Cancer Diagnostics Market Size, Share, Growth Analysis, Future Outlook and Forecast to 2029

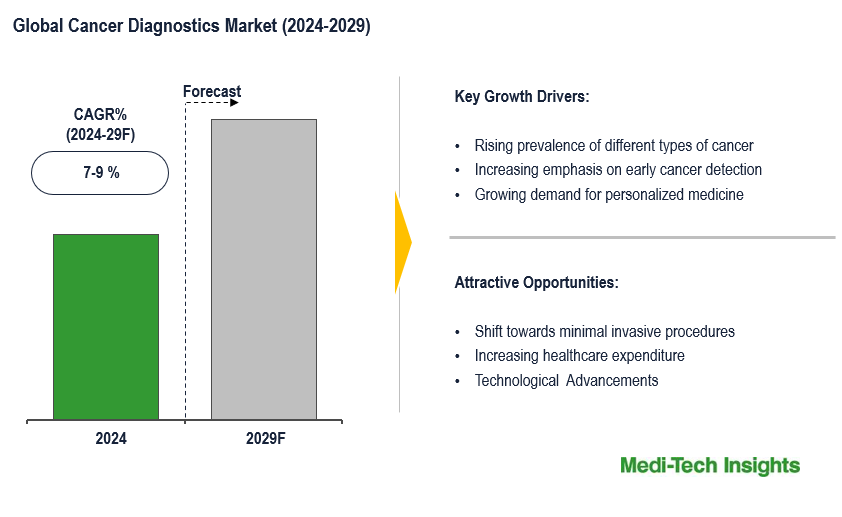

The Cancer Diagnostics Market is projected to grow at a CAGR of 7-9% in the forecast period. This growth can be attributed to the rising incidence of different types of cancer worldwide, continuous advancements in diagnostic products, growing emphasis on early cancer detection, and the shift towards non-invasive and rapid testing methods to improve patient experience and accessibility to diagnostic services. To learn more about the research report, download a sample report.

Cancer diagnostics involve a range of methods and technologies aimed at detecting and diagnosing cancer in individuals. These methods can vary depending on the type of cancer, its stage, and other factors. Here are some common approaches to cancer diagnostics:

- Imaging Techniques: Various imaging techniques such as X-rays, CT scans, MRI scans, PET scans, and ultrasound are used to visualize tumours and assess their size, location, and spread within the body

- Biopsy: A biopsy involves the removal of a small sample of tissue from a suspicious area, which is then examined under a microscope by a pathologist to determine if cancer cells are present

- Blood Tests: Blood tests can be used to detect certain tumour markers or other substances that may indicate the presence of cancer. For example, prostate-specific antigen (PSA) levels are monitored for prostate cancer and CA-125 levels for ovarian cancer.

- Genetic Testing: Genetic testing can identify inherited gene mutations that increase the risk of certain types of cancer, such as BRCA1 and BRCA2 mutations in breast and ovarian cancer.

- Endoscopy: Endoscopic procedures allow doctors to examine the inside of the body using a thin, flexible tube with a camera and light attached. Endoscopy can be used to visualize and biopsy tumours in the digestive tract, respiratory tract, or other organs.

- Screening Programs: Population-based screening programs aim to detect cancer at an early stage, often before symptoms develop, through tests such as mammography for breast cancer, colonoscopy for colorectal cancer, and Pap smears for cervical cancer

These diagnostic methods are often used in combination to provide a comprehensive assessment of an individual's cancer status and to inform treatment planning and monitoring. Early detection plays a crucial role in improving outcomes for many types of cancer, highlighting the importance of regular screenings and prompt evaluation of any concerning symptoms.

Addressing the Global Cancer Burden: Market Trends and Strategies for Improved Diagnostics

The global cancer diagnostics market is a rapidly growing industry that plays a crucial role in identifying and diagnosing various types of cancer. Advances in diagnostic technologies such as next-generation sequencing (NGS), liquid biopsy, and molecular diagnostics have significantly improved the accuracy and efficiency of cancer detection. These technologies offer non-invasive and more sensitive methods for early cancer detection, leading to increased adoption in clinical settings. The rising incidence of cancer worldwide is a major driver for the growth of the diagnostics market. Factors such as aging populations, lifestyle changes, environmental factors, and the prevalence of risk factors like smoking and obesity contribute to the increasing burden of cancer, necessitating better diagnostic tools for timely intervention. There is a growing trend towards personalized medicine, where treatments are tailored to the individual characteristics of each patient, including their genetic makeup and the specific molecular profile of their cancer. This trend drives the need for advanced diagnostic techniques that can accurately identify biomarkers and molecular signatures associated with different cancer types, enabling targeted therapies. For instance,

- In July 2023, Illumina Inc. and Pillar Biosciences Inc. formed a strategic partnership to globally commercialize Pillar's oncology assays within the Illumina portfolio of oncology products. This collaboration aims to provide a comprehensive range of next-generation sequencing solutions, improving the precision, cost-effectiveness, and accessibility of oncology testing. Ultimately, it will enhance personalized cancer treatment options for patients

