DNA Polymerase Market Size, Share, Industry Analysis, Demand and Forecast 2024 to 2029

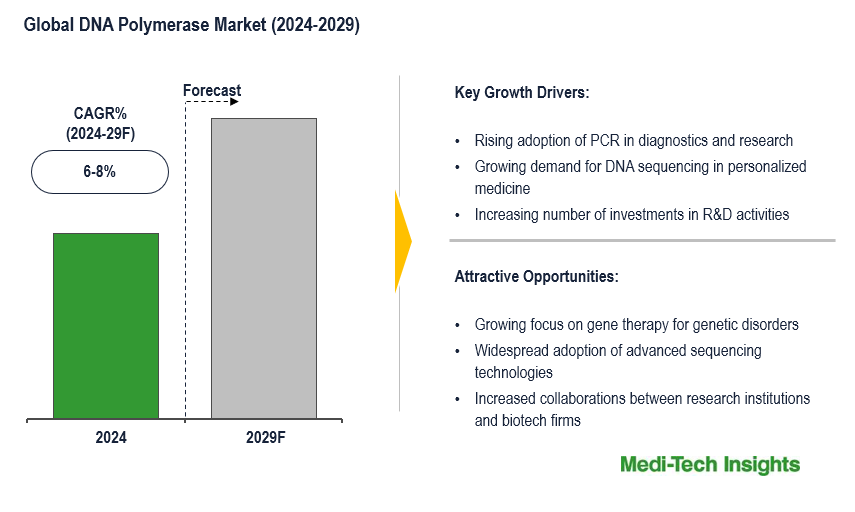

The DNA polymerase market is poised for steady growth, with a projected CAGR of 6-8% over the forecast period, driven by advancements in molecular biology, genomics, and therapeutics. Key factors propelling this growth include the rising use of PCR in diagnostics, the increasing demand for DNA sequencing in personalized medicine, advancements in forensic science, and growing investments in biotechnology research. Additionally, the adoption of synthetic biology and gene-editing technologies like CRISPR further boosts the market. However, the high costs of advanced DNA polymerases, stringent regulatory requirements, and the complexity of genetic technologies may restrain market expansion. To learn more about the research report, download a sample report.

DNA polymerase is an enzyme essential for replicating and repairing DNA. It facilitates the synthesis of a new DNA strand by adding nucleotides in sequence based on the existing template strand. This process is critical for accurate DNA replication during cell division. DNA polymerases are pivotal in many molecular biology techniques, such as polymerase chain reaction (PCR) and DNA sequencing. Their significance extends to various fields, including genetic research, clinical diagnostics, and forensic science, making them indispensable in modern biology and medical applications.

To learn more about this report, download the PDF brochure

PCR and Sequencing Technologies: Catalysts for DNA Polymerase Market Expansion

One significant factor driving the expansion of the DNA polymerase market is the increasing use of polymerase chain reaction (PCR) and DNA sequencing technologies in diagnostics and research. PCR has become a foundation tool for amplifying and analyzing DNA in various applications, including detecting infectious diseases, genetic testing, and forensic science. The surge in demand for accurate and rapid diagnostic tools, especially during the COVID-19 pandemic, highlighted the crucial role of PCR in pathogen detection and genetic mutation analysis. PCR allows clinicians to diagnose diseases more precisely and tailor treatments to individual patients, driving the widespread use of DNA polymerase enzymes. Beyond diagnostics, DNA polymerases are essential in gene cloning, molecular fingerprinting, and mutational analysis, expanding their role in both research and clinical settings. This growing reliance on PCR and sequencing in routine diagnostics and research has significantly contributed to the increased demand for DNA polymerases globally.

