Global Single-Use Bioreactors Market Size, Share, Industry Analysis, Growth, Trends & Applications for Forecasts 2029

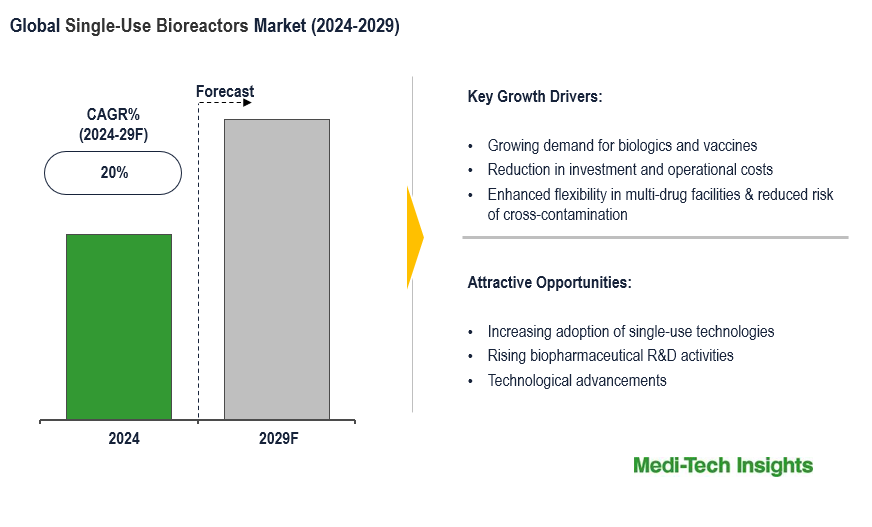

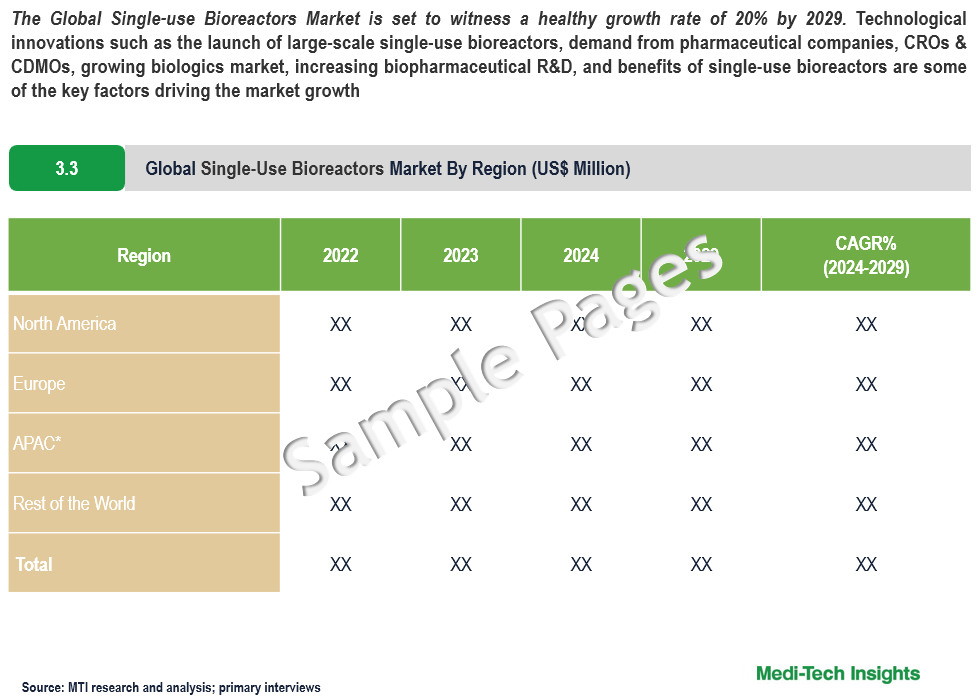

The Global Single-use Bioreactors Market is set to witness a healthy growth rate of 20% by 2029. Technological innovations such as the launch of large-scale single-use bioreactors, demand from pharmaceutical companies, CROs & CDMOs, growing biologics market, increasing biopharmaceutical R&D, and benefits of single-use bioreactors are some of the key factors driving the market growth. To learn more about the research report, download a sample report.

Single-use bioreactors use the disposable bag as a substitute for a culture vessel made of stainless steel or glass. It is widely used by pharmaceutical companies for cell harvesting, media & buffer preparation, filtration, purification, and virus inactivation.

