Home Healthcare Services Market – Global Analysis, Size, Share, Demand, Growth Rate & Trends for Forecast 2024 to 2029

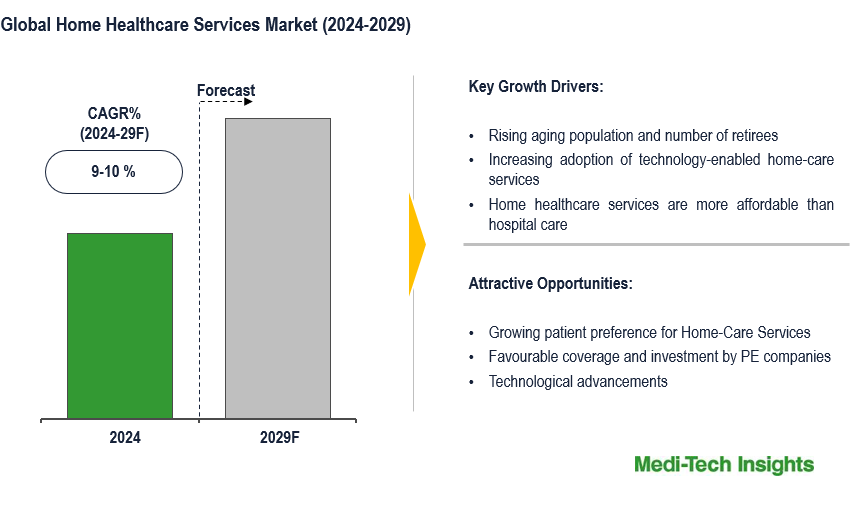

The Global Home Healthcare Services Market will witness a CAGR of 9-10% by 2029. The key factors driving the home healthcare services market growth are the rising aging population and the number of retirees, adoption of technology-enabled healthcare delivery by doctors, patients, insurers, regulators, home health & hospice agencies, increased acceptance of in-home palliative care & hospice care services, home nursing, home medical supply delivery, and in-home diagnostics. To learn more about the research report, download a sample report.

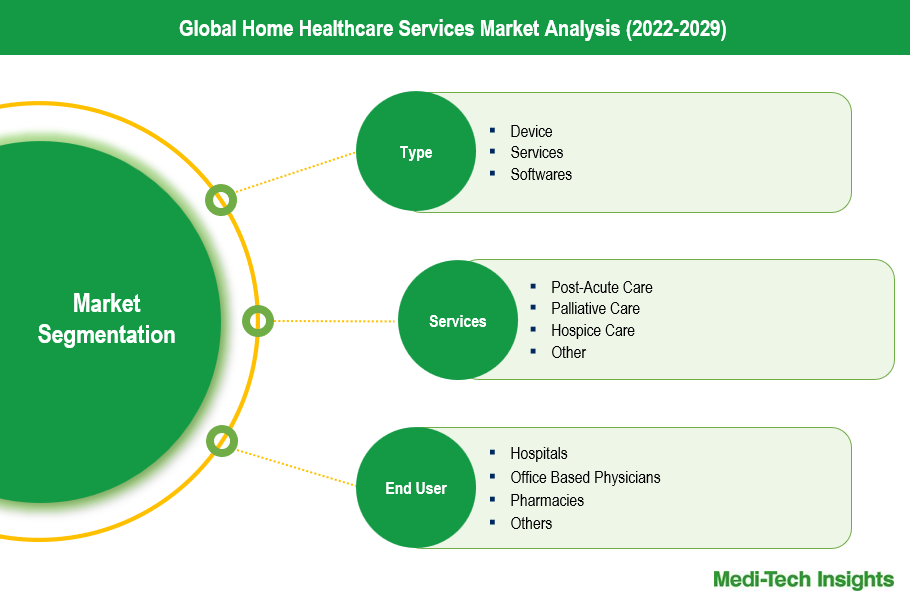

Home healthcare services are provided by skilled and non-skilled medical professionals in the comfort and convenience of a patient’s home. It includes services such as Post-Acute Care, Palliative Care, Hospice Care, Nursing Care/Wellness Checks, Specialized Care (Alzheimer’s & Dementia Care, Recuperative Care, Stroke Recovery, etc.), Companionship Care, Personal Care and Other Services (Meals and Nutrition Planning, Pharmaceutical Services, 24-hour Monitoring/Live-in Care, Laboratory and Imaging Tests).

