Contract Research Organization (CRO) Services Market Size, Share, Trends, Growth Analysis and Forecasts by 2029

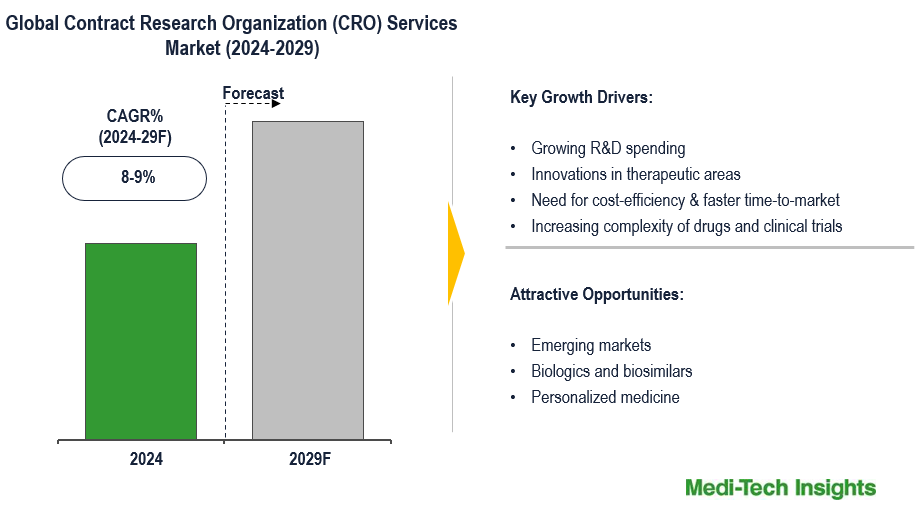

The Global Contract Research Organization (CRO) Services Market is expected to witness a growth rate of 8-9% in the next five years. Growing R&D spending; innovations in therapeutic areas like oncology, and rare diseases; the need for cost-efficiency & faster time-to-market; stringent regulatory compliance/reporting, and increasing complexity of drugs and clinical trials are some of the key factors driving the CRO Services market growth. However, concerns about quality control and the reliability of results, risks related to intellectual property, regulatory and legal challenges and the high cost of services is likely to hinder the market’s growth. To learn more about the research report, download a sample report.

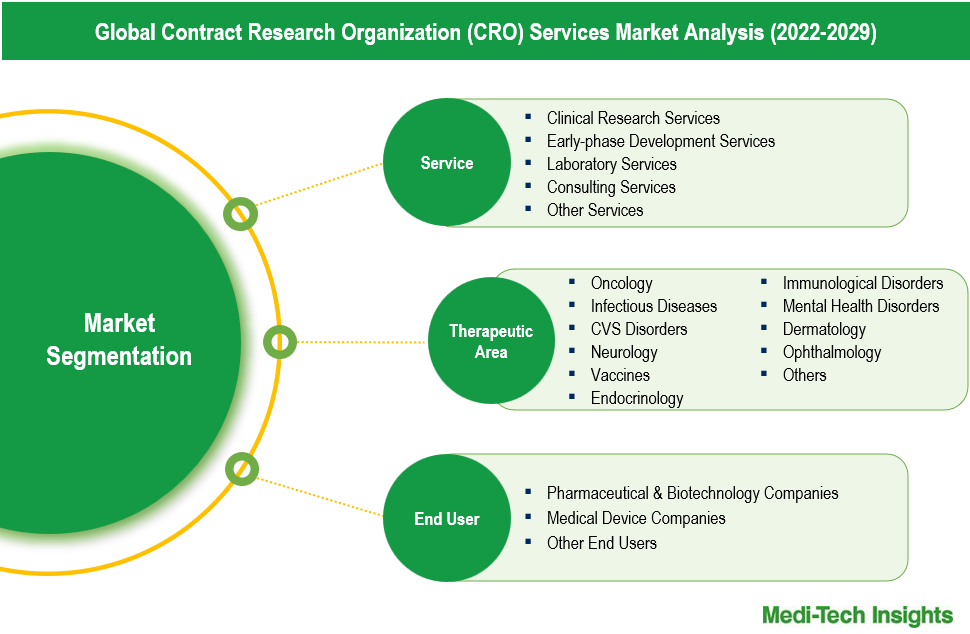

A Contract Research Organizations (CROs) provides comprehensive clinical trial services for the pharmaceutical, biotechnology, and medical device sectors. CRO services majorly include clinical research services, early-phase development services, laboratory services, consulting services, among others. Some of the typical reasons why the pharmaceutical, biotechnology, and medical devices industries outsource to CROs include, better return on R&D investments, lack of internal capabilities (esp. small biopharma companies), increasing complexity in developing targeted therapeutic areas like immuno-oncology therapies, stringent regulatory requirements, to focus on core competencies, strategic choice, and time and cost-efficiency among others.

