Global Next-generation Sequencing Market Size & Trends by Technology (WGS, Whole Exome Sequencing), Product (Platform, Consumables), Application (Diagnostics, Drug Discovery & Development) Analysis and Regional Forecasts to 2029

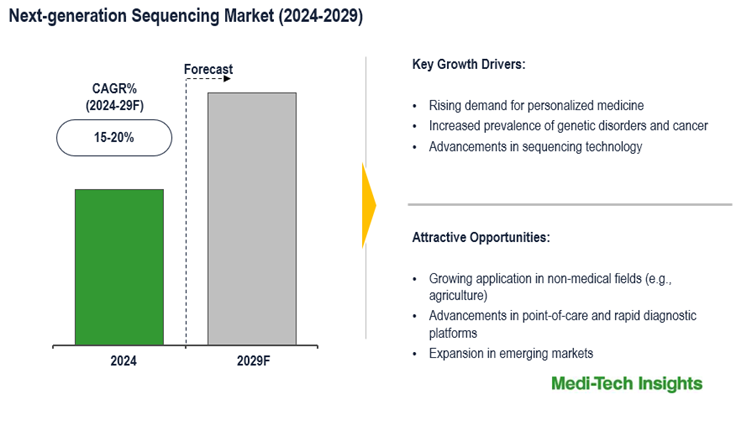

The NGS market is projected to experience strong growth, with a CAGR of approximately 15-20% over the coming years, fueled by its expanding role in precision medicine, diagnostics, and genomics research. This growth trajectory is driven by the increasing need for advanced genetic diagnostics, along with ongoing technological advancements that make NGS more accessible and efficient. However, the high costs associated with sequencing platforms, necessary infrastructure, and complex data analysis pose significant barriers that may hinder wider adoption. To learn more about the research report, download a sample report.

Report Overview

The next-generation sequencing (NGS) market centers on advanced DNA sequencing technologies that allow high-throughput, precise genome analysis, enabling deep insights into genetic material. By decoding complex genetic information quickly, NGS supports applications in clinical diagnostics, drug discovery, oncology, and agricultural genomics. This market is essential in both healthcare and research, facilitating more personalized and targeted treatments, early disease detection, and broader genomic research. NGS technologies are transforming fields by providing rapid, accurate genetic information for diverse applications, from disease management to agricultural innovation.

To learn more about the research report, download a sample report.

Precision in Care: The Role of NGS in Advancing Personalized Medicine

The NGS market is significantly driven by the growing demand for personalized medicine, an approach that tailors medical treatment to the unique genetic profile of each patient. NGS technology enables healthcare providers to delve deeply into an individual's genomic data, revealing specific genetic mutations and variations that can influence treatment choices. This granular insight is especially impactful in cancer care, where identifying specific genetic mutations can guide the selection of targeted therapies, improving outcomes and minimizing side effects. Personalized medicine is transforming how diseases are managed, allowing for treatments that are more effective and closely aligned with the patient’s biology. With its potential to enhance therapeutic precision and reduce adverse reactions, NGS has become an indispensable tool in advancing personalized medicine and is expected to continue fueling growth in the market.

The Rise of Portable and Affordable Sequencing Devices

A pivotal trend in the NGS market is the miniaturization and cost reduction of sequencing platforms, making NGS more accessible across a wide range of settings. Recent advancements have led to the development of compact, portable sequencers that retain high accuracy while being more affordable and user-friendly. These devices are transforming the application of NGS by enabling real-time genomic analysis in settings outside of traditional laboratories, such as point-of-care clinics and field research sites. In epidemiology, for instance, these portable sequencers are invaluable for tracking infectious diseases, allowing for swift responses and efficient public health management in remote or resource-limited areas. By reducing the barriers of cost and infrastructure requirements, portable sequencers are expanding the reach of NGS technology and fostering its adoption across diverse applications, from infectious disease monitoring to wildlife genetics research. This trend is broadening NGS utility, making it a versatile tool for both research and clinical purposes, and catalyzing further growth in the market.

To learn more about the research report, download a sample report.

