Global STD Diagnostics Market Size & Trends Report Segmented By Disease Type (Chlamydia, Hepatitis B, Others), Device Type (Laboratory, Point-of-Care), Test Type (Molecular, Immunology Assay, Others), End User & Regional Forecasts to 2029

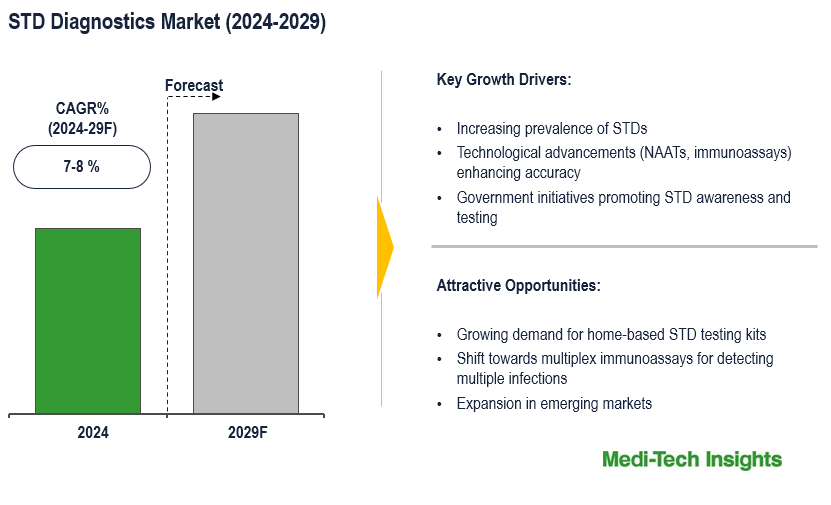

The STD diagnostics market is projected to experience a CAGR of 7-8% in the forecast period. The market growth is primarily fueled by factors such as an increasing prevalence of STDs, advancements in diagnostic technologies, heightened awareness, and growing awareness regarding sexually transmitted diseases (STDs). To learn more about the research report, download a sample report.

Report Overview

Sexually transmitted disease (STD) diagnostics refer to the methods and procedures used to identify and confirm the presence of sexually transmitted infections or diseases in individuals. These diagnostic tools play a crucial role in the early detection and management of STDs, contributing to effective treatment and prevention of further transmission. Some of the STD Diagnostics are classified into the following types:

- Blood Tests: Used for diagnosing infections like syphilis, HIV, and sometimes herpes. Antibodies or markers in the blood indicate the presence of certain STDs

- Urine Tests: Primarily employed to detect infections such as chlamydia and gonorrhoea. Urine samples reveal the presence of specific pathogens.

- Swab Tests: Collect samples from genital, anal, or oral areas for laboratory analysis. Commonly used for detecting chlamydia, gonorrhoea, and herpes infections.

- Molecular Diagnostics: Techniques like polymerase chain reaction (PCR) identify the genetic material of pathogens, offering high sensitivity for various STDs, including HIV and HPV

- Point-of-Care Tests: Rapid tests performed at the point of care, providing quick results without extensive laboratory analysis.

- Serological Tests: Detect antibodies in the blood, essential for identifying infections like syphilis

Overall, STD diagnostics encompass a range of tests and techniques aimed at accurately identifying sexually transmitted infections in individuals. Early detection through these diagnostic methods enables healthcare providers to initiate timely treatment and preventive measures, ultimately reducing the spread of STDs and improving public health outcomes.

