GCC Countries Digital Health Market – Favorable Fundings For Healthcare IT & Digital Evolution In Saudi Arabia & UAE

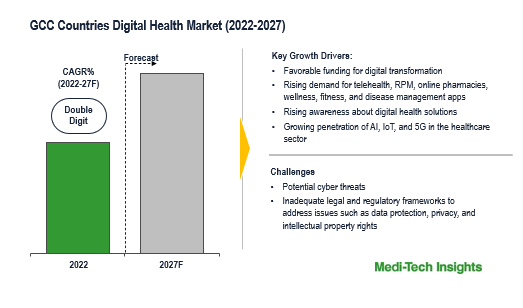

The GCC Countries Digital Health Market is expected to witness a healthy and a double-digit growth by 2027. The key factors driving the growth of the GCC Countries Digital Health Market are favorable fundings for healthcare IT and digital transformation in Saudi Arabia and United Arab Emirates (UAE), rising awareness of digital-health solutions, growing penetration of artificial intelligence, IoT and 5G in the healthcare sector, increasing healthcare service spending towards non-hospital care settings. However, potential cyber threats and inadequate legal and regulatory frameworks to address issues such as data protection, privacy, and intellectual property rights are likely to hamper the market’s growth. To learn more about the research report, fill out a quick inquiry for a sample report.

Digital health refers to the use of digital technologies (information and communications technologies) to manage illnesses and health risks and to promote wellness. The broad scope of digital health includes categories such as Telehealth, mHealth Apps, Connected Medical Devices & Services, Electronic Health Records (EHRs)/Electronic Medical Records (EMRs), Healthcare Analytics, Digital Therapeutics, among others.

Favorable Government Support and Foray of Health Tech Startups Fuels the Growth of GCC Countries Digital Health Market

Saudi Arabia accounts for ~60% of the GCC countries healthcare expenditure and healthcare remains a top priority for the Saudi Arabian government. In Budget 2023, Saudi Arabia plans to invest $50.4 billion (SR189 billion) in Health and Social Development. A major chunk of this budget is expected to be directed toward digital health initiatives to enhance accessibility, efficiency, and transparency within the healthcare system.

The Saudi government is focusing more on preventive health services and intends to digitalize 70% of patient activities by 2030 in order to reduce its dependency on hospital care.

In an endeavor to empower healthcare and artificial intelligence (AI) in Saudi Arabia and other regions, in May 2023, King Faisal Specialist Hospital and Research Centre (KFSH&RC) introduced the Strategic Partner in Innovation & Excellence (SPInE) initiative. The initiative aspires to establish an open, interoperable platform that gathers healthcare data, tools, and algorithms. It is likely to advance the applications of AI in diagnostic imaging, genetics, preventive care, and population health and promote collaboration between healthcare specialists, researchers, and technology experts.

The foray of several health tech startups such as Cura Healthcare, Nala Health (Acquired by Integrative Health), Altibbi, Ynmodata, Labayh, among others in Saudi Arabia and UAE is also fueling the digital health market in the region. Digital tools such as artificial intelligence, the Internet of Things (IoT), and big data analytics are increasingly being integrated into healthcare services to predict, prevent and manage diseases more effectively.

The UAE is also aggressively implementing electronic health records. It maintains a comprehensive, integrated, and paperless health record “Wareed” that minimizes medication errors and hospital stays, which was further enhanced with the introduction of the new service ‘ClinicalKey‘. The country is negotiating discussions with private database providers such as Cerner Corporation, Epic Systems, InterSystems to unify and create an integrated medical record with all public and private information linked. The UAE government is also actively supporting telemedicine and has introduced several telemedicine facilities and has collaborated with several private healthcare companies. The Telecommunications Regulatory Authority (TRA) of UAE has also given its green signal to several companies to offer telemedicine solutions in the country.

As a part of the Public-Private Partnership (PPP) Model, GE Healthcare, the Ministry of Health and Prevention, and Abu Dhabi International Medical Services have collaborated to form ‘Unison’ – UAE’s first public sector teleradiology capability to bring about instrumental changes in the UAE healthcare system.

