Life Science Tools and Services Market Size, Share, Industry Growth Analysis, and Forecast to 2029

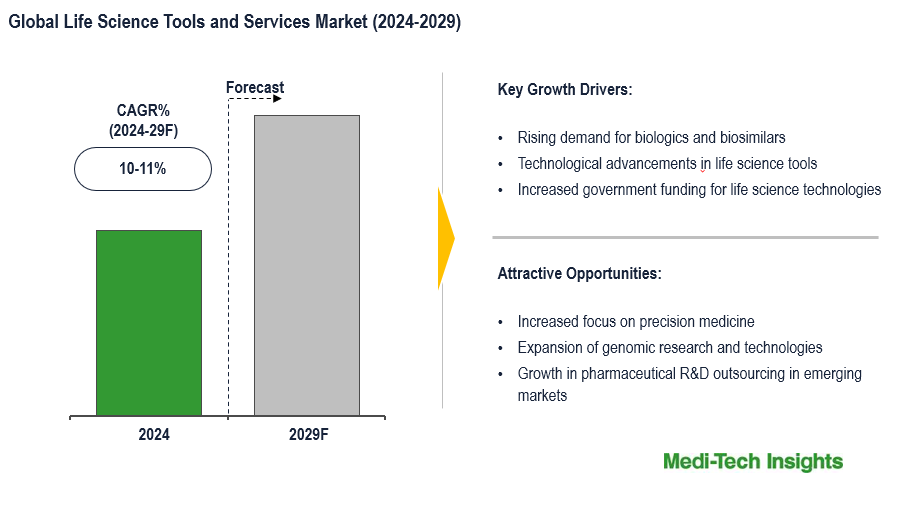

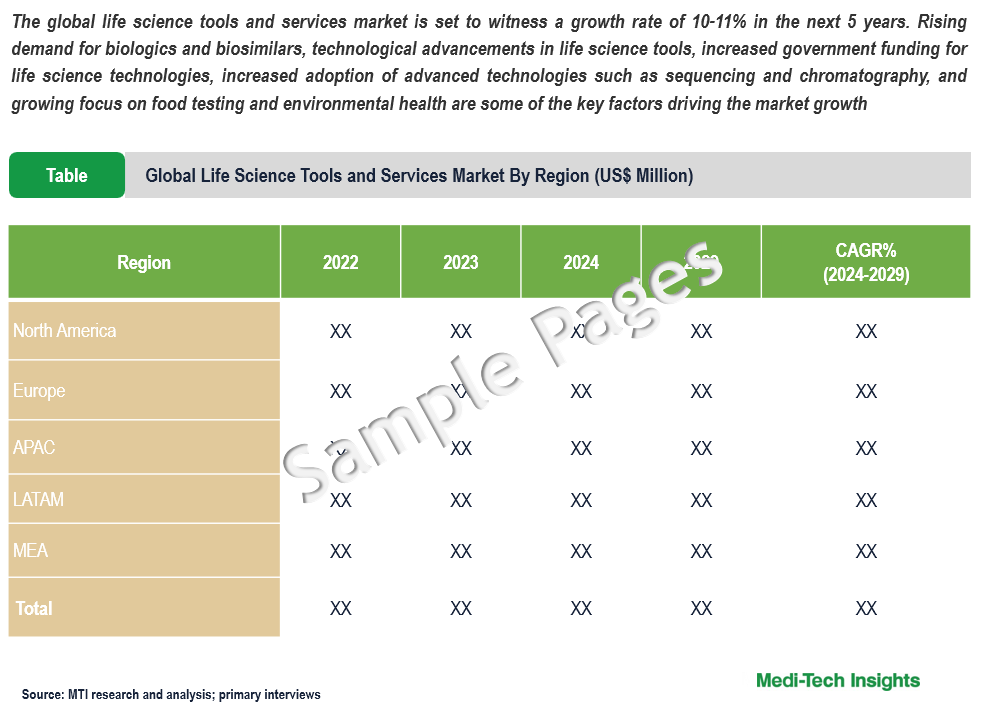

The global life science tools and services market is set to witness a growth rate of 10-11% in the next 5 years. Rising demand for biologics and biosimilars, technological advancements in life science tools, increased government funding for life science technologies, increased adoption of advanced technologies such as sequencing and chromatography, and growing focus on food testing and environmental health are some of the key factors driving the market growth. To learn more about the research report, download a sample report.

