Ambulatory Surgical Center Software Market – Growing Preference For Outpatient Surgeries

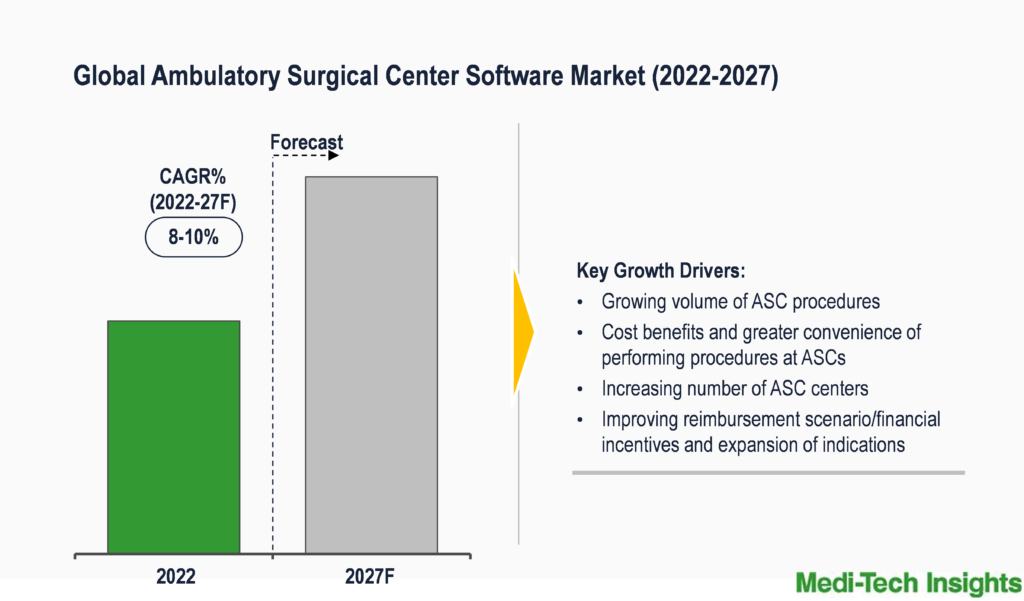

The Global Ambulatory Surgical Center Software Market is set to witness a healthy growth rate of ~10% by 2027. Need to curb growing healthcare costs; growing trend of performing surgical procedures in ambulatory settings and resulting growth in the number of procedures at ASCs; increasing physician and patient preference for outpatient surgeries; and launch of advanced solutions for ASCs are some of the key factors driving the ambulatory surgical centers software market. To learn more about the research, fill out a quick inquiry for a sample report.

Ambulatory care is a medical care provided in outpatient setting and does not require hospital admission. Ambulatory Surgical Center or ASCs—are health care facilities focused on providing same-day surgical care, including diagnostic and preventive procedures. ASCs have transformed the outpatient experience by providing a more convenient alternative to hospital-based outpatient procedures. Common procedures performed in ASCs include cataract surgery, gallbladder removal, tonsillectomy, endoscopy/colonoscopy, arthroscopic/orthopedic procedures, and cardiac procedures. Owing to their cost benefits and convenience the volume of procedures performed at ASCs is growing and software are likely to play important role in these settings by easing day to day operations by effectively preparing staff and patients for pre-op and post-op tasks.

Growing investments in ASC space from Healthcare Companies/PEs indicates a High Growth Potential

Investment companies have picked up on the growing trend of having surgeries done outside of a hospital setting and the significance of ASCs in these procedures. Drawn by the lucrative growth potential in the space, many investors have backed independent ASCs and have consolidated to form larger groups/chains. United Surgical Partners International (USPI), AmSurg, HCA, and Surgical Care Affiliates (now SCA Health) are some of the examples of large ASC chains operating in the U.S. Number of ASCs operated by USPI have increased from ~250 in 2015 to more than 465 at present. Similarly, number of facilities operated by Surgical Care Affiliates increased from about 185 in 2015 to more than 320.

Key Market Players are focusing on Development of New Features/Solutions for ASCs

Key market players are constantly focusing on developing new software solutions or adding new features to existing ASC solutions. Some of the related developments are listed below-

- In January 2023, Ospitek launched live patient charting for ambulatory surgery centres (ASCs) as part of the company’s latest update to the proprietary surgical coordination platform “VIEW”

- In November 2022, 3M Health Information Systems (HIS) announced the launch of 3M Ambulatory Potentially Preventable Complications (3M AM-PPCs) software, developed to address patient safety and quality oversight for procedures performed at ASCs/hospital outpatient departments

- In October 2022, eClinicalWorks launched EHR software, V12. The new version has features such as 40% faster speeds, improved usability with redesigned screens, a module for pre visit planning, enhanced procedure documentation, and enhancements to the ASC workflow model, among others

ASCs are not Federally Mandated to implement EHRs – a Barrier to the Adoption of Ambulatory Surgical Center Software Market in United States

Since 2008, EHR adoption in office-based settings has more than doubled from ~40% to more than 80%. However, according to the Ambulatory Surgery Center Association (ASCA), the adoption rate of EHRs in ASC settings remains low (approx. only 20%). Greater adoption rate in non-ASC settings is due to the Health Information Technology for Economic and Clinical Health (HITECH) Act (2009). This act authorized financial incentives of billions of dollars for doctors and hospitals for EHR implementation and levied a reimbursement penalty for those providers not using a certified EHR. However, it is not mandatory for ASCs to implement EHRs which has caused their low adoption in these settings. However, low adoption rate also indicates that there is an ample scope for ASC solution providers to penetrate the ambulatory surgical center software market.