Growing Investments from Governments, Private Companies, and Venture Capitalists to Drive Market Growth

In recent years, pharmaceutical and biotechnology companies are allocating more funds towards research and development to accelerate the discovery and development of new drugs and therapies. Outsourcing to CROs allows these companies to manage and reduce costs, as CROs provide specialized expertise, advanced infrastructure, and efficient processes for conducting clinical trials and regulatory submissions. This outsourcing not only shortens development timelines but also enhances the likelihood of successful outcomes by leveraging the CROs' extensive experience and technological capabilities. Additionally, the increasing complexity of clinical trials and stringent regulatory requirements necessitate the expertise and support provided by CROs, making them indispensable partners in the R&D process. Consequently, as R&D investments rise, the demand for CRO services continues to grow, fuelling market expansion.

“As the drug development landscape evolves, CROs are adapting to meet the specific needs of both large pharmaceutical companies and smaller biotech firms. There is a notable demand for flexible service models that leverage advanced technologies to streamline processes and enhance efficiency in clinical trials"- Senior Director, A Global Leading CRO, United States

Increasing Complexity of Drugs and Clinical Trials to Fuel Market Growth

Modern drug development involves advanced technologies, such as biologics, gene therapies, and personalized medicines, which require sophisticated research and development processes. These complex therapies necessitate specialized knowledge and capabilities that many pharmaceutical and biotechnology companies may not possess in-house. Additionally, clinical trials for these advanced therapies are becoming more intricate. Trials now often include multiple endpoints, adaptive designs, biomarker-driven approaches, and require rigorous patient stratification. This complexity demands extensive expertise in trial design, patient recruitment, data management, and regulatory compliance, which are the areas where CROs excel. CROs bring the necessary infrastructure, technological advancements, and specialized teams to manage these multifaceted trials effectively. Moreover, the regulatory landscape is continuously evolving, with increasing scrutiny and stringent requirements from regulatory bodies worldwide. CROs, with their comprehensive understanding of global regulatory standards and experience in navigating these complexities, provide invaluable support in ensuring compliance and accelerating the approval process. By outsourcing to CROs, pharmaceutical companies can better manage the complexity of modern drug development and clinical trials, reduce operational risks, and focus on their core competencies. This growing reliance on CROs to handle intricate trial processes and regulatory challenges is driving the robust expansion of the CRO services market.

To learn more about this report, download the PDF brochure

Market Trend Towards Full-service CROs/One-stop-shop Model

The trend towards full-service CROs or a one-stop-shop model is driven by the increasing complexities in drug development. Biopharma companies now prefer CROs that provide comprehensive services across the entire drug development lifecycle, from pre-clinical and clinical stages to commercialization. This shift is due to the need for streamlined processes, cost efficiency, and reduced timelines. Full-service CROs offer a breadth of services that cover all phases of drug development, making it easier for biopharma companies to manage projects without juggling multiple vendors. Additionally, these CROs provide scalable services, i.e., they can adjust their resources and capabilities according to the project’s size and requirements. Specialized technologies and expertise in specific therapeutic areas further enhance their appeal, ensuring high-quality outcomes. Global presence is another critical factor, as drug development increasingly requires international clinical trials and regulatory approvals. CROs with a worldwide network can facilitate smoother operations across different regions, ensuring compliance with various regulatory standards and access to diverse patient populations. This integrated approach helps biopharma companies navigate the complex landscape of drug development more efficiently, driving the growing preference for full-service CROs.

APAC Expected to be a Major Growth Engine in the CRO Services Market

The APAC region is expected to be a major growth engine in the CRO services market. This growth is driven by several factors, including cost-effective operational environments, a large and diverse patient pool for clinical trials, and increasing investments in pharmaceutical research and development. Countries like China and India are particularly prominent due to their expanding healthcare infrastructure, favourable regulatory changes, and a growing number of skilled professionals in the biotechnology and pharmaceutical sectors. Additionally, the region offers significant cost advantages compared to North America and Europe, making it an attractive destination for outsourcing clinical trials and other research activities. The rising prevalence of chronic diseases, coupled with increasing healthcare expenditures, further fuels the demand for CRO services. As a result, the Asia-Pacific region is poised to play a crucial role in the global CRO market's expansion.

To learn more about this report, download the PDF brochure

Service Type Segment Analysis

The CRO services market comprises service types like: Clinical Research Services, Early-phase Development Services, Laboratory Services, Consulting Services, Other Services. Clinical research services represent the largest service type segment. This segment's dominance is driven by the extensive outsourcing of clinical trials by pharmaceutical and biotechnology companies aiming to streamline operations and reduce costs. The increasing complexity of clinical trials, coupled with the need for specialized expertise, further propels the growth of this segment.

