High Potency Active Pharmaceutical Ingredients (HPAPI) Market Size, Share, and Opportunities for Forecast to 2029

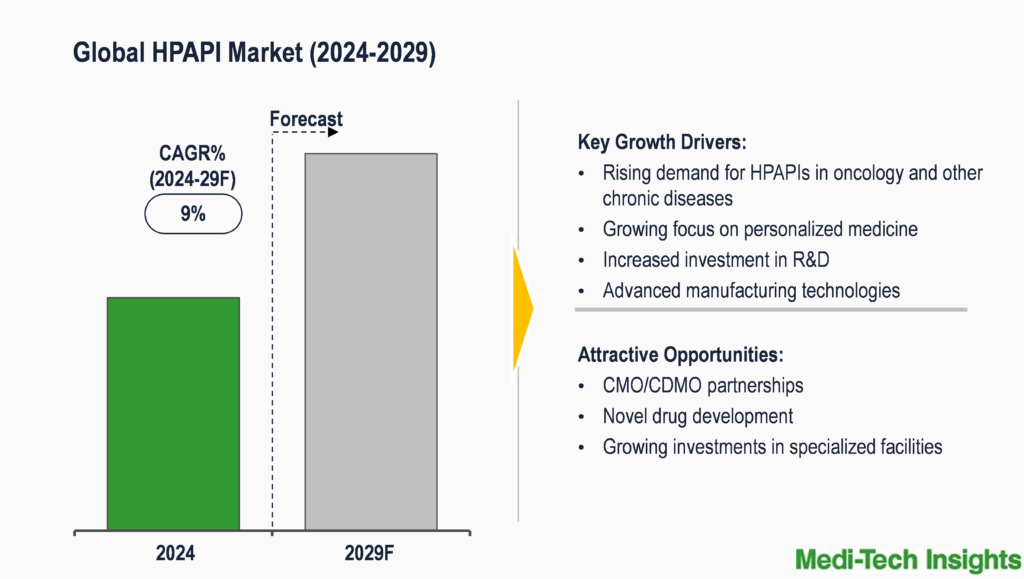

The global HPAPI market is set to witness a high growth rate of 9% in the next 5 years. Rising incidence of cancer and other chronic diseases, increasing R&D activities & investments, advancements in oncology therapies, growing demand for targeted therapies, advances in manufacturing technologies, innovation and pipeline expansion, and increasing outsourcing to CDMOs are some of the key factors driving the HPAPI market.

The market is marked by the presence of key players such as Pfizer Inc. (US); Merck KGaA (Germany); Novartis AG (Switzerland); Sanofi (France); Lonza Group (Switzerland); Bristol Myers Squibb (US); and others. To learn more about the research report, download a sample report.

Highly potent active pharmaceutical ingredient (HPAPI) are chemical entities used in pharmaceuticals that exhibit potent pharmacological effects at low doses. HPAPIs are characterized by their high potency, often requiring stringent containment measures during handling and manufacturing due to their cytotoxic or potent nature. They are typically used in the production of drugs for treating severe diseases such as cancer, autoimmune disorders, and infectious diseases. The classification of an API as highly potent is typically based on factors such as its pharmacological activity, therapeutic index, and potential for adverse effects. An HPAPI is commonly described as an API with an occupational exposure limit (OEL) equal to or below 10 µg/m³ of air over an 8-hour time-weighted average. Owing to the inherent risks associated with their high pharmacological activity, the development and manufacturing of HPAPIs needs to ensure the safety of both patients and employees. This requires a robust quality system and Health, Safety, and Environment (HSE culture), and specialized high containment facilities operated by experienced personnel. HPAPIs by nature are often complex molecules & need specialized technologies for multi-step synthesis and purification.

To learn more about this report, download the PDF brochure

Rising demand for HPAPIs in oncology and chronic diseases spurs market growth

Advances in drug development have generated more targeted and potent drugs, including antibody-drug conjugates, with fewer side effects. This progress is particularly notable in the fields of oncology and other age-related or chronic diseases. Consequently, there has been a surge in market demand and growth for Highly Potent Active Pharmaceutical Ingredients (HPAPIs) worldwide. These molecules are prominently associated with innovative cancer treatments like antibody-drug conjugates (ADC), while also demonstrating efficacy in treating autoimmune diseases, diabetes, and various other conditions

The escalating global incidence of cancer underscores the growing need for potent Active Pharmaceutical Ingredients (APIs) tailored for oncology therapies. The advancement of precise cancer medications capable of effectively eradicating cancerous cells with minimal impact on healthy tissues relies significantly on highly potent APIs (HPAPIs). Their effectiveness against cancer at lower doses and the trend towards more precise therapeutics contribute to the increasing demand for HPAPIs. Lower doses of these therapies can help alleviate adverse side effects for patients. Moreover, the robust pipeline of active compounds in oncology, comprising 37.5% of all drugs in development, is helping the growth of HPAPI, surpassing the broader market trends.

