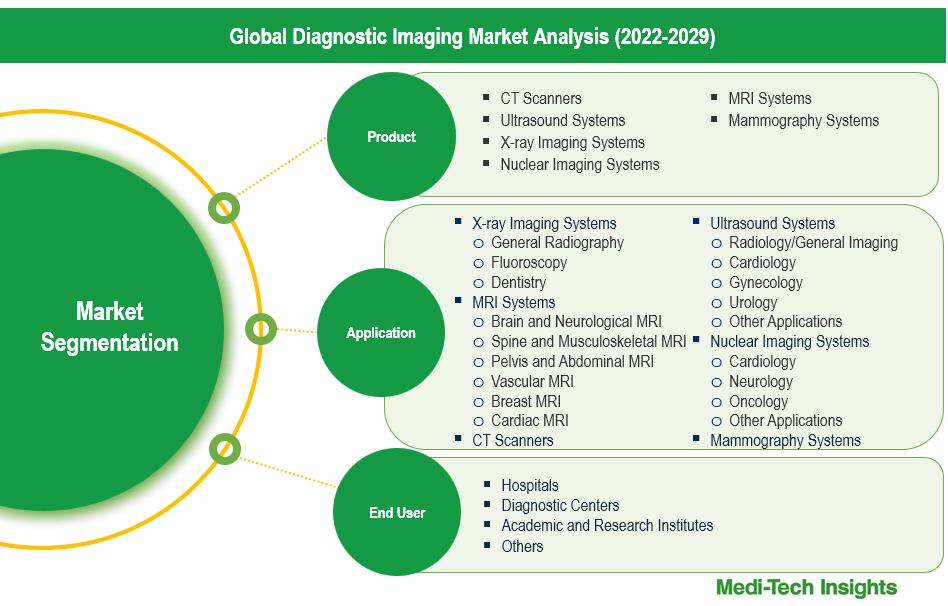

Diagnostic Imaging Market Size & Trends Report Segmented by Product (CT Scanners, Ultrasound, X-ray Imaging, Nuclear Imaging), Application (Cardiology, Dentistry, Gynecology), End User (Hospitals, Diagnostic Centers) & Regional Forecasts to 2029

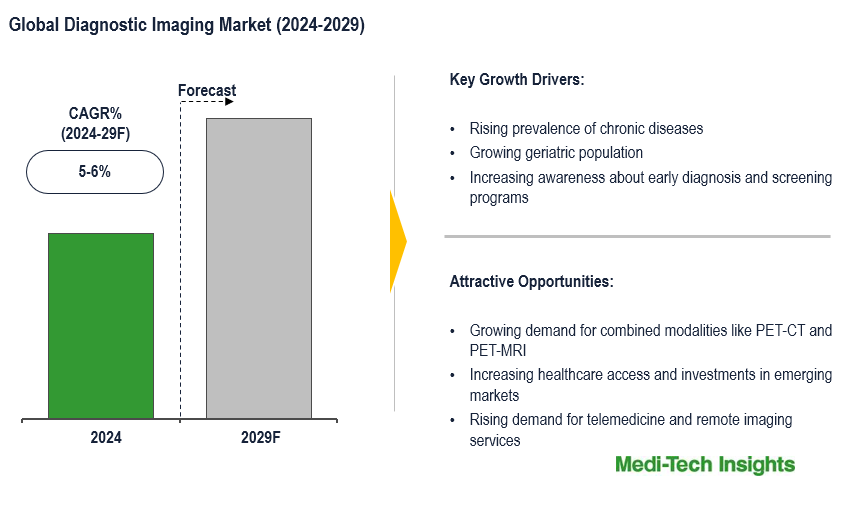

The global diagnostic imaging market is expected to witness a growth rate of 5-6% during the forecast period. This growth is driven by the increasing incidences of chronic diseases, the rising demand for diagnostic imaging services, the growing awareness about preventive healthcare, and technological advancements associated with diagnostic imaging services. To learn more about the research report, download a sample report.