On the other hand, early-phase development services is likely to be the fastest growing segment. The growth in this segment is fueled by the rising focus on early-stage drug development, where the demand for preclinical and Phase I trials is increasing. Pharmaceutical companies are increasingly outsourcing these early-phase services to CROs to leverage their specialized knowledge and accelerate the development process, aiming to bring new drugs to market more swiftly and efficiently. This trend is supported by advancements in technology and personalized medicine, further boosting the segment's growth.

End user Type Segment Analysis

The CRO services market can be analyzed based on end user types, such as Pharmaceutical & Biotechnology Companies, Medical Device Companies, and Other End Users. Pharmaceutical & biotechnology companies are the largest end-user segment for CRO services. This dominance stems from the substantial R&D investments made by these companies to develop new drugs and therapies. They rely heavily on CROs for clinical trial management, regulatory compliance, and specialized services to streamline the drug development process and reduce time-to-market. Growth in the medical device companies is driven by the increasing complexity of medical device regulations and the need for rigorous clinical trials to ensure safety and efficacy. As the medical device industry expands, with innovations in digital health and wearable technologies, these companies are increasingly outsourcing their clinical research needs to CROs to leverage their expertise and infrastructure. This trend is expected to continue, propelling the growth of CRO services within the medical device sector.

Competitive Landscape Analysis: Contract Research Organization (CRO) Services Market

The global CRO services market is marked by the presence of established market players such as IQVIA, Labcorp, Syneos Health, Thermo Fisher Scientific, Parexel, ICON, Charles River, WUXI Apptec, Pharmacon Beijing, SGS, among others.

Get a sample report for competitive landscape analysis

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the Market

Players operating in this market are adopting both organic and inorganic growth strategies such as collaborations, acquisitions, and new product launches to garner market share. For instance,

- In April 2024, Parexel and Palantir Technologies entered into a multi-year strategic partnership to leverage AI to help enhance and accelerate the delivery of safe and effective clinical trials for biopharmaceutical customers. Parexel will integrate Palantir’s Foundry and AI Platform to improve trial efficiency, data quality, and regulatory compliance. This collaboration aims to streamline clinical trial processes, offering real-time data access and accelerating drug development

- In March 2024, Veeda Clinical Research, an Indian CRO, acquired Heads, a European CRO specializing in oncology trials, to enhance its global presence and expand its late-stage clinical trial capabilities. This acquisition allows Veeda to offer comprehensive CRO services across Europe, the US, and Asia Pacific, while providing Heads access to the Indian and Southeast Asian markets for diverse clinical trials

- In August 2023, RQM+, a global leader in MedTech services, acquired Kottmann a Germany based CRO, to strengthen its presence in Europe and enhance its MedTech services, by leveraging Kottmann's expertise to expedite client market entry. This acquisition broadens RQM+'s global operations, integrating comprehensive end-to-end support from pre-clinical phases to commercialization

- In January 2023, Novotech acquired EastHORN, a European CRO, to expand its global presence and enhance its early to late-phase clinical trial services. This acquisition enables Novotech to offer a comprehensive suite of CRO services across Europe, the US, and Asia-Pacific, integrating EastHORN’s local expertise and infrastructure into its global operations

The CRO services market is expected to gain further momentum in the coming years due to technological advancements, rising R&D investments, and aggressive organic and inorganic growth strategies followed by the players.

Future Outlook of the Contract Research Organization (CRO) Services Market

The global CRO services market is expected to gain further momentum in the coming years due to the innovations in technology, globalization of drug development, and growing emphasis on personalized and precision medicine. These factors collectively contribute to the growth and evolution of the CRO services market.

Contract Research Organization (CRO) Services Market Report Scope

| Report Scope | Details |

| Base Year Considered | 2023 |

| Historical Data | 2022 - 2023 |

| Forecast Period | 2024 - 2029 |

| CAGR (2024-2029) | 8-9% |

| Segment Scope | Product, Application, End User |

| Regional Scope |

|

| Key Companies Mapped | IQVIA, Labcorp, Syneos Health, Thermo Fisher Scientific, Parexel, ICON, Charles River, WUXI Apptec, Pharmacon Beijing, SGS, among others. |

| Report Highlights | Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

Key Strategic Questions Addressed

-

What is the market size & forecast for the Global Contract Research Organization (CRO) Services Market?

-

What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the Global Contract Research Organization (CRO) Services Market?

-

How has COVID-19 impacted the Global Contract Research Organization (CRO) Services Market?

-

What are the major growth drivers, restraints/challenges impacting the market?

-

What are the opportunities prevailing in the market?

-

What is the investment landscape?

-

Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market? What is the competitive positioning of key players?

-

Who are the new players entering the market?

-

What are the key strategies adopted by players?

