Pain Management Devices Market Size, Share, Growth, Trends & Demand for Forecast 2024-2029

The Global Pain Management Devices Market is expected to grow at the rate of 9-10 % by 2029. Growing cases of chronic pain-inducing diseases (like obesity, diabetes, arthritis, musculoskeletal, neurological disorders, etc), increase in geriatric population, favorable reimbursement scenario for spinal cord stimulation (SCS) devices in developed countries, rising R&D investment, growing incidence of sports injuries and cancer, and rising demand for chronic pain management in home care treatment are some of the key factors driving the global pain management devices market. To learn more about the research report, download a sample report.

Pain is an unpleasant sensation and emotional experience usually caused by tissue damage. It stems from the activation of the nervous system. Pain can be either acute or chronic. Acute pain is generally intense and short-lived. It tends to occur suddenly, often as a result of a known injury, illness, or medical procedure. On the other hand, chronic pain lasts for a longer time than acute pain and often comes and goes, over multiple months or years. It may occur from a variety of health conditions, such as arthritis, fibromyalgia, chronic migraine, cancer, neurological disorders, etc.

Pain management devices are specialized medical tools designed to alleviate chronic pain through various mechanisms, enhancing patient quality of life. These devices include spinal cord stimulators (SCS), which deliver electrical impulses to the spinal cord to interrupt pain signals; transcutaneous electrical nerve stimulation (TENS) devices, which use surface electrodes to send electrical impulses through the skin to block pain signals; analgesic infusion pumps, which provide continuous delivery of pain medication for severe chronic pain conditions; and ablation devices, which use thermal energy to disrupt specific nerve pathways. Each type of device addresses different pain conditions and patient needs, contributing to the overall effectiveness and versatility of pain management strategies.

To learn more about this report, download the PDF brochure

Advent of Advanced Pain Management Technologies Drives the Pain Management Devices Market

Currently, the first line of treatment for pain management is oral medication. Pain specialists/doctors prefer to prescribe medications over devices to patients majorly due to their easy availability, presence of substantial clinical evidence and lower cost. However, in recent years, the quality of treatment and care has improved immensely due to the development of advanced technologies, FDA-approved non-prescription medical devices, devices used in combination with prescribed medications or other forms of pain management therapy.

There are various types of pain management devices available in the market such as spinal cord stimulators, transcutaneous electrical nerve stimulation devices, etc. which help to block or mask entry of pain signals travelling to the brain. Recently, many developments have been made to improve the quality of life of patients suffering from chronic pain and also to reduce the effects of pain such as:

- In January 2024, Medtronic plc announced the U.S. Food and Drug Administration (FDA) approval of its Percept RC Deep Brain Stimulation (DBS) system, a rechargeable neurostimulator and the latest innovation in the Percept family, which includes the Percept PC neurostimulator, BrainSense technology, and SenSight directional leads, making it the only sensing-enabled DBS system on the market that allows personalized treatment for movement disorders and epilepsy.

- In March 2023, Nevro Corp. announced the full U.S. market launch of its HFX iQ™ spinal cord stimulation (SCS) system, the first and only SCS system that uses artificial intelligence to personalize and maintain pain relief based on each patient's response

- In August 2022, GIMER Medical announced that the US FDA cleared its StimOn Pain Relief System, a handheld stimulator designed to transmit electrical signals through surface electrodes to underlying nerves, functioning as a TENS device to help block pain signals travelling to the brain

- In August 2020, Medtronic announced the commercial launch of its FDA-approved neurostimulator, called the InterStim Micro Neurostimulator which helps patients to effectively control bladder and bowel movement

- In November 2020, Abbott launched the IonicRF Generator, a minimally invasive device that uses heat to target specific nerves for chronic pain management

Benefits associated with these devices such as decreased need for oral pain medications, usage of non-steroidal calming drugs, and other pain-mitigating prescriptions and overall improvement in the quality of life of patients are fueling the market of pain management devices.