Favourable Coverage and Investment by Private Equity Companies drive the Global Home Healthcare Services Market

In key markets such as the U.S., Medicare Part A (Hospital Insurance) and/or Medicare Part B (Medical Insurance) cover eligible home health services as long as patients are homebound and need part-time or intermittent skilled services. Generally, a home health care agency coordinates the services ordered by a doctor or allowed practitioner for the patient. The home health agency caring for the patient must be Medicare-certified.

Some of the covered home health services include: Medically necessary part-time or intermittent skilled nursing care, physical therapy, occupational therapy, speech-language pathology services, medical social services, part-time or intermittent home health aide care, injectable osteoporosis drugs for women, durable medical equipment, medical supplies for use at home.

Also, in the calendar year (CY) 2023, the Centers for Medicare & Medicaid Services (CMS) estimates that Medicare payments to home health agencies (HHAs) are likely to increase in the aggregate by 0.7% as compared to CY 2022.

Citing the lucrative prospects of the home healthcare services market, several private equity companies have started to invest in the global market.

For instance,

- In May 2022, Bow River Capital, a private equity firm completed a strategic investment in Amazing Care, a leading provider of pediatric home health services

- In Jan 2022, Health Care At Home India Pvt Ltd (HCAH), a home healthcare services provider secured $15 million from Singapore-based private equity fund ABC World Asia

- In April 2021, H. Franchising Systems, a Cincinnati-based company that operates Home Helpers® Home Care was acquired by RiverGlade Capital, a healthcare-focused private equity firm.

To learn more about this report, download the PDF brochure

The Growing Role of Artificial Intelligence (AI) in Home Healthcare Services

In recent years, the application of AI in home healthcare has triggered a paradigm shift related to how patients and healthcare caregivers approach and deliver healthcare to patients. AI-based sensors track a patient’s health biometrics 24/7. Any irregularities in readings can immediately trigger alerts to the relevant caregiver or agency. AI-based mobile applications also help in providing preventive care by monitoring and managing medical conditions such as obesity, diabetes, cardiac problems, etc., maintaining diet and nutrition records, sending reports, and issuing alerts to concerned caregivers/physicians in case of deviations. AI-based AI voice assistants can also assist in setting up reminders for taking medicines, checking vital signs parameters, booking appointments, etc.

“……The prominence of AI in the home healthcare services market is expected to grow manifolds in the coming years……AI has the potential to manage complex care plans, streamline operations of home care agencies by optimizing the scheduling and routing of caregivers, and help in data-driven decision-making..”-Director, Home Healthcare Service Provider, U.S.A

To learn more about this report, download the PDF brochure

Service Segment Outlook

Competitive Landscape Analysis: Home Healthcare Services Market

Some of the key and established players operating in the global home healthcare services market are Amedisys, LHC Group (Acquired by UnitedHealth Group), AccentCare, Elara Caring, Interim HealthCare, VITAS Healthcare, James River Home Health, Home Helpers Home Care, Virginia Kares Home Care Services, Companion Extraordinaire Home Care Services, among others.

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the Market

Leading players operating in this global market are adopting organic and inorganic growth strategies such as acquiring related firms, entering into collaborations, and launching new services to garner a higher market share.

For instance,

- In July 2023, PurposeCare, a leading provider of coordinated home care and home health services in the Midwestern United States acquired three Midwest home care agencies in the Indiana and Ohio markets to expand its footprint

- In Feb 2023, UnitedHealthacquired LHC Group, an in-home healthcare service provider. LHC is now part of UnitedHealth's’ health services division Optum

- In September 2022, LHC Group and the University of Maryland Medical System (UMMS) announced a definitive agreement to form a joint venture aimed at enhancing in-home healthcare services across much of Maryland

The global home healthcare services market is expected to gain consistent momentum in the coming years due to the advantages offered by at-home healthcare services such as convenience, cost-effectiveness, hassle-free appointments, personalized attention by the caregiver, reduced risk of infection or virus transmission, government support for home healthcare services in key markets, and aggressive organic and inorganic growth strategies followed by the leading market players.

Home Healthcare Services Market Futures and Scope

|

Report Scope |

Details |

|

Base Year Considered |

2023 |

|

Historical Data |

2022 - 2023 |

|

Forecast Period |

2024 - 2029 |

|

CAGR (2024-2029) |

9-10% |

|

Segment Scope |

Services and End User |

|

Regional Scope |

|

|

Key Companies Mapped |

Amedisys, LHC Group (Acquired by UnitedHealth Group), AccentCare, Elara Caring, Interim HealthCare, VITAS Healthcare, James River Home Health, Home Helpers Home Care, Virginia Kares Home Care Services, Companion Extraordinaire Home Care Services, among others

|

|

Report Highlights |

Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

Key Strategic Questions Addressed

-

What is the market size & forecast for the Global Home Healthcare Services Market?