Early detection of cancer greatly improves treatment outcomes and survival rates. Governments, healthcare organizations, and advocacy groups are increasingly promoting cancer screening programs and raising awareness about the importance of early detection, which in turn fuels the demand for cancer diagnostics. The integration of AI and big data analytics in cancer diagnostics has the potential to revolutionize the field by enabling more accurate and rapid analysis of complex data sets, such as medical images, genomic data, and patient records. AI algorithms can assist clinicians in interpreting diagnostic results, identifying patterns, and making more informed treatment decisions. Emerging economies are witnessing rapid urbanization, improving healthcare infrastructure, and increasing healthcare spending, which is driving the expansion of the cancer diagnostics market in these regions. Moreover, initiatives by governments and healthcare organizations to improve access to cancer screening and diagnostics services further contribute to market growth.

To learn more about this report, download the PDF brochure

To learn more about this report, download the PDF brochure

Expanding Horizons in Cancer Diagnostics: Liquid Biopsies, Precision Oncology, and AI Advancements

The development of new biomarkers for cancer detection and monitoring is a significant emerging trend in the field of cancer diagnostics. Biomarkers offer valuable insights into the presence, progression, and response to treatment of various cancer types. Advancements in biomarker research are continually enhancing the accuracy and effectiveness of cancer diagnostics, promising improved patient outcomes and better-informed treatment decisions. Several trends and opportunities are shaping the cancer diagnostics market. One significant trend is the widespread adoption of liquid biopsies, which involve the analysis of blood or urine samples to detect and scrutinize cancer. Liquid biopsies offer a non-invasive alternative, enabling earlier detection, monitoring treatment responses, and identifying resistance to therapy. For instance,

- In April 2024, QIAGEN unveiled a suite of new products aimed at advancing cancer research and introducing urine collection and stabilization as an innovative method for liquid biopsy at the AACR Annual Meeting

Additionally, there is a growing emphasis on personalized medicine in cancer care. Personalized medicine involves tailoring treatment plans based on an individual patient's genetic and molecular characteristics. Accurate cancer diagnostics play a crucial role in determining the most suitable treatment options for each patient and optimising therapeutic strategies. Precision oncology, which integrates genomic testing, biomarker analysis, and targeted therapies, is gaining prominence in cancer diagnostics. Artificial intelligence (AI) and machine learning have the potential to revolutionize cancer diagnostics by analysing complex datasets and enhancing diagnostics. Furthermore, the rise of private diagnostic centers, especially in developing countries, is driving market growth. These centres provide advanced diagnostic imaging services and contribute to the accessibility of cutting-edge diagnostic

Key Constraints/Challenges

The cancer diagnostics market faces several challenges that impact its effectiveness and growth. One significant challenge is the complexity and heterogeneity of cancer itself, which makes accurate diagnosis and treatment selection difficult. Variability in tumour biology, genetic mutations, and disease progression necessitates sophisticated diagnostic tools capable of capturing this diversity. Additionally, the high cost of advanced diagnostic technologies such as next-generation sequencing and molecular diagnostics poses financial barriers, limiting access to cutting-edge diagnostics, particularly in low-resource settings. Regulatory hurdles and the lengthy approval process for new diagnostic tests also impede innovation and market entry. Furthermore, issues related to data privacy, security, and ethical considerations arise with the integration of AI and big data analytics in cancer diagnostics, requiring robust governance frameworks.

Regional Analysis of the Cancer Diagnostics Market

The regional segmentation analysis of the cancer diagnostics market reveals a nuanced landscape shaped by diverse factors across different geographical areas. In North America, the cancer diagnostics market is characterized by a high level of technological advancement, robust regulatory frameworks, and significant investments in healthcare infrastructure. The region boasts a mature market with widespread adoption of advanced diagnostic technologies such as next-generation sequencing, liquid biopsy, and molecular diagnostics. Moreover, favourable reimbursement policies and high healthcare spending contribute to the accessibility of cutting-edge diagnostic tools and services.

In Europe, the cancer diagnostics market mirrors many trends seen in North America, with well-established healthcare systems, advanced diagnostic technologies, and a strong emphasis on research and development. However, differences in healthcare financing systems and regulatory environments across European countries can lead to variations in market dynamics. Additionally, efforts to harmonize regulatory standards and improve cross-border collaboration are driving market growth and innovation in the region. In the Asia-Pacific region, the cancer diagnostics market is experiencing rapid expansion fueled by rising cancer incidence, improving healthcare infrastructure, and increasing investments in healthcare technology. However, challenges such as disparities in access to healthcare, regulatory complexities, and cultural attitudes towards cancer screening and diagnosis present barriers to market growth. Nevertheless, strategic initiatives by governments and industry stakeholders to improve healthcare access, enhance regulatory frameworks, and promote awareness about the importance of early cancer detection are driving market expansion in the region.

Competitive Landscape

The market is dominated by several key companies including GE Healthcare, Abbott Laboratories, Siemens Healthcare GmbH, Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd., Qiagen, Becton, Dickinson and Company and Hologic Inc. among others.