Report Overview

Diagnostic imaging encompasses various techniques healthcare professionals employ to visually inspect and analyze the body's internal structures for medical purposes. These imaging modalities play a crucial role in diagnosing and monitoring various diseases and conditions, offering vital information that aids surgeons and healthcare professionals in comprehending the size, location, and extent of tumours or abnormalities. This information enhances surgical precision and facilitates the implementation of targeted therapies, showcasing the significance of diagnostic imaging in patient care, medical research, and healthcare systems. Key modalities and techniques include X-ray imaging, a traditional method utilizing ionizing radiation; Computed Tomography (CT), which provides 3D imaging through X-rays; Magnetic Resonance Imaging (MRI), utilizing strong magnetic fields and radio waves; Ultrasound, employing sound waves to generate images; and Nuclear Medicine, involving the use of radioactive tracers for imaging.

To learn more about this report, download the PDF brochure

Technological Advances and Healthcare Trends Fueling the Diagnostic Imaging Market

The growth of the diagnostic imaging market is propelled by various factors. Technological advancements play a pivotal role, as ongoing improvements in imaging technologies continually enhance diagnostic accuracy and efficiency. These advancements are giving rise to the production of high-resolution imaging devices that deliver superior image quality and facilitate detailed analysis. An illustrative example is the progress in MRI technology, leading to the creation of high-field MRI systems. These systems offer clearer and more detailed images, enhancing accuracy in diagnoses. For instance,

- In November 2023, Philips unveiled AI-enabled advancements during the RSNA23 medical imaging conference. These innovations encompass next-generation ultrasound systems designed to boost diagnostic imaging and workflow efficiency, the world's first mobile MRI system operating without helium, and novel AI-enabled cloud solutions aimed at augmenting radiology efficiency

The rising incidence of diseases, particularly chronic conditions, significantly contributes to the increasing demand for diagnostic imaging services. Moreover, the aging population worldwide is a key driver, as the elderly demographic requires more diagnostic procedures, contributing to market expansion. Increased awareness about preventive healthcare practices also encourages early diagnosis through imaging, further fueling the demand for diagnostic imaging services. Together, these factors form a dynamic landscape that supports the continuous growth of the diagnostic imaging market.

Future-Forward: AI, 3D Printing, and Point-of-Care Imaging Reshape Diagnostic Imaging Services

Recent developments and advancements in diagnostic imaging have significantly transformed the field, enhancing capabilities and patient care. The integration of AI is a notable trend, as AI algorithms enable more accurate image analysis and interpretation, aiding healthcare professionals in diagnosis and treatment planning. For instance,

- In January 2024, Philips unveiled its AI-powered enterprise imaging solutions, including the Compact Ultrasound System 5000 series and the BlueSeal magnet MRI, at the IRIA 2024, highlighting innovations in ultrasound, MRI, and CT systems

- In November 2023, Siemens Healthineers launched the Acuson Maple Workhorse Ultrasound System, an advanced, adaptable, and cost-effective ultrasound platform designed to facilitate swift diagnosis and evaluation across diverse clinical environments. The system incorporates artificial intelligence (AI)-driven features, enhancing routine clinical operations for users with varying skill levels

Hybrid imaging, which involves combining different imaging modalities, has become increasingly prevalent. Techniques like PET-CT and SPECT-CT provide more comprehensive diagnostic information by merging the strengths of multiple imaging technologies. This integration aids in more accurate localization and characterization of abnormalities. The advent of 3D printing technology has brought about innovative applications in diagnostic imaging. Clinicians can now create physical models from imaging data, facilitating pre-surgical planning and providing a tangible representation of anatomical structures. This development is particularly valuable in complex surgeries where a precise understanding of the patient's anatomy is crucial. Portable and point-of-care imaging devices represent another significant advancement. Compact and portable imaging tools allow for on-the-spot diagnostic imaging, reducing the need for patients to travel to imaging centres. This is especially beneficial in emergencies or remote healthcare settings where immediate diagnostic information is essential. For instance,

- In August 2023, GE HealthCare launched the Vscan Air SL, a wireless handheld ultrasound device with a dual-headed probe featuring sector and linear arrays, enabling seamless cardiac and vascular assessments at the point of care, both in and out of hospital settings

- In February 2022, FUJIFILM Sonosite, Inc. expanded its next-generation point-of-care ultrasound (POCUS) offerings with the introduction of the Sonosite LX system. This system incorporates the company's most extensive clinical image and a monitor with extended, rotating, and tilting capabilities, facilitating improved real-time collaboration for healthcare providers

Diagnostic Imaging Market: Key Constraints/Challenges

The challenges in diagnostic imaging include substantial initial and maintenance costs for advanced equipment, posing financial barriers for healthcare facilities. Concerns about radiation exposure in modalities using ionizing radiation and challenges related to reimbursement policies and healthcare financing further complicate the landscape.

