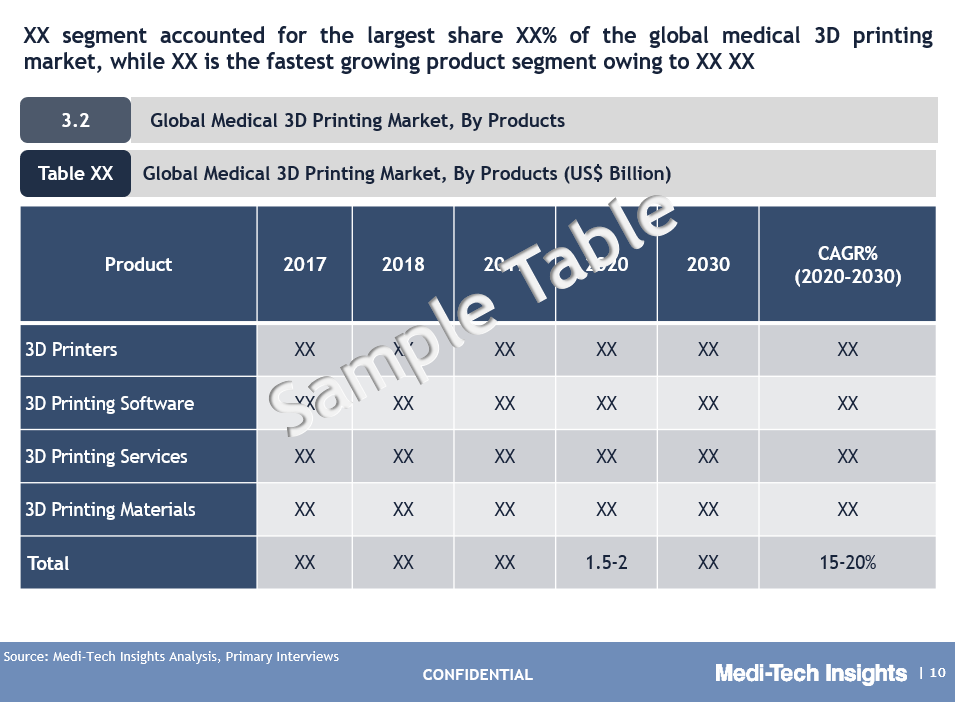

Medical 3D Printing Market to an Impressive 15-20% Growth from Forecast 2023 to 2027

Global medical 3D printing market pegged at $1.5-2 billion (2020) growing at lucrative rate of 15-20%. The market growth would be driven by patient specific 3D printed implants and growing adoption of POC printing. To learn more about the research, fill out a quick inquiry for a sample report.

The rise in number of scientific evidence supporting the financial and clinical benefits of 3D printing technology has paved the way for a rapid adoption of medical device 3D printing.

Medical device 3D printing is poised to revolutionize the healthcare industry. It is being increasingly used in medical and dental market for prototyping; producing anatomic models for surgical planning; making surgical guides; and manufacture of implants, instruments and prosthetics. Growing preference for 3D printing over traditional machining methods owing to advantages such as less wastage of materials, cost effectiveness for smaller batches/more complex shapes, and better clinical outcomes is driving the market growth. Moreover, the rising aging population, steady growth in orthopaedic and dental procedures, and improving reimbursement scenario are other important factors driving the market growth.

Medi-Tech Insights’ research on 3D printing analyses the market with respect to product, application, technology, end user, and geography