Report Overview

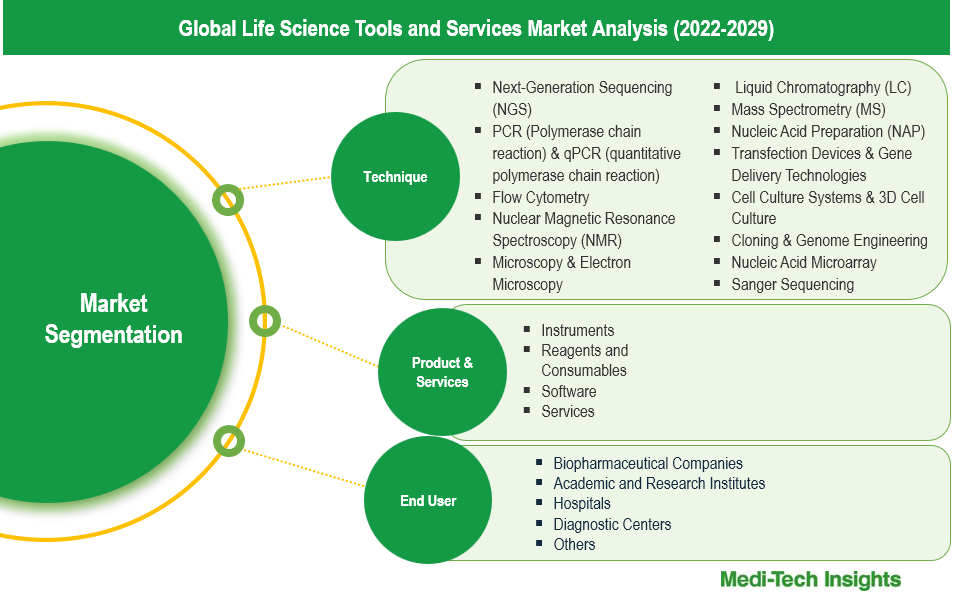

Life science’ is an umbrella term that studies organisms and microorganisms. Different fields fall under life science such as cell biology, biotechnology, genetics, molecular biology, biomedicine, and biochemistry. The life science tools and services market is segmented based on technique, products & services and end user.

Technological Advancements in Life Science Tools and Services Market to Fuel Its Global Demand

Continuous advancements in the life science tools and services market have enabled the development of efficient products with advanced capabilities, increased applications, and cost-effectiveness. Such advancements tend to provide a competitive edge to manufacturers. Therefore, major players are continuously investing in research activities for new product development and expanding their geographic reach to strengthen their position in the life science tools and services market. Some of the technological advancements are listed below:

- In May 2024, Agilent Technologies Inc. introduced the 8850 Gas Chromatograph, a compact, energy-efficient system that merges the legacy of the 6850 GC with the intelligence and capabilities of the 8890 GC, designed to enhance laboratory efficiency across industries like energy, chemicals, food, and pharmaceuticals

- In December 2023, Merck introduced AIDDISON the first AI-driven drug discovery software that integrates virtual molecule design with real-world manufacturability by combining generative AI, machine learning, and Synthia retrosynthesis API to enhance drug discovery and synthesis processes.

- In August 2022, Roche launched its Digital Light Cycler System, a next-generation digital PCR system to assist clinical researchers in better understanding the nature of a patient’s infection, genetic disease or cancer, leading to early diagnosis

- In June 2022, Waters Corporation introduced the New Xevo G3 quadrupole time-of-flight mass spectrometer, a more sensitive spectrometer than its predecessor to drive drug discovery and development

- In May 2022, Bio-Rad Laboratories, Inc. launched the CFX Duet Real-Time PCR System to help researchers develop singleplex and duplex quantitative PCR (qPCR) assays by offering a robust thermal performance featuring its proprietary and accurate optical shuttle system

- In March 2022, Element Biosciences Inc. launched its benchtop sequencer - Element AVITI System, which offers a combination of performance, cost, and flexibility in an unprecedented way. This system consists of a benchtop NGS instrument and related consumables

- In August 2021, Becton, Dickinson and Company launched its benchtop cell analyzer “FACSymphony A1”, offering new capabilities to researchers in small as well as large labs by performing exploratory experiments without tying up freestanding cell analyzers