The Role of High-Fidelity DNA Polymerases in Advancing Genomic Research and Therapeutics

A major advancement shaping the DNA polymerase market is the rise of high-fidelity DNA polymerases, which enhance the accuracy and reduce error rates in DNA replication. These enzymes are increasingly essential in genomic research, where precision is paramount, particularly in applications such as next-generation sequencing (NGS). NGS relies on high-fidelity polymerases to ensure the accurate reading and interpretation of genetic sequences. Furthermore, advancements in gene-editing technologies like CRISPR-Cas9 have expanded the application of DNA polymerases in therapeutic fields. CRISPR requires the precise activity of DNA polymerases for efficient gene modifications, which opens the door for treating genetic disorders. Additionally, the integration of artificial intelligence (AI) into genomics is improving the analysis of large datasets, which in turn enhances the performance of DNA polymerases in various applications. These developments are driving the DNA Polymerase market forward, unlocking new opportunities in both research and clinical applications.

To learn more about this report, download the PDF brochure

Competitive Landscape Analysis

The global DNA polymerase market is marked by the presence of established and emerging market players such as Thermo Fisher Scientific, Inc.; Agilent Technologies; Merck KGaA; Danaher Corporation; QIAGEN; Hoffmann-La Roche Ltd; Bio-Rad Laboratories, Inc.; Takara Bio, Inc.; Illumina Inc. and New England Biolabs among others. Some of the key strategies adopted by market players include product innovation and development, strategic partnerships and collaborations, and geographic expansion.

Report Scope

| Report Scope | Details |

| Base Year Considered | 2023 |

| Historical Data | 2022 - 2023 |

| Forecast Period | 2024 - 2029 |

| Growth Rate | 6-8% |

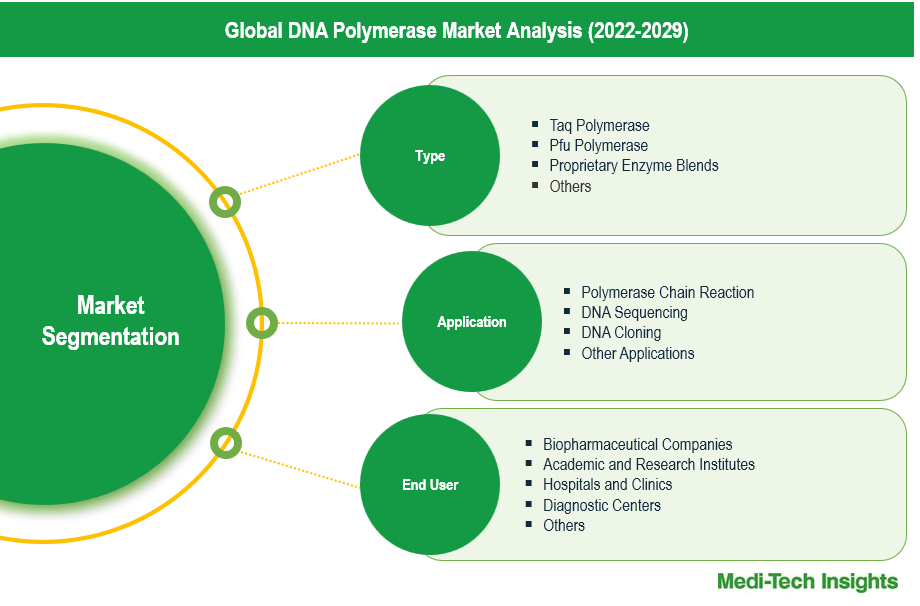

| Segment Scope | Type, Application, End User |

| Regional Scope |

|

| Key Companies Mapped | Thermo Fisher Scientific, Inc.; Agilent Technologies; Merck KGaA; Danaher Corporation; QIAGEN; Hoffmann-La Roche Ltd; Bio-Rad Laboratories, Inc.; Takara Bio, Inc.; Illumina Inc. and New England Biolabs among others |

| Report Highlights | Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

Key Strategic Questions Addressed

-

What is the market size & forecast of the DNA polymerase market?

-

What are historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the DNA polymerase market?

-

What are the key trends defining the market?

-

What are the major factors impacting the market?

-

What are the opportunities prevailing in the market?

-

Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market?

-

What are the key strategies adopted by players?