Competitive Landscape Analysis

The Next-generation Sequencing (NGS) market is marked by the presence of key players such as Illumina; Thermo Fisher Scientific; Pacific Biosciences; Oxford Nanopore Technologies; Hoffmann-La Roche AG; PierianDx; DNASTAR, Inc.; Eurofins Scientific; Perkin Elmer, Inc.; Bio-Rad Laboratories, Inc. and QIAGEN among others.

Report Scope

| Report Scope | Details |

| Base Year Considered | 2023 |

| Historical Data | 2022 - 2023 |

| Forecast Period | 2024 - 2029 |

| Market Drivers |

|

| Attractive Opportunities |

|

| Segment Scope | Technology, Product, Application and End User |

| Regional Scope |

|

| Key Companies Mapped | Illumina; Thermo Fisher Scientific; Pacific Biosciences; Oxford Nanopore Technologies; Hoffmann-La Roche AG; PierianDx; DNASTAR, Inc.; Eurofins Scientific; Perkin Elmer, Inc.; Bio-Rad Laboratories, Inc. and QIAGEN among others |

| Report Highlights | Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

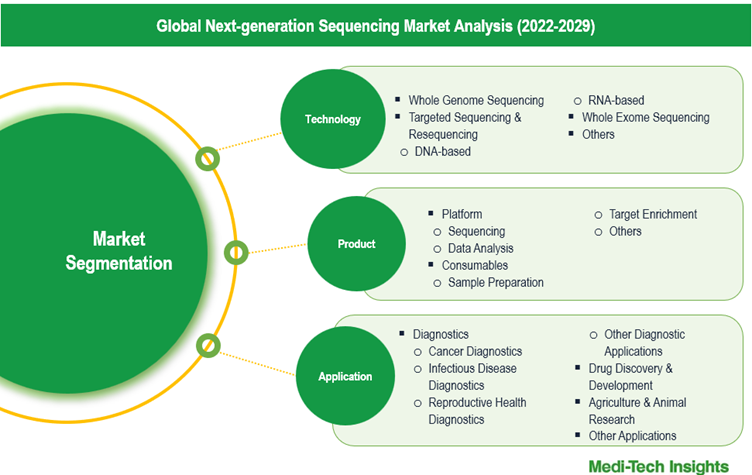

Market Segmentation

This report by Medi-Tech Insights provides size of the next-generation sequencing (NGS) market at the regional- and country-level from 2022 to 2029. The report further segments the market on the basis of technology, product, application and end user.

- Market Size & Forecast (2022-2029), By Technology, USD Million

- Whole Genome Sequencing

- Whole Exome Sequencing

- Targeted Sequencing & Resequencing

- DNA-based

- RNA-based

- Others

- Market Size & Forecast (2022-2029), By Product, USD Million

- Platform

- Sequencing

- Data Analysis

- Consumables

- Sample Preparation

- Target Enrichment

- Others

- Platform

- Market Size & Forecast (2022-2029), By Application, USD Million

- Diagnostics

- Cancer Diagnostics

- Infectious Disease Diagnostics

- Reproductive Health Diagnostics

- Other Diagnostic Applications

- Drug Discovery & Development

- Agriculture & Animal Research

- Other Applications

- Diagnostics

- Market Size & Forecast (2022-2029), By End User, USD Million

- Hospitals & Clinics

- Academic & Research Institutes

- Pharma & Biotech Companies

- Other End Users

- Market Size & Forecast (2022-2029), By Region, USD Million

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

- North America

Key Strategic Questions Addressed

- What is the market size & forecast of the next-generation sequencing (NGS) market?

- What are historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the next-generation sequencing (NGS) market?

- What are the key trends defining the market?

- What are the major factors impacting the market?

- What are the opportunities prevailing in the market?

- Which region has the highest share in the global market?

- Which region is expected to witness the highest growth rate in the next 5 years?

- Who are the major players operating in the market?

- What are the key strategies adopted by players?

