Orthobiologics Market Size, Share, Growth Drivers, Trends, Demands & Analysis 2026

The Global Orthobiologics Market valued at $5.4 billion (2021), is set to witness a growth rate of 7% by 2026.Growing number of sports injuries and road accidents, geriatric and obese population globally, increasing number of people suffering from arthritis and other spine-related disorders, rising patient preference for minimally invasive procedures, and mechanical advancements in biomaterials are some of the key factors driving the orthobiologics market growth.

Orthobiologics employs biomaterials and cell-based therapies to rapidly heal musculoskeletal injuries. These products are derived from components that are naturally present in the body and interact dynamically with the musculoskeletal system to facilitate the healing of bone, cartilage, ligament, and diseased or injured meniscus & tendons. They are used across various orthopedic procedures to support tissue healing and restoration through their regenerative potential.

Technological advancements in Orthobiologics Market to fuel its Global Market Demand

Continuous advances in orthobiologics have enabled to develop efficient products with advanced patient healing capabilities and increased applications, among others. Such advancements tend to provide a competitive edge to all manufacturers and therefore, major players are continuously focusing on investing in research activities for new product development and expanding their geographic reach to strengthen their positions in the orthobiologics market. Some of the technological advancements are listed below:

- In October 2022, Paragon 28, Inc. launched its V92-FC+ Cellular Bone Matrix, a mouldable allograft matrix that contains primitive cells used for bone defects and remodelling in the foot and ankle.

- In June 2022, Royal Biologics announced the FDA 510K regulatory clearance and U.S. commercial launch for its MAXX-BMC system, a bone marrow aspirate concentration system that provides optimal sample of concentrated bone marrow aspirate from a patient at the point-of-care.

- In June 2022, Istos Biologics launched the Influx Fibrant line of 100% cortical allograft products featuring a patented technology from TheraCell and designed to advance patient healing.

- In March 2022, SeaSpine launched new orthobiologic products- NorthStar cervical facet fusion and Flash navigation lumbar facet fusion, with an aim to streamline reproducible procedural workflow while maximizing the area for fusion.

- In September 2020, Cerapedics received approval for its i-FACTOR+ Matrix bone graft from Health Canada. This next-generation bone graft is based on P15 osteogenic cell-binding peptide that supports bone growth through cell attraction, attachment, and activation.

Key Growth Strategies Adopted by Leading Market Players in Orthobiologics Market

Leading market players operating in the global orthobiologics market have adopted acquisition and partnership as key growth strategy to expand their product offerings, enhance their geographic presence & distribution capabilities, and to co-develop advanced products. Some of these developments are listed as below-

- In October 2022, HippoFi, Inc. (formerly ORHub) entered into a strategic agreement with Precision Spine, Inc. to drive revenue by selling PUR Biologics’ (HippoFi’s regenerative therapeutics division) product line including biological solutions for spine surgery capitalizing on Precision’s strong presence in the spine market.

- In August 2022, Orthofix Medical Inc. entered in a strategic partnership with CGBio, a synthetic bone grafts developer, to co-develop and commercialize Novosis recombinant human bone morphogenetic protein-2 (rhBMP-2) bone growth materials and other tissue regenerative solutions for the Canadian and US markets.

- In July 2021, Celularity Inc. and Arthrex, Inc. entered into a supply and distribution agreement for the distribution and commercialization of multiple products including placental-derived biomaterial products from Celularity for orthopaedics and sport medicine in the US.

- In April 2022, Isto Biologics announced the acquisition of TheraCell, Inc., a US-based regenerative medicine company. This acquisition led to the expansion of Isto Biologics’ portfolio of orthopaedic grafts.

- In March 2021, SeaSpine Holdings Corporation entered in an agreement to acquire 7D Surgical, Inc., a Canada-based medical device company. This acquisition was aimed at combining spinal implant and orthobiologics portfolios to advance spine surgery.

North America expected to hold a Major Share in the Orthobiologics Market

From a geographical perspective, North America holds a major share of the global orthobiologics market. This can be mainly attributed to the rapid adoption of biologics for bone-related disorders and injuries, better reimbursement policies in the US and Canada, increasing incidence of arthritis & sports-related injuries. However, the Asia Pacific is expected to ascend at the fastest CAGR over the forecast period on account of the growing geriatric population and obesity, high prevalence of bone diseases, rising healthcare spending and increased disposable income, and growing penetration of leading market players.