Due to their Ability to Enhance Flexibility, Reduce Investment & Limit Operational Costs, Single-use Bioreactors Have Become Established in Modern Biopharmaceutical Processes

Enhanced flexibility is one of the biggest benefits of single-use bioreactors. There is a growing trend towards multi-drug facilities, which warrants the production of different drugs using the same facility with minimum time & cost and top-notch quality. In such scenarios, one of the key manufacturing challenges is line clearance and validation of cleaning to ensure there is no carry-over from earlier batches. Downtime limits the number of batches produced in a given period.

Single-use bioreactors significantly reduce the time spent preparing the bioreactor for the subsequent batch. A line changeover with a stainless-steel bioreactor can take ~6 to 10 hours and three weeks for a full product changeover while by using single-use bioreactors it is likely to take 2 hours for line changeover. If the manufacturing line is composed of all single-use components such as bags, filters, and connectors, the total time for product changeover can be 48 hours. Single-use bioreactors possess the capability to reduce downtime from two to three weeks to 48 hours, which in turn can significantly impact a company's output.

Some of the other key advantages of using single-use bioreactors are:

- Elimination of validation issues as no cleaning process is required

- Lowers the risk of cross-contamination

- Reduces operating costs and capital investments (including space, labour requirements, and utilities)

- Single-use bags are scalable and can be adjusted to different volumes

- Simple installation

To learn more about this report, download the PDF brochure

Potential Time Savings for Highly Trained Personnel Another Key Benefit of Single-use Bioreactors

Generally, drug development research, process development, and scale-up activities are performed by highly qualified and trained personnel. These individuals are involved in every stage of a study from early-stage research through to benchtop manufacturing. With stainless steel or glass benchtop bioreactors, individual components need to be cleaned, assembled, leak-tested, sterilized, and cooled before every trial batch is taken. However, the use of single-use bioreactors almost eliminates these steps, which allows scientists more time to focus on their developmental studies.

Technological Advancements & Customer-Centric Approach – A Key Factor Bolstering the Demand of Single-use Bioreactors

Commercially available single-use bioreactors are robust and provide the high performance necessary for commercial manufacturing of biopharmaceuticals. Significant advancements in bioreactor design, film technologies, stirring mechanisms, and sensor systems have contributed to the increasing adoption of single-use bioreactors from the lab to the production scale.

To cater to the changing needs of the customers such as next-generation cell- and gene-therapies and continuous bioprocessing, suppliers of single-use bioreactors often work closely with its customers, which in turn is expected to fuel the demand for single-use bioreactors.

“The uptake of single-use bioreactors is mainly driven by the activity of the different regions regarding the development of new disease treatments and biosimilars. In addition, existing production capacity comes into play and company strategies regarding the manufacture of clinical material. As the USA is indeed leading in the field of developing innovative treatments, we see a strong uptake of single-use bioreactors, but Europe and Asia are not far behind.”

- CEO, Leading Manufacturer of Single-use Bioreactors, United States

Introduction of Large-Scale Single-use Bioreactors Set to Drive the Market

Traditionally, single-use bioreactors were restricted in size due to pressure challenges from the increased weight of the liquid medium in larger volume bags with 2,000 L being the upper limit. Therefore, if bio manufacturers required larger volumes, they had to run several systems in unison or opt for stainless-steel tanks.

However, in the last few years, considering strong demand from pharmaceutical companies and contract development and manufacturing organizations (CDMOs), several single-use bioreactor manufacturers have launched large-scale single-use bioreactors which are expected to fuel the market growth in the coming years.

Aligned with this trend,

- In March 2023, Getinge is expanding its bioreactor line with the Single-Use Production Reactor (SUPR) system, available initially in 50-litre and 250-litre sizes, to help expedite the delivery of life-saving medicines and improve quality of life

- In March 2021, Thermo Fisher launched 3,000 L and 5,000 L HyPerforma DynaDrive single-use bioreactors. It is touted as a next-level innovation in single-use bioreactors with unmatched design, scalability, and performance. The system provides improved performance and scalability to larger volumes and is suitable for fed-batch and perfusion processes

