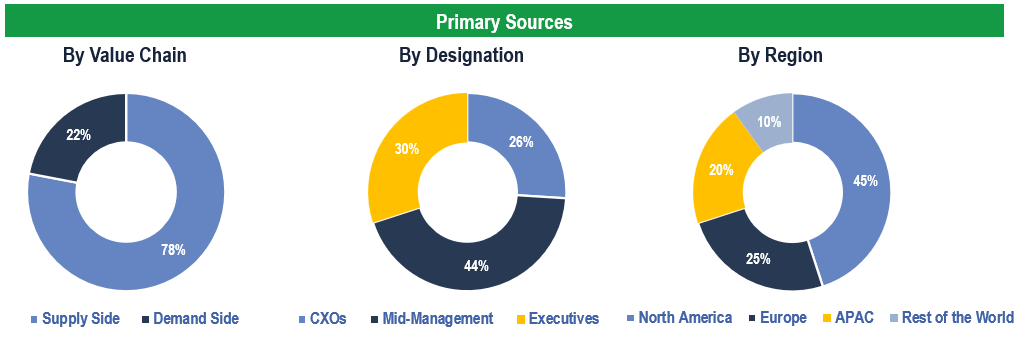

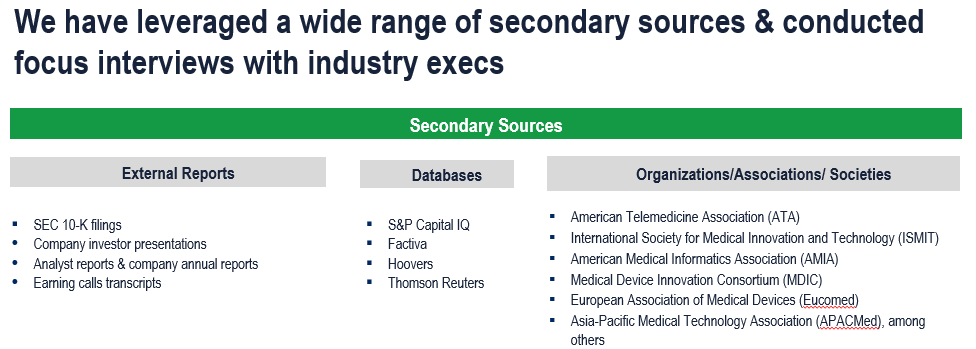

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders in Hospitals, Physician's Clinics & Offices, home care settings

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis were validated with Primary Interviews, Internal Knowledge Repository, and Company Sales Data.