COVID-19 negatively impacted the Orthobiologics Market

The Covid-19 pandemic has negatively impacted some of the key players operating in the orthobiologics market due to the declining patient visits and supply chain challenges obstructing the sales of orthobiologic products. This further largely impacted the revenues of market players who witnessed a considerable decline in sales. However, the demand for orthobiologics started to rise in 2021 which was evident through the increased patient volumes and relaxation of government regulations across the globe.

For instance, Orthofix Medical, one of the leading players operating in the orthobiologics market saw a decline of over 11% in its revenue in 2020 as compared to 2019, while showed a growth of over 14% in 2021 revenue as compared to 2020.

Irrespective of the challenges such as unfavorable reimbursement scenario and pricing pressure on market players, the global orthobiologics market is growing and is expected to gain further momentum in the coming years due to a strong emphasis on spinal fusion segment, focus on demineralized bone putties with excipients, increasing usage of viscosupplements, and innovations addressing the entire procedure, among others.

For instance, during the forecast period, the viscosupplements segment is anticipated to be driven by advancements in hyaluronic acid-based therapies, rising prevalence of lifestyle-induced disorders, high effectiveness in delaying total knee replacement procedures, and growing preference for non-surgical treatments for osteoarthritis. Additionally, conventional techniques like autograft (using the patient's own bone) and allograft (bone transplanted from a donor) are used by surgeons, which are difficult to manage, painful for the patient, and have fairly contrasting outcomes. This entails that many patients require repeat surgeries and that the procedures are complicated and frequently dependent on donors. Hence, an easier-to-use solution is likely to be accepted by doctors and healthcare providers which has greater success rate from a medical and financial standpoint, providing opportunity for market players in this space.

Competitive Landscape Analysis: Orthobiologics Market

The global orthobiologics market is marked by the presence of established market players such as Medtronic Plc (Ireland); Zimmer Biomet Holdings, Inc. (US); Arthrex, Inc. (US); Bioventus (US); DePuy Synthes (Johnson & Johnson Services, Inc.) (US); Stryker Corporation (US); MTF Biologics (US); and others.

Key Strategic Questions Addressed

- What is the market size & forecast of the orthobiologics market?

- What are historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the orthobiologics market?

- What are the key trends defining the orthobiologics market?

- What are the major factors impacting the orthobiologics market?

- What are the opportunities prevailing in the market?

- Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

- Who are the major players operating in the orthobiologics market?

- What are the key strategies adopted by players in orthobiologics market?

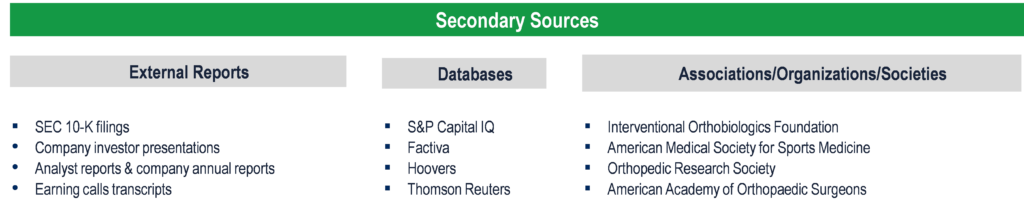

The study has been compiled based on the extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

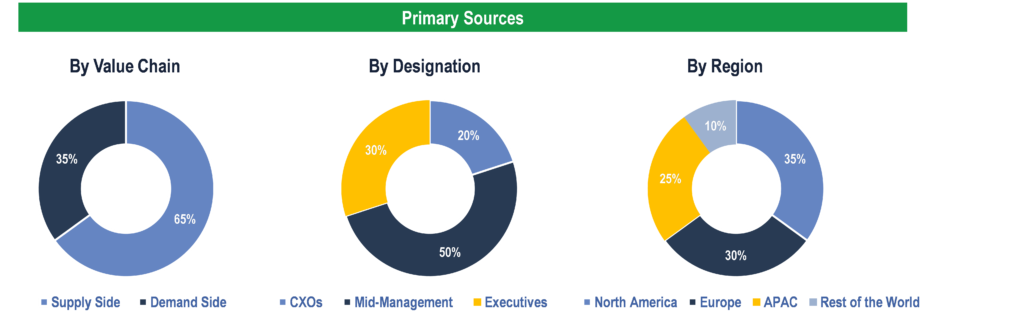

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, R&D Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders in Hospitals, Orthopedic Clinics, Ambulatory Care Centers, Research and Academic Institutes, Dental Clinics and Facilities.

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis were validated with Primary Interviews, Internal Knowledge Repository, and Company Sales Data.