Hearing Aids Market – Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2024 to 2029

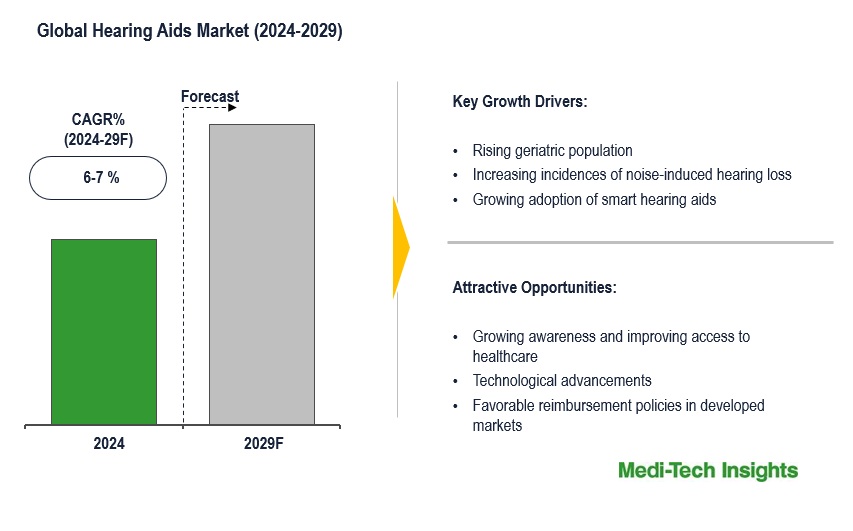

The Global Hearing Aids Market is expected to witness a growth rate of 6-7 % in the next five years. The rising geriatric population, technological advancements, increasing adoption of smart hearing aids, rising incidence of noise-induced hearing loss, favourable reimbursement in developed markets, growing awareness, and improving access to healthcare in emerging markets are some of the key factors driving the hearing aids market growth. However, a shortage of trained health personnel, educational facilities, and necessary data to address the needs of those living with hearing problems is likely to impact the market’s growth. To learn more about the research report, download a sample report.

Hearing loss is the reduction in one’s ability to hear certain sounds. According to the World Health Organization (WHO), about 15% of the world’s population is affected by hearing loss. Over 5% of the world’s population (~466 million people) has disabling hearing loss and this number is expected to be over 900 million by 2050 people.

Underserved Low- and Middle-Income Countries Offer Ample Growth Opportunities

The global hearing aids market in low- and middle-income countries remains largely untapped as people often have little or no access to audiological services. The prevalence rate of disabling hearing loss in regions such as South Asia, Asia Pacific, and Sub-Saharan Africa is almost four times that of higher-income regions. As per WHO, global hearing aid production meets only around 3% of the need in these countries. However, growing awareness about hearing aids and rising affluence in these regions is expected to open up substantial growth opportunities.

“As per WHO, approximately 90% of the people with disabling hearing loss live in low- and middle-income countries. A large population base, growing awareness & spending power, and a strong focus of hearing manufacturers on increasing access to hearing care in low- and middle-income countries, especially for children is expected to open growth opportunities in low- and middle-income countries."-Director, Leading Hearing Aids Device Manufacturer, United States

Digital Solutions Offered By Players Spurs the Adoption of Hearing Aids Market

The leading players operating in the hearing aids market are increasingly offering digital solutions that congregate the healthcare providers and the consumers in real-time through all stages of the hearing journey. The digitally networked solutions provide consumers a higher degree of control and autonomy as they get access to online-based histories, customer support, remote adjustments, and optimization under real-life conditions. The digital solutions allow audiologists to directly capture data on the specific audiological situation of the user and provide immediate assistance. Moreover, users get more targeted advice due to continuous data monitoring and statistical analysis of their listening situations.