The Ministry of Health and Prevention in the United Arab Emirates (UAE) plans to launch a comprehensive “Smart Digital Health” regulatory framework by the end of the year 2023, which will require all healthcare providers in the country to offer at least one form of remote service. These include consulting, prescribing medications, monitoring patients, or performing robotic surgeries.

Fill out the "Quick Inquiry Form" to request a sample copy

Surge in GCC Countries Digital Health Market Post Covid-19 Pandemic

Due to strict government regulations on social distancing during the COVID-19 pandemic, GCC countries witnessed a dramatic increase in the use of virtual care solutions, such as online doctor consultations, e-prescriptions, online pharmacies, remote patient monitoring (RPM), among others which is expected to be the new normal in the Arab world. The COVID-19 pandemic has also created a fertile environment for digital health startups. The region witnessed the emergence of several health tech startups during post Covid-19 pandemic.

“Post Covid-19 Pandemic in order to enhance patient experiences and improve the quality of care, the adoption of digital health increased manifolds in key markets such as Saudi Arabia. The growing prominence of Saudi-based companies such as Nala Health (Acquired by Integrative Health) and Cura Healthcare that offer instant consultations to tailored digital care programs are key examples. Also to eliminate the need for physical hospital visits, Saudi Arabia’s Ministry of Health(MoH) has launched apps like Mawid, Tabaud, and Seha, which provide virtual consultations.”-Partner, UAE-based Venture Capital Firm

Favorable Funding Environment Fuels the Growth of the GCC Countries Digital Health Market

In recent years, the GCC region has witnessed an increase in funding for digital health startups which in turn is expected to bolster the GCC Countries Digital Health Market.

For instance,

- In June 2022, WEMA Health, a digital health startup, launched its services in the UAE after raising $3.50 million in a seed funding round led by Dawn Health, Europe’s digital health company. The firm provide a virtual obesity programme to help its members lose up to 20% of their body weight by deploying in-house experts

- In March 2022, The Middle East’s largest AI-based digital health platform, Altibbi raised $44 million in Series B funding. The funding was led by Foundation Holdings, Hikma Ventures, and existing investors Global Ventures and DASH Ventures. The company plans to use the funds to expand the platform’s offering into online pharmacy and diagnostics collection. It also aims to increase its investments in machine learning to support doctors in providing precise diagnoses, referrals, and prescriptions.

Competitive Landscape Analysis: GCC Countries Digital Health Market

Some of the key players operating in the GCC Countries digital health market are listed below:-

- 3M Health Information Systems

- GE Healthcare

- Philips Healthcare

- InterSystems

- Cerner Corporation

- Epic Systems

- Altibbi

- Cura Healthcare

- Integrative Health (Acquired Nala Health)

- Ynmodata

- Labayh

- AlemHealth

- Okadoc

- Vezeeta

- GluCare.Health, among others.

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the GCC Countries Digital Health Market

Leading players operating in the GCC Countries digital health market are adopting both organic and inorganic growth strategies such as launching new services and entering into collaborations to garner a higher market share in the GCC Countries digital health market.

For instance,

- In March 2023, King Faisal Specialist Hospital and Research Centre (KFSH&RC) inked a non-binding Memorandum of Understanding (MoU) with Oracle to accelerate the application of electronic medical records technology and improve digital transformation in the Saudi healthcare sector.

- In November 2022, Altibbi, the Middle East’s largest digital health platform, launched a new men’s health plan. The New ‘Weqaya’ subscription plan raises awareness of early checkups, prevention and serves individual and family primary care needs.

The GCC Countries Digital Health Market is expected to gain a further momentum in the coming years with a growing digitalized healthcare environment, rising demand for telehealth, virtual visits, mHealth and remote patient monitoring (RPM), online pharmacies, online fitness classes & diet-management apps, condition-management & mental well-being apps, growing adoption of wearable medical devices, investments in the healthcare-IT sector, increasing product developments by key market players, and aggressive organic and inorganic growth strategies followed by the leading players.

Key Strategic Questions Addressed in this Research Report

- What is the market size & forecast for the GCC Countries Digital Health Market?

- What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the GCC Countries Digital Health Market?