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Market Forecasting

- Executive Summary

- Market Overview

-

- Market Dynamics

- Drivers

- Restraints

- Key Market Trends

- Industry Speaks

- Market Dynamics

- Key Revenue Pockets

- Global Contract Research Organization (CRO) Services Market - Size & Forecast (2022-2029), By Service Type

- Clinical Research Services

- By Phase

- Phase III

- Phase II

- Phase I

- Phase IV

- By Study Design

- Interventional

- Real World Evidence (RWE)

- Early-phase Development Services

- Chemistry, Manufacturing and Controls Services

- Preclinical Services

- Pharmacokinetics/ Pharmacodynamics Services

- Toxicology Testing Services

- Other Preclinical Services

- Discovery Studies

- Laboratory Services

- Analytical Testing Services

- Physical Characterization Services

- Raw Material Testing Services

- Batch Release Testing Services

- Stability Testing Services

- Other Analytical Testing Services

- Bioanalytical Testing Services

- Consulting Services

- Other Services

- Analytical Testing Services

- By Phase

- Clinical Research Services

- Global Contract Research Organization (CRO) Services Market - Size & Forecast (2022-2029), By Therapeutic Area Type

- Oncology

- Infectious Diseases

- CVS Disorders

- Neurology

- Vaccines

- Endocrinology

- Immunological Disorders

- Mental Health Disorders

- Dermatology

- Ophthalmology

- Others

- Global Contract Research Organization (CRO) Services Market - Size & Forecast (2022-2029), By End User Type

- Pharmaceutical & Biotechnology Companies

- Medical Device Companies

- Other End Users

- Global Contract Research Organization (CRO) Services Market - Size & Forecast (2022-2029), By Region

- North America (U.S. & Canada)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, Rest of Asia Pacific)

- Rest of the World (Latin America, Middle East & Africa)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Competitive Positioning of Key Players (2023)

- Offerings Assessment, By Player

- Key Strategies Assessment, By Player (2022-2024)

- New Product & Service Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Key Companies Scanned (Indicative List)

- IQVIA

- Labcorp

- Syneos Health

- Thermo Fisher Scientific

- Parexel

- ICON

- Charles River

- WUXI Apptec

- Pharmacon Beijing

- SGS

- Other Prominent Players

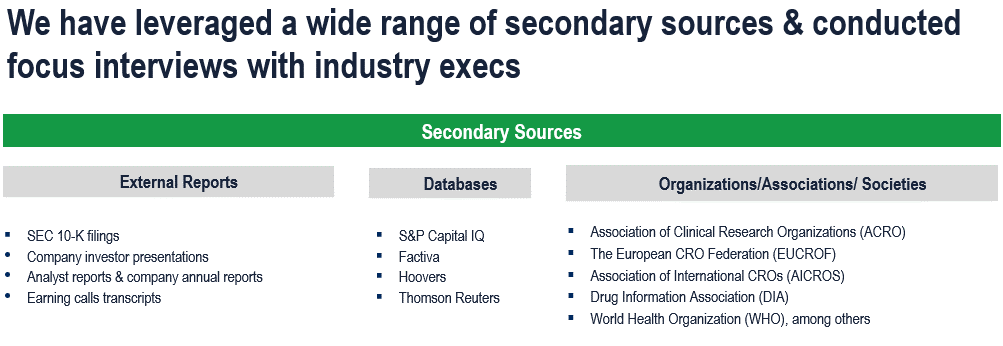

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

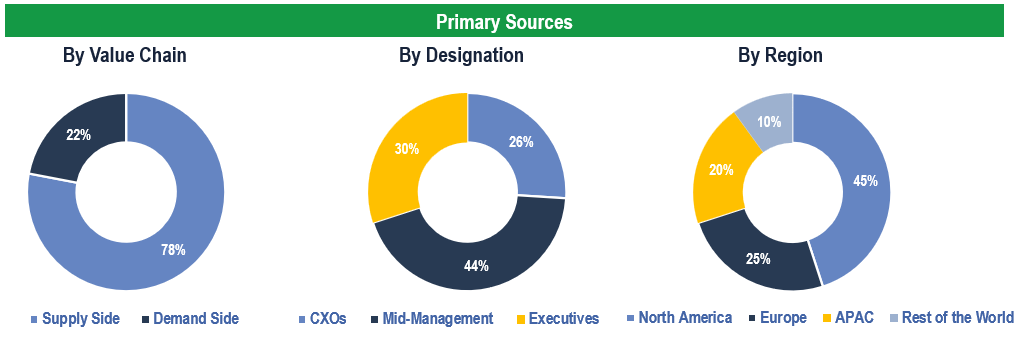

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders in Pharmaceutical and Biotechnology Companies, Medical Device Companies and Other End Users

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis were validated with Primary Interviews, Internal Knowledge Repository, and Company Sales Data.