To learn more about this report, download the PDF brochure

Emerging Opportunities in the Life Science Tools and Services Market

- Greater Acceptance of Genomics

- NCCN guideline adoption: The National Comprehensive Cancer Network (NCCN) has recommended the adoption of genetic panel testing in ovarian and breast cancer testing, to help find mutations

- Shift towards consumerism: Shift towards a more consumer-oriented model is expected to drive the demand for genomic technologies to understand future health outcomes

- Bioproduction, a fast-growing area

- Growth within biosimilars: The biosimilars market exhibits a high CAGR due to low cost and increased demand which further drive the expansion of the bioproduction industry

- Access to healthcare in emerging markets: Large molecule drugs have seen high growth in emerging markets and is expected that pharmerging economies will drive the medicine volume usage in next five years

- Focus on Food Testing & Environmental Health

- Food testing: Increased global food safety regulations, corporate brand management, and increasing emphasis on efficient livestock and agricultural production have contributed to the growth of the life science tools and services market for food testing

- Environmental health: Improving the quality of the soil, air, and water as well as cleaning up pollutants falls under the environmental health agenda. Governments now seem to be more committed to these programs for better quality

North America is expected to hold a major share in the Global Life Science Tools and Services Market

From a geographical perspective, North America holds a major market share of the life science tools and services market. This can be mainly attributed to the growing number of genomic procedures, rapid growth in biologics coupled with opportunities in biosimilars, and increased access to advanced technologies. However, the Asia Pacific is expected to ascend at the fastest CAGR over the forecast period on account of the large customer base and growing health concerns in key markets such as Japan, China & India and the increasing focus of major players on pharmaceutical R&D outsourcing.

Competitive Landscape Analysis

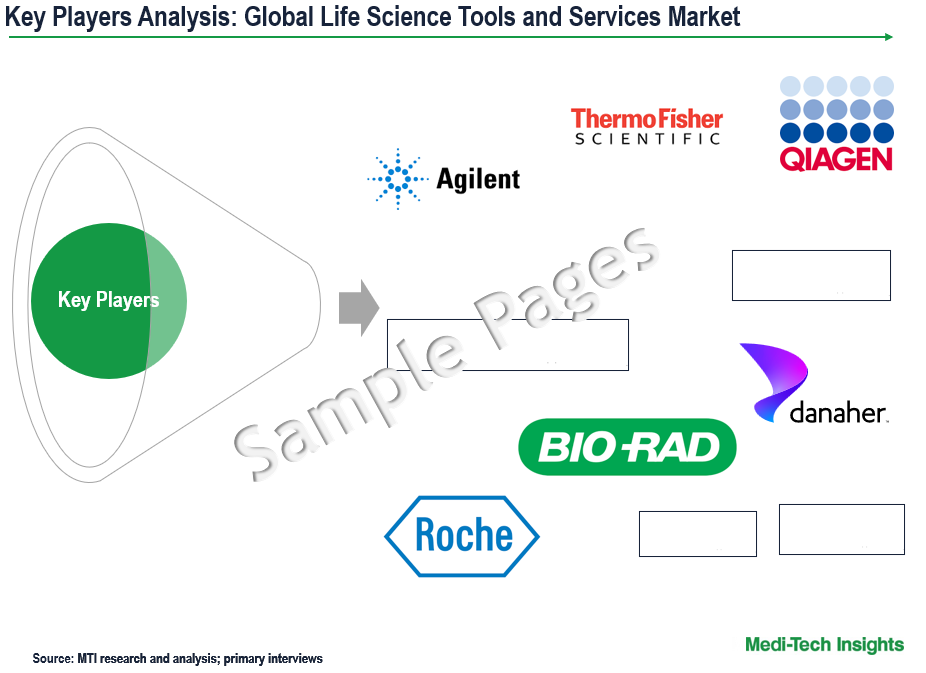

The global life science tools and services market is marked by the presence of established and emerging market players such as F. Hoffmann-La Roche Ltd.; Agilent Technologies, Inc.; Becton; Dickinson and Company; Bio-Rad Laboratories, Inc.; Merck KGaA; Danaher Corporation; Illumina, Inc.; Thermo Fisher Scientific, Inc; QIAGEN N.V.; Shimadzu Corporation; Hitachi Ltd.; Bruker Corporation; Oxford Instruments plc; and Zeiss International among others.

