Alzheimer’s Drugs Market Size, Analysis, Innovations, Challenges, and Global Perspectives 2024 to 2029

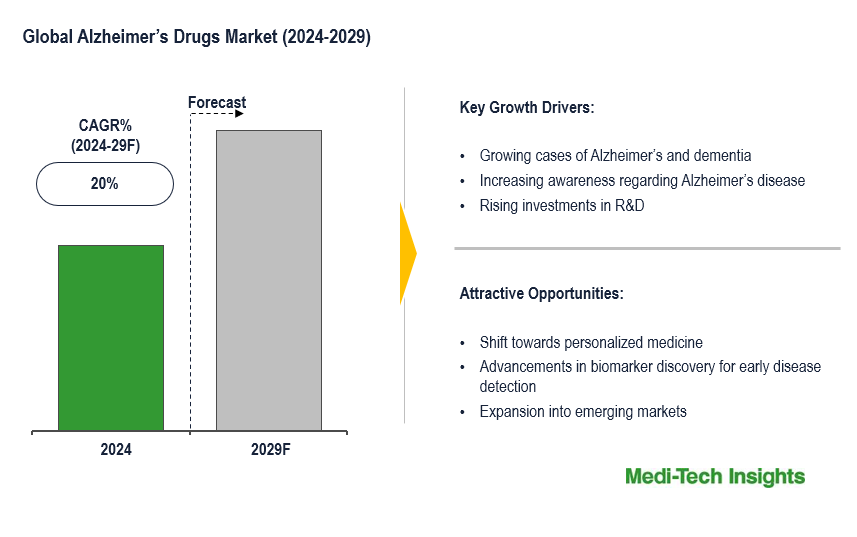

The Alzheimer’s Drugs Market is anticipated to experience a compound annual growth rate (CAGR) of approximately 20% over the forecast period. This growth is largely driven by the increasing incidence of Alzheimer’s disease, an aging global population, innovations in drug discovery and development, and greater awareness and diagnosis of the condition. Additionally, the market’s expansion is bolstered by increased investments in research and development (R&D) and the emergence of novel drug therapies aimed at addressing the root causes of Alzheimer’s, rather than merely managing its symptoms. To learn more about the research report, download a sample report.

Alzheimer’s disease is a progressive neurodegenerative disease marked by a gradual decline in cognitive abilities, significant memory loss, and distinct shifts in behaviour. It is the most prevalent cause of dementia, especially among the elderly, posing substantial challenges to healthcare systems worldwide. The disease places a growing burden on caregiving and healthcare resources, particularly as the global population ages. Although the precise cause of Alzheimer’s remains unclear, it is strongly associated with the abnormal buildup of amyloid plaques and tau tangles in the brain. These pathological changes lead to neuronal damage, synaptic dysfunction, and the eventual death of brain cells, contributing to the cognitive decline and other symptoms that define the disease.

Key Strategies in Alzheimer's Drug Development

The treatment landscape for Alzheimer’s disease is continuously evolving, with several promising strategies in play:

Cholinesterase Inhibitors: These medications enhance the levels of acetylcholine, a neurotransmitter that plays a crucial role in memory and cognition. Common inhibitors include Donepezil, Rivastigmine, and Galantamine, which are typically prescribed for managing symptoms in the early to moderate stages of Alzheimer’s

NMDA Receptor Antagonists: Memantine, an NMDA receptor antagonist, helps regulate glutamate activity, a neurotransmitter that can lead to neuronal damage when present in excess. It is often used to treat moderate to severe Alzheimer’s

Amyloid-targeting Therapies: These treatments aim to reduce the buildup of amyloid plaques in the brain, which are believed to contribute to the progression of Alzheimer’s. The recent FDA approvals of drugs like Aducanumab and Lecanemab, which target amyloid-beta, represent significant advancements in this category

Tau-targeting Therapies: Tau proteins play a role in stabilizing microtubules within neurons. However, in Alzheimer’s disease, abnormal tau proteins form tangles that disrupt neuronal function. Ongoing research into tau-targeting drugs, such as anti-tau antibodies, holds the potential for new treatment options