For instance,

- The Sonova brand Phonak offers myPhonak app, which gives users an enhanced and personalized hearing experience. Remote support, fitting and control, a hearing diary, and advanced customization options such as noise reduction and speech focus are some of the highlights of the platform

To learn more about this report, download the PDF brochure

Technological Advancements are driving the Hearing Aids Market

The hearing aids market is technology-driven and is marked by constant product enhancements/innovations. For instance,

- In June 2023,Sennheiser introduced the Sennheiser OTC hearing aids, granting American consumers access to advanced assistive hearing technology with the FDA-cleared All-Day Clear and All-Day Clear Slim models, reinforcing the brand's commitment to enhancing global auditory experiences through their exceptional acoustics, speech enhancement capabilities, and user-friendly self-fitting features

- In July 2022, Audientes A/S announced the addition of a new product to its portfolio Companion by Audientes. Companion by Audientes is a situational hearing device in the advanced hearables category. It is a new consumer electronics device, which also includes Bluetooth streaming functionality

- In May 2022, Chinese tech company iFLYTEK launched iFLYTEK Smart Hearing Aids. The pair of hearing aids comes in two models Pleasure and Privilege, both having core functions such as digital multi-channel, autonomous app fitting, and adaptive scene recognition

- In October 2021, Audibel (A brand of Starkey Hearing Technologies) launched "Arc AI" Hearing Aid Line. The "Effortless" hearing aid uses artificial intelligence to adjust to the wearer's environment

China Expected to be a Major Growth Engine in Hearing Aids Market

Hearing-aid usage in China is on the rise. A rising aging population, increasing cases of hearing loss, growing awareness regarding hearing loss & its treatment options among consumers, continuous training of audiologists/experts who can treat hearing loss problems by hearing aid manufacturers, availability and acceptability of more advanced and sophisticated hearing aid products, economic growth, expanding basic health insurance coverage, and presence of key players in the country are some of the key factors that are expected to drive the Chinese hearing aid market.

According to the World Health Organization (WHO), in China alone, the number of people with hearing loss has been steadily increasing from 74 million in 2008 to 96 million in 2018.

Citing the lucrative prospects of the Chinese market, several players are striving to establish their foothold in the market. For instance,

- In June 2022, Demant completed the full acquisition of ShengWang, the Chinese hearing aid chain of some 500 stores. The acquisition provides Demant full ownership of the leading network of hearing aid clinics in China.

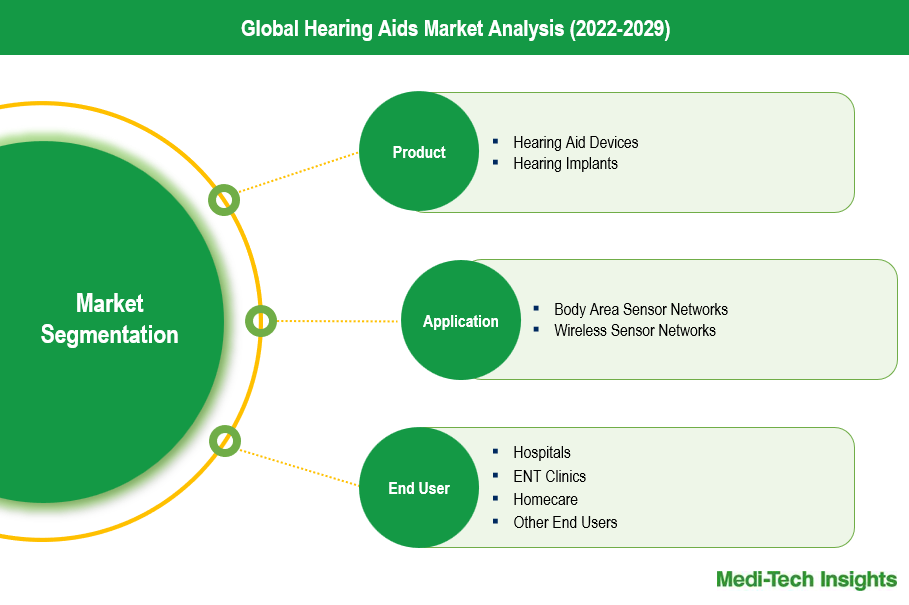

Product Type Segment Analysis

The hearing aid market comprises two main product types: Hearing Aid Devices and Hearing Implants. Hearing Aid Devices are non-invasive, wearable devices that amplify sound for individuals with hearing loss. They dominate the market share due to their accessibility, ease of use, and non-surgical nature. Factors driving their growth include technological advancements, such as digital signal processing and wireless connectivity, as well as increasing awareness and acceptance of hearing loss.