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the Market

Players operating in this market are adopting both organic and inorganic growth strategies such as collaborations, and acquisitions to garner market share. For instance,

- In September 2024, Agilent Technologies Inc. finalized its acquisition of BIOVECTRA, specializing in biologics, highly potent active pharmaceutical ingredients, and molecules for targeted therapeutics, expanding its specialized CDMO offerings for pharmaceutical customers

- In November 2023, Thermo Fisher Scientific and Flagship Pioneering announced a strategic partnership aimed at developing and scaling multiproduct platforms, focusing on establishing new companies that will leverage innovative tools and capabilities to expedite therapy development

- In January 2023, Agilent Technologies Inc. announced its acquisition of Avida Biomed, a life sciences company specializing in high-performance NGS target enrichment workflows that enable simultaneous genomic and epigenomic profiling for cancer research, aimed at advancing precision medicine

The market continues to evolve with ongoing research, technological innovations, an increasing focus on precision medicine, increasing government funding and aggressive organic and inorganic growth strategies followed by the players.

Report Scope

|

Report Scope |

Details |

|

Base Year Considered |

2023 |

|

Historical Data |

2022 - 2023 |

|

Forecast Period |

2024 - 2029 |

|

Growth Rate |

CAGR of 10-11% |

|

Market Drivers |

|

|

Attractive Opportunities |

|

|

Segment Scope |

Technique, Product & Services, End User |

|

Regional Scope |

|

|

Key Companies Mapped |

F. Hoffmann-La Roche Ltd.; Agilent Technologies, Inc.; Becton; Dickinson and Company; Bio-Rad Laboratories, Inc.; Merck KGaA; Danaher Corporation; Illumina, Inc.; Thermo Fisher Scientific, Inc; QIAGEN N.V.; Shimadzu Corporation; Hitachi Ltd.; Bruker Corporation; Oxford Instruments plc; and Zeiss International |

|

Report Highlights |

Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

Market Segmentation

This report by Medi-Tech Insights provides size of the Life Science Tools and Services at a regional level from 2022 to 2029. The report further segments the market on the basis of technique, product & services, and end user.

Market Size & Forecast (2022-2029), By Technique, USD Million

- Next-Generation Sequencing (NGS)

- PCR (Polymerase chain reaction) & qPCR (quantitative polymerase chain reaction)

- Flow Cytometry

- Nuclear Magnetic Resonance Spectroscopy (NMR)

- Microscopy & Electron Microscopy

- Liquid Chromatography (LC)

- Mass Spectrometry (MS)

- Nucleic Acid Preparation (NAP)

- Transfection Devices & Gene Delivery Technologies

- Cell Culture Systems & 3D Cell Culture

- Cloning & Genome Engineering

- Nucleic Acid Microarray

- Sanger Sequencing

Market Size & Forecast (2022-2029), By Products & Services, USD Million

- Instruments

- Reagents and Consumables

- Software

- Services

Market Size & Forecast (2022-2029), By End User, USD Million

- Biopharmaceutical Companies

- Academic and Research Institutes

- Hospitals

- Diagnostic Centers

- Others

Market Size & Forecast (2022-2029), By Region, USD Million

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

To learn more about this report, download the PDF brochure

Key Strategic Questions Addressed

-

What is the market size & forecast of the life science tools and services market?

-

What are historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the life science tools and services market?

-

What are the key trends defining the market?

-

What are the major factors impacting the market?

-

What are the opportunities prevailing in the market?

-

Which region has the highest share in the global market?

-

Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market?

-

What are the key strategies adopted by players?

- Introduction

- Introduction

- Market Scope

- Market Definition

- Segments Covered

- Regional Segmentation

- Research Timeframe

- Currency Considered

- Study Limitations

- Stakeholders

- List of Abbreviations

- Key Conferences and Events (2023-2024)

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Bottom-Up Approach

- Top-Down Approach

- Market Forecasting

- Executive Summary

- Life Science Tools and Services Market Snapshot (2023-2029)

- Segment Overview

- Regional Snapshot

- Competitive Insights

- Market Overview

- Market Dynamics

- Drivers

- Rising demand for biologics and biosimilars

- Technological advancements in life science tools

- Increased government funding for life science technologies

- Growing focus on food testing and environmental health

- Increased adoption of advanced technologies like sequencing and chromatography

- Restraints

- High cost of advanced life science tools

- Regulatory challenges in genomic and biotechnology applications

- Limited access to life science tools in certain emerging markets

- Opportunities

- Increased focus on precision medicine

- Growth in pharmaceutical R&D outsourcing in emerging markets

- Key Market Trends

- Shift toward consumer-oriented genomic technologies

- Advancements in next-generation sequencing (NGS) technologies

- Unmet Market Needs

- Industry Speaks

- Regulatory Analysis

- Drivers

- Market Dynamics

- Global Life Science Tools and Services Market Size & Forecast (2022-2029), By Technique, USD Million