Anti-inflammatory and Neuroprotective Agents: These therapies aim to reduce neuroinflammation and protect neurons from damage. Emerging treatments focus on modulating the brain's immune response to prevent or slow disease progression

Driving Forces Behind the Alzheimer’s Drugs Market

The Alzheimer’s drug market is poised for substantial growth, driven by a convergence of several factors. The rising global geriatric population and the increasing prevalence of Alzheimer’s and dementia cases form the core of this growth. Coupled with this are technological advancements and innovative product developments, which are reshaping treatment options. Rising investments in research and development by market leaders are accelerating the pace of breakthroughs while growing awareness and government funding further propel the market forward. Additionally, the emergence of personalized medicine, the expansion of digital health solutions, and the adoption of biomarkers and advanced diagnostics are enhancing early detection and tailored care approaches. Increased collaboration between academic institutions and industry, along with the growth of telemedicine and remote monitoring, is further transforming the landscape, ensuring broader access to care and more effective management of the disease.

To learn more about this report, download the PDF brochure

Market Trends and Innovations

Several key trends are shaping the Alzheimer’s drugs market:

Personalized Medicine: There is a growing emphasis on personalized medicine, where treatments are tailored to a patient’s genetic profile, biomarkers, and disease progression. This approach aims to enhance treatment effectiveness and minimize side effects

Gene Therapy and CRISPR Technology: Advances in gene therapy and CRISPR technology are being explored for their potential to correct genetic mutations linked to Alzheimer’s and to modify disease pathways at the genetic level

Biomarker Development: Identifying and validating biomarkers for early diagnosis and treatment monitoring is crucial for the success of Alzheimer’s therapies. Innovations in diagnostic tools, such as imaging techniques and cerebrospinal fluid (CSF) analysis, are further driving this trend

AI and Big Data Analytics: The integration of artificial intelligence (AI) and big data analytics is revolutionizing drug discovery processes, enabling the analysis of large datasets to identify new drug targets and predict therapeutic outcomes more accurately

Challenges and Constraints

Despite notable progress, the Alzheimer’s drugs market still grapples with significant obstacles. The development of Alzheimer’s medications remains an expensive and lengthy process, with many drug candidates faltering in advanced clinical trials, posing substantial financial risks for pharmaceutical companies. Regulatory challenges further complicate the landscape, as stringent requirements—particularly for drugs targeting amyloid or tau proteins—can delay approvals and hinder market entry. Additionally, the limited effectiveness of current treatments, which primarily manage symptoms rather than halt disease progression, underscores a critical unmet need. Compounding these issues is the difficulty in recruiting and retaining participants for Alzheimer’s clinical trials, given the complexity of the disease and the extended duration of studies.