- Introduction

- Introduction

- Market Scope

- Market Definition

- Segments Covered

- Regional Segmentation

- Research Timeframe

- Currency Considered

- Study Limitations

- Stakeholders

- List of Abbreviations

- Key Conferences and Events (2023-2024)

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Bottom-Up Approach

- Top-Down Approach

- Market Forecasting

- Executive Summary

- DNA Polymerase Market Snapshot (2023-2029)

- Segment Overview

- Regional Snapshot

- Competitive Insights

- Market Overview

- Market Dynamics

- Drivers

- Rising adoption of PCR in diagnostics and research

- Growing demand for DNA sequencing in personalized medicine

- Increasing number of investments in R&D activities

- Advancements in CRISPR and gene-editing technologies

- Expanding applications of DNA polymerases in synthetic biology and gene editing

- Restraints

- High costs of advanced DNA polymerases

- Stringent regulatory frameworks

- Lack of skilled professionals for complex genomic tasks

- Opportunities

- Growing focus on gene therapy for genetic disorders

- Increased collaborations between research institutions and biotech firms

- Key Market Trends

- Development of high-fidelity DNA polymerases for error-free replication

- Integration of AI in genomics for enhanced analysis

- Unmet Market Needs

- Industry Speaks

- Regulatory Analysis

- Drivers

- Market Dynamics

- Global DNA Polymerase Market Size & Forecast (2022-2029), By Type, USD Million

- Introduction

- Taq Polymerase

- Pfu Polymerase

- Proprietary Enzyme Blends

- Others

- Global DNA Polymerase Market Size & Forecast (2022-2029), By Application, USD Million

- Introduction

- Polymerase Chain Reaction

- DNA Sequencing

- DNA Cloning

- Other Applications

- Global DNA Polymerase Market Size & Forecast (2022-2029), By End User, USD Million

- Introduction

- Biopharmaceutical Companies

- Academic and Research Institutes

- Hospitals and Clinics

- Diagnostic Centers

- Others

- Global DNA Polymerase Market Size & Forecast (2022-2029), By Region, USD Million

- Introduction

- North America DNA Polymerase Market Size & Forecast (2022-2029), By Country, USD Million

- US

- Market Size & Forecast, By Type (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Canada

- Market Size & Forecast, By Type (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- US

- Europe DNA Polymerase Market Size & Forecast (2022-2029), By Country, USD Million

- UK

- Market Size & Forecast, By Type (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Germany

- Market Size & Forecast, By Type (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- France

- Market Size & Forecast, By Type (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Italy

- Market Size & Forecast, By Type (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Spain

- Market Size & Forecast, By Type (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Rest of Europe

- Market Size & Forecast, By Type (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- UK

- North America DNA Polymerase Market Size & Forecast (2022-2029), By Country, USD Million

- Introduction

-

-

- Asia Pacific (APAC) DNA Polymerase Market Size & Forecast (2022-2029), By Country, USD Million

- China

- Market Size & Forecast, By Type (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Japan

- Market Size & Forecast, By Type (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- India

- Market Size & Forecast, By Type (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Rest of Asia Pacific

- Market Size & Forecast, By Type (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- China

- Latin America (LATAM) DNA Polymerase Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Type (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Middle East & Africa (MEA) DNA Polymerase Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Type (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Asia Pacific (APAC) DNA Polymerase Market Size & Forecast (2022-2029), By Country, USD Million

-

- Competitive Landscape

- Key Players and their Competitive Positioning

- Key Player Comparison

- Segment-wise Player Mapping

- Market Share Analysis (2023)

- Company Categorization Matrix

- Dominants/Leaders

- New Entrants

- Emerging Players

- Innovative Players

- Key Strategies Assessment, By Player (2022-2024)

- New Product Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Company Profiles*

(Business Overview, Financial Performance**, Products Offered, Recent Developments)

- Thermo Fisher Scientific, Inc.

- Agilent Technologies

- Merck KGaA

- Danaher

- QIAGEN

- Hoffmann-La Roche Ltd

- Bio-Rad Laboratories, Inc.