- Introduction

- Introduction

- Market Scope

- Market Definition

- Segments Covered

- Regional Segmentation

- Research Timeframe

- Currency Considered

- Study Limitations

- Stakeholders

- List of Abbreviations

- Key Conferences and Events (2023-2024)

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Bottom-Up Approach

- Top-Down Approach

- Market Forecasting

- Executive Summary

- Next-generation SequencingMarket Snapshot (2023-2029)

- Segment Overview

- Regional Snapshot

- Competitive Insights

- Market Overview

- Market Dynamics

- Drivers

- Rising demand for personalized medicine

- Advancements in sequencing technology

- Increased prevalence of genetic disorders and cancer

- Expansion in clinical applications (infectious disease, reproductive health)

- Increased investments in R&D

- Restraints

- High cost of sequencing platforms and infrastructure

- Complexity in data analysis and bioinformatics requirements

- Limited skilled workforce for NGS data interpretation

- Opportunities

- Growing application in non-medical fields (e.g., agriculture)

- Advancements in point-of-care and rapid diagnostic platforms

- Key Market Trends

- Miniaturization and affordability of sequencing platforms

- Integration with artificial intelligence (AI) for data analysis

- Unmet Market Needs

- Industry Speaks

- Regulatory Analysis

- Drivers

- Market Dynamics

- Global Next-generation Sequencing Market Size & Forecast (2022-2029), By Technology Type, USD Million

- Introduction

- Whole Genome Sequencing

- Whole Exome Sequencing

- Targeted Sequencing & Resequencing

- DNA-based

- RNA-based

- Others

- Global Next-generation Sequencing Market Size & Forecast (2022-2029), By Product, USD Million

- Introduction

- Platform

- Sequencing

- Data Analysis

- Consumables

- Sample Preparation

- Target Enrichment

- Others

- Global Next-generation Sequencing Market Size & Forecast (2022-2029), By Application, USD Million

- Introduction

- Diagnostics

- Cancer Diagnostics

- Infectious Disease Diagnostics

- Reproductive Health Diagnostics

- Other Diagnostic Applications

- Drug Discovery & Development

- Agriculture & Animal Research

- Other Applications

- Global Next-generation Sequencing Market - Size & Forecast (2022-2029), By End User

- Introduction

- Hospitals & Clinics

- Academic & Research Institutes

- Pharma & Biotech Companies

- Other End Users

- Global Next-generation Sequencing Market Size & Forecast (2022-2029), By Region, USD Million

- Introduction

- North America Next-generation Sequencing Market Size & Forecast (2022-2029), By Country, USD Million

- US

- Market Size & Forecast, By Technology (USD Million)

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Canada

- Market Size & Forecast, By Technology (USD Million)

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- US

-

- Europe Next-generation Sequencing Market Size & Forecast (2022-2029), By Country, USD Million

- UK

- Market Size & Forecast, By Technology (USD Million)

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Germany

- Market Size & Forecast, By Technology (USD Million)

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- France

- Market Size & Forecast, By Technology (USD Million)

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Italy

- Market Size & Forecast, By Technology (USD Million)

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Spain

- Market Size & Forecast, By Technology (USD Million)

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Rest of Europe

- Market Size & Forecast, By Technology (USD Million)

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- UK

- Asia Pacific (APAC) Next-generation Sequencing Market Size & Forecast (2022-2029), By Country, USD Million

- China

- Market Size & Forecast, By Technology (USD Million)

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Japan

- Market Size & Forecast, By Technology (USD Million)

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- India

- Market Size & Forecast, By Technology (USD Million)

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Rest of Asia Pacific

- Market Size & Forecast, By Technology (USD Million)

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- China

- Latin America (LATAM) Next-generation Sequencing Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Technology (USD Million)

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Middle East & Africa (MEA) Next-generation Sequencing Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Technology (USD Million)

- Market Size & Forecast, By Product (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Key Player Comparison

- Segment-wise Player Mapping

- Market Share Analysis (2023)

- Company Categorization Matrix

- Dominants/Leaders

- New Entrants

- Emerging Players

- Innovative Players

- Key Strategies Assessment, By Player (2022-2024)

- New Product Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Europe Next-generation Sequencing Market Size & Forecast (2022-2029), By Country, USD Million

- Company Profiles*(Business Overview, Financial Performance**, Products Offered, Recent Developments)

-

- Illumina

- Thermo Fisher Scientific

- Pacific Biosciences

- Oxford Nanopore Technologies

- Hoffmann-La Roche AG

- PierianDx

- DNASTAR, Inc.