On the other hand, Hearing Implants are surgically implanted devices designed for individuals with severe to profound hearing loss. Although they hold a smaller market share compared to Hearing Aid Devices, they are gaining traction due to advancements in implant technology, improving efficacy and outcomes for recipients. Driving factors include rising demand for more effective solutions among severe cases of hearing loss and expanding applications of implants beyond cochlear implants to include bone conduction and middle ear implants. Overall, while Hearing Aid Devices maintain a dominant market position, the growth of Hearing Implants reflects a trend towards more specialized and advanced solutions catering to diverse needs within the hearing-impaired population.

To learn more about this report, download the PDF brochure

Application Type Segment Analysis

The hearing aids market can be analyzed based on application types, such as Body Area Sensor Networks and Wireless Sensor Networks. Body Area Sensor Networks involve hearing aids that are integrated with sensors to monitor physiological data and provide personalized hearing assistance. While still emerging, they hold promise for improving user experience and treatment outcomes, particularly in healthcare settings. Factors driving their growth include advancements in sensor technology, increasing demand for personalized healthcare solutions, and the growing prevalence of chronic conditions requiring continuous monitoring. Wireless Sensor Networks refer to hearing aids that utilize wireless connectivity to enhance communication and accessibility. These devices enable seamless integration with smartphones, TVs, and other digital devices, offering users greater flexibility and convenience. Their market share is significant, driven by the increasing adoption of wireless technology, consumer demand for connected devices, and the desire for improved quality of life among hearing-impaired individuals.

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the Market

Players operating in this market are adopting both organic and inorganic growth strategies such as collaborations, acquisitions, and new product launches to garner market share. For instance,

- In February 2024, USound, a prominent international supplier of MEMS speakers, is expected to unveil its most recent product advancements at FIRA GRAN VIA, featuring streamlined audio solutions tailored for TWS earphones and OTC hearing aids.

- In July 2023, EssilorLuxottica revealed plans to enter the hearing solutions market, leveraging a specialized Super Audio team, internal R&D capabilities, and facilitated by its complete acquisition of Israeli startup Nuance, aiming to unveil innovative hearing technology to aid the 1.25 billion individuals with mild to moderate hearing impairments

- In April 2022, Cochlear Limited finalized an agreement to purchase Oticon Medical for DKK850 million (approximately AUD170 million) after Demant's withdrawal from its hearing implants business, with Cochlear committing to continue supporting Oticon Medical's existing base of over 75,000 hearing implant users, encompassing both cochlear and acoustic implants.

- In April 2022, medical device and consumer electronics manufacturer, Nuheara Limited entered into a global trademark license agreement for the use of certain HP trademarks on Nuheara’s hearing aids, personal sound amplification devices, and accessories.

- In October 2021, Signia announced the general availability of its Insio Charge&Go AX custom hearing aids, the newest revolutionary device built upon Signia's pioneering Augmented Xperience (AX) platform. The Insio Charge&Go AX is the world's first custom hearing aid with contactless charging, Bluetooth, and streaming to Android and Apple iOS devices.

The animal health market is expected to gain further momentum in the coming years due to technological advancements, rising R&D investments, new product launches, and aggressive organic and inorganic growth strategies followed by the players.