- How has Covid-19 impacted the GCC Countries Digital Health Market?

- What are the major growth drivers, restraints/challenges impacting the GCC Countries Digital Health Market?

- What are the opportunities prevailing in the GCC Countries Digital Health Market?

- What is the investment landscape of GCC Countries Digital Health Market?

- Which region has the highest share in the market? Which region is expected to witness the highest growth rate in the next 5 years?

- Who are the major players operating in the market? What is the competitive positioning of key players?

- Who are the new players entering the GCC Countries Digital Health market?

- What are the key strategies adopted by players operating in GCC Countries Digital Health Market?

1. Research Methodology

1.1. Secondary Research

1.2. Primary Research

1.3. Market Estimation

1.4. Market Forecasting

2. Executive Summary

3. Market Overview

3.1. Market Dynamics

3.1.1. Drivers

3.1.2. Restraints

3.1.3. Opportunities

3.2. Industry Speaks

4. Investment Landscape Assessment

5. Snapshot: Most Funded Health Tech Startups

6. GCC Countries Digital Health Market - Size & Forecast (2019-2027), By Product

6.1. Telehealth

6.2. mHealth Apps, Connected Medical Devices & Services

6.3. Electronic Health Records (EHRs)/Electronic Medical Records (EMRs)

6.4. Healthcare Analytics

6.5. Digital Therapeutics

6.6. Others

7. GCC Countries Digital Health Market - Size & Forecast (2019-2027), By Region

7.1. Saudi Arabia

7.2. United Arab Emirates (UAE)

7.3. Kuwait

7.4. Other GCC Countries (Qatar, Bahrain, and Oman)

8. Competitive Landscape

8.1. Key Players and their Competitive Positioning

8.1.1. Competitive Positioning of Key Players (2022)

8.1.2. Offerings Assessment, By Players

8.2. Key Strategies Assessment, By Player (2021-2023)

8.2.1. New Product & Service Launches

8.2.2. Partnerships, Agreements, & Collaborations

8.2.3. Mergers & Acquisitions

8.2.4. Geographic Expansion

9. Key Companies Scanned (Indicative List)

9.1. 3M Health Information Systems

9.2. GE Healthcare

9.3. Philips Healthcare

9.4. InterSystems

9.5. Cerner Corporation

9.6. Epic Systems

9.7. Altibbi

9.8. Cura Healthcare

9.9. Integrative Health (Acquired Nala Health)

9.10. Ynmodata

9.11. Labayh

9.12. AlemHealth

9.13. Okadoc

9.14. Vezeeta

9.15. GluCare.Health

9.16. Other Key Players

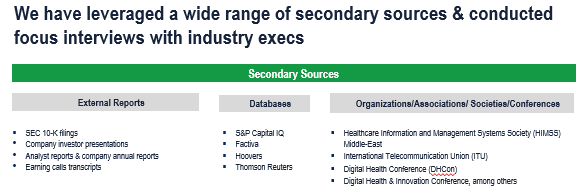

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

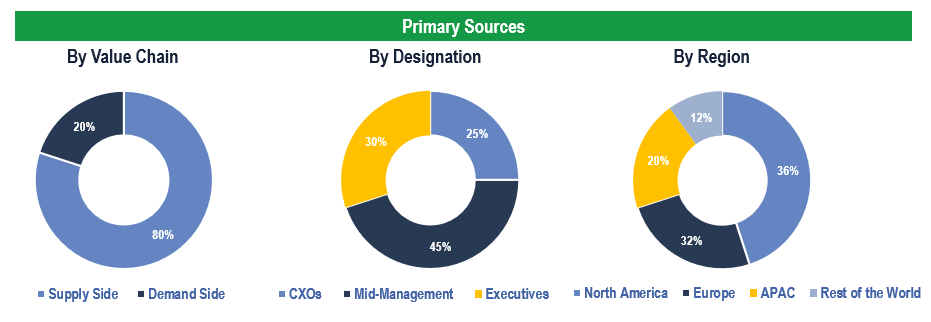

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, R&D Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders in Providers, Payers and Other End Users.

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis were validated with Primary Interviews, Internal Knowledge Repository, and Company Sales Data.