To learn more about this report, download the PDF brochure

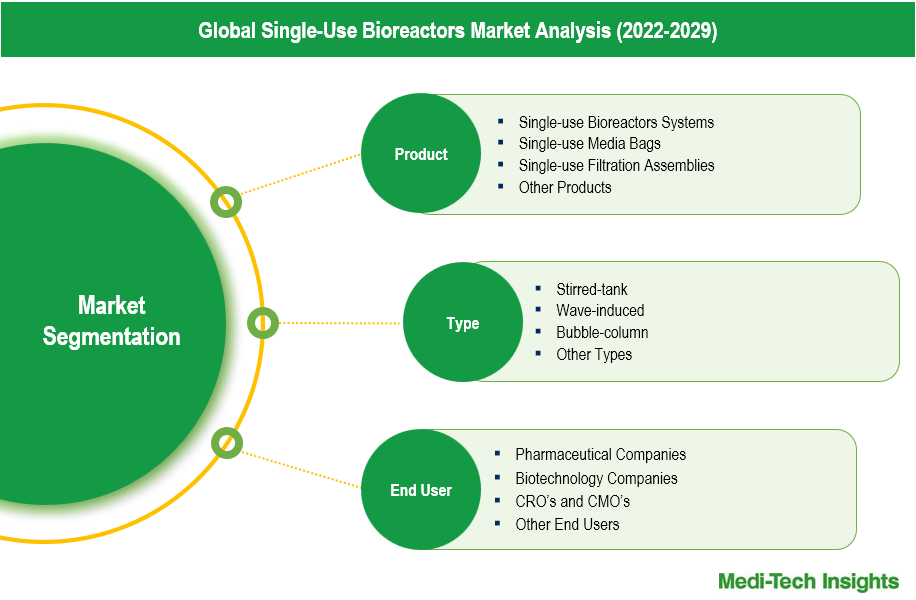

Stirred-tank Single-use Bioreactors Accounts for the Largest Share in the Single-use Bioreactors Market

The stirred-tank single-use bioreactors dominate the single-use bioreactors market. They are commonly employed for culturing biological agents such as cells, enzymes, or antibodies, and GMP production of monoclonal antibodies (MAb) therapeutics and other biological. Stirred-tank single-use bioreactors are mainly used to scale up a process from the research and development scale to the manufacturing scale. Available sizes range from 15 mL to 2000 L for single-use and larger than 2000 L for stainless steel. The benefits of good fluid mixing and oxygen transferability, easy scale-up, low operating costs, compliance with current good manufacturing practice requirements, good temperature control, and alternative impellers are some of the key factors bolstering its demand.

Single-use Bioreactor Systems: Pioneering Flexibility and Cost-Reduction in Bioprocessing

Single-use bioprocessing solutions, including Single-use Bioreactor Systems, Single-use Media Bags, and Single-use Filtration Assemblies, are revolutionizing the pharmaceutical industry. Dominating this segment, Single-use Bioreactor Systems replace traditional stainless steel or glass vessels with disposable bags, enhancing flexibility, reducing capital investment, and lowering operational costs. These systems are widely used for cell harvesting, media preparation, and virus inactivation due to their scalability and efficiency.

Complementing these bioreactor systems, Single-use Media Bags provide scalable and pre-sterilized options that minimize cross-contamination risks and eliminate cleaning validation needs, ensuring process integrity. Additionally, Single-use Filtration Assemblies offer ready-to-use, pre-sterilized solutions for purification and filtration, streamlining operations and meeting stringent GMP standards. Together, these single-use components enable a flexible, cost-effective, and efficient approach to biopharmaceutical manufacturing.

