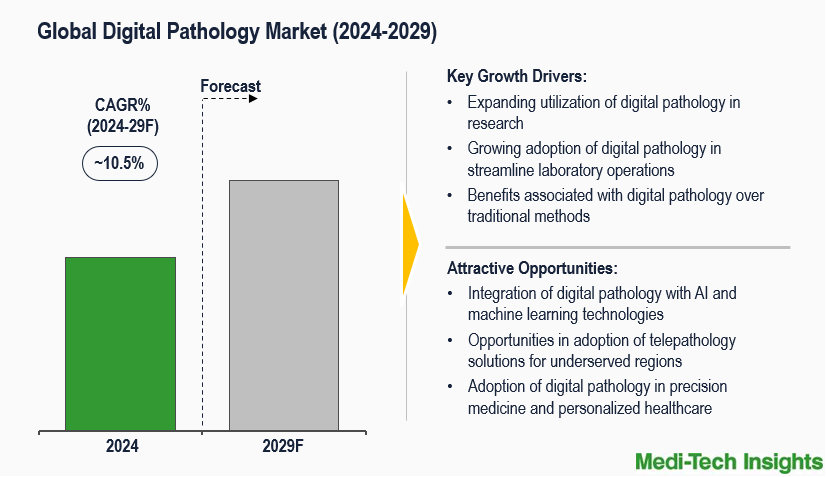

Digital Pathology Market Size Anticipates a Remarkable 10.5% Growth Rate by 2029

The Digital Pathology Market is expected to witness a growth rate of ~10.5% by 2029. The key factors driving the market are the rising incidence of chronic illnesses like cancer, diabetes, and cardiovascular conditions, the expanding utilization of digital pathology in research, the growing integration of digital pathology in drug discovery and precision medicine initiatives, the escalating acceptance of telepathology, and the adoption of digital pathology to streamline laboratory operations and enhance efficiency. To learn more about the research report, download a sample report.

Digital Pathology encompasses the capturing, organization, dissemination, and analysis of pathology data, including slides and information, within a digital framework. Digital slides are generated by scanning glass slides using specialized devices, producing high-resolution digital images that can be accessed and viewed on computer screens or mobile devices.

Rising Adoption of Artificial Intelligence in Digital Pathology Drives the Market

Artificial Intelligence (AI) is revolutionizing pathology by augmenting traditional diagnostic methods, enhancing accuracy, and improving patient outcomes. This technology encompasses machine learning algorithms and deep learning techniques and offers significant potential in various aspects of pathology, including diagnosis, prognosis, and treatment planning. One of the primary applications of AI in pathology is in the interpretation of histopathology slides. Histopathology involves the microscopic examination of tissue samples to diagnose diseases such as cancer. Moreover, AI enables the integration of multiple data sources, such as genomic data and clinical information, to provide comprehensive insights into disease pathology. By correlating histopathological findings with genetic mutations and clinical outcomes, AI algorithms can assist in personalized treatment planning, allowing targeted therapies tailored to individual patients. For instance,

- In February 2024, Paige announced a significant expansion of its AppLab marketplace, with the addition of six new digital pathology and AI providers. New applications will be added to the AppLab to provide support for pathology labs worldwide in building deeply integrated and customized AI-enabled workflows

- In August 2023, PathAI announced the commercial launch of its AISight digital pathology image management system (IMS) for anatomic pathology laboratories. The launch comes at a time when the pathology space is increasingly transitioning to digitally-enabled reads and recognizing the utility of AI and machine learning to enhance quality control, standardize diagnoses, and quantify biomarkers

Growing Integration of Digital Pathology in Precision Medicine Accelerates Market Growth

Digital pathology plays a pivotal role in advancing precision medicine approaches by facilitating thorough examination of tissue samples, biomarkers, and genetic information. The integration of digital pathology with electronic health records (EHRs), genomic profiling, and clinical decision support systems offers promising prospects for tailoring treatment strategies according to individual patients' molecular profiles and disease characteristics. The momentum of precision medicine further propels the adoption of digital pathology.