North America Accounts for the Largest Share of the Global Market

The size of the market varies across regions, with typically more well-established services in developed countries. North America dominates the global market owing to its robust research and development efforts and advanced healthcare system featuring medical facilities equipped with advanced diagnostic imaging devices. The region's emphasis on medical research and clinical trials further drives the demand for diagnostic imaging. Additionally, favourable insurance and reimbursement policies, especially in the US contribute to increased accessibility and affordability of diagnostic imaging services for patients, thereby propelling market growth. Meanwhile, the Asia-Pacific region is experiencing rapid expansion in the forecast period. Countries in this region have been investing in healthcare infrastructure and adopting modern diagnostic imaging equipment to meet the rising demand for diagnostic imaging services.

To learn more about this report, download the PDF brochure

Competitive Landscape

The global diagnostic imaging market is marked by the presence of established and emerging market players such as GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; Canon Medical Systems Corporation; Mindray Medical International; FUJIFILM VisualSonics Inc.; Carestream Health; Hitachi; Samsung Medison Co., Ltd.; PerkinElmer Inc.; Hologic, Inc.; and Varex Imaging among others.

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the Market

Players operating in this market are adopting both organic and inorganic growth strategies such as collaborations, and acquisitions to garner market share. For instance,

- In October 2024, Shimadzu Medical Systems USA, a subsidiary of Shimadzu Corporation Japan, acquired California X-ray Imaging Services, Inc. to enhance its healthcare business expansion in North America

- In October 2023, Carestream Health revealed its collaboration with EXAMION to introduce innovative, Future-Focused Healthcare Imaging Solutions to Germany. Through this alliance, Carestream strives to enhance patient experience, and clinical outcomes, and streamline radiography workflows by delivering diagnostic imaging solutions to healthcare organizations in Germany and other European countries

- In November 2022, Siemens Healthineers inaugurated its Ultrasound manufacturing facility in Košice, Slovakia, marking its first establishment in Europe. The facility boasts an initial production capacity of up to 120 systems per week and will serve as a strategic expansion of the company's manufacturing capabilities for ultrasound products

The diagnostic imaging market continues to evolve with ongoing research, technological innovations, an increasing focus on personalized and precise medical diagnostics and aggressive organic and inorganic growth strategies followed by the players.

Report Scope

| Report Metric | Details |

| Base Year Considered | 2023 |

| Historical Data | 2022 - 2023 |

| Forecast Period | 2024 – 2029 |

| Growth Rate | CAGR of 5-6% |

| Market Drivers |

|

| Key Market Trends |

|

| Segment Scope | Product, Application, End User |

| Regional Scope |

|

| Key Companies Mapped | GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; Canon Medical Systems Corporation; Mindray Medical International; FUJIFILM VisualSonics Inc.; Carestream Health; Hitachi; Samsung Medison Co., Ltd.; PerkinElmer Inc.; Hologic, Inc.; and Varex Imaging among others |

| Report Highlights | Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

Market Segmentation

This report by Medi-Tech Insights provides the size of the global diagnostic imaging market at the regional- and country-level from 2022 to 2029. The report further segments the market based on product, application, and end user.

- Market Size & Forecast (2022-2029), By Product, USD Million

- CT Scanners

- Ultrasound Systems

- X-ray Imaging Systems

- Nuclear Imaging Systems

- MRI Systems

- Mammography Systems

- Market Size & Forecast (2022-2029), By Application, USD Million

- X-ray Imaging Systems

- General Radiography

- Fluoroscopy

- Dentistry

- MRI Systems

- Brain and Neurological MRI

- Spine and Musculoskeletal MRI

- Pelvis and Abdominal MRI

- Vascular MRI

- Breast MRI

- Cardiac MRI

- CT Scanners

- Ultrasound Systems

- Radiology/General Imaging

- Cardiology

- Gynecology

- Urology

- Other Applications

- Nuclear Imaging Systems

- Cardiology

- Neurology

- Oncology

- Other Applications

- Mammography Systems

- X-ray Imaging Systems

- Market Size & Forecast (2022-2029), By End User, USD Million

- Hospitals

- Diagnostic Centers

- Academic and Research Institutes

- Others

- Market Size & Forecast (2022-2029), By Region, USD Million

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

- North America

Key Strategic Questions Addressed

- What is the market size & forecast of the global diagnostic imaging market?