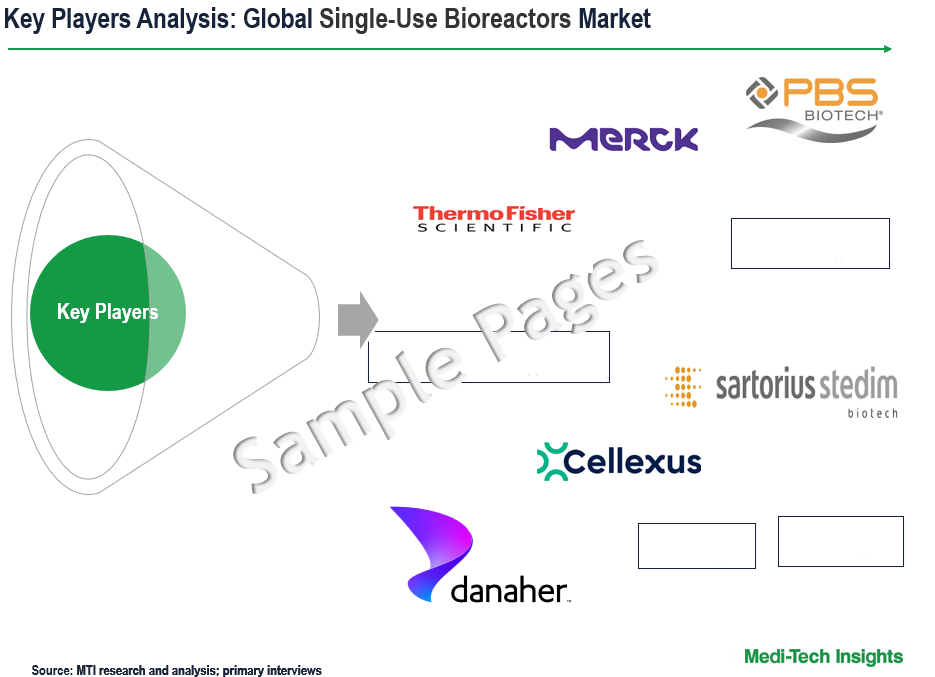

Competitive Landscape Analysis

Some of the key players operating in the market are Sartorius Stedim Biotech, Thermo Fisher Scientific, Danaher Corporation, Merck KGaA, Celltainer Biotech BV, Getinge AB, Eppendorf AG, Cellexus, PBS Biotech Inc., ABEC, Able Corporation & Biott Corporation, G&G Technologies Inc., Solida Biotech GmbH, and Satake Chemical Equipment Mfg among others.

Get a sample report for competitive landscape analysis

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the Market

Players operating in this market are adopting both organic and inorganic growth strategies such as collaborations, acquisitions, and new product launches to garner market share. For instance,

- In August 2023, Sartorius and Repligen Corporation have launched an integrated bioreactor system combining Sartorius’ Biostat STR® and Repligen’ s XCell® ATF technology, featuring a single direct control interface to simplify upstream process intensification and optimize facility equipment and maintenance requirements for biopharmaceutical manufacturers

- In March 2022, Cellexus has partnered with Verder Liquids to supply pumps for controlling pH balance in their CellMaker Plus and Low Flow bioreactor systems, enabling manual or automated injection of acids or alkali into the bioreactor bag

- In July 2021, Cytiva and Pall Corporation announced a $1.5 billion investment over two years to expand manufacturing capacity for life sciences products at 13 sites, addressing the growing demand for biotechnology solutions

The market is expected to gain further momentum in the coming years due to technological advancements, rising R&D investments, new product launches, and aggressive organic and inorganic growth strategies followed by the players.

Single-Use Bioreactors Market Report Scope

| Report Scope | Details |

| Base Year Considered | 2023 |

| Historical Data | 2022 - 2023 |

| Forecast Period | 2024 - 2029 |

| CAGR (2024-2029) | 20% |

| Segment Scope | Product, Type, Cell, Molecule, Application, and End User |

| Regional Scope |

|

| Key Companies Mapped | Sartorius Stedim Biotech, Thermo Fisher Scientific, Danaher Corporation, Merck KGaA, Celltainer Biotech BV, Getinge AB, Eppendorf AG, Cellexus, PBS Biotech Inc., ABEC, Able Corporation & Biott Corporation, G&G Technologies Inc., Solida Biotech GmbH, and Satake Chemical Equipment Mfg among others |

| Report Highlights | Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

Key Strategic Questions Addressed

-

What is the market size & forecast for the Global Single-Use Bioreactors Market?

-

What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the Global Single-Use Bioreactors Market?

-

How has COVID-19 impacted the Global Single-Use Bioreactors Market?

-

What are the major growth drivers, restraints/challenges impacting the market?

-

What are the opportunities prevailing in the market?

-

What is the investment landscape?

-

Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market? What is the competitive positioning of key players?

-

Who are the new players entering the market?

-

What are the key strategies adopted by players?