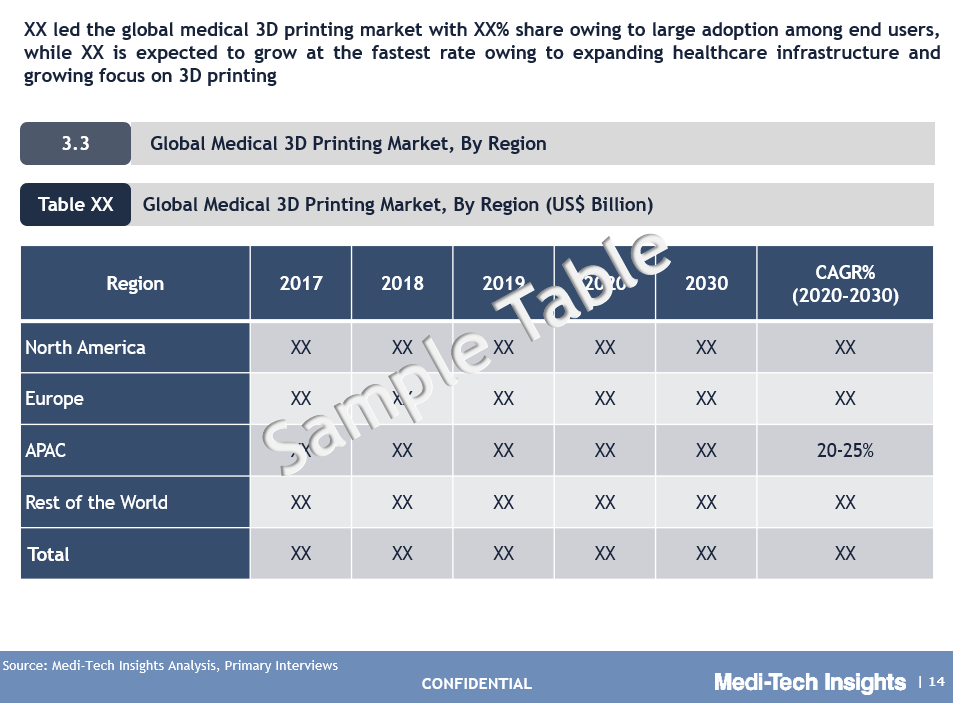

Based on our research & interviews with industry experts, it is evident that surgical planning & patient specific implants are the major applications today while US is largest geographic market with China emerging very quickly as a large market.

Geographic Snapshot: Medical 3D Printing Market

Comprehensive regional assessment of the global medical 3D printing market covering U.S., Europe (Germany, Italy, France, Spain, UK, and Rest of Europe), Asia-Pacific (India, China, Japan, Australia, New Zealand, Singapore and Rest of Asia-Pacific) and Rest of the World (Latin America, Middle-East & Africa) suggests that U.S. is likely to continue its dominance in the next 10 years. Rising prevalence of orthopaedic disorders, favourable government policies for adoption of novel technologies, and growing number of point of care facilities is set to catapult the U.S. medical 3D printing market. The number of U.S. hospitals with a centralized 3D printing facility has increased substantially, from just three in 2010 to over 100 in 2019. As the 3D technology develops and reimbursement scenario further improves, this point-of-care model may become even more widespread.

Improving reimbursement scenario would drive the adoption

Governments (especially in developed countries) are taking steps to incentivise use of 3D printing in hospitals. For instance, in 2019, in the U.S., Category III CPT billing codes were introduced for 3D printing. These codes were introduced for anatomic models and for 3D-printed anatomic guides. In the first phase, the codes would not guarantee the payment. However, it will serve to collect necessary data to decide on future policies for reimbursement.

“Orthopaedic and CMF surgeons are increasingly adopting surgical planning and associated tools made using 3D printing, as they understand the positive impact of patient specific solutions/products on clinical outcomes”- CEO, Leading 3D Printing Company

Leading players are focusing on potential areas such as regenerative medicine

3D printing is not only gaining ground in manufacturing medical devices, but also entering into the realm of regenerative medicine. There is a shortage of organs, as the population is living longer. Since 2013, the number of patients requiring an organ has doubled, while the actual number of available donor organs has barely moved (Source: HRSA). Citing the growth potential, key players are adopting strategies to enter the market. In April 2017, 3D Systems, Inc. collaborated with United Therapeutics and its organ manufacturing and transplantation-focused subsidiary, Lung Biotechnology PBC. The agreement focuses on development of 3D printing systems for solid-organ scaffolds. They made significant progress related to platform solution for lung scaffolds and driven by this advancement, in January 2021 they took decision to further expand their development efforts significantly.

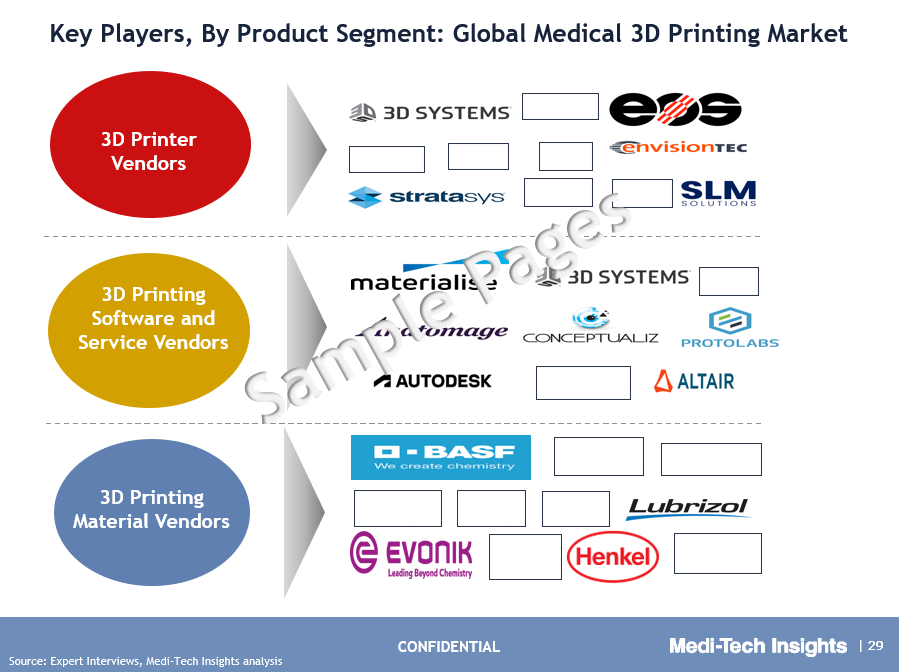

Medical device 3D printing offers high growth opportunities for leading as well as new players

