Laboratory Information Management Systems Market Size and Trends Report by Component (Software, Services), Deployment Mode (Cloud, On-premises), End User (Pharmaceuticals & Biotechnology, Food & Beverage, Environmental Testing) Forecast to 2029

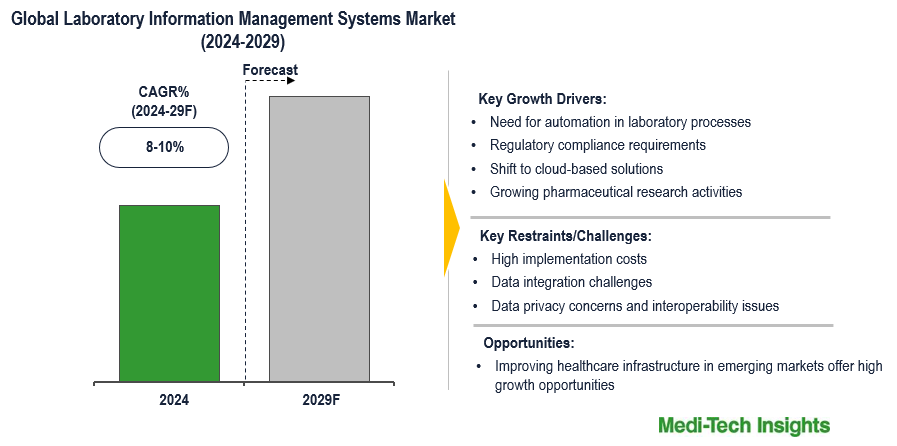

The global laboratory information management systems (LIMS) market is projected to grow at a CAGR of 8-10% from 2024 to 2029. This growth is driven by the increased demand for automation and regulatory compliance in laboratories across pharmaceuticals, biotechnology, environmental testing, and other industries. As laboratories adopt digital solutions to enhance operational efficiency and data accuracy, LIMS adoption continues to rise. To learn more about the research report, download a sample report.

Report Overview

The laboratory information management systems (LIMS) market focuses on software solutions that enhance data management, workflow efficiency, and compliance across various laboratory environments. Unlike Laboratory Information Systems (LIS), which are tailored to healthcare and clinical applications, LIMS primarily supports non-clinical settings, including pharmaceuticals, environmental testing, and food and beverage industries.

To learn more about this report, download the PDF brochure

Rising Demand for Laboratory Automation and Regulatory Compliance

The rising demand for laboratory automation and regulatory compliance significantly drives the LIMS market. By automating data capture and sample tracking, LIMS enhances data accuracy, minimizes human errors, and speeds up sample processing, which is essential in high-throughput laboratories. Automation allows labs to meet stringent regulatory requirements imposed by agencies such as the FDA, EMA, and other global bodies, which increasingly mandate digital record-keeping and audit trails. Additionally, the shift toward cloud-based LIMS solutions offers laboratories scalable and flexible options, providing secure, compliant data management without the overhead of on-premises infrastructure. This enables laboratories to meet regulatory standards while achieving cost-effective, efficient digital transformation.

Key Challenges in Laboratory Information Management Systems: Data Integration and Security Concerns

The LIMS market faces several key challenges, such as data integration with other systems like electronic lab notebooks (ELNs) and enterprise resource planning (ERP) systems, especially in environments using legacy software. Additionally, data privacy and security concerns are significant, as labs manage sensitive data that require robust encryption and access control measures. The high initial setup costs for LIMS can also pose a barrier, especially for smaller laboratories. Overcoming these challenges is essential to optimize LIMS' value in laboratory environments.

To learn more about this report, download the PDF brochure

Competitive Landscape Analysis

Key players in the LIMS market, including Thermo Fisher Scientific, LabWare, LabVantage Solutions, STARLIMS, Agilent Technologies, Dassault, CloudLIMS, Lablynx, Labworks, and Autoscribe Informatics, are investing in technology upgrades, expanding product portfolios, and forming strategic partnerships to maintain their market position. Increasing focus on cloud-based solutions and AI-enhanced data analysis capabilities aim to make LIMS more adaptable, efficient, and scalable for various laboratory needs.

Report Scope

| Report Metric | Details |

| Base Year Considered | 2023 |

| Historical Data | 2022 - 2023 |

| Forecast Period | 2024 - 2029 |

| Growth Rate | CAGR of 8-10% |

| Market Drivers |

|

| Market Restraints |

|

| Segment Scope | Component, Deployment Mode, End User |

| Regional Scope |

|

| Key Companies Mapped | Thermo Fisher Scientific, LabWare, LabVantage Solutions, STARLIMS, Agilent Technologies, Dassault, CloudLIMS, Lablynx, Labworks, and Autoscribe Informatics; among others |