- What are historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the global diagnostic imaging market?

- What are the key trends defining the market?

- What are the major factors impacting the market?

- What are the opportunities prevailing in the market?

- Which region has the highest share in the global market?

- Which region is expected to witness the highest growth rate in the next 5 years?

- Who are the major players operating in the market?

- What are the key strategies adopted by players?

- Introduction

- Introduction

- Market Scope

- Market Definition

- Segments Covered

- Regional Segmentation

- Research Timeframe

- Currency Considered

- Study Limitations

- Stakeholders

- List of Abbreviations

- Key Conferences and Events (2023-2024)

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Bottom-Up Approach

- Top-Down Approach

- Market Forecasting

- Executive Summary

- Diagnostic Imaging Market Snapshot (2023-2029)

- Segment Overview

- Regional Snapshot

- Competitive Insights

- Market Overview

- Market Dynamics

- Drivers

- Rising prevalence of chronic diseases

- Growing geriatric population

- Increasing awareness about early diagnosis and screening programs

- Advancements in imaging technologies

- Increasing adoption of minimally invasive procedures

- Restraints

- High cost of imaging equipment

- Strict regulatory requirements and compliance

- Shortage of skilled radiologists in some regions

- Opportunities

- Growing demand for combined modalities like PET-CT and PET-MRI

- Increasing healthcare access and investments in emerging markets

- Key Market Trends

- Increasing adoption of portable and point-of-care imaging devices

- AI integration in imaging technologies

- Unmet Market Needs

- Industry Speaks

- Regulatory Analysis

- Drivers

- Market Dynamics

- Global Diagnostic Imaging Market Size & Forecast (2022-2029), By Product, USD Million

- Introduction

- CT Scanners

- Ultrasound Systems

- X-ray Imaging Systems

- Nuclear Imaging Systems

- MRI Systems

- Mammography Systems

- Global Diagnostic Imaging Market Size & Forecast (2022-2029), By Application, USD Million

- Introduction

- X-ray Imaging Systems

- General Radiography

- Fluoroscopy

- Dentistry

- MRI Systems

- Brain and Neurological MRI

- Spine and Musculoskeletal MRI

- Pelvis and Abdominal MRI

- Vascular MRI

- Breast MRI

- Cardiac MRI

- CT Scanners

- Ultrasound Systems

- Radiology/General Imaging

- Cardiology

- Gynaecology

- Urology

- Other Applications

- Nuclear Imaging Systems

- Cardiology

- Neurology

- Oncology

- Other Applications

- Mammography Systems

- Global Diagnostic Imaging Market Size & Forecast (2022-2029), By End User, USD Million

- Introduction

- Hospitals

- Diagnostic Centers

- Academic and Research Institutes

- Others

- Global Diagnostic Imaging Market Size & Forecast (2022-2029), By Region, USD Million

- Introduction

- North America Diagnostic Imaging Market Size & Forecast (2022-2029), By Country, USD Million

- US

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Canada

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- US

- Europe Diagnostic Imaging Market Size & Forecast (2022-2029), By Country, USD Million

- UK

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Germany

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- France

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Italy

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Spain

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Rest of Europe

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- UK

- Asia Pacific (APAC) Diagnostic Imaging Market Size & Forecast (2022-2029), By Country, USD Million

- China

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Japan

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- India

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Rest of Asia Pacific

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- China

- Latin America (LATAM) Diagnostic Imaging Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Middle East & Africa (MEA) Diagnostic Imaging Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Key Player Comparison

- Segment-wise Player Mapping

- Market Share Analysis (2023)

- Company Categorization Matrix

- Dominants/Leaders

- New Entrants

- Emerging Players

- Innovative Players

- Key Strategies Assessment, By Player (2022-2024)

- New Product Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Company Profiles*

(Business Overview, Financial Performance**, Products Offered, Recent Developments)

- GE Healthcare

- Koninklijke Philips N.V.

