Animal Health Market – Global Industry Analysis, Size, Share, Trends, Growth & Revenue for Forecast 2024 to 2029

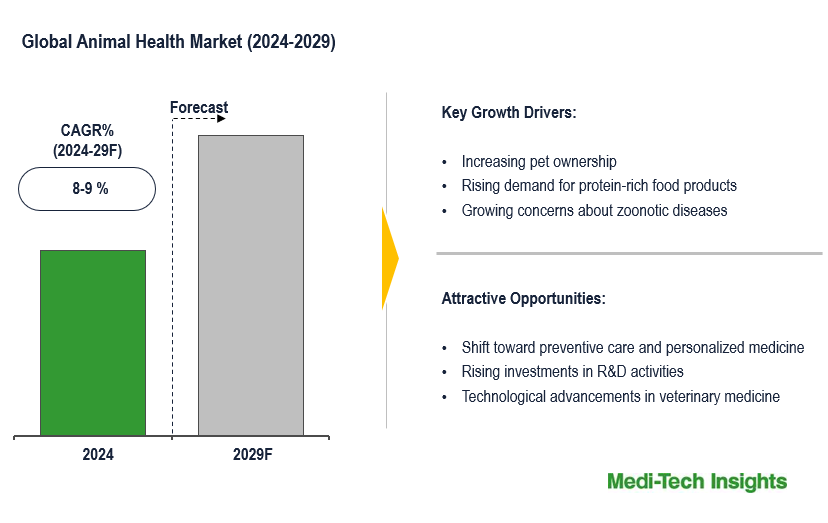

Global Animal Health Market is expected to grow at a rate of 8-9% by 2029. Growing awareness of animal health products, rising demand for protein-rich food including meat, milk, eggs, and fish, increasing prevalence of zoonotic and food-borne diseases, increasing trend of companion animal adoption, and growing investments in research and development of medications & vaccines for animal care are some of the key factors driving the animal health market growth. To learn more about the research report, download a sample report.

Animal health is a medical discipline that emphasizes the prevention, detection, control, and therapeutics associated with veterinary diseases, disorders, and injuries. Animal health covers a broad spectrum of animal species, including the domesticated and wild, with an extensive range of conditions that affect several species. It involves taking care of animals with the appropriate use of vaccines, anti-infective and anti-parasitic drugs, a complete range of fertility management products, pharmaceutical speciality products, innovative delivery solutions, performance technologies, and value-added programs, such as pet recovery services and livestock data management tools.

Innovations in Animal Health Market

Key emerging trends and growth drivers in the animal health market include the increased focus on preventive care and personalized medicine, driven by advancements such as smart sensors for continuous vital sign monitoring and AI-driven prediction technologies, alongside the rising adoption of pets worldwide, which is expected to drive demand for products like parasiticides, antimicrobials, vaccines, and feed additives, consequently fueling market growth.

Scientific advances, innovations, and emerging technologies from artificial intelligence to stem cell therapy and new generations of vaccines have provided greater opportunities to predict, prevent, diagnose and treat animal illness more quickly, accurately, and safely. Veterinary researchers and developers continue to break new ground in reducing disease spread and its impact due to the development of new medicines and vaccinations for animal health. Recently, several technological developments have been made to improve the quality of life of animals such as:

- In January 2024, Merck Animal Health revealed that the European Commission has approved the use of BRAVECTO® (fluralaner) 150 mg/ml powder and solvent for injecting dogs for longer-lasting flea and tick protection

- In April 2022, Zoetis announced its latest innovation in diagnostics with the addition of artificial intelligence (AI) blood smear testing to its multi-purpose platform, Vetscan ImagystTM. Vetscan Imagyst is a first-of-its-kind technology with a multitude of applications, helping veterinarians broaden in-clinic diagnostic offerings to provide the best possible care for dogs and cats.

- In January 2022, Zoetis announced the addition of new digital solutions to their Performance Ranch™ and BLOCKYARD™ tools to enhance cattle data management.

- In June 2021, Vetoquinol announced the launch of a new device called Phovia for faster skin recovery in dogs and cats.