To learn more about this report, download the PDF brochure

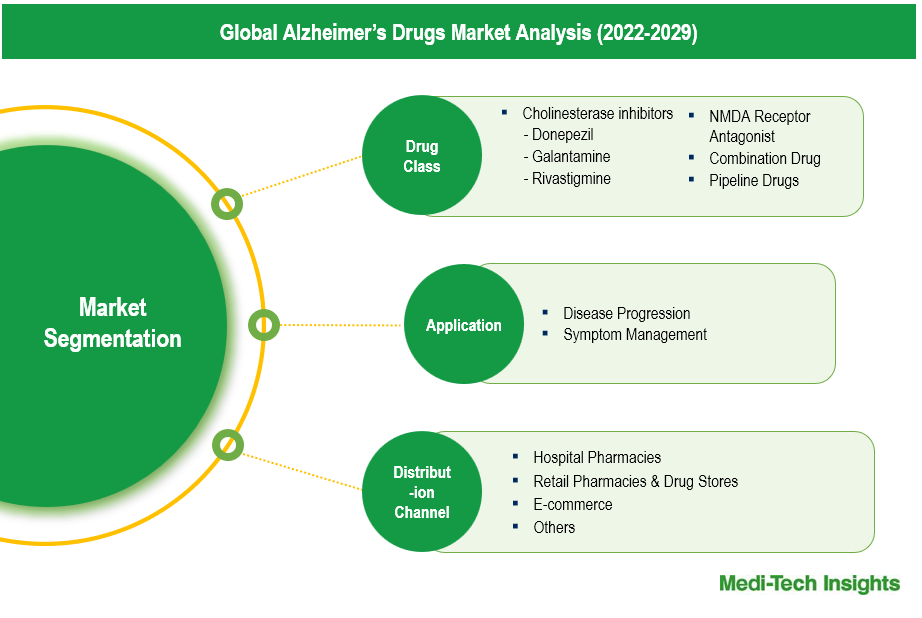

Drug Class Segment Outlook

The Alzheimer's drug market is segmented into several key drug classes, including cholinesterase inhibitors, NMDA receptor antagonists, and emerging disease-modifying therapies. Cholinesterase inhibitors, such as donepezil and rivastigmine, dominate the market by managing symptoms and improving cognitive function. NMDA receptor antagonists, like memantine, also hold a significant share by addressing moderate to severe stages of the disease. Recently, disease-modifying therapies, including amyloid-beta and tau-targeted treatments, are gaining attention for their potential to alter the disease's progression, though their market share is currently smaller compared to established treatments.

Application Segment Outlook

The Alzheimer's drug market applications span several key areas, focusing on symptom management and disease progression. Symptom management remains the largest application segment, aiming to improve daily functioning and quality of life for patients. Disease progression is emerging as a key area of growth with innovative treatments designed to slow or halt the advancement of the disease. Overall, the Alzheimer’s market reflects a dynamic interplay between established therapies and cutting-edge research, shaping its evolving landscape.

The Alzheimer’s Drugs Market: Regional Variations

The Alzheimer’s drugs market exhibits distinct regional differences. North America stands as the largest market, propelled by a high incidence of Alzheimer’s, a well-established healthcare system, and significant R&D investments, with the U.S. leading through numerous clinical trials and recent FDA approvals. In Europe, a substantial market share is maintained through advanced drug development and a strong healthcare network, though market dynamics are influenced by varying regulatory frameworks and healthcare policies across countries. The Asia-Pacific region is witnessing rapid growth fueled by an aging population and increasing Alzheimer’s awareness, though challenges like limited access to advanced treatments and inconsistent regulatory standards pose hurdles. Meanwhile, in regions such as Latin America, the Middle East, and Africa, the market remains in its early stages, with lower awareness and limited access to advanced therapies. Nevertheless, improvements in healthcare infrastructure and rising investments in healthcare signal potential for future market expansion in these areas.

Competitive Landscape Analysis

The Alzheimer’s drugs market is marked by the presence of established key players such as Eli Lily, Johnson & Johnson, Sanofi, Novartis AG, Biogen Inc., Eisai Co., Ltd., AbbVie Inc. (Allergan Plc.), Adamas Pharmaceuticals, Inc., H. Lundbeck A/S, AC Immune, F. Hoffmann La Roche Ltd., Daiichi Sankyo Company, Limited and TauRx Pharmaceuticals Ltd. among others.

Get a sample report for competitive landscape analysis

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the Market

Players operating in this market are adopting both organic and inorganic growth strategies such as collaborations, acquisitions, and new product launches to garner market share. For instance,

- In July 2024, the FDA approved Eli Lilly’s Kisunla, a once-monthly IV infusion for early symptomatic Alzheimer's, making it the first amyloid plaque-targeting therapy that allows treatment to be stopped once plaques are removed, potentially reducing costs and infusions

- In June 2024, Biogen Inc. partnered with Eisai Co. Ltd. to launch LEQEMBI in Asian countries, a drug designed to slow the progression of Alzheimer’s disease

- In May 2023, Otsuka Pharmaceuticals, Co. Ltd. and Lundbeck LLC announced that their collaborative development, REXULTI, received the US Food and Drug Administration approval for the treatment of neuropsychiatric symptoms in Alzheimer’s and dementia

The global market is growing and is expected to gain further momentum in the coming years due to growing cases of Alzheimer’s and dementia, rising demand for personalized medicine, significant investments in R&D, technological advancements, and aggressive organic and inorganic growth strategies followed by the players.