HPAPIs represent a significant share of the pharmaceutical drug pipeline, comprising over 30% of ongoing developments. Interest in highly potent drugs is primarily driven by oncology research, as well as the demand for more targeted therapies across various medical indications. Numerous highly potent small molecules are in development, majority of them targeting oncology, antidiabetics, autoimmune diseases, and other diverse indications. Due to their wide range of potential uses and benefits for patients, the growth in the HPAPI market is likely to outpace the overall API market.

A significant portion of the HPAPI market caters to the demand for highly potent cancer drugs. The rapid expansion of the global oncology market reflects the trajectory of HPAPIs, propelled by aging populations, improved survival rates due to new therapeutic options, and the dominance of cancer drug candidates in pharmaceutical R&D pipelines. The oncology therapeutics market is poised for substantial growth in the next five years, with numerous new cancer drugs having entered the market over the past half-decade. Notably, in 2023, the U.S. Food and Drug Administration (FDA) approved 55 new drugs, with over ~9 were designated for cancer treatment. In January 2023, Pirtobrutinib received FDA approval for the treatment of adult patients with relapsed or refractory mantle cell lymphoma. On the other hand, advances in drug development have generated more targeted and potent drugs, and also antibody-drug conjugates, with fewer side-effects, again in the fields of oncology and also for other age-related or chronic diseases. This has fueled strong market demand and growth for HPAPIs worldwide as well.

Considering the high demand, many leading pharmaceutical companies are strategically investing in HPAPI manufacturing infrastructure and R&D to bolster their HPAPI pipelines. For instance, in November 2021, Cordenpharma invested USD 10.5 million (Eur 9.7 million) to enhance their HPAPI manufacturing capabilities for high-potency oncology compounds. Similarly, in 2022, PolPharma invested USD 25.9 million (Eur 24 million) in a specialized facility dedicated to the R&D and production of highly active substances. The company also built a product pipeline of highly potent substances.

Thus, growing utilization of HPAPI molecules presents significant potential benefits for patients, making them an attractive proposition for pharmaceutical manufacturers. However, this trend also presents challenges in handling, containment, and manufacturing, given the inherent risks associated with these potent compounds. Manufacturing HPAPIs entails stringent specifications to ensure safe handling and production, maintaining a high-quality working environment devoid of cross-contamination and exposure risks. Emphasizing facility design, protection strategies, procedures, and personal protective equipment is crucial to ensuring safe HPAPI handling.

Given the rigorous regulatory demands and steep production expenses, pharmaceutical innovators are seeking to outsource HPAPI production from the initial stages, ideally to entities capable of offering both development and manufacturing services. Contract development and manufacturing organizations (CDMOs) are developing integrated and flexible capabilities tailored for HPAPI manufacturing, with a focus on safety across all stages from preclinical to commercial production. Outsourcing for HPAPI production is witnessing a surge, with demand for highly potent small molecule API manufacturing and development services expected to experience significant growth. For biopharma innovators, collaborating with a single partner throughout the development process can streamline timelines and mitigate risks. CDMO partners can access in-house expertise across a range of drug substance and drug product challenges, engage in technology transfer endeavors, and share information, insights, and best practices throughout the drug development journey.

Competitive Landscape

Some of the key players operating in the market include Pfizer Inc. (US); Merck KGaA (Germany); Novartis AG (Switzerland); Sanofi (France); Lonza Group (Switzerland); Bristol Myers Squibb (US); among others.

Get a Sample Report for Competitive Landscape Analysis

Key strategies adopted by pharmaceutical manufacturers and CDMOs

HPAPIs are becoming increasingly prevalent within the pharmaceutical industry. Pharmaceutical companies consistently seek avenues to stay competitive, often by refining existing market offerings. High potency drugs have the potential for achieving similar efficacy at reduced dosages compared to APIs, a quality appealing to drug developers as it minimizes patient exposure to medication. Furthermore, most oncological agents fall under the category of HPAPIs, and there is a growing clientele base with these compounds. The growing acceptance of these compounds coupled with the increase in R&D for the development of newer HPAPIs are likely to drive the market growth considerably. Over the past several years, key industry players have been expanding facilities, collaborating, and partnering with CMOs/CDMOs to strengthen their positions in this high growth market. Some of the recent developments are listed below-

- In January 2023, Sai Life Sciences, opened of a new HPAPI manufacturing facility at its cGMP API manufacturing campus in India. The inclusion of this latest facility has expanded the company’s proficiency in HPAPI development and manufacturing, providing its customers a more efficient route for new chemical entity (NCE) development

- In September 2022, Lonza completed the expansion of its Highly Potent API (HPAPI) multipurpose suite in Visp, Switzerland. This expansion includes increased development and manufacturing capacity for ADC payloads, facilitating the entire development and manufacturing pipeline from feasibility studies to commercial supply

- In May 2022, Piramal Pharma Solutions invested USD 23 million (CAD 30 million) to open a new API manufacturing facility at Ontario Canada, which includes HPAPI capabilities. It further enhances the company’s capacity to produce APIs from clinical to commercial scale, including HPAPIs meeting an occupational exposure limit (OEL) of 1 mcg/m3

- In June 2022, WuXi STA, a subsidiary of WuXi AppTec, has inaugurated a new HPAPI plant at its Changzhou site in Jiangsu, China, with a view to address the increasing need for HPAPI process R&D and manufacturing services

- In June 2022, Merck invested USD 63.8 million (Eur 59 million) to expand its high potent active pharmaceutical ingredients (HPAPI) production capacity with the expansion of its facility in Wisconsin, US, in order to meet the growing demand for cancer therapeutics.