To learn more about this report, download the PDF brochure

Insights into Market Momentum: Drivers of STD Diagnostic Industry Growth

The STD diagnostic market is witnessing robust growth driven by several key factors. The increasing prevalence of STDs globally has increased the necessity for efficient diagnostic solutions. This rise in cases also underscores the critical need for prompt detection and treatment. There is a growing emphasis on early detection and prevention of STDs to reduce transmission rates and mitigate the risk of complications such as infertility and certain cancers. This increased awareness among individuals and healthcare providers further drives the market. Moreover, technological advancements in diagnostic techniques have revolutionized the field, providing more accurate and rapid tests, which are crucial for effective disease management. Additionally, government initiatives and education campaigns/programs aimed at controlling the spread of STDs are playing a significant role in driving the market forward by promoting screening and treatment. The rising demand for point-of-care testing and home testing kits is propelling market growth, as individuals seek convenient and accessible options for testing in the comfort of their own homes. These key drivers collectively indicate a promising trajectory for the STD diagnostic market in the forecast period. For instance,

- In December 2023, MedMira Inc. disclosed that the US FDA approved its Advanced Reveal G4 Rapid HIV-1/2 Antibody Test, marking the successful acquisition of 510(k) clearance for the HIV-2 claim on the test in the US

- In May 2023, Simple HealthKit introduced an expanded at-home sexual health kit covering five common STIs in the US: Chlamydia, Gonorrhea, Trichomoniasis, HIV, and Syphilis. The kit is user-friendly, accessible, inclusive, and cost-effective, providing a telehealth visit and aftercare for individuals testing positive for any of the conditions

- In March 2023, BioPerfectus has introduced two new PCR kits, the Mycoplasma Hominis Real Time PCR Kit and Treponema Pallidum Real Time PCR Kit, offering a comprehensive PCR solution for early STD detection

From Labs to Homes: Transformative Trends in STD Diagnostics

Advancements in diagnostic technologies like nucleic acid amplification tests (NAATs), and point-of-care testing have significantly enhanced the precision, sensitivity, and specificity of STD diagnostics, thereby fueling market growth through the provision of more effective and dependable testing methodologies. Moreover, the progression in molecular and immunoassay tests serves as a solid foundation for future innovations such as Next-Generation Sequencing (NGS), CRISPR-based diagnostics, multiplex immunoassays, and microfluidic technologies, promising enhanced accuracy and convenience in STD testing, thus fostering increasingly optimistic prospects for early detection, treatment, and prevention of STDs. For instance,

- In May 2022, Abbott received FDA clearance for its Alinity m STI Assay, a multiplex test designed to detect and differentiate four common sexually transmitted infections (STIs). Operating on the Alinity m system, this advanced molecular PCR platform offers fast results in high volumes, enhancing the efficiency of STI diagnostics

The escalating adoption of point-of-care testing (POCT) for STD diagnostics is notable, driven by its inherent benefits such as swift results, convenience, and its suitability for diverse settings like community health clinics, outreach programs, and remote areas where laboratory facilities are scarce. Simultaneously, there's an increasing demand for home-based STD testing kits, propelled by concerns regarding privacy, convenience, and the inclination towards self-monitoring. This trend has spurred companies to intensify the development and marketing of home testing kits for various STDs, consequently broadening the market scope.

Key Constraints/Challenges

However, the anticipated growth of the STD diagnostics market during the projected timeframe may encounter impediments due to the elevated expenses linked with advanced diagnostic devices and the enforcement of rigorous regulatory measures. Additionally, the persistent social stigma surrounding clinic visits for sexual diseases is poised to pose a significant challenge to the market in the forecast period. Overcoming these obstacles will require innovative approaches and comprehensive strategies aimed at reducing costs, enhancing accessibility, and destigmatizing STD testing to ensure the sustained growth and efficacy of the market.

Regional Segmentation of the STD Diagnostics Market

In North America, the adoption of advanced diagnostic technologies is notably high, owing to well-established healthcare infrastructure and widespread awareness. Government initiatives and private sector investments further propel market growth, responding to increasing rates of STDs, particularly within specific demographics. Similarly, Europe showcases advanced healthcare systems and a robust awareness regarding STD screening and diagnosis. Although the region benefits from technological advancements, the approval processes for products may differ among individual countries due to regulations specific to each nation.

