Packaging and Labeling CDMO Market Size, Share, Growth, Trends & Forecasts 2027

The Global Packaging and Labeling CDMO Market is expected to grow at a rate of 9-10% by 2027. The market growth is being propelled by several key factors, including growing demand from OEMs to comply with regulatory requirements, cost savings, technical know-how, risk mitigation, increased drug manufacturing, and the growing prevalence of chronic diseases, infectious diseases, and genetic disorders.

Contract Development and Manufacturing Organizations (CDMOs) specializing in packaging encompass a wide range of services, which include product development, clinical and commercial API production, the manufacturing of medication products, primary and secondary packaging, labeling, sterilization, and distribution. They also provide customized packaging solutions to manufacturers for some complex or specific products.

Demand for Environmentally Friendly Packaging and Labeling, and Compliance with Regulatory Requirements are the Key Factors Fueling the Growth of the Packaging and Labeling CDMO Market

The global packaging and labeling CDMO market is a rapidly growing market. In recent years, CDMOs have experienced significant transformations in their packaging and labeling practices, reflecting a multifaceted evolution within the industry. Primarily, sustainability has emerged as a dominant factor, with an emphasis on environmentally friendly packaging and labeling solutions.

For instance,

- In January 2021, Jabil Inc. has revealed its acquisition of Ecologic Brands, Inc., a prominent sustainable packaging company. This strategic move represents a substantial enhancement to Jabil's sustainable packaging portfolio.

Furthermore, in sectors such as pharmaceuticals and healthcare, stringent regulations have increased the demand for serialization and track-and-trace solutions. CDMOs are incorporating advanced technologies like QR codes, RFID, etc. to ensure adherence to regulatory requirements, enhance transparency within the supply chain, and combat counterfeiting. Security features, such as tamper-evident seals and holograms, are gaining prominence due to rising concerns surrounding product tampering and counterfeiting.

As CDMOs seek to serve diverse regions, understanding distinct regulatory frameworks and consumer preferences that influence packaging and labeling decisions has become a necessity. The COVID-19 pandemic has emphasized the importance of having resilient supply chains. Contract Development and Manufacturing Organizations (CDMOs) are broadening their supplier networks and exploring local sourcing alternatives to reduce their exposure to future vulnerabilities. These trends reflect the evolving landscape of packaging and labeling in the CDMO industries, driven by a combination of regulatory requirements, technological advancements, and a growing focus on sustainability and patient safety. Companies in these sectors are continually adapting to overcome these challenges.

For instance,

In October 2022, Aphena Pharma Solutions Inc. announced the completion of its $20 million expansion and renovation project which includes a new 500,000-square-foot facility for solid dose packaging. The facility includes the addition of four high-speed bottling lines and two high-speed blister lines, enhancing the company's capabilities for packaging solid-based products.

Key Factors Driving the Global Packaging and Labeling CDMO Market

The global packaging and labeling CDMO market is projected to witness a healthy growth rate over the forecast period. Filling and packaging play a pivotal role in the overall contract manufacturing process. The requirement for a specialty packaging service has given rise to an alternate industry of contract manufacturing. Most companies are now outsourcing the packaging task to companies who are skilled in handling the packaging of drugs and devices.

The rising geriatric population, stringent regulatory requirements of governing agencies, and advanced packaging technologies are some of the factors that will boost the growth of the packaging and labeling CDMO market across the world. In addition, the lack of in-house packaging capabilities, expertise, and budget constraints for small companies is also expected to accelerate the market growth.

Producing innovative and customized packaging has uncertainties, which have inspired manufacturers to opt for contract packaging services that have capable know-how technology and mandatory infrastructure. Also, there is an upsurge in the requirement for drug delivery devices and blister packaging which is further fueling the market growth.

For instance,

- In June 2023, Catalent announced that its OneBio® Suite, an integrated solution encompassing development, manufacturing, and supply, has been expanded to encompass various biologic modalities. This suite provides customers with an all-inclusive service designed to expedite the progression of programs from development to manufacturing. This includes activities such as fill/finish, packaging, and assistance with clinical supply and commercial launch.

Key Market Constraints/Challenges: Packaging and Labeling CDMO Market

Factors such as intellectual property concerns and a reduction in the number of FDA approvals in developed nations are likely to hamper the growth of the packaging and labeling CDMO market in the forecast period.

North America Accounts for the Largest Share in the Global Packaging and Labeling CDMO Market

North America is expected to continue to dominate the global packaging and labeling CDMO market in the coming years. This can be mainly attributed due to the rising elderly population, robust R&D, and the presence of key players in the region. However, the Asia-Pacific region is expected to witness the highest CAGR in the forecast period. Factors such as technological advancements in the field of packaging and rising investments in the healthcare sector are driving the Asia-Pacific market.

Competitive Landscape Analysis: Packaging and Labeling CDMO Market

Some of the key players operating in the global packaging and labeling CDMO market are Aphena Pharma Solutions, Eurofins Scientific, Catalent, PCI Pharma, Pfizer CentreOne, Becton, Dickinson & Co, Almac Group, Jabil, Tecomet and Integer.

Organic and Inorganic Growth Strategies Adopted by the Key Market Players to Establish Their Foothold in the Global Packaging and Labeling CDMO Market

Leading players operating in this global market are adopting both organic and inorganic growth strategies such as collaborations, acquisitions, and new product launches to garner a larger market share.