- Introduction

- Next-Generation Sequencing (NGS)

- PCR (Polymerase chain reaction) & qPCR (quantitative polymerase chain reaction)

- Flow Cytometry

- Nuclear Magnetic Resonance Spectroscopy (NMR)

- Microscopy & Electron Microscopy

- Liquid Chromatography (LC)

- Mass Spectrometry (MS)

- Nucleic Acid Preparation (NAP)

- Transfection Devices & Gene Delivery Technologies

- Cell Culture Systems & 3D Cell Culture

- Cloning & Genome Engineering

- Nucleic Acid Microarray

- Sanger Sequencing

- Global Life Science Tools and Services Market Size & Forecast (2022-2029), By Product & Services, USD Million

- Introduction

- Instruments

- Reagents and Consumables

- Software

- Services

- Global Life Science Tools and Services Market Size & Forecast (2022-2029), By End User, USD Million

- Introduction

- Biopharmaceutical Companies

- Academic and Research Institutes

- Hospitals

- Diagnostic Centers

- Others

- Global Life Science Tools and Services Market Size & Forecast (2022-2029), By Region, USD Million

- Introduction

- North America Life Science Tools and Services Market Size & Forecast (2022-2029), By Country, USD Million

- US

- Market Size & Forecast, By Technique (USD Million)

- Market Size & Forecast, By Product & Services (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Canada

- Market Size & Forecast, By Technique (USD Million)

- Market Size & Forecast, By Product & Services (USD Million)

- Market Size & Forecast, By End User (USD Million)

- US

- Europe Life Science Tools and Services Market Size & Forecast (2022-2029), By Country, USD Million

- UK

- Market Size & Forecast, By Technique (USD Million)

- Market Size & Forecast, By Product & Services (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Germany

- Market Size & Forecast, By Technique (USD Million)

- Market Size & Forecast, By Product & Services (USD Million)

- Market Size & Forecast, By End User (USD Million)

- France

- Market Size & Forecast, By Technique (USD Million)

- Market Size & Forecast, By Product & Services (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Italy

- Market Size & Forecast, By Technique (USD Million)

- Market Size & Forecast, By Product & Services (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Spain

- Market Size & Forecast, By Technique (USD Million)

- Market Size & Forecast, By Product & Services (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Rest of Europe

- Market Size & Forecast, By Technique (USD Million)

- Market Size & Forecast, By Product & Services (USD Million)

- Market Size & Forecast, By End User (USD Million)

- UK

- North America Life Science Tools and Services Market Size & Forecast (2022-2029), By Country, USD Million

- Introduction

-

-

- Asia Pacific (APAC) Life Science Tools and Services Market Size & Forecast (2022-2029), By Country, USD Million

- China

- Market Size & Forecast, By Technique (USD Million)

- Market Size & Forecast, By Product & Services (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Japan

- Market Size & Forecast, By Technique (USD Million)

- Market Size & Forecast, By Product & Services (USD Million)

- Market Size & Forecast, By End User (USD Million)

- India

- Market Size & Forecast, By Technique (USD Million)

- Market Size & Forecast, By Product & Services (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Rest of Asia Pacific

- Market Size & Forecast, By Technique (USD Million)

- Market Size & Forecast, By Product & Services (USD Million)

- Market Size & Forecast, By End User (USD Million)

- China

- Latin America (LATAM) Life Science Tools and Services Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Technique (USD Million)

- Market Size & Forecast, By Product & Services (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Middle East & Africa (MEA) Life Science Tools and Services Market Size & Forecast (2022-2029), USD Million

- Market Size & Forecast, By Technique (USD Million)

- Market Size & Forecast, By Product & Services (USD Million)

- Market Size & Forecast, By End User (USD Million)

- Asia Pacific (APAC) Life Science Tools and Services Market Size & Forecast (2022-2029), By Country, USD Million

-

- Competitive Landscape

- Key Players and their Competitive Positioning

- Key Player Comparison

- Segment-wise Player Mapping

- Market Share Analysis (2023)

- Company Categorization Matrix

- Dominants/Leaders

- New Entrants

- Emerging Players

- Innovative Players

- Key Strategies Assessment, By Player (2022-2024)

- New Product Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Company Profiles*

(Business Overview, Financial Performance**, Products Offered, Recent Developments)

- Hoffmann-La Roche Ltd.