In terms of competitive landscape, 3D Systems, Stratasys 3D, Materialise Medical, EOS 3D, Arcam, SLM Solutions, and Concept Laser are some of the leading players in the 3D printing market. On the other hand, Tiertime 3D, Orchestrate 3D, T&R BioFab, Anatomics, LIMA, PVA Med, and Biomodel are some of the emerging players in 3D printing market. The report provides detailed analysis of key players with respect to business overview, financial overview, key strategies adopted, and developments.

Medi-Tech Insights’ research comprehensively analyses key areas such as investment trends in medical device 3D printing and pricing intelligence

Benefits aside, 3D printing’s high initial cost and lack of reimbursement have been restraining the adoption to some extent. Commercial printers usually range from $10,000 to $500,000. Further, there is cost associated with fixed annual fees for segmentation software, lab space, resource cost and so on. Drawn by the huge promise to disrupt healthcare, many VCs/Investors have backed companies in 3D printing. For example Lightforce Orthodontics, which enables orthodontists to use 3D printing to make custom braces for patients, raised $14 million in Series B funding in September 2020. Similarly, Aspect Biosystems, a developer of microfluidic 3D bioprinting for human tissue-based therapeutics, raised $20 million in a Series A round in January 2020.

Medical 3D Printing Market Scope

|

Report Metric |

Details |

|

Market Size (2020) |

$1.5-2 billion |

|

Market Growth Rate |

15-20% |

|

Drivers of Market Growth |

|

|

Key Applications |

|

|

Geographic Analysis |

|

|

Key Players |

|

|

Investment Trends |

|

Key Strategic Questions Addressed

- What is the market size & forecast of medical 3D printing market?

- What are historical, present, and forecasted market shares and growth rates of various segments and sub-segments of medical 3D printing market?

- How is the funding landscape of medical 3D printing market?

- What are the key trends defining the market?

- What are the major factors impacting the market?

- What are the opportunities prevailing in the market?

- What are the key applications of medical 3D printing market?

- Which region has the highest share in the global market? Which region is expected to witness highest growth rate in the next 5 years?

- Who are the key end-users of the market?

- Who are the major players operating in the market? What is their market share?

- Who are the new players entering the market?

- What are the key strategies adopted by players?

The study has been compiled based on the extensive primary and secondary research.

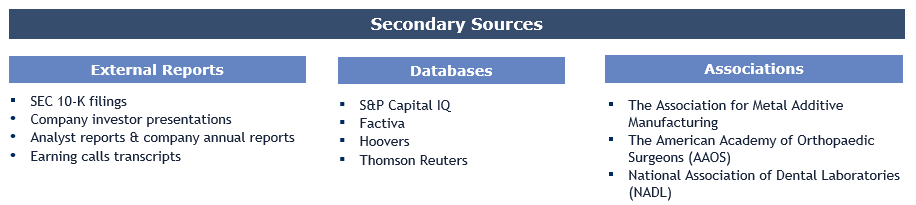

Secondary Research (Indicative List)

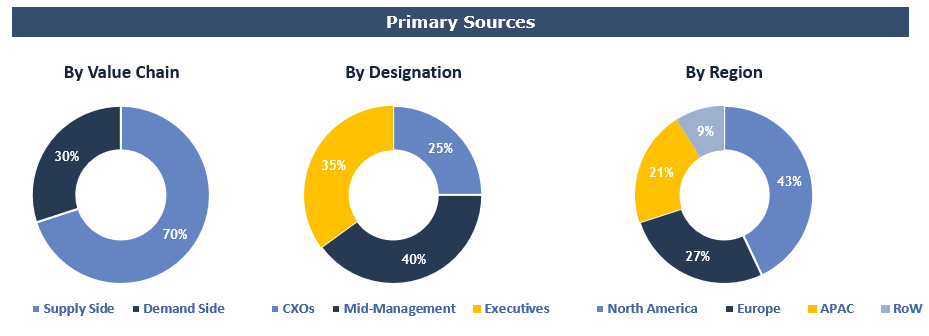

Primary Research

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, R&D Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders in hospitals and clinics, medical and dental device manufacturers, pharma/biotech companies, academic & research Institutes and other end users

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts

Data Triangulation

Research findings derived through secondary sources & internal analysis was validated with Primary Interviews, Internal Knowledge Repository and Company’s Sales Data