“A new wave of innovation from smart sensors that continually monitor vital signs and AI-driven prediction technologies to mRNA vaccines, feed supplemented with health-boosting ingredients, and many more scientific advances offer enormous potential for better animal health. An advancement in digital technologies monitoring and surveillance enables individual-level treatment, even in groups of hundreds or thousands of animals. Technology has a key role to play.” - President, Global Operations, Animal Health Company, United States

To learn more about this report, download the PDF brochure

Increased Adoption of Pet Animals for Companionship & Communities

Pet ownership has skyrocketed across the globe. Over 50% of households in major markets currently own a pet which rises to over 80% in nations like Brazil and Argentina. This reflects the increased recognition that pets are not only companions but offer tangible benefits to our health and happiness. Research also shows pets improve the lives of their owners and may help them live longer. Moreover, pet owners are more likely to get to know their neighbourhood than those without pets, which can lead to more community engagement and improves the quality of life and relationships. Growth in companion animal ownership is expected to boost the consumption of parasiticides antimicrobials & antibiotics, vaccines, feed additives, and growth promoters, which in turn is expected to fuel the market in the coming years.

North America Likely to Continue its Dominance in the Coming Years

From a geographical perspective, North America holds a major market share of the animal health market. This can be attributed to an increasing number of pet owners in this region - more than 67% of American households own pets, rising incidence of zoonotic diseases, higher expenditure on pet care products, rising initiatives taken by government animal welfare organizations to enhance animal health, technological advancements & increase in research and development activities by prominent players in this region. APAC is also expected to witness strong growth in the coming years, due to increasing awareness about animal health, rising adoption of pet animals for companionship, and increasing investment by key players in research and development to develop innovative vaccines & medicines for animal health in this region.

To learn more about this report, download the PDF brochure

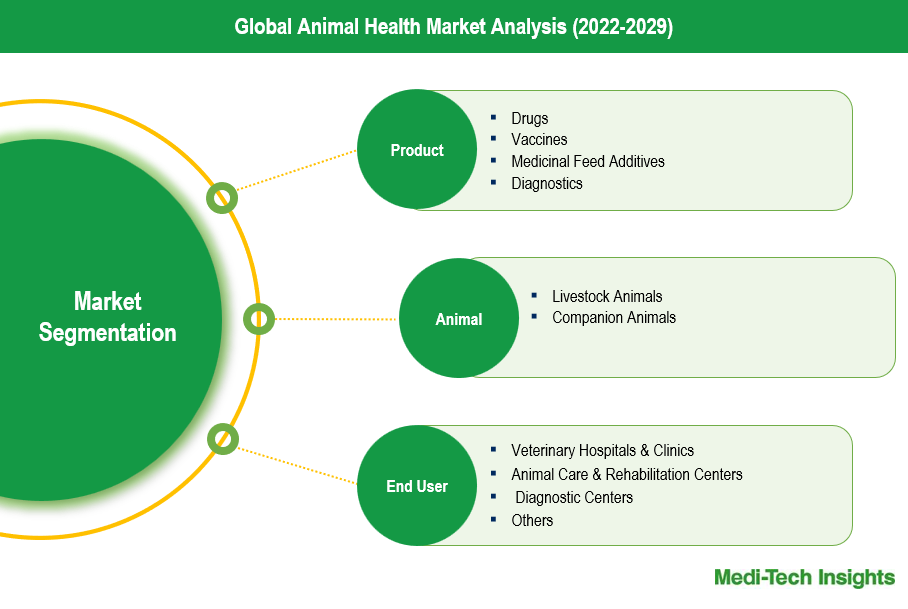

Product Type Segment Analysis

The animal health market demonstrates robust growth driven by various essential product types, each comprising subsegments with varying market shares. Pharmaceuticals like drugs, and vaccines, play pivotal roles in disease prevention and treatment, hold major market share fueled by increasing disease prevalence and regulatory support. Medicinal feed additives, including probiotics, prebiotics, and amino acids, are crucial for enhancing animal nutrition and health, holding a comparatively minor market share. Diagnostics, vital for early disease detection, comprise subsegments like rapid diagnostic kits and laboratory tests, contributing significantly to the market driven by technological innovations and a growing emphasis on preventive care.

Animal Type Segment Analysis

The animal health market is poised for strong growth due to the varied healthcare requirements of both livestock and companion animals. Livestock, including cattle, poultry, swine, and others, command a substantial portion of this market, with significant contributions to pharmaceuticals, vaccines, and feed additives. Meanwhile, companion animals such as dogs, cats, and horses form another key segment, demanding pharmaceuticals, vaccines, diagnostics, and tailored veterinary services. While livestock holds a dominant market share owing to large-scale production and global protein demand, companion animals make notable contributions propelled by rising pet ownership, technological advancements, and the deepening human-animal connection. It's crucial for stakeholders to grasp the distinct dynamics and driving forces within each segment to seize emerging opportunities and navigate evolving market dynamics effectively.