In the Asia Pacific region, rapid economic growth, escalating healthcare expenditure, and heightened awareness about STDs foster market expansion. Large population bases, notably in countries like China and India, present substantial market opportunities, with particularly high adoption of point-of-care testing in remote or underserved areas.

To learn more about this report, download the PDF brochure

Competitive Landscape Analysis

The global STD diagnostics market is marked by the presence of established and emerging market players including Abbott Laboratories; MedMira Inc; Cepheid (Danaher Corporation); F. Hoffmann-La Roche AG; Thermo-Fisher Scientific Inc.; Hologic Inc.; Biocartis; bioMeriuex; Diasorin S.p.A; Bio-Rad Laboratories; and Qiagen among others. Leading companies are focusing on key strategies such as product innovation and development, forming strategic partnerships and collaborations, and expanding their geographic presence to strengthen their market position.

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the Market

Players operating in this market are adopting both organic and inorganic growth strategies such as collaborations, and acquisitions to garner market share. For instance,

- In October 2024, Labcorp expanded its STI testing offerings by exclusively distributing NOWDiagnostics’ FDA-authorized First to Know Syphilis Test, a blood test that can be performed both by physicians and patients

- In May 2022, BD (Becton, Dickinson, and Company) launched the fully automated BD COR™ MX molecular diagnostic platform in the U.S., featuring FDA-cleared BD CTGCTV2 molecular assays to detect Chlamydia trachomatis, Neisseria gonorrhoeae, and Trichomonas vaginalis, streamlining high-throughput STI testing in large labs

The STD diagnostics market is expected to gain momentum in the coming years due to the rising incidences of STD infections, growing awareness about STDs and the importance of early detection, technological advancements, and aggressive organic and inorganic growth strategies followed by the players.

Report Scope

| Report Metric | Details |

| Base Year Considered | 2023 |

| Historical Data | 2022 - 2023 |

| Forecast Period | 2024 - 2029 |

| Growth Rate | CAGR of 7-8% |

| Market Drivers |

|

| Attractive Opportunities |

|

| Segment Scope | Disease Type, Device Type, Test Type and End User |

| Regional Scope |

|

| Key Companies Mapped | Abbott Laboratories; MedMira Inc; Cepheid (Danaher Corporation); F. Hoffmann-La Roche AG; Thermo-Fisher Scientific Inc.; Hologic Inc.; Biocartis; bioMeriuex; Diasorin S.p.A; Bio-Ra d Laboratories; and Qiagen among others |

| Report Highlights | Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

Market Segmentation

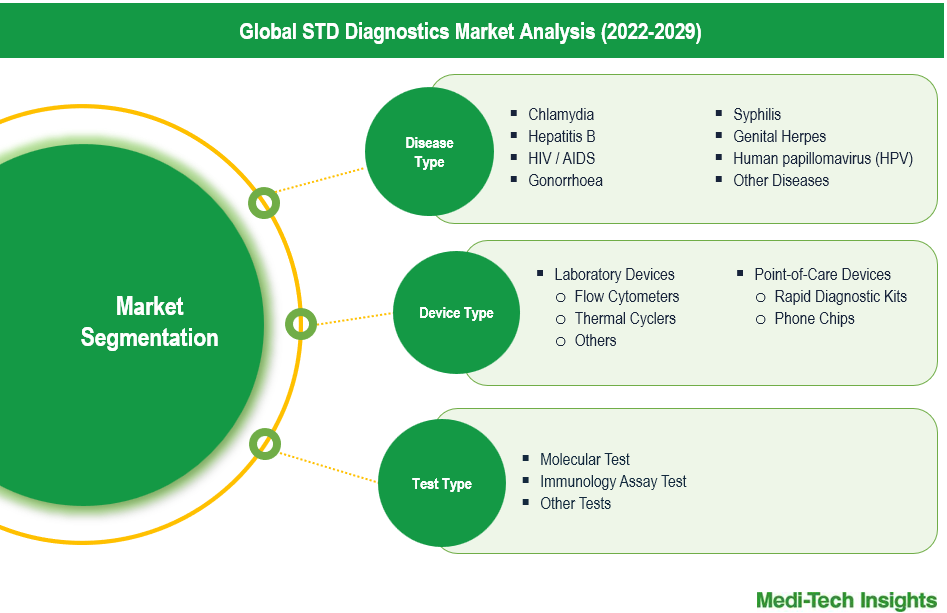

This report by Medi-Tech Insights provides size of the STD diagnostics market at the regional- and country-level from 2022 to 2029. The report further segments the market on the basis of disease type, device type, test type, and end user.