Global Alzheimer’s Drugs Market Scope

| Report Scope | Details |

| Base Year Considered | 2023 |

| Historical Data | 2022 - 2023 |

| Forecast Period | 2024 - 2029 |

| CAGR (2024-2029) | 20% |

| Segment Scope | Drug Class, Application, Distribution Channel |

| Regional Scope |

|

| Key Companies Mapped | Eli Lily, Johnson & Johnson, Sanofi, Novartis AG, Biogen Inc., Eisai Co., Ltd., AbbVie Inc. (Allergan Plc.), Adamas Pharmaceuticals, Inc., H. Lundbeck A/S, AC Immune, F. Hoffmann La Roche Ltd., Daiichi Sankyo Company, Limited and TauRx Pharmaceuticals Ltd. among others |

| Report Highlights | Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

Key Strategic Questions Addressed

-

What is the market size & forecast for the Global Alzheimer’s Drugs Market?

-

What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the Global Alzheimer’s Drugs Market?

-

How has COVID-19 impacted the Global Alzheimer’s Drugs Market?

-

What are the major growth drivers, restraints/challenges impacting the market?

-

What are the opportunities prevailing in the market?

-

What is the investment landscape?

-

Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market? What is the competitive positioning of key players?

-

Who are the new players entering the market?

-

What are the key strategies adopted by players?

- Introduction

- Introduction

- Market Scope

- Market Definition

- Segments Covered

- Regional Segmentation

- Research Timeframe

- Currency Considered

- Study Limitations

- Stakeholders

- List of Abbreviations

- Key Conferences and Events (2023-2024)

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Bottom-Up Approach

- Top-Down Approach

- Market Forecasting

- Executive Summary

- Alzheimer's Drug Market Snapshot (2023-2029)

- Segment Overview

- Regional Snapshot

- Competitive Insights

- Market Overview

- Market Dynamics

- Drivers

- Rising geriatric population

- Technological advancements and new product innovations

- Rising investments in R&D by market players

- Growing cases of Alzheimer's and dementia

- Increasing awareness regarding Alzheimer's disease

- Restraints

- High failure rates of clinical studies

- Complex and lengthy regulatory approval process

- Opportunities

- Increasing government funding and initiatives

- Growth in healthcare expenditure

- Key Market Trends

- Use of biomarkers in Alzheimer's diagnosis

- Growing focus on personalized medicine

- Unmet Market Needs

- Industry Speaks

- Porter’s Five Forces Analysis

- Regulatory Analysis

- Drivers

- Market Dynamics

- Global Alzheimer's Drug Market Size & Forecast (2022-2029), By Drug Class, USD Million

- Introduction

- Cholinergic

- Donepezil

- Galantamine

- Rivastigmine

- NMDA Receptor Antagonist

- Combination Drug

- Pipeline Drugs

- Global Alzheimer's Drug Market Size & Forecast (2022-2029), By Application, USD Million

- Introduction

- Disease Progression

- Symptom Management

- Global Alzheimer's Drug Market Size & Forecast (2022-2029), By Distribution Channel, USD Million

- Introduction

- Hospital Pharmacies

- Retail Pharmacies & Drug Stores

- E-commerce

- Others

- Global Alzheimer's Drug Market Size & Forecast (2022-2029), By Region, USD Million

- Introduction

- Alzheimer's Drug Market Size & Forecast (2022-2029), By Country, USD Million

- US

- Market Size & Forecast, By Drug Class (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By Distribution Channel (USD Million)

- Canada

- Market Size & Forecast, By Drug Class (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By Distribution Channel (USD Million)

- Alzheimer's Drug Market Size & Forecast (2022-2029), By Country, USD Million

- UK

- Market Size & Forecast, By Drug Class (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By Distribution Channel (USD Million)

- Germany

- Market Size & Forecast, By Drug Class (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By Distribution Channel (USD Million)

- France

- Market Size & Forecast, By Drug Class (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By Distribution Channel (USD Million)

- Italy

- Market Size & Forecast, By Drug Class (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By Distribution Channel (USD Million)

- Spain

- Market Size & Forecast, By Drug Class (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By Distribution Channel (USD Million)

- Rest of Europe

- Market Size & Forecast, By Drug Class (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By Distribution Channel (USD Million)