To learn more about this report, download the PDF brochure

Rapid Digitalization in Pathology Workflow Propels Market Growth

The increasing digitalization of pathology workflows represents a transformative shift in how pathology laboratories operate, leveraging technology to streamline processes, enhance efficiency, and improve patient care. Digital workflow enables the transmission of images to pathologists, both the speed of diagnosis and the quality of reviews increase. There is access to an expansive pool of specialist pathologists. Interoperability across EMRs enhances continuity of care. DP provides more power to clinicians, who can show pathology images and discuss findings better with patients, as well as review images easily at tumor boards and meetings. It also offers increased productivity through improved workflow distribution, information management, and integration of data. Operational costs are reduced, because slides and associated paperwork do not have to be moved about, and also delays in diagnosis can be eliminated. In addition, the technology helps compensate for a shrinking pool of pathologists in the workforce because the workload can be distributed remotely to where pathologists are and help enable them to work more efficiently.

Key Constraints/ Challenges

Numerous obstacles hinder the extensive adoption of digital pathology, encompassing the substantial upfront investment needed to establish infrastructure such as slide scanners, image analysis software, and data management systems. Additional challenges entail technological constraints, regulatory hurdles, recurring maintenance expenses, implementation complexities, and reluctance among pathologists to embrace new technologies.

North America Expected to Continue to Hold a Major Share in the Digital Pathology Market

From a geographical perspective, North America holds the major market share of the Digital Pathology Market. This can be mainly attributed to advancement in whole slide imaging (WSI) technology, the rising prevalence of chronic diseases, the growing integration of digital pathology systems into existing laboratory workflows, and the expanding utilization of digital pathology in research, computer-aided diagnosis (CAD), and personalized medicine in the region. However, the Asia-Pacific region is expected to witness strong growth in the coming years due to the increasing adoption of digital pathology solutions, rising healthcare expenditure, and growing awareness about the benefits of digital pathology in the region.

Competitive Landscape

Some of the key players operating in the market are 3DHISTECH Ltd., Apollo Enterprise Imaging Corp., Paige, Corista, Danaher, Glencoe Software, Inc, Techcyte, Hamamatsu Photonics Inc., Huron Digital Pathology, Indica Labs, KONFOONG BIOTECH INTERNATIONAL CO., LTD, Koninklijke Philips, Leica Biosystems Nussloch GmbH, Mikroscan Technologies, Objective Pathology Services, Olympus Corporation, OptraScan, Proscia Inc., Roche Ltd., Sectra AB, Visiopharm A/S, among others.

Get a sample report for competitive landscape analysis

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the Market

Players operating in this market are adopting organic and inorganic growth strategies such as launching new products, acquiring related firms, and entering into mergers & collaborations to garner higher market share. For instance,

- In February 2024, Proscia, a leading digital and computational pathology solutions provider, announced they had received 510(k) clearance from the United States (U.S.) Food and Drug Administration (FDA) for its Concentriq AP-Dx. The digital pathology solution was cleared for primary diagnosis

- In March 2023, Paige, a global leader in end-to-end digital pathology solutions and clinical AI applications, and Leica Biosystems, a cancer diagnostics company and global leader in workflow solutions, announced an expanded partnership to enhance the use of digital pathology workflows at hospitals and laboratories around the world

The digital pathology market is a rapidly evolving industry that is expected to gain further momentum in the coming years due to the advancements in imaging technology and artificial intelligence, adoption of digital pathology is revolutionizing pathology education and training, and aggressive organic and inorganic growth strategies followed by the players.

Key Strategic Questions Addressed

-

What is the market size and forecast for the Digital Pathology Market?

-

What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the Digital Pathology Market?

-

What are the major growth drivers, restraints/challenges impacting the Digital Pathology market?