COVID-19 Impact on Pain Management Devices Market

COVID-19 adversely impacted the overall pain management devices market. Due to nationwide lockdowns, patients who specifically relied on exercise programs or pain therapy as a part of pain management regimen were adversely impacted. Many clinics and pain services were open for public services for a limited time. Major regulatory authorities across the globe (such as CDC, WHO, MHRA, TGA, and EMA) recognized that cancer patients are at greater risk of COVID-19 infection than healthy adults. To prevent patients and staff from being infected with Covid-19 infections, elective surgeries, non-urgent procedures like treatment for chronic refractory neuropathic pain, implantation of infusion pumps or neurostimulators used for treatment of nerve pain and chest pain were delayed or stopped to minimize the risk of viral spread which in turn adversely impacted the demand of pain management devices. However, the market is now on the recovery path and is expected to witness healthy growth as demand for home care treatment surges globally.

Key Challenges/ Constraints

Pain management devices are usually used as a second line of treatment in patients with chronic pain who become resistant to drug therapy. Hypersensitivity reactions and post-operative infections caused due to the use of these devices are likely to hamper the growth of the pain management devices market.

Product Segment Outlook

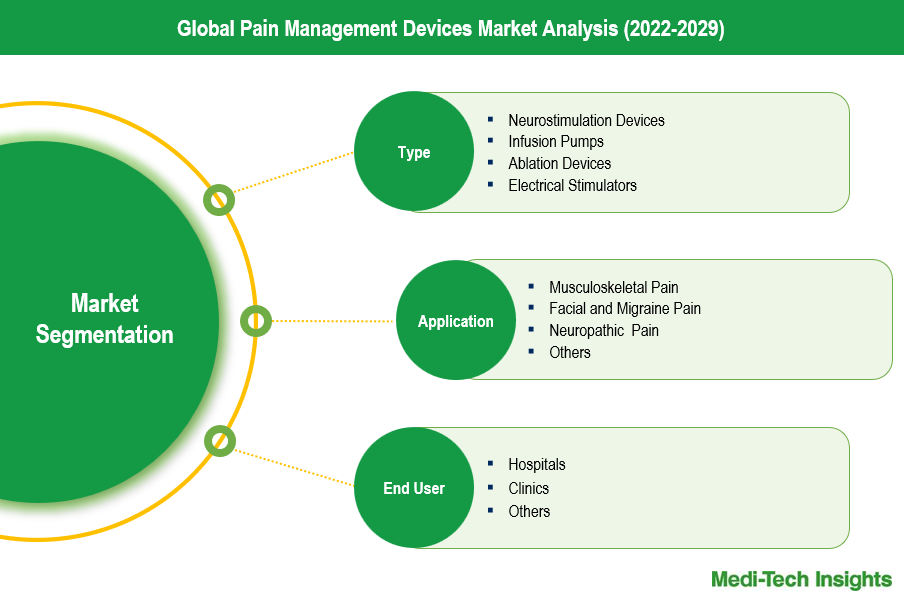

The pain management devices market comprises various product types, each addressing specific pain relief needs and contributing differently to the overall market share. Analgesic infusion pumps are a significant segment, providing continuous and controlled delivery of pain medication directly into the patient's bloodstream or specific areas of the body, making them crucial for managing severe chronic pain. Neuromodulation and neurostimulation devices represent a substantial market share, particularly with the growing adoption of spinal cord stimulators and neurostimulators like Medtronic’s InterStim Micro Neurostimulator. These devices modify nerve activity to reduce pain perception, offering relief for patients with complex pain conditions. Ablation devices, which use thermal energy to target and disrupt specific nerve pathways, are gaining popularity for their minimally invasive approach to chronic pain management, such as Abbott's IonicRF Generator. Lastly, electrical stimulators, including transcutaneous electrical nerve stimulation (TENS) devices, provide non-invasive pain relief by delivering electrical impulses to nerve fibers, widely used for both acute and chronic pain conditions. Each subsegment holds a distinct place within the market, with neuromodulation and neurostimulation devices typically leading in terms of innovation and adoption, followed by infusion pumps, ablation devices, and electrical stimulators, collectively driving the growth and diversification of the pain management devices market.