- Asia Pacific (APAC) Alzheimer's Drug Market Size & Forecast (2022-2029), By Country, USD Million

- China

- Market Size & Forecast, By Drug Class (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By Distribution Channel (USD Million)

- Japan

- Market Size & Forecast, By Drug Class (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By Distribution Channel (USD Million)

- India

- Market Size & Forecast, By Drug Class (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By Distribution Channel (USD Million)

- Rest of Asia Pacific

- Market Size & Forecast, By Drug Class (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By Distribution Channel (USD Million)

- Latin America (LATAM) Alzheimer's Drug Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Drug Class (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By Distribution Channel (USD Million)

- Middle East & Africa (MEA) Alzheimer's Drug Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Drug Class (USD Million)

- Market Size & Forecast, By Application (USD Million)

- Market Size & Forecast, By Distribution Channel (USD Million)

- China

- UK

- US

- Competitive Landscape

- Key Players and their Competitive Positioning

- Competitive Positioning of Key Players (2022)

- Offerings Assessment, By Player

- Key Strategies Assessment, By Player (2021-2023)

- New Product & Service Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Key Companies Scanned (Indicative List)

- Eli Lily

- Johnson & Johnson

- Sanofi

- Novartis AG

- Biogen Inc.

- Eisai Co., Ltd.

- AbbVie Inc. (Allergan Plc.)

- Adamas Pharmaceuticals, Inc.

- Lundbeck A/S

- AC Immune

- Hoffmann La Roche Ltd.

- Daiichi Sankyo Company, Limited

- TauRx Pharmaceuticals Ltd.

- Other Prominent Players

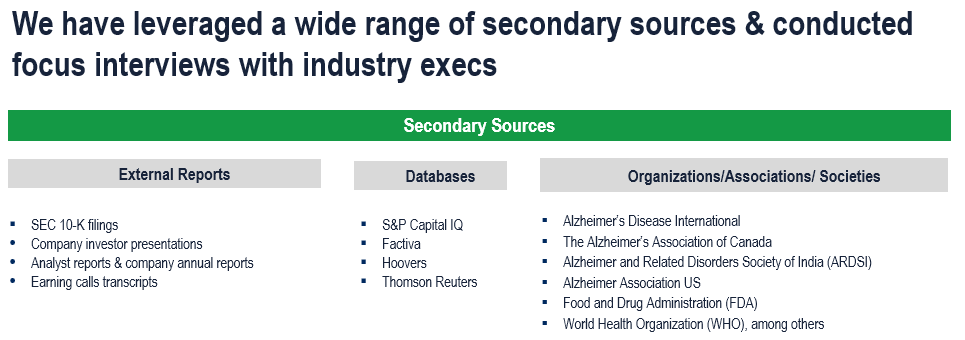

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

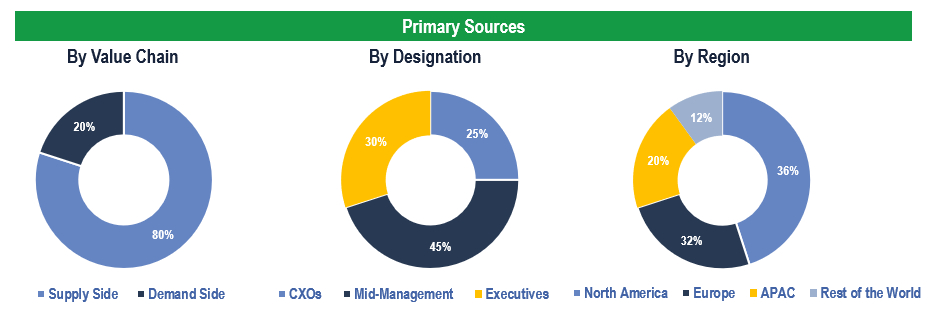

Primary Research

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, Business Development Managers, Consultants

- Demand Side Stakeholders: Stakeholders in Hospitals Pharmacies, Retail Pharmacies & Drug Stores, E-commerce and Other End Users

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis were validated with Primary Interviews, Internal Knowledge Repository, and Company Sales Data.