North America expected to hold a major share in the HPAPI market

From a geographical perspective, North America holds a major market share of the HPAPI market. This can be mainly attributed to a well-established pharmaceutical industry, significant investments in research and development within the pharmaceutical sector, well-defined and rigorous regulatory environment, presence of multinational pharma & biotech companies supporting high R&D investments, and increased incidence of cancer and other chronic diseases. According to Centers for Disease Control and Prevention (CDC), cancer accounted for 605,213 deaths in 2021 in the US. Additionally, there is a growing demand for targeted therapies in the region, driven by advancements in precision medicine and personalized treatment approaches. HPAPIs play a crucial role in the development of targeted therapies, further fuelling the demand for these potent active ingredients in the region.

Regardless of the challenges related to manufacturing of a high-quality HPAPI production, safety concerns, supply chain complexity, and emerging regulatory frameworks among others, the global HPAPI market has high potential to grow at a significant rate and is expected to gain further momentum in the coming years due to a strong focus on innovation, advances in clinical pharmacology and oncology research, greater demand for targeted therapies across the globe, and emerging HPAPI manufacturing technologies among others. For instance, novel containment solutions to include essential measures like closed systems, high-efficiency particular air (HEPA) filtration, dedicated air handling unit, and stringent decontamination protocols; automation and real-time monitoring systems are pivotal in overcoming the inherent challenges posed by HPAPI manufacturing. Furthermore, pharmaceutical companies and CDMOs are expanding their HPAPI manufacturing capabilities globally to meet the increasing demand for high potency drugs, thereby fueling the market growth.

Key Strategic Questions Addressed

-

What is the market size & forecast of the HPAPI market?

-

What are historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the HPAPI market?

-

What are the key trends defining the market?

-

What are the major factors impacting the market?

-

What are the opportunities prevailing in the market?

-

Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market?

-

What are the key strategies adopted by players?

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Bottom-up and Top-down Approach

- Market Forecasting

- Executive Summary

- Market Overview

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Market Trends

- Industry Speaks

- Opportunity Analysis

- Market Dynamics

- Global HPAPI Market- Size & Forecast (2023-2028), By Type

- Innovative HPAPI

- Generic HPAPI

- Global HPAPI Market- Size & Forecast (2023-2028), By Type of Synthesis

- Synthetic HPAPI

- Innovative synthetic HPAPI

- Generic synthetic HPAPI

- Biotech HPAPI

- Innovative biotech HPAPI

- Biosimilars

- Synthetic HPAPI

- Global HPAPI Market- Size & Forecast (2023-2028), By Type of Manufacturer

- Captive HPAPI Manufacturers

- Merchant HPAPI Manufacturers

- Global HPAPI Market- Size & Forecast (2023-2028), By Therapeutic Application

- Oncology

- Diabetes

- Glaucoma

- Hormonal Imbalance

- Autoimmune Diseases

- Other Therapeutic Applications

- Global HPAPI Market- Size & Forecast (2023-2028), By Region

- North America (U.S. & Canada)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, Rest of Asia Pacific)

- Rest of the World (Latin America, Middle East & Africa)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Market Share Analysis (2022)

- Segment-wise Player Mapping

- Key Strategies Assessment, By Player (2020-2022)

- New Product Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Key Companies Scanned (Indicative List)

- Pfizer Inc.

- Novartis AG

- Merck KGaA

- Lonza Group

- Sanofi S.A.

- CordenPharma International

- Bristol Myers Squibb

- AstraZeneca

- GSK plc

- Takeda Pharmaceutical Company

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

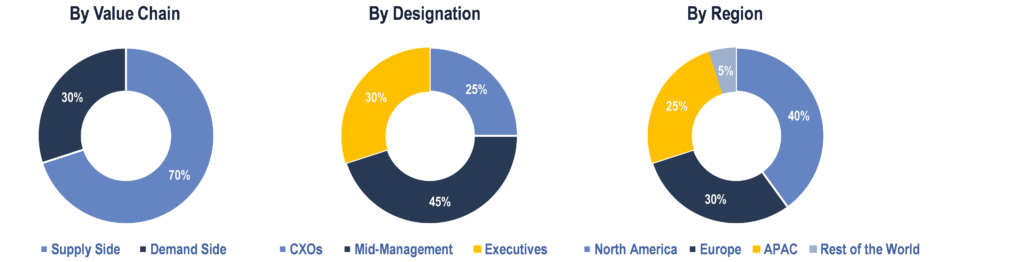

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, R&D Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Pharmaceutical & Biopharmaceutical Companies, CROs/CDMOs, and Research Institutes & Laboratories

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down & Bottom-Up Approaches’ were used to derive market size estimates and forecasts

Data Triangulation

Research findings derived through secondary sources & internal analysis was validated with Primary Interviews, Internal Knowledge Repository and Company’s Sales Data