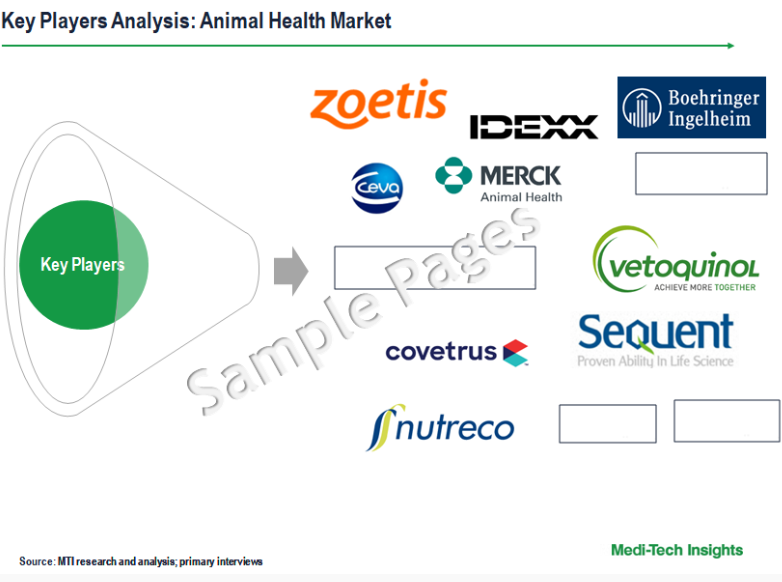

Competitive Landscape Analysis: Animal Health Market

Some of the key players operating in the animal health market are Merck Animal Health, Ceva Sante Animale, Vetoquinol S.A., Zoetis, Boehringer Ingelheim GmbH, Elanco, IDEXX, Heska Corporation, Covetrus, DRE Veterinary, Mars Inc., Virbac, Televet, Abaxis, Genus PLC, Phibro Animal Health Corporation, B.Braun Vet Care, Bayer, Dechra Pharmaceuticals, Neogen, Nutreco N.V., Eli Lilly & Company, and SeQuent Scientific Ltd., among others.

Get a sample report for competitive landscape analysis

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the Market

Players operating in this market are adopting both organic and inorganic growth strategies such as collaborations, acquisitions, and new product launches to garner market share. For instance,

- In February 2024, Merck Animal Health announced a deal to purchase Elanco Animal Health's aquatic-focused business based in Indiana for $1.3 billion, encompassing Elanco's entire range of aquatic species medicines, vaccines, supplements, and nutrition, along with two manufacturing plants in Vietnam and Canada and a research facility in Chile, with the transaction anticipated to conclude by mid-2024 pending regulatory clearance.

- In June 2022, Zoetis announced an agreement to acquire Basepaws, a privately held pet care genetics company. This acquisition will advance Zoetis’ portfolio in the precision animal health space and will inform and shape its future pipeline of pet care innovations.

- In June 2022, Boehringer Ingelheim and CarthroniX announced that they have entered into a research collaboration to pursue small molecule therapeutics in canine oncology. The collaboration will focus on identifying new molecules to target cancers in dogs.

- In April 2022, Elanco entered into a strategic alliance with Royal DSM to develop, manufacture, and commercialize Bovaer® for beef and dairy cattle. Bovaer® is a first-in-class and best-in-class methane-reducing innovative feed additive for beef and dairy cattle.

- In January 2022, Zoetis announced that they had received U.S. Food and Drug Administration (FDA) approval to use Solensia™, its first and only injectable monoclonal antibody (mAb) treatment to control the pain of osteoarthritis (OA) in cats, helping improve their mobility, comfort and overall well-being

The animal health market is expected to gain further momentum in the coming years due to technological advancements, rising R&D investments, new product launches, and aggressive organic and inorganic growth strategies followed by the players.

| Report Scope | Details |

| Base Year Considered | 2023 |

| Historical Data | 2022 - 2023 |

| Forecast Period | 2024 - 2029 |

| CAGR (2024 - 2029) | 8-9% |

| Segment Scope | Product, Animal, End User |

| Regional Scope |

|

| Key Companies Mapped | Merck Animal Health, Ceva Sante Animale, Vetoquinol S.A., Zoetis, Boehringer Ingelheim GmbH, Elanco, IDEXX, Heska Corporation, Covetrus, DRE Veterinary, Mars Inc., Virbac, Televet, Abaxis, Genus PLC, Phibro Animal Health Corporation, B.Braun Vet Care, Bayer, Dechra Pharmaceuticals, Neogen, Nutreco N.V., Eli Lilly & Company, and SeQuent Scientific Ltd. among others |

| Report Highlights | Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

Key Strategic Questions Addressed

-

What is the market size & forecast for the Global Animal Health Market?