- Market Size & Forecast (2022-2029), By Disease Type, USD Million

- Chlamydia

- Hepatitis B

- HIV / AIDS

- Gonorrhoea

- Syphilis

- Genital Herpes

- Human papillomavirus (HPV)

- Other Diseases

- Market Size & Forecast (2022-2029), By Device Type, USD Million

- Laboratory Devices

- Flow Cytometers

- Thermal Cyclers

- Others

- Point-of-Care Devices

- Rapid Diagnostic Kits

- Phone Chips

- Laboratory Devices

- Market Size & Forecast (2022-2029), By Test Type, USD Million

- Molecular Test

- Immunology Assay Test

- Other Tests

- Market Size & Forecast (2022-2029), By End User, USD Million

- Hospitals

- Clinical Laboratories

- Academic & Research Institutes

- Others

- Market Size & Forecast (2022-2029), By Region, USD Million

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

- North America

Key Strategic Questions Addressed

- What is the market size & forecast of the STD diagnostics market?

- What are historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the STD diagnostics market?

- What are the key trends defining the market?

- What are the major factors impacting the market?

- What are the opportunities prevailing in the market?

- Which region has the highest share in the global market?

- Which region is expected to witness the highest growth rate in the next 5 years?

- Who are the major players operating in the market?

- What are the key strategies adopted by players?

- Introduction

- Introduction

- Market Scope

- Market Definition

- Segments Covered

- Regional Segmentation

- Research Timeframe

- Currency Considered

- Study Limitations

- Stakeholders

- List of Abbreviations

- Key Conferences and Events (2023-2024)

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Bottom-Up Approach

- Top-Down Approach

- Market Forecasting

- Executive Summary

- STD Diagnostics Market Snapshot (2023-2029)

- Segment Overview

- Regional Snapshot

- Competitive Insights

- Market Overview

- Market Dynamics

- Drivers

- Increasing prevalence of STDs

- Technological advancements (NAATs, immunoassays) enhancing accuracy

- Government initiatives promoting STD awareness and testing

- Focus on early diagnosis to prevent complications

- Increased investments in R&D

- Restraints

- High costs associated with advanced diagnostic tools

- Stringent regulatory requirements and compliance hurdles

- Social stigma deterring clinic visits and early diagnosis

- Opportunities

- Growing demand for home-based STD testing kits

- Shift towards multiplex immunoassays for detecting multiple infections

- Key Market Trends

- Adoption of Next-Generation Sequencing (NGS) for better diagnosis

- Potential for AI-driven diagnostic tools for quicker results and analysis

- Unmet Market Needs

- Industry Speaks

- Regulatory Analysis

- Drivers

- Market Dynamics

- Global STD Diagnostics Market Size & Forecast (2022-2029), By Disease Type, USD Million

- Introduction

- Chlamydia

- Hepatitis B

- HIV / AIDS

- Gonorrhoea

- Syphilis

- Genital Herpes

- Human papillomavirus (HPV)

- Other Diseases

- Global STD Diagnostics Market - Size & Forecast (2021-2028), By Device Type

- Introduction

- Laboratory Devices

- Flow Cytometers

- Thermal Cyclers

- Others

- Point-of-Care Devices

- Rapid Diagnostic Kits

- Phone Chips

- Global STD Diagnostics Market - Size & Forecast (2021-2028), By Test Type

- Introduction

- Molecular Test

- Immunology Assay Test

- Other Tests

- Global STD Diagnostics Market - Size & Forecast (2021-2028), By End User

- Introduction

- Hospitals

- Clinical Laboratories

- Academic & Research Institutes

- Other End Users

- Global STD Diagnostics Market Size & Forecast (2022-2029), By Region, USD Million