For instance,

- In March 2022, Almac Pharma Services introduced its distinctive Ultra-Low Temperature Solutions of commercial packaging, labeling, and distribution services, in order to facilitate the introduction of Advanced Therapy Medicinal Products (ATMPs) from its European Centre of Excellence. Almac customized services for Just-in-Time labeling, packaging, and serialization under ultra-low temperatures (ranging from -20°C to -80°C) will provide clients with an exclusively tailored experience, ensuring that each facet of this intricately detailed process is finely adjusted to meet the precise needs of both the client and their valuable product.

- In February 2022, Thermo Fisher Scientific unveiled an innovative offering known as the Patheon Commercial Packaging Services for Cell and Gene Therapies (CGT). This solution brings together a range of critical elements, including GMP storage, serialization, ultracold and cryogenic packaging, and worldwide distribution. These integrated services are crafted to cater to the unique requirements of cell and gene therapies, from the initial manufacturing stages to packaging, labeling, and distribution.

The global packaging and labeling CDMO market is a growing market and is expected to gain a further momentum in the upcoming years due to a strong emphasis on developing new drugs and devices, growing investments in the R&D activities to introduce several advanced products, and aggressive organic and inorganic growth strategies followed by the key market players.

Key Strategic Questions Addressed in this Research report are as follows:-

- What is the market size & forecast for the Global Packaging and Labeling CDMO Market?

- What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the Global Packaging and Labeling CDMO Market?

- How has COVID-19 impacted the Global Packaging and Labeling CDMO Market?

- What are the major growth drivers, restraints/challenges impacting the market?

- What are the opportunities prevailing in the Packaging and Labeling CDMO Market?

- What is the investment landscape of Packaging and Labeling CDMO Market?

- Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

- Who are the major players operating in the Packaging and Labeling CDMO Market? What is the competitive positioning of key players?

- Who are the new players entering the Packaging and Labeling CDMO Market?

- What are the key strategies adopted by players in Packaging and Labeling CDMO Market?

1. Research Methodology

1.1. Secondary Research

1.2. Primary Research

1.3. Market Estimation

1.4. Market Forecasting

2. Executive Summary

3. Market Overview

3.1. Market Dynamics

3.1.1. Drivers

3.1.2. Restraints

3.1.3. Key Market Trends

3.2. Industry Speaks

4. Global Packaging & Labeling CDMO Market - Size & Forecast (2019-2027), By Services

4.1. Primary & Secondary Packaging

4.2. Serialization and Track & Trace

4.3. Label Design & Printing

4.4. Compliance & Regulatory Services

4.5. Supply Chain Management

4.6. Other Services

5. Global Packaging & Labeling CDMO Market - Size & Forecast (2019-2027), By Sector

5.1. Pharmaceutical/Biopharma Companies

5.2. Biotechnology Companies

5.3. MedTech Companies

5.4. Others

6. Global Packaging & Labeling CDMO Market - Size & Forecast (2019-2027), By Region

6.1. North America (U.S. & Canada)

6.2. Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

6.3. Asia Pacific (China, India, Japan, Rest of Asia Pacific)

6.4. Rest of the World (Latin America, Middle East & Africa)

7. Competitive Landscape

7.1. Key Players and their Competitive Positioning

7.1.1. Competitive Positioning of Key Players (2022)

7.1.2. Offerings Assessment, By Player

7.2. Key Strategies Assessment, By Player (2021-2023)

7.2.1. New Product & Service Launches

7.2.2. Partnerships, Agreements, & Collaborations

7.2.3. Mergers & Acquisitions

7.2.4. Geographic Expansion

8. Key Companies Scanned (Indicative List)

8.1. Aphena Pharma Solutions

8.2. Eurofins Scientific

8.3. Catalent

8.4. PCI Pharma

8.5. Pfizer CentreOne

8.6. Becton, Dickinson & Co

8.7. Almac Group

8.8. Jabil

8.9. Tecomet

8.10. Integer

8.11. Other Prominent Players

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

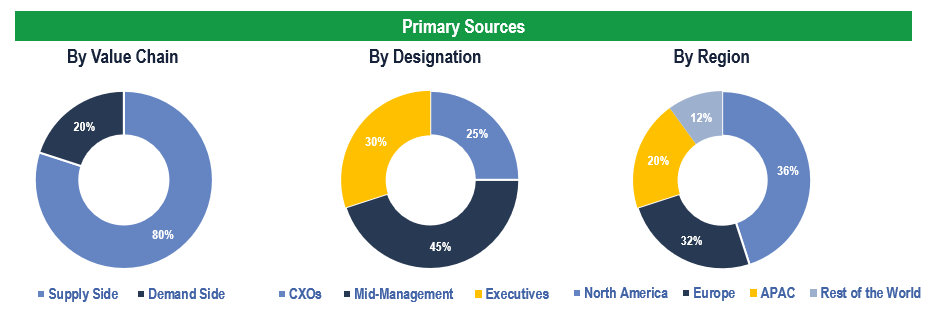

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, R&D Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders in biotechnology, pharmaceutical, life sciences, medical device companies, among others.

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis was validated with Primary Interviews, Internal Knowledge Repository and Company’s Sales Data.