-

What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the Global Animal Health Market?

-

How has Covid-19 impacted the Global Animal Health Market?

-

What are the major growth drivers, restraints/challenges impacting the market?

-

What are the opportunities prevailing in the market?

-

What is the investment landscape?

-

Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market? What is the competitive positioning of key players?

-

Who are the new players entering the market?

-

What are the key strategies adopted by players?

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Market Forecasting

- Executive Summary

- Market Overview

- Market Dynamics

- Drivers

- Restraints

- Key Market Trends

- Market Dynamics

-

- Industry Speaks

- Key Revenue Pockets

- Global Animal Health Market - Size & Forecast (2021-2028), By Product Type

- Drugs

- Vaccines

- Medicinal Feed Additives

- Diagnostics

- Global Animal Health Market - Size & Forecast (2021-2028), By Animal Type

- Livestock Animals

- Companion Animals

- Global Animal Health Market - Size & Forecast (2021-2028), By End User

- Veterinary Hospitals & Clinics

- Animal Care & Rehabilitation Centers

- Diagnostic Centers

- Animal Farm

- Others

- Global Animal Health Market - Size & Forecast (2021-2028), By Region

- North America (U.S. & Canada)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, Rest of Asia Pacific)

- Rest of the World (Latin America, Middle East & Africa)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Competitive Positioning of Key Players (2022)

- Offerings Assessment, By Player

- Key Strategies Assessment, By Player (2021-2023)

- New Product & Service Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Key Companies Scanned (Indicative List)

- Merck Animal Health

- Ceva Sante Animale

- Vetoquinol S.A.

- Zoetis

- Boehringer Ingelheim GmbH

- Elanco

- IDEXX, Heska Corporation

- Covetrus, DRE Veterinary

- Mars Inc.

- Virbac

- Televet

- Abaxis

- Genus PLC

- Phibro Animal Health Corporation

- Braun Vet Care

- Bayer

- Dechra Pharmaceuticals

- Neogen, Nutreco N.V.

- Eli Lilly & Company

- SeQuent Scientific Ltd

- Other Prominent Players

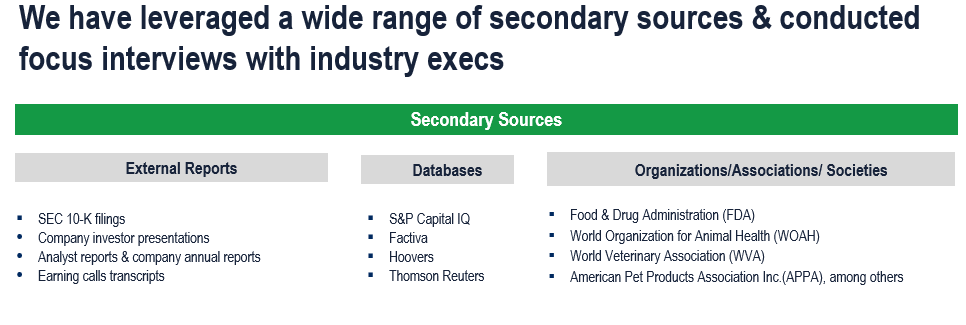

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

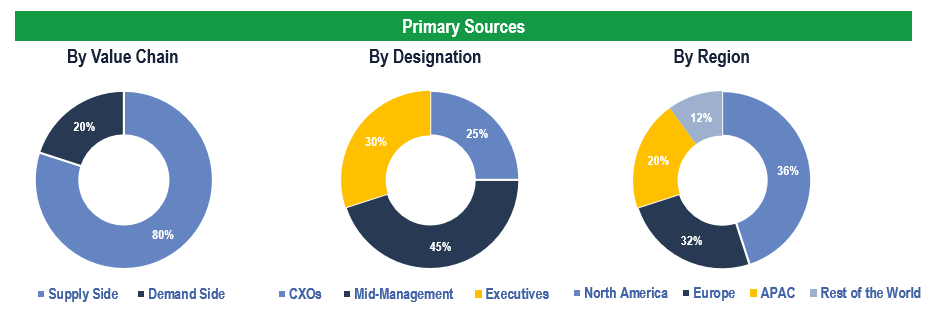

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Stakeholders in Veterinary Hospitals & Clinics, Animal Care & Rehabilitation Centers, Diagnostic Centers, Animal Farm, and Other End Users

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis were validated with Primary Interviews, Internal Knowledge Repository, and Company Sales Data.