- Introduction

- North America STD Diagnostics Market Size & Forecast (2022-2029), By Country, USD Million

- US

- Market Size & Forecast, By Disease (USD Million)

- Market Size & Forecast, By Device (USD Million)

- Market Size & Forecast, By Test (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Canada

- Market Size & Forecast, By Disease (USD Million)

- Market Size & Forecast, By Device (USD Million)

- Market Size & Forecast, By Test (USD Million)

- Market Size & Forecast, By End User (USD Million)

- US

- Europe STD Diagnostics Market Size & Forecast (2022-2029), By Country, USD Million

- UK

- Market Size & Forecast, By Disease (USD Million)

- Market Size & Forecast, By Device (USD Million)

- Market Size & Forecast, By Test (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Germany

- Market Size & Forecast, By Disease (USD Million)

- Market Size & Forecast, By Device (USD Million)

- Market Size & Forecast, By Test (USD Million)

- Market Size & Forecast, By End User (USD Million)

- France

- Market Size & Forecast, By Disease (USD Million)

- Market Size & Forecast, By Device (USD Million)

- Market Size & Forecast, By Test (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Italy

- Market Size & Forecast, By Disease (USD Million)

- Market Size & Forecast, By Device (USD Million)

- Market Size & Forecast, By Test (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Spain

- Market Size & Forecast, By Disease (USD Million)

- Market Size & Forecast, By Device (USD Million)

- Market Size & Forecast, By Test (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Rest of Europe

- Market Size & Forecast, By Disease (USD Million)

- Market Size & Forecast, By Device (USD Million)

- Market Size & Forecast, By Test (USD Million)

- Market Size & Forecast, By End User (USD Million)

- UK

- Asia Pacific (APAC) STD Diagnostics Market Size & Forecast (2022-2029), By Country, USD Million

- China

- Market Size & Forecast, By Disease (USD Million)

- Market Size & Forecast, By Device (USD Million)

- Market Size & Forecast, By Test (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Japan

- Market Size & Forecast, By Disease (USD Million)

- Market Size & Forecast, By Device (USD Million)

- Market Size & Forecast, By Test (USD Million)

- Market Size & Forecast, By End User (USD Million)

- India

- Market Size & Forecast, By Disease (USD Million)

- Market Size & Forecast, By Device (USD Million)

- Market Size & Forecast, By Test (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Rest of Asia Pacific

- Market Size & Forecast, By Disease (USD Million)

- Market Size & Forecast, By Device (USD Million)

- Market Size & Forecast, By Test (USD Million)

- Market Size & Forecast, By End User (USD Million)

- China

- Latin America (LATAM) STD Diagnostics Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Disease (USD Million)

- Market Size & Forecast, By Device (USD Million)

- Market Size & Forecast, By Test (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Middle East & Africa (MEA) STD Diagnostics Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Disease (USD Million)

- Market Size & Forecast, By Device (USD Million)

- Market Size & Forecast, By Test (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Key Player Comparison

- Segment-wise Player Mapping

- Market Share Analysis (2023)

- Company Categorization Matrix

- Dominants/Leaders

- New Entrants

- Emerging Players

- Innovative Players

- Key Strategies Assessment, By Player (2022-2024)

- New Product Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Company Profiles*

(Business Overview, Financial Performance**, Products Offered, Recent Developments)

- Abbott Laboratories

- MedMira Inc

- Cepheid (Danaher Corporation)

- Hoffmann-La Roche AG

- Thermo-Fisher Scientific Inc.

- Hologic Inc.

- Biocartis

- bioMeriuex

- Diasorin S.p.A

- Bio-Rad Laboratories

- Qiagen

- Other Prominent Players

Note: *Indicative list

**For listed companies

The study has been compiled based on extensive primary and secondary research.