-

What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the Global Home Healthcare Services Market?

-

How has COVID-19 impacted the Global Home Healthcare Services Market?

-

What are the major growth drivers, restraints/challenges impacting the market?

-

What are the opportunities prevailing in the market?

-

What is the investment landscape?

-

Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market? What is the competitive positioning of key players?

-

Who are the new players entering the market?

-

What are the key strategies adopted by players?

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Market Forecasting

- Executive Summary

- Market Overview

-

- Market Dynamics

- Drivers

- Restraints

- Key Market Trends

- Industry Speaks

- Market Dynamics

- Key Revenue Pockets

- Global Home Healthcare Services Market - Size & Forecast (2021-2028), By Type

- Devices

- Services

5.3. Software

- Global Home Healthcare Services Market - Size & Forecast (2021-2028), By Services

- Post-Acute Care

- Palliative Care

- Hospice Care

- Nursing Care/Wellness Checks

- Specialized Care (Alzheimer’s & Dementia Care, Recuperative Care, Stroke Recovery, etc.)

- Companionship Care

- Personal Care

- Other Services (Meals and Nutrition Planning, Pharmaceutical Services, 24-Hour Monitoring/Live-in Care, Laboratory and Imaging Tests)

- Global Home Healthcare Services Market - Size & Forecast (2021-2028), By End User

- Hospitals

- Medical Device Manufacturers

- Pharma/Biotech Companies

- Academic & Research Institutes

- Other End-Users

- Global Home Healthcare Services Market - Size & Forecast (2021-2028), By Region

- North America (U.S. & Canada)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, Rest of Asia Pacific)

- Rest of the World (Latin America, Middle East & Africa)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Competitive Positioning of Key Players (2022)

- Offerings Assessment, By Player

- Key Strategies Assessment, By Player (2021-2023)

- New Product & Service Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Key Companies Scanned (Indicative List)

- Amedisys

- LHC Group (Acquired by UnitedHealth Group)

- AccentCare

- Elara Caring

- Interim HealthCare

- VITAS Healthcare

- James River Home Health

- Home Helpers Home Care

- Virginia Kares Home Care Services

- Companion Extraordinaire Home Care Services

- Other Prominent Players

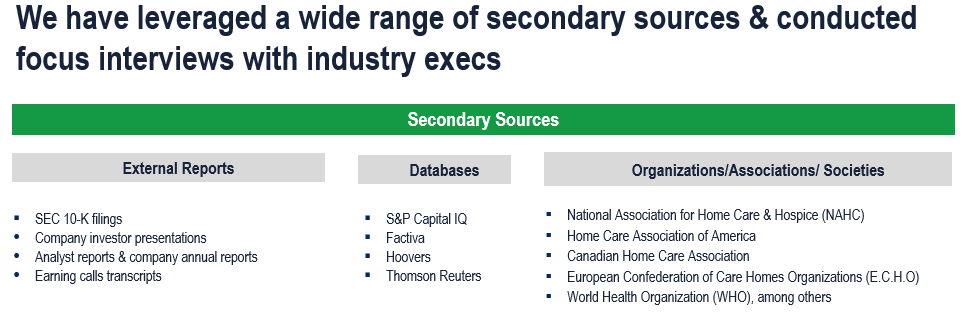

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

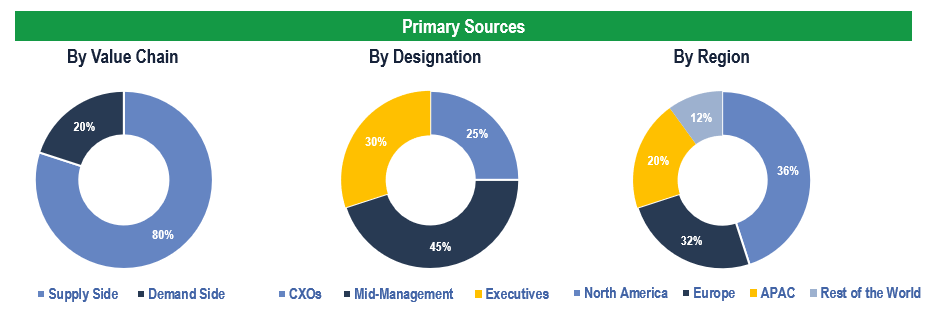

Primary Research

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders in Hospitals, Medical Device Manufacturers, Pharma/Biotech Companies, Academic & Research Institutes and Other End Users

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis were validated with Primary Interviews, Internal Knowledge Repository, and Company Sales Data.