To learn more about this report, download the PDF brochure

Application Outlook

The application segment of the pain management devices market is diverse, targeting various types of pain conditions. Neuropathic pain accounts for a significant portion of the market, driven by the increasing prevalence of diabetes and related complications, which often result in nerve damage and chronic pain. Devices such as spinal cord stimulators and neurostimulators are particularly effective for this type of pain. Facial and migraine pain represent another important segment, with transcutaneous electrical nerve stimulation (TENS) devices and neurostimulation therapies providing targeted relief for patients suffering from severe headaches and facial pain syndromes. Cancer pain management is also a crucial application, with analgesic infusion pumps playing a vital role in delivering continuous pain relief for cancer patients, thus holding a substantial market share. Musculoskeletal pain, including conditions such as arthritis, back pain, and sports injuries, constitutes a major segment, benefiting from a wide range of pain management devices like ablation devices, electrical stimulators, and infusion pumps, which offer non-invasive and minimally invasive pain relief options. Each application segment contributes uniquely to the market, with neuropathic and musculoskeletal pain devices often leading due to their broader prevalence and demand, followed by cancer pain and facial & migraine pain devices.

North America Leads in Terms of Adoption of Pain Management Devices Market

North America holds the largest market for pain management devices with >50% share, followed by Europe and Asia Pacific. The growing prevalence of chronic pain conditions, demand for drug-free therapy, availability of well-planned reimbursement and insurance coverage and presence of leading players in this region are some of the key factors driving the market growth.

Developed countries in Europe such as Germany, the UK and France are expected to grow significantly over the forecast period due to adopting the latest technology, new product launches and increased awareness regarding pain management devices. Asia Pacific region is expected to witness the highest CAGR in the coming years as manufacturers are expanding their foothold in the emerging Asia-Pacific countries due to a large patient base.

“New delivery models are emerging to address growing chronic care demands. Technology has a key role to play. Advancements in precise detection and diagnosis of diseases will go far to minimize the cost of treating chronic conditions.” -Executive Vice President, Global Operations and Supply Chain, Pain Management Device Company, United States

Competitive Landscape Analysis: Pain Management Devices Market

The pain management devices market is marked by presence of established key players such as Medtronic, Boston Scientific, Abbott, Becton, Dickinson and Company, Baxter International, B. Braun Melsungen AG, Stryker, Smiths Medical, Nipro Corporation, Nevro Corp. Mindray Medical International Limited, Shenzhen MedRena Biotech Co., Ltd., Epic Medical, Microtransponder, Neuronano, Gimer Medical, Bluewind Medical, among others.

Get a sample report for competitive landscape analysis

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the Market

Players operating in this market are adopting both organic and inorganic growth strategies such as collaborations, acquisitions, and new product launches to garner market share. For instance,

- In May 2024, Enovis™ Corporation announced the opening of a new production plant at their San Daniele, Italy location, previously part of LimaCorporate S.p.A., which Enovis acquired in January 2024, doubling their production capacity

- In April 2024, Medtronic plc announced that the U.S. Food and Drug Administration (FDA) approved the Inceptiv™ closed-loop rechargeable spinal cord stimulator (SCS) for treating chronic pain, marking the first Medtronic SCS device with a closed-loop feature that senses biological signals along the spinal cord and automatically adjusts stimulation in real time to synchronize therapy with daily movements

- In November 2023, Nevro Corp. announced the acquisition of Vyrsa Technologies, a privately held medical technology company specializing in minimally invasive treatment options for patients suffering from chronic sacroiliac (SI) joint pain

- In October 2021, SPR Therapeutics secured $37 million VP funding to scale operations for Sprint pain relief device

The global pain management devices market is a growing market that is expected to gain further momentum in the coming years due to technological advancements, new product launches, and aggressive organic and inorganic growth strategies followed by the players.

Pain Management Devices Market Futures and Scope

| Report Scope | Details |

| Base Year Considered | 2023 |

| Historical Data | 2022 - 2023 |

| Forecast Period | 2024 - 2029 |

| CAGR (2024-2029) | 9-10 % |

| Segment Scope | Product, Application, End User |

| Regional Scope |

|

| Key Companies Mapped | Medtronic, Boston Scientific, Abbott, Becton, Dickinson and Company, Baxter International, B. Braun Melsungen AG, Stryker, Smiths Medical, Nipro Corporation, Nevro Corp. Mindray Medical International Limited, Shenzhen MedRena Biotech Co., Ltd., Epic Medical, Microtransponder, Neuronano, Gimer Medical, Bluewind Medical |

| Report Highlights | Market Size & Forecast, Growth Drivers & Restraints, Trends, Competitive Analysis |

Key Strategic Questions Addressed

-

What is the market size & forecast for the Global Pain Management Devices Market?

-

What are the historical, present, and forecasted market shares and growth rates of various segments and sub-segments of the Global Pain Management Devices Market?