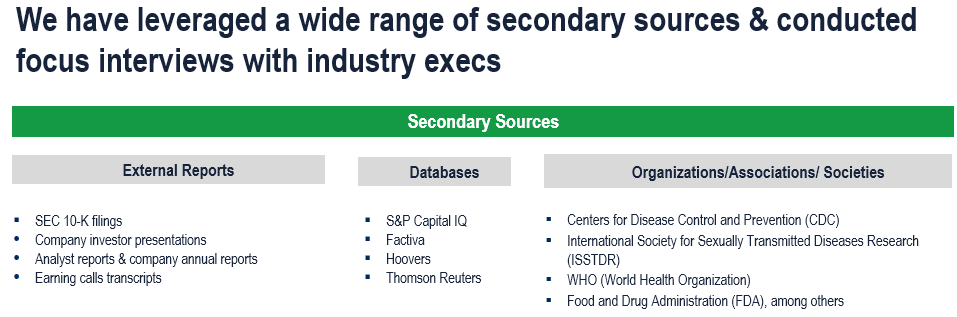

Secondary Research (Indicative List)

Primary Research

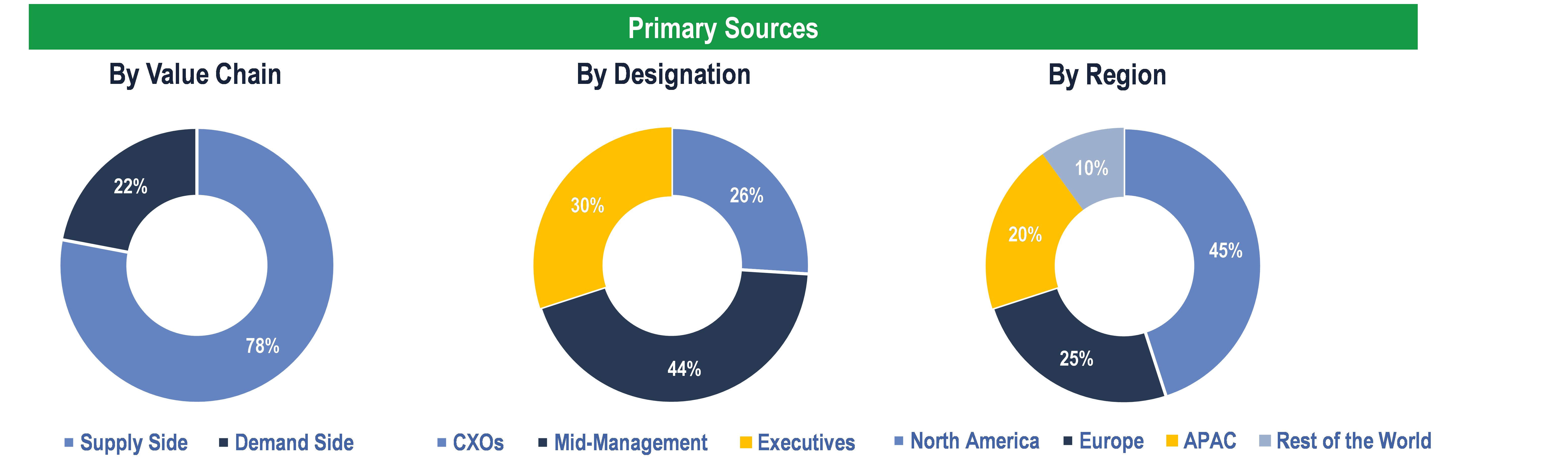

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, R&D Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Hospitals, Clinical Laboratories, Academic & Research Institutes and Others

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down & Bottom-Up Approaches’ were used to derive market size estimates and forecasts

Data Triangulation

Research findings derived through secondary sources & internal analysis was validated with Primary Interviews, Internal Knowledge Repository and Company’s Sales Data