| Report Highlights | Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

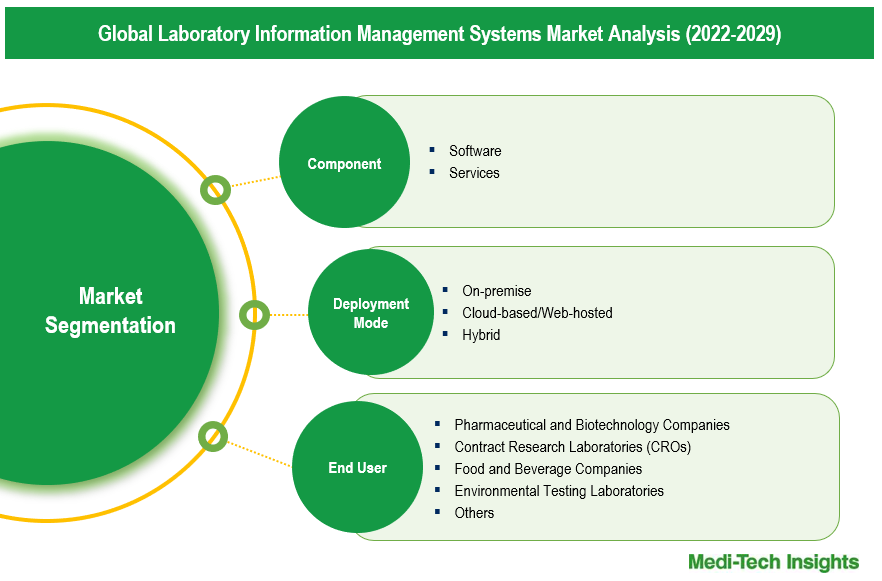

Market Segmentation

This report by Medi-Tech Insights provides the size of the global laboratory information management systems market at the regional- and country-level from 2022 to 2029. The report further segments the market based on component, deployment model, and end user.

- Market Size & Forecast (2022-2029), By Component, USD Billion

- Software

- Services

- Market Size & Forecast (2022-2029), By Deployment Mode, USD Billion

- On-premise

- Cloud-based/Web-hosted

- Hybrid

- Market Size & Forecast (2022-2029), By End User, USD Billion

- Pharmaceutical and Biotechnology Companies

- Contract Research Laboratories (CROs)

- Food and Beverage Companies

- Environmental Testing Laboratories

- Others

- Market Size & Forecast (2022-2029), By Region, USD Billion

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

- North America

Key Strategic Questions Addressed

- What is the market size & forecast of the laboratory information management systems market?

- What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the laboratory information management systems market?

- What are the key trends defining the market?

- What are the major factors impacting the market?

- What are the opportunities prevailing in the market?

- Which region holds the highest market share?

- Which region is expected to witness the highest growth rate in the next 5 years?

- Who are the major players in the market?

- What are the key strategies adopted by market players?

- Introduction

- Introduction

- Market Scope

- Market Definition

- Segments Covered

- Regional Segmentation

- Research Timeframe

- Currency Considered

- Study Limitations

- Stakeholders

- List of Abbreviations

- Key Conferences and Events (2023-2024)

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Bottom-Up Approach

- Top-Down Approach

- Market Forecasting

- Executive Summary

- Global Laboratory Information Management Systems Market Snapshot (2023-2029)

- Segment Overview

- Regional Snapshot

- Competitive Insights

- Market Overview

- Market Dynamics

- Drivers

- Need for automation in laboratory processes

- Regulatory compliance requirements

- Shift to cloud-based solutions

- Growing pharmaceutical research activities

- Restraints/Challenges

- High implementation costs

- Data integration challenges

- Data privacy and security concerns

- Opportunities

- Improving healthcare infrastructure in emerging markets

- Key Market Trends

- Drivers

- Industry Speaks

- Market Dynamics

- Laboratory Information Management Systems Market Size & Forecast (2022-2029), By Component, USD Billion

- Introduction

- Software

- Services

- Laboratory Information Management Systems Market Size & Forecast (2022-2029), By Deployment Mode, USD Billion

- Introduction

- On-premise

- Cloud-based/Web-hosted

- Hybrid

- Laboratory Information Management Systems Market Size & Forecast (2022-2029), By End User, USD Billion

- Introduction

- Pharmaceutical and Biotechnology Companies

- Contract Research Laboratories (CROs)

- Food and Beverage Companies

- Environmental Testing Laboratories

- Others

- Global Laboratory Information Management Systems Market Size & Forecast (2022-2029), By Region, USD Billion

- Introduction

- North America Laboratory Information Management Systems Market Size & Forecast (2022-2029), By Country, USD Billion

- US

- Market Size & Forecast, By Component (USD Billion)

- Market Size & Forecast, By Deployment Mode (USD Billion)

- Market Size & Forecast, By End User (USD Billion)

- Canada

- Market Size & Forecast, By Component (USD Billion)

- Market Size & Forecast, By Deployment Model (USD Billion)

- Market Size & Forecast, By End User (USD Billion)

- US

- Europe Laboratory Information Management Systems Market Size & Forecast (2022-2029), By Country, USD Billion

- UK

- Market Size & Forecast, By Component (USD Billion)

- Market Size & Forecast, By Deployment Model (USD Billion)

- Market Size & Forecast, By End User (USD Billion)

- Germany

- Market Size & Forecast, By Component (USD Billion)

- Market Size & Forecast, By Deployment Model (USD Billion)

- Market Size & Forecast, By End User (USD Billion)