- Siemens Healthineers

- Canon Medical Systems Corporation

- Mindray Medical International

- FUJIFILM VisualSonics Inc.

- Carestream Health

- Hitachi

- Samsung Medison Co., Ltd.

- Hologic, Inc.

- Other Prominent Players

Note: *Indicative list

**For listed companies

The study has been compiled based on extensive primary and secondary research.

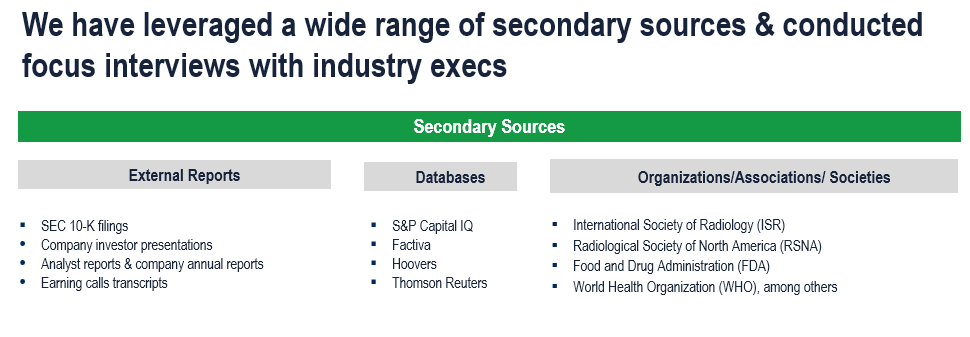

Secondary Research (Indicative List)

Primary Research

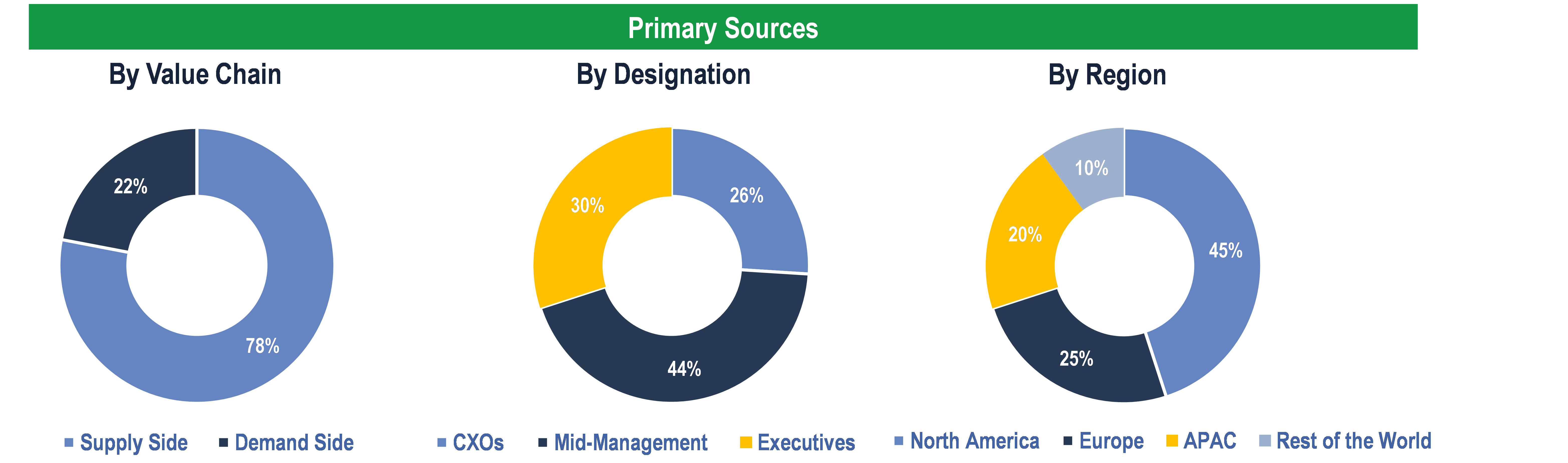

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, R&D Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Hospitals, Specialty Clinics, Academic and Research Institutes and Others

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down & Bottom-Up Approaches’ were used to derive market size estimates and forecasts

Data Triangulation

Research findings derived through secondary sources & internal analysis was validated with Primary Interviews, Internal Knowledge Repository and Company’s Sales Data