-

How has COVID-19 impacted the Global Pain Management Devices Market?

-

What are the major growth drivers, restraints/challenges impacting the market?

-

What are the opportunities prevailing in the market?

-

What is the investment landscape?

-

Which region has the highest share in the global market? Which region is expected to witness the highest growth rate in the next 5 years?

-

Who are the major players operating in the market? What is the competitive positioning of key players?

-

Who are the new players entering the market?

-

What are the key strategies adopted by players?

- Research Methodology

- Secondary Research

- Primary Research

- Market Estimation

- Market Forecasting

- Executive Summary

- Market Overview

-

- Market Dynamics

- Drivers

- Restraints

- Key Market Trends

- Industry Speaks

- Market Dynamics

- Key Revenue Pockets

- Global Pain Management Devices Market - Size & Forecast (2021-2028), By Type

- Neurostimulation Devices

- Infusion Pumps

- Ablation Devices

- Electrical Stimulators

- Global Pain Management Devices Market - Size & Forecast (2021-2028), By Application

- Musculoskeletal Pain

- Facial and Migraine Pain

- Cancer Pain

- Neuropathic Pain

- Trauma

- Others

- Global Pain Management Devices Market - Size & Forecast (2021-2028), By End User

- Hospitals

- Clinics

- Pain Management Services

- Others

- Global Pain Management Devices Market - Size & Forecast (2021-2028), By Region

- North America (U.S. & Canada)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, Rest of Asia Pacific)

- Rest of the World (Latin America, Middle East & Africa)

- Competitive Landscape

- Key Players and their Competitive Positioning

- Competitive Positioning of Key Players (2022)

- Offerings Assessment, By Player

- Key Strategies Assessment, By Player (2021-2023)

- New Product & Service Launches

- Partnerships, Agreements, & Collaborations

- Mergers & Acquisitions

- Geographic Expansion

- Key Players and their Competitive Positioning

- Key Companies Scanned (Indicative List)

- Medtronic

- Boston Scientific

- Abbott

- Becton, Dickinson and Company

- Baxter International

- Braun Melsungen AG

- Stryker

- Smith’s Medical

- Nipro Corporation

- Nevro Corp.

- Gimer Medical

- Bluewind Medical

- Other Prominent Players

The study has been compiled based on extensive primary and secondary research.

Secondary Research (Indicative List)

Primary Research

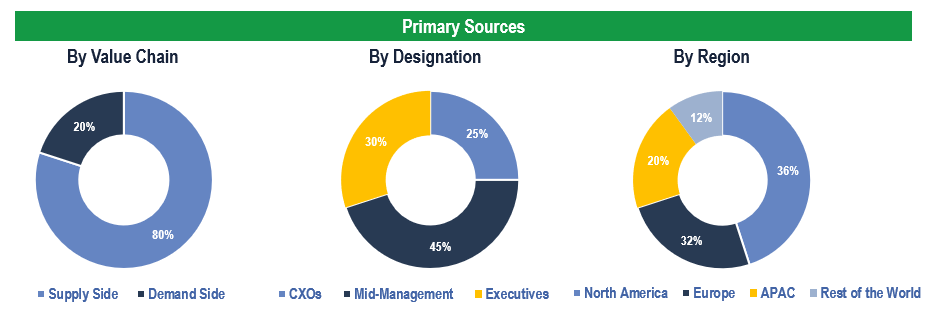

To validate research findings (market size & forecasts, market segmentation, market dynamics, competitive landscape, key industry trends, etc.), extensive primary interviews were conducted with both supply and demand-side stakeholders.

Supply Side Stakeholders:

- Senior Management Level: CEOs, Presidents, Vice-Presidents, Directors, Chief Technology Officers, Chief Commercial Officers

- Mid-Management Level: Product Managers, Sales Managers, Brand Managers, Business Development Managers, Consultants

- Demand Side Stakeholders: Stakeholders in Hospitals, Clinics, Pain Services Centres and Other End Users

Breakdown of Primary Interviews

Market Size Estimation

Both ‘Top-Down and Bottom-Up Approaches’ were used to derive market size estimates and forecasts.

Data Triangulation

Research findings derived through secondary sources & internal analysis were validated with Primary Interviews, Internal Knowledge Repository, and Company Sales Data.