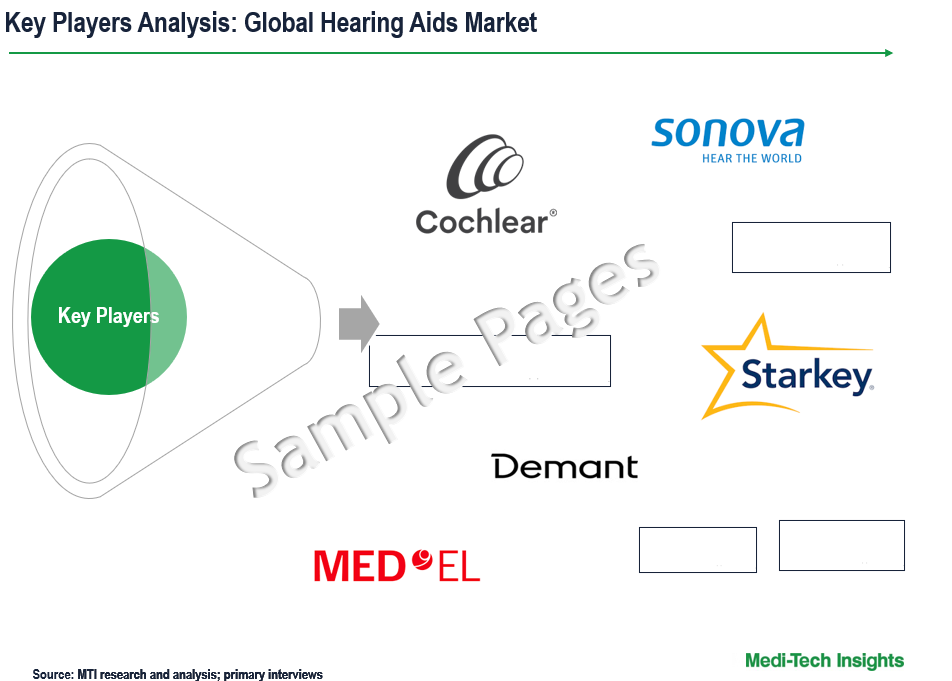

Competitive Landscape Analysis: Hearing Aids Market

The global hearing aids market is marked by the presence of established market players such as Sonova Group, Demant, Starkey, Cochlear, GN Store Nord, MED-EL, RION, SeboTek Hearing Systems, audifon, Audina Hearing Instruments, among others.

Get a sample report for competitive landscape analysis

Future Outlook of the Hearing Aids Market

The global hearing aids market is expected to gain further momentum in the coming years due to the hearing aid sales recovery from the Covid-19 pandemic, potential implementation of the ‘Over-the-Counter Hearing Aid Act’, aging population, technological advancements in hearing aid devices, better awareness & healthcare reimbursement coverage in high-income countries, and potential opportunities in under-penetrated low- and middle-income countries.

| Report Scope | Details |

| Base Year Considered | 2023 |

| Historical Data | 2022 - 2023 |

| Forecast Period | 2024 - 2029 |

| CAGR (2024 - 2029) | 6-7% |

| Segment Scope | Product, Application, End User |

| Regional Scope |

|

| Key Companies Mapped | Sonova Group, Demant, Starkey, Cochlear, GN Store Nord, MED-EL, RION, SeboTek Hearing Systems, audifon, Audina Hearing Instruments among others |

| Report Highlights | Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

Key Strategic Questions Addressed

-

What is the market size & forecast for the Global Hearing Aids Market?

-

What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the Global Hearing Aids Market?

-

How has COVID-19 impacted the Global Hearing Aids Market?

-

What are the major growth drivers, restraints/challenges impacting the market?

-

What are the opportunities prevailing in the market?

-

What is the investment landscape?

-

Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market? What is the competitive positioning of key players?

-

Who are the new players entering the market?

-

What are the key strategies adopted by players?