- Agilent Technologies, Inc.

- Becton; Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Merck KGaA

- Danaher Corporation

- Illumina, Inc.

- Thermo Fisher Scientific, Inc

- QIAGEN N.V.

- Shimadzu Corporation

- Other Prominent Players

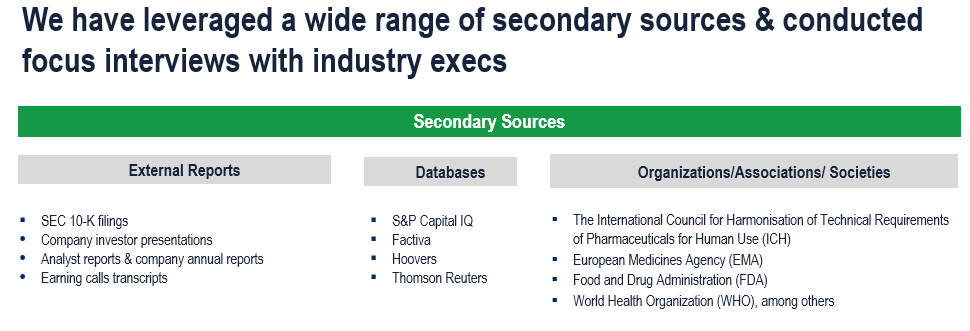

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

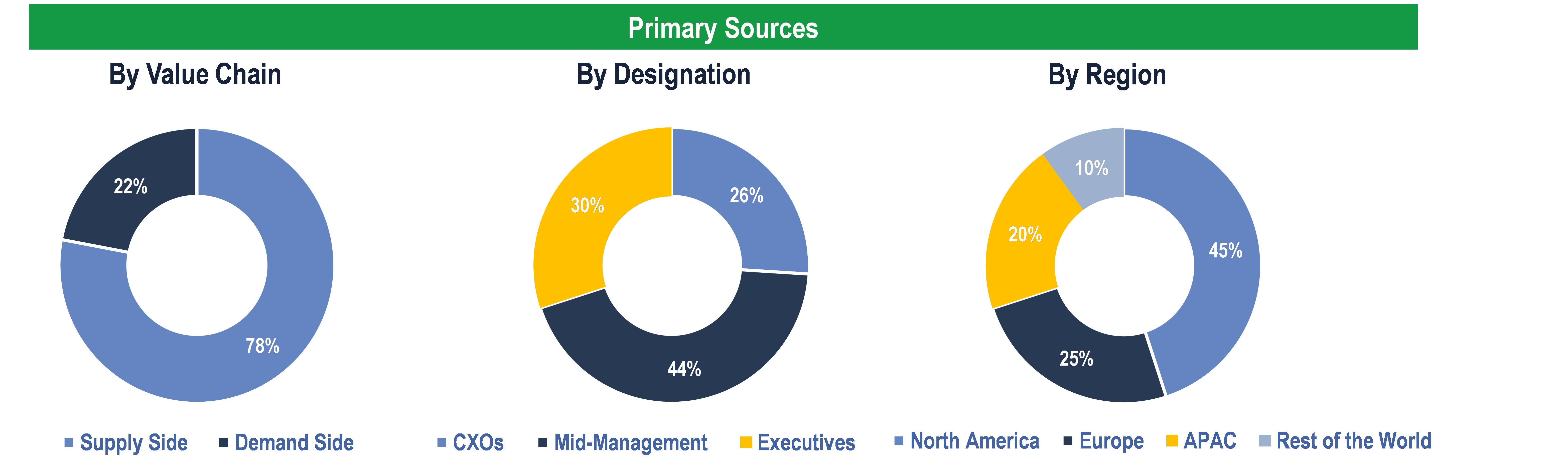

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, R&D Managers, Business Development Managers, Consultants

Demand Side Stakeholders:

- Biopharmaceutical Companies, Academic and Research Institutes, Hospitals, Diagnostic Centers and Others

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down & Bottom-Up Approaches’ were used to derive market size estimates and forecasts

Data Triangulation

Research findings derived through secondary sources & internal analysis was validated with Primary Interviews, Internal Knowledge Repository and Company’s Sales Data