- Takara Bio, Inc.

- Illumina Inc.

- New England Biolabs

- Other Prominent Players

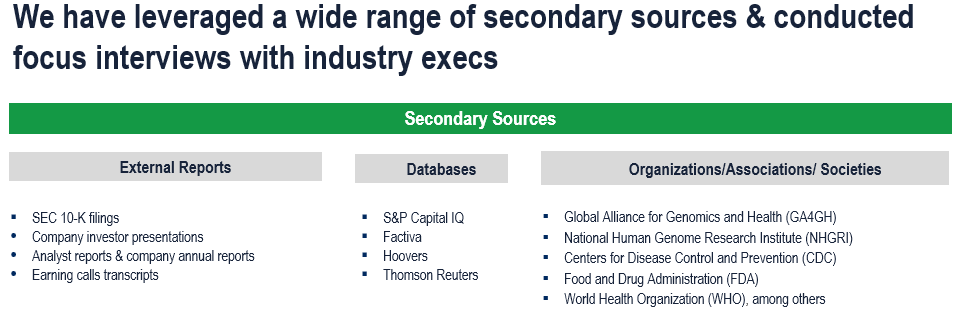

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

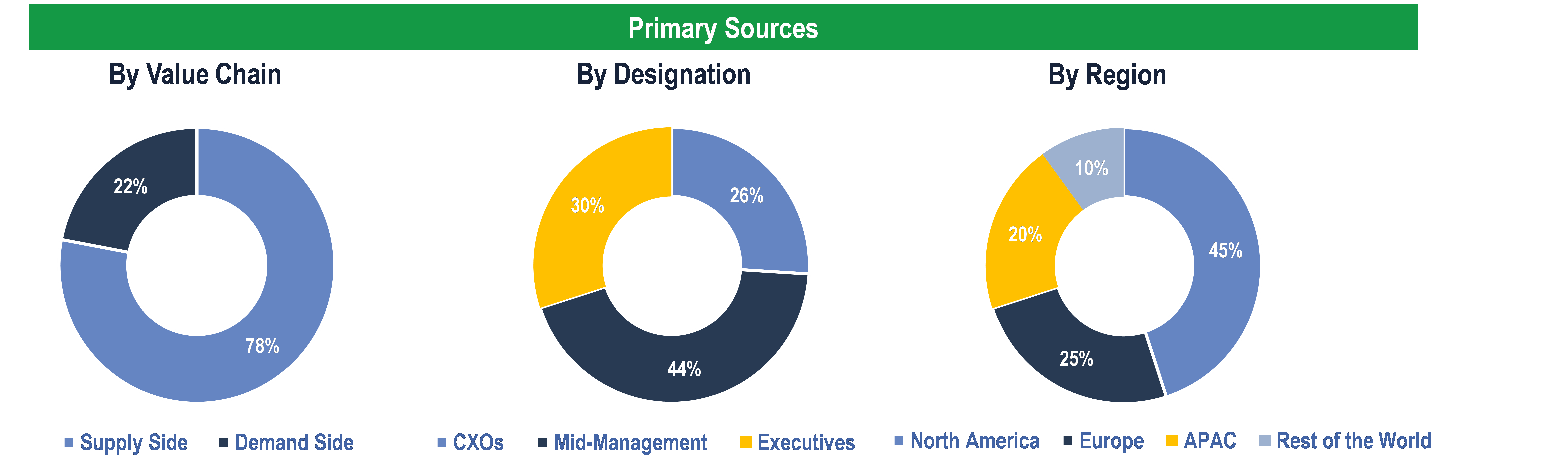

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, R&D Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Biopharmaceutical Companies, Academic and Research Institutes, Hospitals and Clinics, Diagnostic Centers and Others

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down & Bottom-Up Approaches’ were used to derive market size estimates and forecasts

Data Triangulation

Research findings derived through secondary sources & internal analysis was validated with Primary Interviews, Internal Knowledge Repository and Company’s Sales Data