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Market Forecasting

- Executive Summary

- Market Overview

-

- Market Dynamics

- Drivers

- Restraints

- Key Market Trends

- Industry Speaks

- Market Dynamics

- Key Revenue Pockets

- Global Single-Use Bioreactors Market - Size & Forecast (2021-2028), By Product

- Single-use Bioreactor Systems

- Up to 10L

- 11-100L

- 100-500L

- 501-1500L

- Above 1500L

- Single-use Media Bags

- 2D Bags

- 3D Bags

- Other Bags

- Single-use Filtration Assemblies

- Other Products

- Single-use Bioreactor Systems

- Global Single-Use Bioreactors Market - Size & Forecast (2021-2028), By Type

- Stirred-tank

- Wave-induced

- Bubble-column

- Other Types

- Global Single-Use Bioreactors Market - Size & Forecast (2021-2028), By Cell Type

- Mammalian Cells

- Bacterial Cells

- Yeast Cells

- Other Cells

- Global Single-Use Bioreactors Market - Size & Forecast (2021-2028), By Molecule Type

- Monoclonal Antibodies

- Vaccines

- Stem Cells

- Gene-modified Cells

- Other Molecules

- Global Single-Use Bioreactors Market - Size & Forecast (2021-2028), By Application Type

- Bioproduction

- Process Development

- Research and Development

- Global Single-Use Bioreactors Market - Size & Forecast (2021-2028), By End User Type

- Pharmaceutical Companies

- Biotechnology Companies

- CRO’s and CMO's

- Other End Users

- Global Single-Use Bioreactors Market - Size & Forecast (2021-2028), By Region

- North America (U.S. & Canada)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, Rest of Asia Pacific)

- Rest of the World (Latin America, Middle East & Africa)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Competitive Positioning of Key Players (2022)

- Offerings Assessment, By Player

- Key Strategies Assessment, By Player (2021-2023)

- New Product & Service Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Key Companies Scanned (Indicative List)

- Sartorius Stedim Biotech

- Thermo Fisher Scientific

- Danaher Corporation

- Merck KGaA

- Celltainer Biotech BV

- Getinge AB

- Eppendorf AG

- Cellexus

- PBS Biotech Inc.

- ABEC

- Able Corporation & Biott Corporation

- G&G Technologies Inc.

- Solida Biotech GmbH

- Satake Chemical Equipment Mfg

- Other Prominent Players

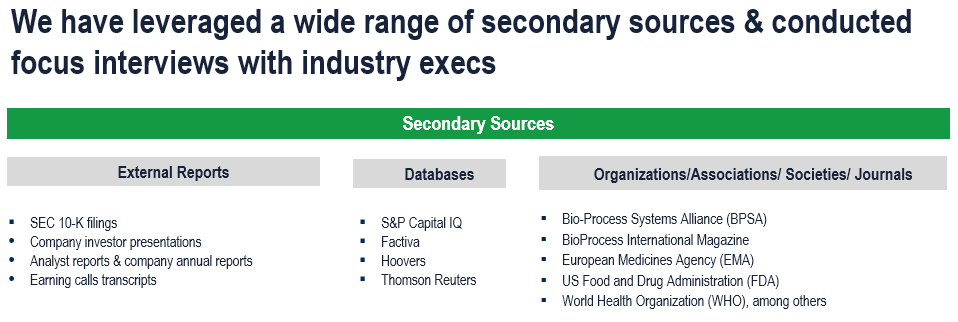

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

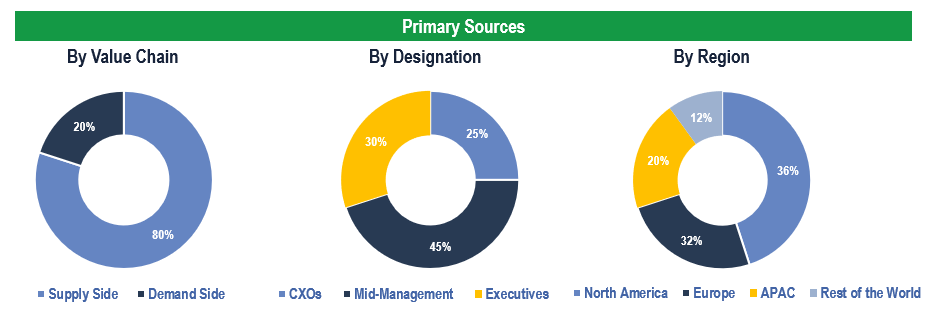

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders in Pharmaceutical & Biopharmaceutical Companies, CROs & CMOs, and Academic & Research Institutes and Other End Users

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis were validated with Primary Interviews, Internal Knowledge Repository, and Company Sales Data.