North America controls a Large Share in the Ambulatory Surgical Center Software Market

From a geographical perspective, North America holds a larger market share of the ambulatory surgical center software market. This is attributed to the presence of large number of ASC centers and number of procedures being performed, relatively greater adoption of ASC solutions, rising financial incentives, and high prevalence of various diseases and associated surgeries. The number of Medicare certified ASCs have consistently grown in the U.S. from ~5200 in 2011 to ~5500 in 2015 and ~5800 in 2020 (total number of ASCs in the U.S. is ~11,800). Previously ASC procedures were reimbursed based on Consumer Price Index for All Urban Consumers (“CPI-U”) which caused lower reimbursement. However, from 2019 through 2023, CMS decided to update the ASC payment system using the hospital market basket update, rather than the CPI-U. This further improved reimbursement for ASC procedures. Such developments are likely to drive ASC and in turn, ASC software market growth.

Competitive Landscape Analysis: Ambulatory Surgical Center Software Market

Some of the key players operating in ambulatory surgical center software market are listed below:-

- Athena Health

- Cerner

- Epic

- Allscripts

- Surgical Information Systems (SIS)

- HST Pathways

- eClinicalWorks

- NexGen Healthcare

- Advanced Data Systems Corporation

Key Strategic Questions Addressed in this Report:

- What is the market size & forecast of the ambulatory surgical center software market?

- What are historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the ambulatory surgical center software market?

- What are the key trends defining the ambulatory surgical center software market?

- What are the major factors impacting the growth of the ambulatory surgical center software market?

- What are the opportunities prevailing in the ambulatory surgical center software market?

- Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

- Who are the major players operating in the ambulatory surgical center software market?

- What are the key strategies adopted by players in ambulatory surgical center software market?

1. Research Methodology

1.1. Secondary Research

1.2. Primary Research

1.3. Market Estimation

1.3.1. Bottom-up and Top-down Approach

1.4. Market Forecasting

2. Executive Summary

3. Market Overview

3.1. Market Dynamics

3.1.1. Drivers

3.1.2. Restraints

3.1.3. Opportunities

3.1.4. Market Trends

3.2. Industry Speaks

4. COVID-19 Impact on Ambulatory Surgical Center Software Market

5. Global Ambulatory Surgical Center Software Market- Size & Forecast (2020-2027), By Software and Services

5.1. Software

5.2. Services

6. Global Ambulatory Surgical Center Software Market- Size & Forecast (2020-2027), By Deployment Mode

6.1. Cloud-based solutions

6.2. On-premise solutions

7. Global Ambulatory Surgical Center Software Market- Size & Forecast (2020-2027), By ASC Ownership

7.1. Physician-owned

7.2. Hospital-owned

7.3. Others

8. Global Ambulatory Surgical Center Software Market- Size & Forecast (2020-2027), By Region

8.1. North America (U.S. & Canada)

8.2. Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

8.3. Asia Pacific (China, India, Japan, Rest of Asia Pacific)

8.4. Rest of the World (Latin America, Middle East & Africa)

9. Competitive Landscape

9.1. Key Players and their Competitive Positioning

9.1.1. Key player Rankings (2022)

9.2. Key Strategies Assessment, By Player (2020-2022)

9.2.1. New Product Launches

9.2.2. Partnerships, Agreements, & Collaborations

9.2.3. Mergers & Acquisitions

9.2.4. Geographic Expansion

10. Key Companies Scanned (Indicative List)

10.1. Athenahealth

10.2. Cerner

10.3. Epic

10.4. Allscripts

10.5. Surgical Information Systems (SIS)

10.6. HST Pathways

10.7. eClinicalWorks

10.8. NexGen Healthcare

10.9. Advanced Data Systems Corporation

10.10. AdvancedMD, Inc.

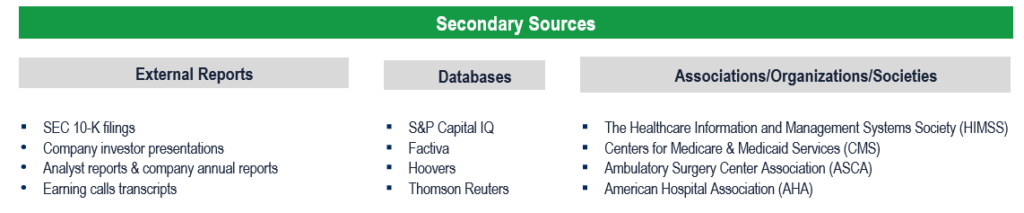

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

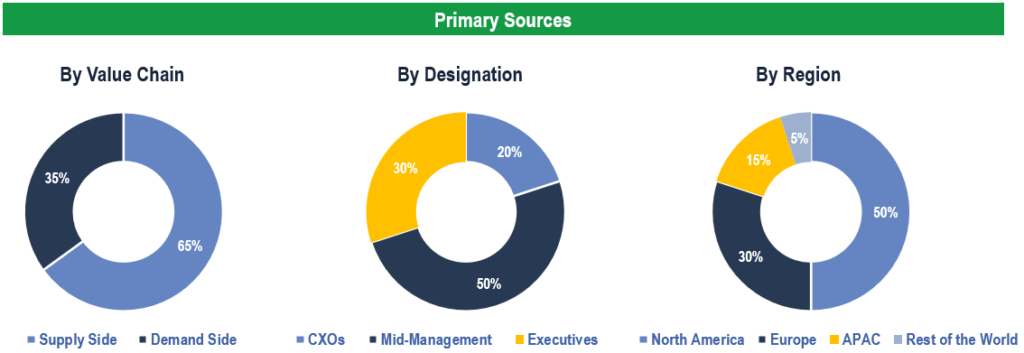

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, R&D Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders in Ambulatory surgical center (ASCs).

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis were validated with Primary Interviews, Internal Knowledge Repository, and Company Sales Data.