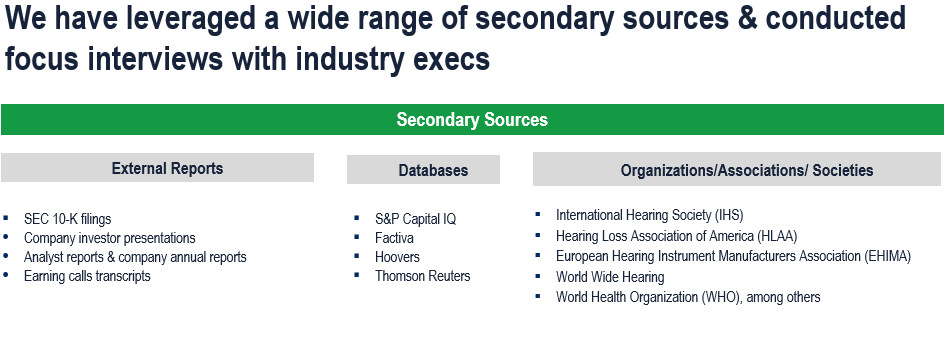

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Market Forecasting

- Executive Summary

- Market Overview

- Market Dynamics

- Drivers

- Restraints

- Key Market Trends

- Market Dynamics

-

- Industry Speaks

- Key Revenue Pockets

- Global Hearing Aids Market - Size & Forecast (2021-2028), By Product Type

- Hearing Devices

- Behind-the-Ear (BTE)

- In the Ear (ITE)

- Receiver in the Canal (RIC)

- Completely in the Canal (CIC)

- Others

- Hearing Implants

- Cochlear Implants

- Bone Anchored Implants

- Hearing Devices

- Global Hearing Aids Market - Size & Forecast (2021-2028), By Application Type

- Body Area Sensor Networks

- Wireless Sensor Networks

- Global Hearing Aids Market - Size & Forecast (2021-2028), By Hearing Loss Type

- Sensorineural Hearing Loss

- Conductive Hearing Loss

- Global Hearing Aids Market - Size & Forecast (2021-2028), By Patient Type

- Adults

- Pediatric

- Global Hearing Aids Market - Size & Forecast (2021-2028), By End User Type

- Hospitals

- ENT Clinics

- Homecare

- Other End Users

- Global Hearing Aids Market - Size & Forecast (2021-2028), By Region

- North America (U.S. & Canada)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, Rest of Asia Pacific)

- Rest of the World (Latin America, Middle East & Africa)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Competitive Positioning of Key Players (2022)

- Offerings Assessment, By Player

- Key Strategies Assessment, By Player (2021-2023)

- New Product & Service Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Key Companies Scanned (Indicative List)

- Sonova Group

- Demant

- Starkey, Cochlear

- GN Store Nord

- MED-EL

- RION

- SeboTek Hearing Systems

- Audifon

- Audina Hearing Instruments

- Other Prominent Players

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

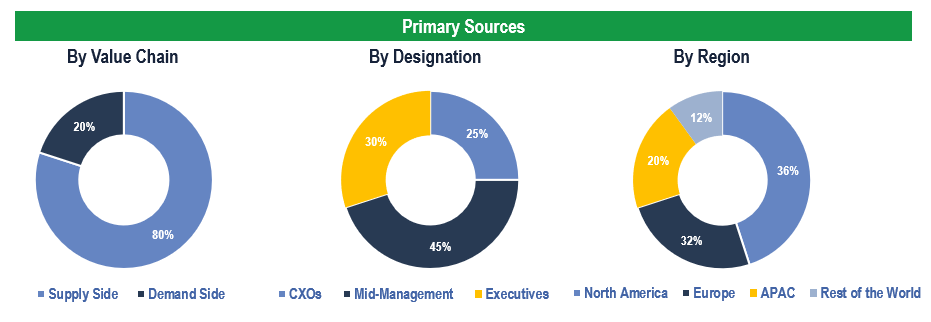

Primary Research

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders in Hospitals, ENT Clinics, Homecare and Other End Users

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis were validated with Primary Interviews, Internal Knowledge Repository, and Company Sales Data.