- France

- Market Size & Forecast, By Component (USD Billion)

- Market Size & Forecast, By Deployment Model (USD Billion)

- Market Size & Forecast, By End User (USD Billion)

- Italy

- Market Size & Forecast, By Component (USD Billion)

- Market Size & Forecast, By Deployment Model (USD Billion)

- Market Size & Forecast, By End User (USD Billion)

- Spain

- Market Size & Forecast, By Component (USD Billion)

- Market Size & Forecast, By Deployment Model (USD Billion)

- Market Size & Forecast, By End User (USD Billion)

- Rest of Europe

- Market Size & Forecast, By Component (USD Billion)

- Market Size & Forecast, By Deployment Model (USD Billion)

- Market Size & Forecast, By End User (USD Billion)

- UK

- Asia Pacific (APAC) Laboratory Information Management Systems Market Size & Forecast (2022-2029), By Country, USD Billion

- China

- Market Size & Forecast, By Component (USD Billion)

- Market Size & Forecast, By Deployment Model (USD Billion)

- Market Size & Forecast, By End User (USD Billion)

- Japan

- Market Size & Forecast, By Component (USD Billion)

- Market Size & Forecast, By Deployment Model (USD Billion)

- Market Size & Forecast, By End User (USD Billion)

- India

- Market Size & Forecast, By Component (USD Billion)

- Market Size & Forecast, By Deployment Model (USD Billion)

- Market Size & Forecast, By End User (USD Billion)

- Rest of Asia Pacific

- Market Size & Forecast, By Component (USD Billion)

- Market Size & Forecast, By Deployment Model (USD Billion)

- Market Size & Forecast, By End User (USD Billion)

- China

- Latin America (LATAM) Laboratory Information Management Systems Market Size & Forecast (2022-2029), USD Billion

- Market Size & Forecast, By Component (USD Billion)

- Market Size & Forecast, By Deployment Model (USD Billion)

- Market Size & Forecast, By End User (USD Billion)

- Middle East & Africa (MEA) Laboratory Information Management Systems Market Size & Forecast (2022-2029), USD Billion

- Market Size & Forecast, By Component (USD Billion)

- Market Size & Forecast, By Deployment Model (USD Billion)

- Market Size & Forecast, By End User (USD Billion)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Key Player Comparison

- Segment-wise Player Mapping

- Market Share Analysis (2023)

- Company Categorization Matrix

- Dominants/Leaders

- New Entrants

- Emerging Players

- Innovative Players

- Key Strategies Assessment, By Player (2022-2024)

- New Product/Solution Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Company Profiles*

(Business Overview, Financial Performance**, Products Offered, Recent Developments)

- Thermo Fisher Scientific

- LabWare

- LabVantage Solutions

- STARLIMS

- Agilent Technologies

- Dassault

- CloudLIMS

- Lablynx

- Labworks

- Autoscribe Informatics

- Other Prominent Players

Note: *Indicative list

**For listed companies

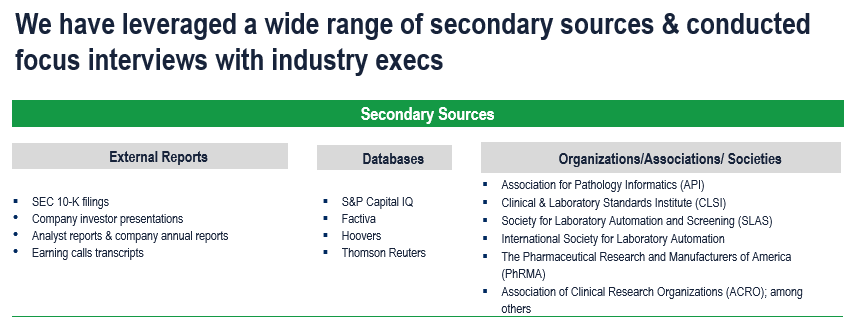

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

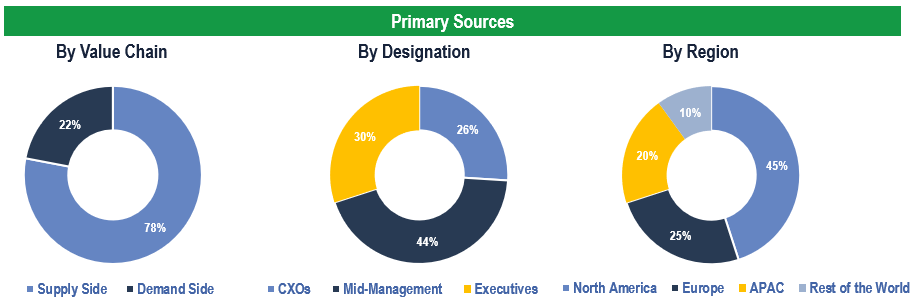

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, R&D Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Hospitals and Health Systems, Clinics/Physician Practices, and Others

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down & Bottom-Up Approaches’ were used to derive market size estimates and forecasts

Data Triangulation

Research findings derived through secondary sources & internal analysis was validated with Primary Interviews, Internal Knowledge Repository and Company’s Sales Data