-

What are the opportunities prevailing in the market?

-

What is the investment landscape?

-

Which region has the highest share in the market? Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market? What is the competitive positioning of key players?

-

Who are the new players entering the market?

-

What are the key strategies adopted by players?

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Market Forecasting

- Executive Summary

- Market Overview

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Industry Speaks

- Market Dynamics

- Digital Pathology Market - Size & Forecast (2022-2029), By Product

- Scanners

- Software

- Storage Systems

- Other Products

- Digital Pathology Market- Size & Forecast - Size & Forecast (2022-2029), By Application

- Drug Discovery

- Disease Diagnosis

- Education & Training

- Digital Pathology Market- Size & Forecast - Size & Forecast (2022-2029), By End-Users

- Academic & Research Institutes

- Hospitals & Reference Laboratories

- Pharmaceutical & Biotechnology Companies

- Digital Pathology Market- Size & Forecast - Size & Forecast (2022-2029), By Region

- North America (U.S. & Canada)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, Rest of Asia Pacific)

- Rest of the World (Latin America, Middle East & Africa)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Competitive Positioning of Key Players (2023)

- Offerings Assessment, By Players

- Key Strategies Assessment, By Player (2021-2023)

- New Service Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Other Developments

- Key Players and their Competitive Positioning

- Key Companies Scanned (Indicative List)

- Apollo Enterprise Imaging Corp.

- Paige

- Corista

- Danaher

- Glencoe Software Inc.

- Hamamatsu Photonics Inc.

- Huron Digital Pathology

- Indica Labs

- Koninklijke Philips

- Leica Biosystems Nussloch GmbH

- Olympus Corporation

- OptraScan

- Proscia Inc.

- Roche Ltd.

- Techcyte

- Other Prominent Players

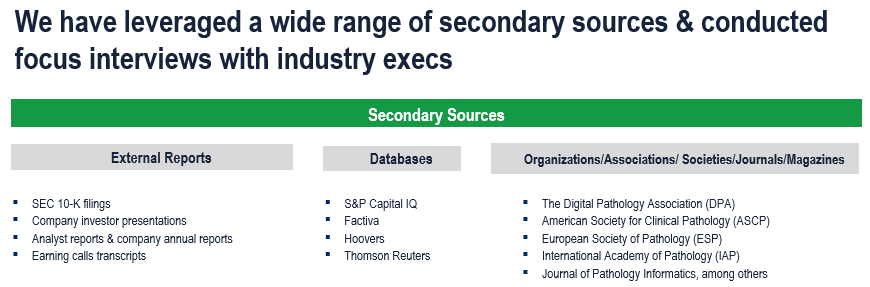

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

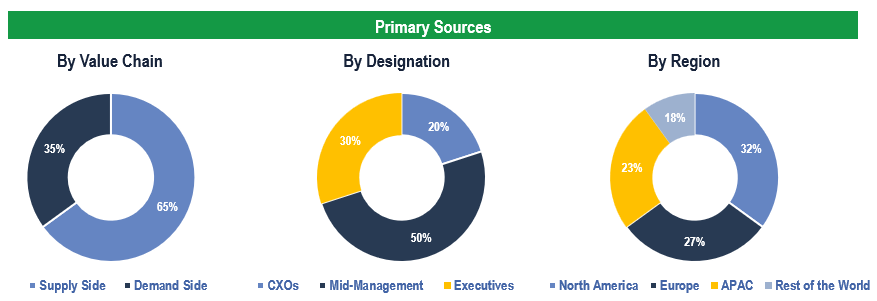

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, Business Development Managers, Consultants

- Demand Side Stakeholders: Hospitals & Reference Laboratories, Academic & Research Institutes, and Pharmaceutical & Biotechnology Companies, Among Others

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & and internal analysis were validated with Primary Interviews, Internal Knowledge Repository, and Company Sales Data.