Get a sample report for competitive landscape analysis

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the Market

Players operating in this market are adopting both organic and inorganic growth strategies such as collaborations, and acquisitions to garner market share. For instance,

- In September 2023, Pfizer and Thermo Fisher Scientific Inc. (NYSE: TMO) unveiled a collaborative agreement aimed at expanding the availability of next-generation sequencing (NGS)-based testing for lung and breast cancer patients in over 30 countries throughout Latin America, Africa, the Middle East, and Asia

The Cancer Diagnostics Market is expected to gain momentum in the coming years due to the rising incidences of diverse cancer diseases, increasing emphasis on early cancer detection, growing demand for personalized medicine, technological advancements, strategic collaborations and aggressive organic and inorganic growth strategies followed by the players.

Key Strategic Questions Addressed

-

What is the market size & forecast for the Global Cancer DiagnosticsMarket?

-

What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the Global Cancer Diagnostics Market?

-

How has COVID-19 impacted the Global Cancer Diagnostics Market?

-

What are the major growth drivers, restraints/challenges impacting the market?

-

What are the opportunities prevailing in the market?

-

What is the investment landscape?

-

Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market? What is the competitive positioning of key players?

-

Who are the new players entering the market?

-

What are the key strategies adopted by players?

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Market Forecasting

- Executive Summary

- Market Overview

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Market Dynamics

- Global Cancer Diagnostics Market - Size & Forecast (2021-2028), By Product

- Instruments

- Consumables

- Services

- Global Cancer Diagnostics Market - Size & Forecast (2021-2028), By Technology

- IVD

- Imaging

- Biopsy

- Others

- Global Cancer Diagnostics Market - Size & Forecast (2021-2028), By Application

- Breast Cancer

- Lung Cancer

- Prostate

- Others

- Global Cancer Diagnostics Market - Size & Forecast (2021-2028), By End User

- Hospitals

- Diagnostic Laboratories

- Academic & Research Institute

- Other End Users

- Global Cancer Diagnostics Market - Size & Forecast (2021-2028), By Region

- North America (U.S. & Canada)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, Rest of Asia Pacific)

- Rest of the World (Latin America, Middle East & Africa)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Competitive Positioning of Key Players (2022)

- Offerings Assessment, By Players

- Key Strategies Assessment, By Player (2021-2023)

- New Product Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Other Developments

- Key Players and their Competitive Positioning

- Key Companies Scanned (Indicative List)

- Hoffmann-La Roche Ltd

- Abbott Laboratories

- Siemens Healthineers

- Thermo Fisher Scientific

- Hoffmann-La Roche Ltd

- Qiagen

- Becton, Dickinson and Company

- Hologic Inc.

- Other Players

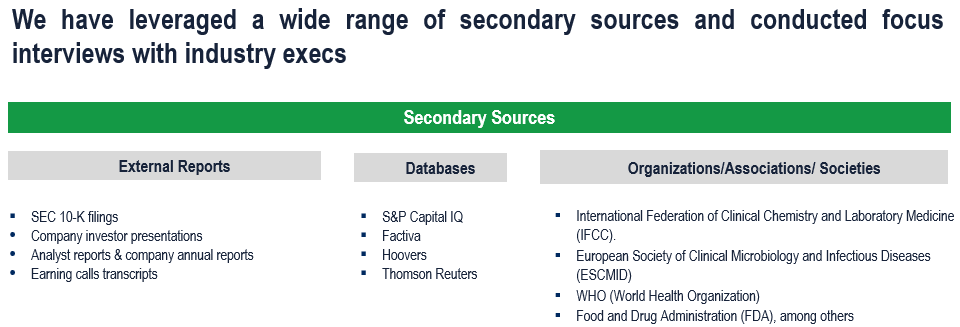

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

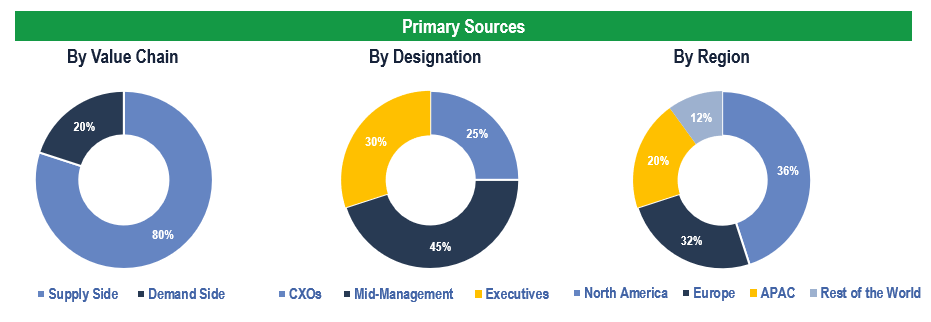

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders in Hospitals, Diagnostic Laboratories, and Academic & Research Centers among others

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis were validated with Primary Interviews, Internal Knowledge Repository, and Company Sales Data.