- Eurofins Scientific

- Perkin Elmer, Inc.

- Bio-Rad Laboratories, Inc.

- Qiagen

- Other Prominent Players

Note: *Indicative list

**For listed companies

The study has been compiled based on extensive primary and secondary research.

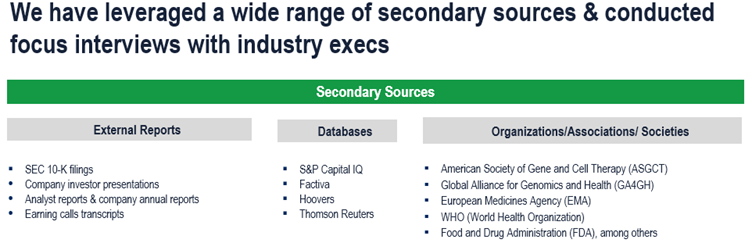

Secondary Research (Indicative List)

Primary Research

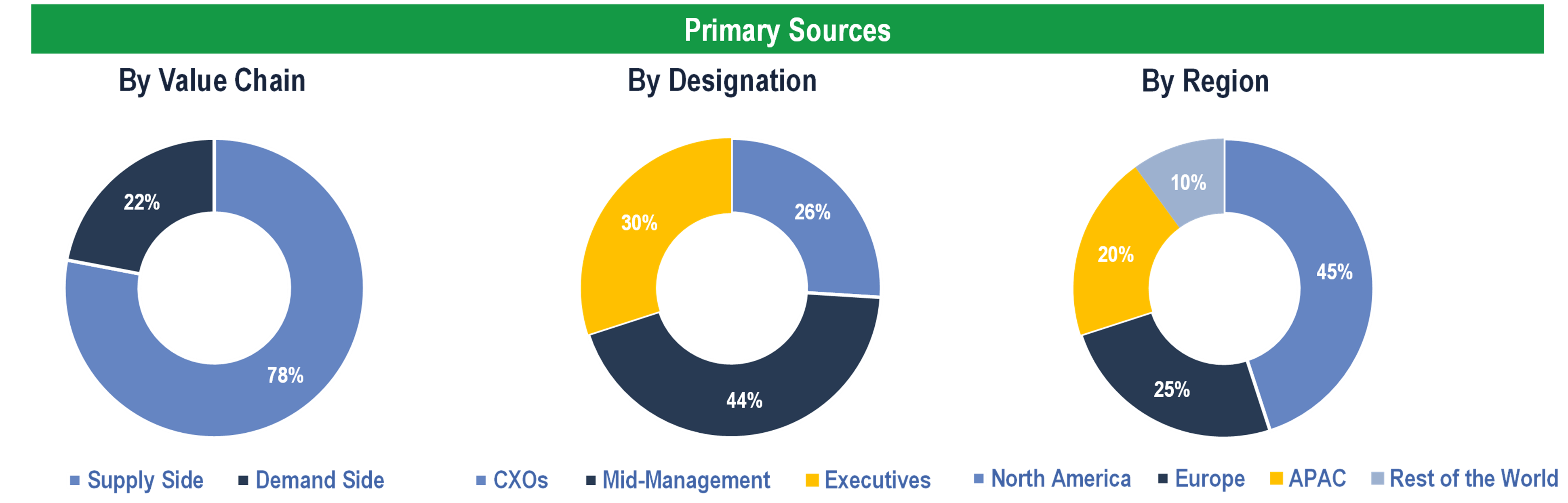

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, R&D Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Hospitals & Clinics, Academic & Research Institutes, Pharma & Biotech Companies and Others

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down & Bottom-Up Approaches’ were used to derive market size estimates and forecasts

Data Triangulation

Research findings derived through secondary sources & internal analysis was validated with Primary Interviews, Internal Knowledge Repository and Company’s Sales Data